Palantir CEO Dumps $1.2B in Stock—Should You?

376: IRS Layoffs, Android Tech, CIA Uses Drones over Mexico

Morning kings.

If you missed Tuesday’s Post you can find it below. Some good updates from earlier this week and a test section in which I talk about a personal experience I had last weekend doing some training in my off time.

US Special Forces in Mexico, DC Exodus, & Argentina’s Crypto Bloodbath

If you want to make sure you get a look at some of my top picks (for stocks and crypto) for 2025 — check out the post below. Broadcom, which we highlighted, announced it is potentially acquiring Intel's chip design business. Not advice — but I would also think hard about trimming some PLTR 0.00%↑ given the high amount of insider selling as well. Your call.

Top Assets To Hold in 2025

Markets & Crypto

This week, major U.S. stock indices saw modest gains, with the S&P 500 reaching another record high, while the Dow Jones and Nasdaq also posted slight increases. Year-to-date, all three indices remain in positive territory, reflecting resilience despite economic uncertainties and the Fed’s inflation problem. Investors are beginning to shift focus away from U.S. equities due to high valuations, exploring opportunities in global markets, including China.

Notable stock movements included Intel INTC 0.00%↑ surging 16% on acquisition speculation and Tesla gaining momentum after expediting Model Y deliveries in China. Meanwhile, market participants are closely monitoring the Federal Reserve’s latest meeting minutes for insights into future interest rate policy, particularly in response to recent inflation data.

Overall, the market reflects cautious optimism, balancing strong corporate earnings with concerns over economic shifts and global investment trends, as well as new Trump admin curveballs.

Palantir CEO Alex Karp announced a new plan to sell $1.2 billion of stock this week — PLTR 0.00%↑ dumped over 10% on this news yesterday

Elon Musk is considering sending all U.S. taxpayers $5,000 checks from DOGE induced savings according to Forbes.

Broadcom, a major U.S. infrastructure company, is reportedly exploring the acquisition of Intel's chip design division, while Taiwan’s semiconductor giant $TSMC is considering purchasing part or all of Intel's chip manufacturing operations.

SEC acknowledged 21Shares filing to allow staking for its spot Ethereum ETF (WatcherGuru)

Shift4 Payments reported mixed fourth-quarter results, with earnings exceeding expectations but revenue and payment volumes aligning with forecasts. The company announced a $2.5 billion acquisition of Global Blue to expand its tax refund and currency conversion services, focusing on premium retail and hospitality markets. Additionally, CEO Jared Isaacman is set to step down, pending Senate confirmation for a new role at NASA, which led to an 11% drop in Shift4's stock price.

The world’s first spot XRP exchange-traded fund (ETF) has been approved by Brazil’s securities regulator, the Comissão de Valores Mobiliários (CVM) (CoinDesk)

The richest 1% of people now own nearly 45% of all wealth, while 44% of humanity are living below the World Bank poverty line of $6.85 per day, per Oxfam (Unusual Whales)

Clonerobotics launched a video of their first “protoclone”, the world's first bipedal, musculoskeletal android. Talk about nightmare fuel — imagine these things lurking around the streets.

Look at this thing lmao.

The company thinks they can get these out at mass scale in the future for $20,000/pop. While it’s a young company, this tech could prove to be bullish in the coming years alongside AI and Automation. '

The rapid advancements in humanoid robotics, exemplified by Clone Robotics' latest android prototype, signal a future where AI-driven automation and robotics will play a transformative role in industries ranging from manufacturing to personal assistance. As companies refine synthetic muscles, advanced sensors, and real-time AI decision-making, we move closer to seamless human-machine collaboration.

Size lords who are looking to capitalize on this trend may consider companies at the forefront of AI and automation, such as Nvidia (NVDA) for its dominance in AI computing, Tesla (TSLA) for its Optimus humanoid robot development, Boston Dynamics (owned by Hyundai) for its cutting-edge robotics research, and Intuitive Surgical (ISRG) for AI-assisted medical robotics.

As demand for automation grows, these firms could be pivotal in shaping the next generation of intelligent, human-like machines. Who knows maybe they’ll make some with Zyn dispensers in their chests.

Layoffs & Store Closures This Week

Layoff and store closure news has been breaking all week from everything to the retail sector to federal and public agencies.

Neiman Marcus

Closing downtown Dallas location by March 31, 2025, after over 100 years.

Employees offered relocation or severance packages.

Forever 21

Preparing for second bankruptcy.

Plans to close at least 200 stores next month.

Seeking a buyer for remaining 350 locations, could liquidate if no buyer is found.

Jack Wills

Closing its Derby, UK, store after three years.

NetEase

Laid off U.S.-based developers from its Marvel Rivals game.

Centers for Disease Control and Prevention (CDC)

Laid off 16 out of 24 lab program fellows due to federal budget cuts.

Department of Housing and Urban Development (HUD)

Facing potential layoffs of up to 50% of its 9,000 employees.

IRS

ABC reported that the Trump administration kicked off layoffs at the IRS this week. According to the NYT the IRS is set to lay off 6,000 employees today. On top of that, President Trump is seeking to abolish the IRS, according to Commerce Secretary Howard Lutnick. Feel like an idiot having already paid federal taxes this year — seems like we coudl see some big shake ups in the near future

Chevron

Plans to lay off 15%-20% of workforce (~6,000-8,000 employees).

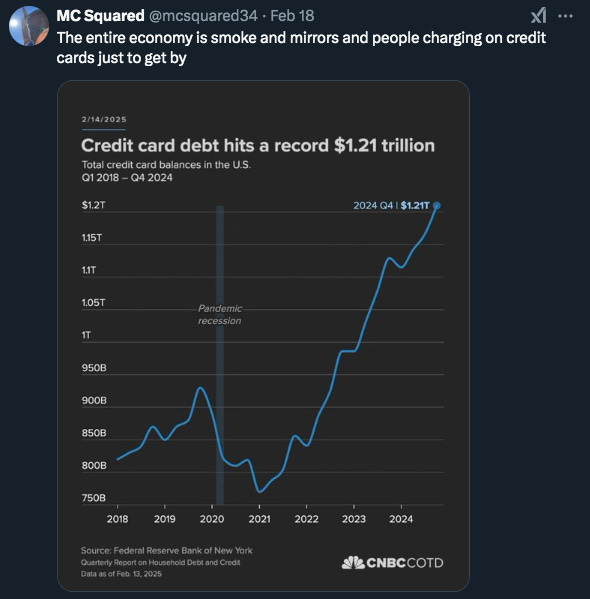

These updates along with others add more fuel to speculation that something is bubbling underneath the surface while the market chugs along. Take the chart below from CNBC on Credit Card debt.

The vast majority of Americans are not in a good place right now and this is not sustainable. Eventually, the chickens will come home to roost — pray for our sake and for our bag’s sake that we don’t get some grand reckoning in 2025. I’m not Nostradamus but despite the positive moves being made to cut back on the national deficit by the incoming administration, these types of data points cannot be ignored. In many situations these are likely people who do not have the capability to get out of debt.

Think about when you go out in a major city or even when you’re in the suburbs — places are still packed. Not everyone is in a good enough financial position to responsibly be consumers as regularly as many people are. They are abusing credit and going further and further into debt.

Crypto

A quick note on crypto and the market in general. We’ve become super accustomed since the onset of COVID of things or narratives ALWAYS happening in the financial markets.

For those of you like myself (who derive a substantial part of entertainment and dopamine) from this, it sucks when things get boring or worse, our bags start to bleed. Not only do we lose money on paper but our source of entertainment is lacking. While I’m not going to give you guys formal advice since I’m not a Northwestern Mutual rep or a forex Instagram advisor, these are the periods where I really do think it pays to touch grass.

Figure out SOME way to distract yourself from making impulsive decisions and distract yourself so that you can sit on your hands. Many times the best investors or traders simply know when to do nothing. This goes against the very fiber of modern society which is go go go all the time (instant gratification/stimulation). At least on the crypto front, we’ve seen this shit before, it’s nothing new.

Reason why crypto twitter and others online are losing it is because we have the meme coin scams, Argentina $LIBRA rug pull, a brain dead Ethereum price, and a slumping alt market amplifying the shitty sentiment.

The tide is going to turn and those that were patient will be rewarded, but until then, focus on something else. A side hustle, your job, the gym, anything that can help bring back some balance to your day to day — because when the pump starts again, you’re going to get sucked right back into this shit 24/7.

My two cents, take it for what it’s worth.

I’m still long Bitcoin, Ethereum, Chainlink, AAVE, Avalanche, Zyncoin, PEPE, FIL (Filecoin), Solana, and GRT (the Graph). Won’t be selling anytime soon. If you want to review the basics — just check out the posts in the Arb Letter archive. I don’t believe this bull run has reached it’s peak. Doesn’t mean it’s going to rip forever but I suspect sometime in the spring we will see another run.

This week, Google announced plans to integrate Bitcoin wallets into its ecosystem, allowing users to access their Bitcoin holdings through their Google accounts. This initiative aims to lower barriers for Web2 users, making Bitcoin transactions as simple as traditional online payments.

The company is reportedly also exploring advanced encryption technologies, such as zero-knowledge proofs, to enhance security and trust between on-chain and off-chain systems. This development could significantly boost mainstream adoption of Bitcoin by leveraging Google's vast user base and familiar authentication systems.

I do not think Microstrategy ends up being the only major company that buys Bitcoin in 2025.

Geopolitics

The Trump Administration continues it’s work with DOGE to assess the financial state of various agencies, moving on from USAID and examining the IRS most recently. Elon Musk has also announced that payments to Ukraine will be examined soon as well.

This week, major developments unfolded around government efficiency reforms and the oversight of U.S. gold reserves amid sky high prices globally. The Trump administration, with Elon Musk leading the newly established Department of Government Efficiency (DOGE), is pushing for significant budget cuts and operational streamlining. DOGE has been granted extensive access to federal agencies' digital infrastructure, sparking concerns about data security and oversight.

Meanwhile, Musk has also called for an audit of Fort Knox’s gold reserves, estimated at $425 billion, fueling public interest in transparency over the nation’s assets. These moves highlight ongoing efforts to reshape federal operations and increase scrutiny over our financial reserves. Trump has said we will be “going to Fort Knox to make sure the gold is there.”

Additionally this week the Washington Post reported this week that the Trump Administration has ordered the Pentagon to prepare for 8% budget cuts alongside Secretary of Defense Pete Hegseth.

President Putin announced this week that Russia and the United States have officially agreed to restore diplomatic relations

A Tesla Showroom was shot up in Oregon this week, per local media

The Senate voted to advance confirmation of Kash Patel as FBI Director this week, the final confirmation vote is set for Thursday

President Trump is set to sign an executive order designed to terminate any and all federal taxpayer benefits going to illegal aliens according to Fox

Delta is reportedly offering $30,000 to each passenger on the plane that landed upside-down at Toronto airport (ABC)

The FBI announced last night it thwarted a “mass casualty attack” at a local school in Houston, Texas that was planned by two teens

This week, tensions in U.S.-Ukraine relations intensified following remarks from former President Trump, who labeled President Zelenskyy a "dictator" and suggested Ukraine was responsible for provoking the war with Russia. These statements have raised concerns in Kyiv about continued U.S. support and potential emboldenment of Russian aggression.

In response, Zelenskyy dismissed the claims as Russian disinformation (classic) and stressed the importance of Ukraine’s role in any future peace negotiations. Meanwhile, European leaders reaffirmed their support for Ukraine, emphasizing Zelenskyy’s leadership. Amid these diplomatic strains, U.S. officials are engaging with Ukraine to discuss potential paths toward resolving the conflict.

Zelensky tweeted the following last night:

I spoke with U.S. Senator @LindseyGrahamSC We greatly appreciate the bicameral and bipartisan support of the US Congress to the Ukrainian people in our fight against the Russian aggression. As always, Senator Graham is constructive and doing a lot to help bring peace closer. It’s all-important that security guarantees remain on the table—and that they work for Ukraine, for real and lasting peace. Thank you for your support.

This isn’t saying much since we know Lindsey Graham is a neocon war hawk. Countless lives have been lost in this war on all sides and with an examination coming of where US funds have actually been going in this conflict I suspect the tension between the US and Ukraine is far from over.

The Trump Administration has escalated action against criminal and cartel organizations in Mexico after its announcement earlier this week of sending Green Berets to train Mexican forces.

As of this week the U.S. State Department under the Trump Administration has officially designated the following as Foreign Terrorist Organizations:

- Tren de Aragua

- MS-13

- Sinaloa Cartel

- Jalisco New Generation Cartel

- United Cartels

- Northeast Cartel

- Gulf Cartel

- Michoacán Family

In response, Mexico's leadership has pushed back against what it views as external interference while continuing security cooperation. Meanwhile, news broke this week that the CIA has been ramping up surveillance efforts, deploying drones deep into Mexican territory with government approval to monitor cartel movements.

As we covered earlier this week U.S. Army Green Berets are training Mexico's Naval Infantry Marines in combat tactics to disrupt the flow of drugs and firearms. These efforts highlight a mix of unilateral U.S. actions and joint security initiatives as both countries navigate the challenges of cartel violence and border control.

That’s all I have for you guys this week — we had to bump an interview for Risk On so we will be back next week to our usual cadence. Next Tuesday I think we will do a classic Arbitrage Andy Guide for all paid subs — maybe a preview of the top deal sleds for Spring……

See you guys on the Discord and X this weekend.

Andy

BullX Crypto Trading Software

Gemini Crypto - Get Free Bitcoin

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before investing and ensure you have a good understanding of your personal risk tolerance.

Great letter, thank you for writing! I think the credit card balance charts are deceiving when not adjusted for inflation or compared to wage growth. Thought I’d throw that out there for food for thought.