Breaking: Trump Says It's Time to Buy the Dip

395: China & US Trade War Intensifies

Trying a bit of a different cadence this week and free-styling given how volatile the state of markets are.

I am clicking send on this around 1:23pm ET — markets are fucking ripping off the bottom due to breaking news. President Trump is hiking tariffs on China to 125% and has authorized a 90 day tariff pause on everyone else in the world effective immediately.

This is insanity.

I talked about speed yesterday — quite a bit happened over night that needs to be covered. If you guys are still catching up check out the Buy The Dip Series below for some of my thoughts on the deals that might present themselves in the coming days, weeks, and months. In these post I talk through individual equities/etfs/assets I am beginning (key word beginning) to buy and lay out the tariff landscape up until Tuesday morning. While we don’t get everything right, given the breaking news today on tariff pauses these were well timed.

It’s one of those weeks in which there are almost too many updates to keep up with. Tariff fears have gripped markets in a chokehold, the China/US beef is intensifying by the hour, and as many have pointed out on X and other platforms, things appear to be breaking.

"We are witnessing a simultaneous collapse in the price of all US assets including equities, the dollar versus alternative reserve FX and the bond market. We are entering unchartered territory in the global financial system"

— Deutsche Bank (Zerohedge)

Rhetoric is starting to get pretty wild cross the board from business icons, world leaders, pundits, and media heads. Kevin O’Leary called for 400% tariffs on China on CNN in a fierce rant about IP theft, corrupt business, and the illicit practices of the Chinese government. Ray Dalio said in an interview this week that he is skeptical of the United State’s ability to transfer major manufacturing domestically given the composition of our workforce. Walmart WMT 0.00%↑ pulled their quarterly operating income forecast this week.

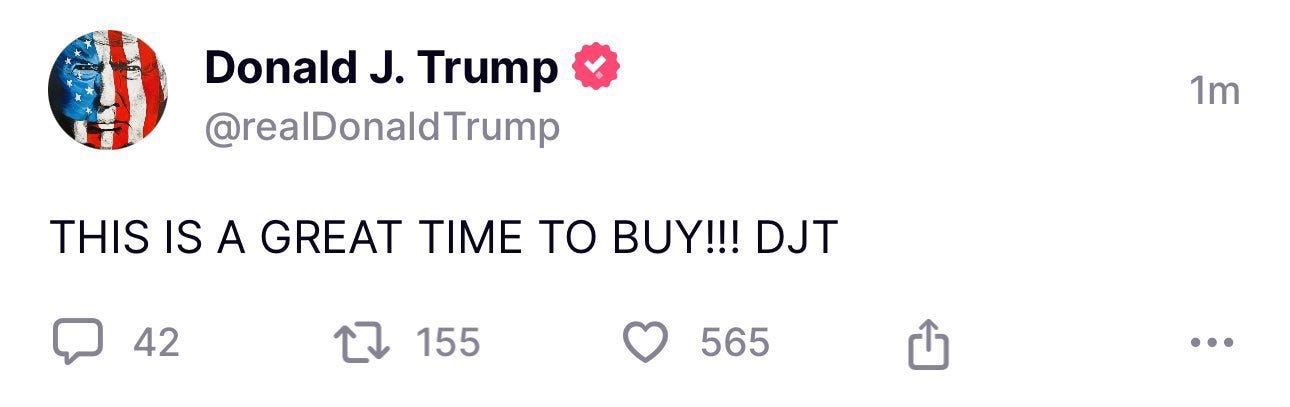

President Trump posted to Truth Social that it’s a great time to buy. Is this going to turn out like Eric Trump’s Ethereum buy recommendation or is this time different?

The S&P 500 is down around 10.5% since the start of the month, experiencing its sharpest two-day drop since the COVID-era selloff in 2020.

The Dow Jones Industrial Average has shed nearly 4,000 points, including a 5.5% single-day decline on April 4.

The Nasdaq Composite has officially entered bear market territory, sliding over 5.8% in a single session last week.

We’ve got a lot to cover today — treasury movement, China, crypto news, a bullish development for semis, and more. I’ve essentially tried to compress all need to know news on markets into today’s update.

Everyone’s stuck in this international game of chicken — risks are high in the short term but the cost of being sidelined when this all turns around might be higher.

So the question remains — are we going to see a short term rebound in markets and maybe even positive news break on the tariff front sooner than most expect (we just got a major one, will there be more)? Or is the damage already done?