Buying The Dip Part 2

394: Asset Allocation, Shopping Lists, China Implications

Good morning all,

Welcome to our new ~500 subscribers since Friday, it’s a wild time in markets and a great time to get locked into the opportunities presenting themselves in the market. Today’s going to be part 2 of Friday’s post What I am Buying on The Dip (below).

Lot of important stuff to cover today — as yesterday was a complete shit show in the market. It came complete with absurd volatility, fake headlines that drove markets higher and lower, and a whole range of charged political commentary on what these tariffs mean for our economy, country, and our investments.

One of the main principles I wanted to strive for with Arb Letter when I started it in 2020 was speed — someone commented on a meme I dropped on X this morning replying with “I am impressed with how quickly you get these memes out”. Great compliment, I will take it, but honestly if I can’t give you guys speed AND valuable viewpoints/content, I’m not really doing my job. Speed is what people pay for, contrarian viewpoints are what they pay for, a publication that is not beholden to corporate or politically correct fluff is what people pay for.

Sometimes you have to take medicine

— President Trump re: market movements

Speed is the name of the game in this market environment — the quicker you can get vital info, the better. Then you can move before the crowd does.

As a general rule of thumb — buying and remaining calm when people are shitting themselves is better — selling and being conservative when they are taking screenshots of animal coins and quitting their day jobs is better.

My gut feeling is today we’re going to bounce a bit soon — the Nikkei 225 in Japan surged over 6% on open this morning, crypto has stopped it’s dumping for now 9as of 9:14pm ET), and we saw a bit of optimism late into trading yesterday.

The big caveat that could cause more pain though? China. And we’ll talk about that today — futures were hurt last night by new updates from Chinese officials.

Fear is at all time levels. Not that we are hyper focused on short term movement, but a bounce is welcomed.

Poll results indicated you guys were okay with me bumping the 2025 Watch Review to Thursday or next week so today we’re going to focus on the market again, expanding on Friday’s post to include crypto, other equities, and some major signs of what’s actually going on in the market and where Trump’s head is at.

The following took place Monday/early this morning:

BlackRock CEO Larry Fink said he won't rule out another 20% market drop

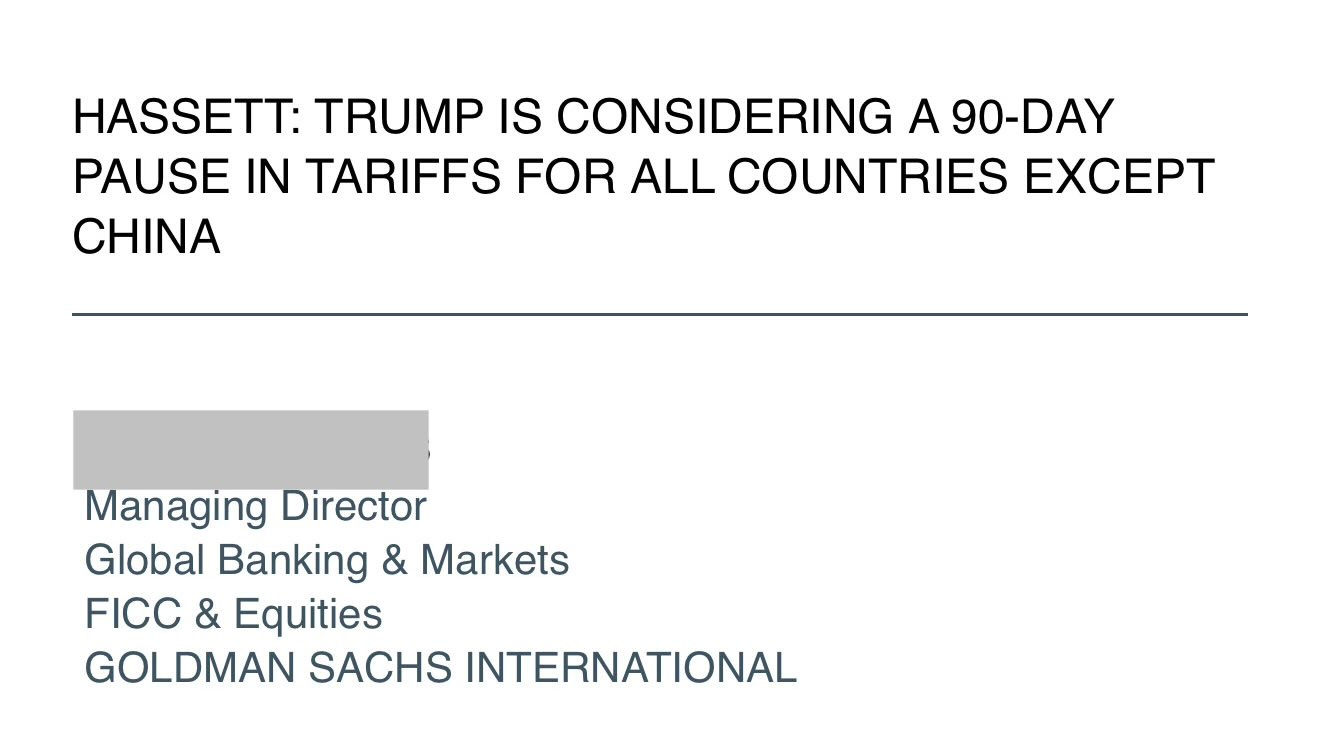

A leaked email from a Goldman Sachs Managing Director shows he may have been the one that perpetuated the fake Tariff Pause headlines that made markets rip vertical early on Monday - other sources say it was the popular fintwit account Walter Bloomberg

President Trump canceled his press conference with Israeli Prime Minister Netanyahu after he flew to the US to reportedly negotiate new tariff deal

President Trump announced he will be putting an additional 50% tariff on China if they do not move to withdraw their retaliatory tariffs Tuesday

Vietnam's HNX index fell 6.8% in today's trading (Spectator Index)

Today we’re going to talk through yesterday’s developments and some implications to the expanding trade war, what I am buying right now, and how I am currently allocated. Rest of the week is probably going to be insane so want to make sure we’re covering everything relevant and useful to those of you who might be looking to make some moves or take advantage of the chaos.

We’re starting to see some real panic, which is good, but let’s start by reviewing all the crucial info and signs in the market from yesterday and then we can move into specifics for equities and crypto that are on my shopping list.

No time to waste so let’s get into it.