Winter Storms & Market Chop

518: Snowfall, Selloffs, and Sovereignty

Morning Arb lords.

Looks like we have quite the storm headed for parts of the US this week. I love a good storm. Something about the uncertainty and chaos (I swear I’m not a sick pup).

Got a good one for you today on the heels of our Tokenization part II post we dropped on Tuesday as a follow up to the successful Part I from mid 2025. TLDR: the tokenization trend on Wall Street and on the institutional side is undeniable at this point.

Anyone who wants to potentially generate some insane returns would be dumb not to do some basic research on how to gain exposure (which is exactly what these guides tell you how to do).

But Andy! ITey are paid guides!

Yeah.

Why shouldn’t they be? Go talk to the subs here who printed on PLTR 0.00%↑ KTOS 0.00%↑ AVGO 0.00%↑ NVDA 0.00%↑ and others and ask them if paid is worth it.

In addition to the guide THIS article covering BlackRock’s recent comments on tokenization and Ethereum is well worth a read.

Markets

Markets are pretty interesting right now, though they are volatile and the last two days have been pretty painful, especially for crypto.

Trump declared this week the U.S. is "going heavy into nuclear" at Davos. The American President commented on all kinds of topics from Minnesota Somali Fraud schemes, to crypto, to metals, to Canada, China, and more.

One couldn’t help but notice he had a bit more command of the room than previous trips. Maybe the global elite and world leaders view the US a bit differently now?

"USA is the economic engine of the planet, and when America booms, the entire world booms."

President Trump at Davos

Ironically, shortly after the meetings wrapped up, President Donald Trump announced that a framework for some kind of deal had been reached with NATO leadership that would give the United States “everything we wanted” in Greenland.

Markets liked this.

Whether that materializes or not, markets seem to be taking the broader message seriously. The U.S. is leaning harder into power politics, resource security, and strategic leverage.

Davos didn’t calm markets, but it reminded them that the next phase looks less like globalization and more like controlled confrontation. Volatility may be the tax, but in my opinion select sectors are already signaling where capital thinks the world is headed next. Elon Musk made a point of talking quite a bit about robotics.

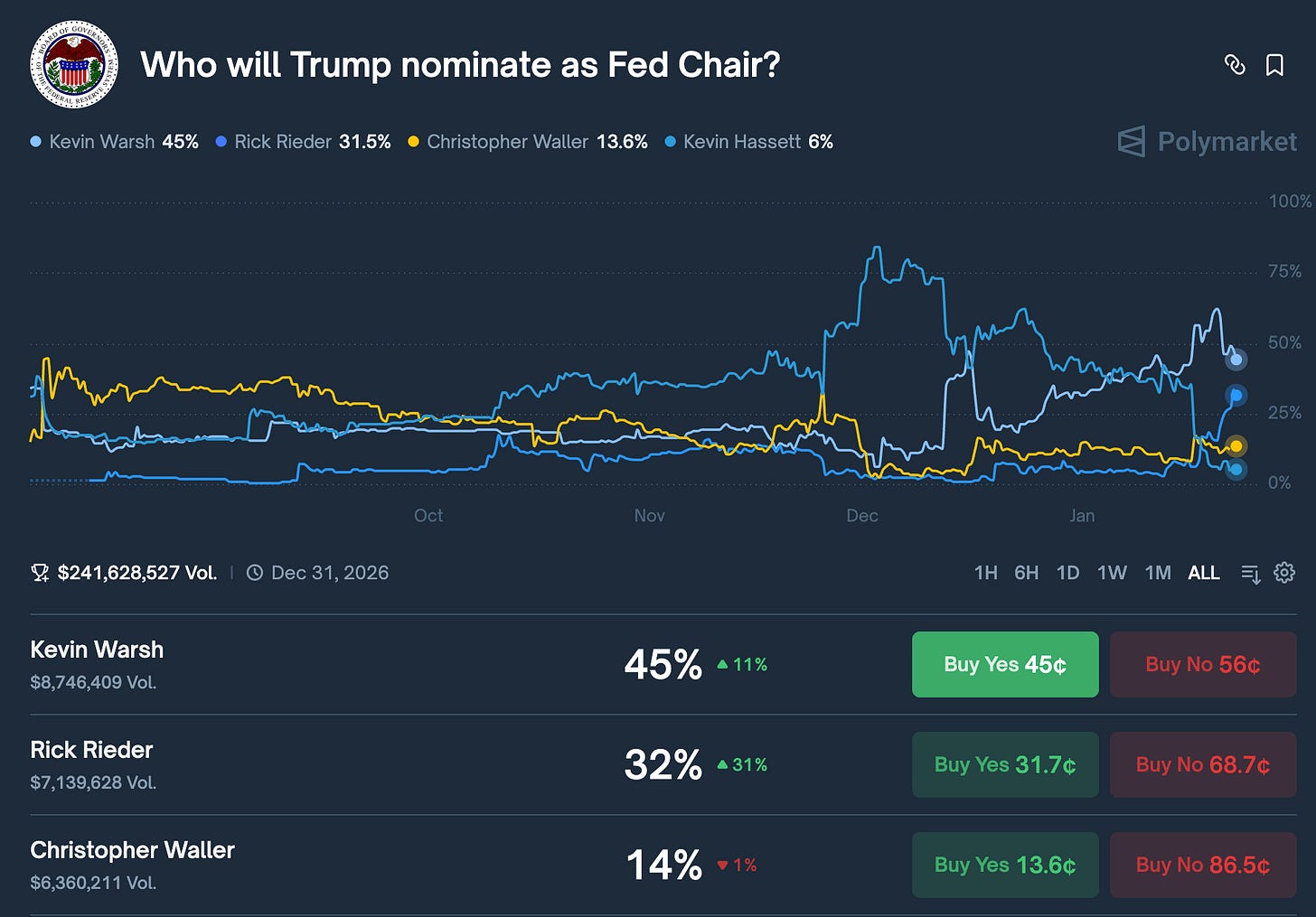

Polymarket traders as of yesterday are pricing a 98% probability that the Fed leaves rates unchanged at its January meeting

U.S. stock market added about $700 billion in market capitalization yesterday after a quick morning dip (CoinTelegraph)

Spot silver surged past $96.18 per ounce this week

Gold reached another all time high of just over $4,900, absolutely insaneo

President Trump has filed a $5 billion lawsuit against JPMorgan and CEO Jamie Dimon for "debanking" him

Sandisk has returned an absurd +1267% in the last year. Not ashamed to say I completely missed this. Feels bad man.

My general 2026 equity strategy is pretty much unchanged (defense, tech, semis, energy).

I am sitting on my hands on the equity front right now with the exception of some KTOS 0.00%↑ and AVGO 0.00%↑ buys on the dip.

Over the last couple of week we have discussed the following tickers/companies:

UAVS 0.00%↑ - defense

KTOS 0.00%↑ - defense

LHX 0.00%↑ - defense

SMCI 0.00%↑ - semis

AMD 0.00%↑ - semis

NB 0.00%↑ - metals

UAMY 0.00%↑ - metals

SSYS 0.00%↑ - 3d printing/components

INTC 0.00%↑ - tech/computers/ai

QUIK 0.00%↑ - semis

If you want my full thoughts on names I am following this year check out the post below.

If you missed the 2026 Investment Picks for Size Lords Post you can read it here.

Crypto

Bitcoin liked Trump’s comments in Davos rebounding from about $88,000 over $90,000 yesterday and then resuming a small dump this morning. ETH and alts remain tempered for the moment.

Besides the next Fed chair pick the other big piece of news we need to focus on is going to be what happens with the crypto market structure build.

Bloomberg is reporting it likely gets pushed back to February or March as Senate Banking Committee pivots to Trump's housing affordability push. Coinbase CEO Brian Armstrong did not support it in its last iteration.

For now I am watching Bitcoin and seeing if we might make a move back to $100K as soon as we have a confirmation of this legislation moving forward.

If there was anything I feel like I should be buying MORE of right now, it is Ethereum and Chainlink.

Tom Lee’s BitMine bought another 35,629 $ETH for $110M, bringing total holdings to 4,203,036 $ETH (CoinDesk)

Grayscale filed an S-1 with the SEC to launch a Grayscale NEAR trust

Treasury Secretary Scott Bessent said this week at the American Banker’s Association "We are removing all regulatory obstacles for crypto."

Stripe has integrated Ethereum payments

Ondo Finance launched over 200 tokenized stocks, ETFs, bonds, and commodities on Solana (CoinBureau)

Chainlink acquired transaction ordering solution Atlas

NEAR Protocol was in focus this week as signs of growing institutional interest emerged alongside continued product development, even as broader crypto markets sold off. The protocol leaned into its “intents” framework, highlighting expanding cross chain activity and real usage that contrasts with the recent weakness in token price.

We spoke with Mark Mi of NEAR protocol on Risk On last year.

At the same time, NEAR reinforced its longer term positioning around AI-native infrastructure and scalable execution, aiming to differentiate itself from other general-purpose Layer 1s. Despite those fundamentals, NEAR traded largely in line with the broader risk off move in crypto, which highlights how sentiment and macro conditions are continuing to dominate short term price action and suppress our bags (for now).

I am still long NEAR.

The tokenization themes continued this week with the Ondo RWA news (above) and references about where crypto and defi are heading by Larry Fink and others in Davos.

I am begging you guys to not sleep on this theme. When crypto accelerates again (which I think is going to be as we move into Spring) I expect this topic to be top of mind for every corporate and institution.

Combine it with a real alt season and some of the projects/picks we outlined in the guides will absolutely send.

Global News & Geopolitics

Global headlines this week were shaped by a forceful showing from Donald Trump at World Economic Forum, where he floated aggressive moves on nuclear energy, trade, and global security while signaling a more transactional U.S. posture toward allies.

That tone was reinforced days later by comments around a NATO framework tied to Greenland, underscoring renewed focus on strategic resources and geography.

Markets reacted accordingly with risk assets wobbling on tariff and geopolitical uncertainty, crypto seeing more outsized pain, and capital quietly rotating toward defense, energy, and hard assets (gold/silver) as investors recalibrate for a more confrontational global order.

It’s getting weird out there brothers.

At Davos, Jared Kushner outlined a sweeping (and controversial) vision for a post-war Gaza, centered on reconstruction, economic development, and long term stability rather than short term ceasefires.

The proposal emphasizes reopening crossings, rebuilding core infrastructure, and attracting private investment, with demilitarization framed as a prerequisite for any progress. Kushner positioned the plan as a multi year effort with no alternative track, arguing that economic opportunity and security must move together if Gaza is ever to transition from perpetual conflict to a period of sustained growth.

People are outraged by the proposal online, and I have to admit it’s pretty wild lol as the images look like some sort of futuristic automated city complete with offices, recreation areas, and modern city buildings.

The gunman who killed ex-Japanese PM Shinzo Abe gets life in prison

The DOJ has arrested two suspects in connection with the storming of a Minnesota church but a judge refused to charge former CNN anchor Don Lemon in the anti-ICE protest at a Minnesota church, per CBS (Polymarket)

A federal appeals court lifted restrictions on immigration agents’ enforcement tactics in Minnesota, giving DHS broader authority amid ongoing protests and legal battles

Democratic lawmakers are pushing to block or condition Homeland Security funding in response to ICE enforcement actions, setting up another high-stakes budget and immigration fight in Washington

Ukraine and Russia traded renewed long-range strikes this week, keeping escalation risk elevated as Western officials are quietly acknowledging ammunition and air-defense constraints heading into late winter

Iran experienced fresh protests and internet restrictions in multiple provinces

Several European leaders used Davos to signal higher defense spending and energy security commitments

US Winter Storm

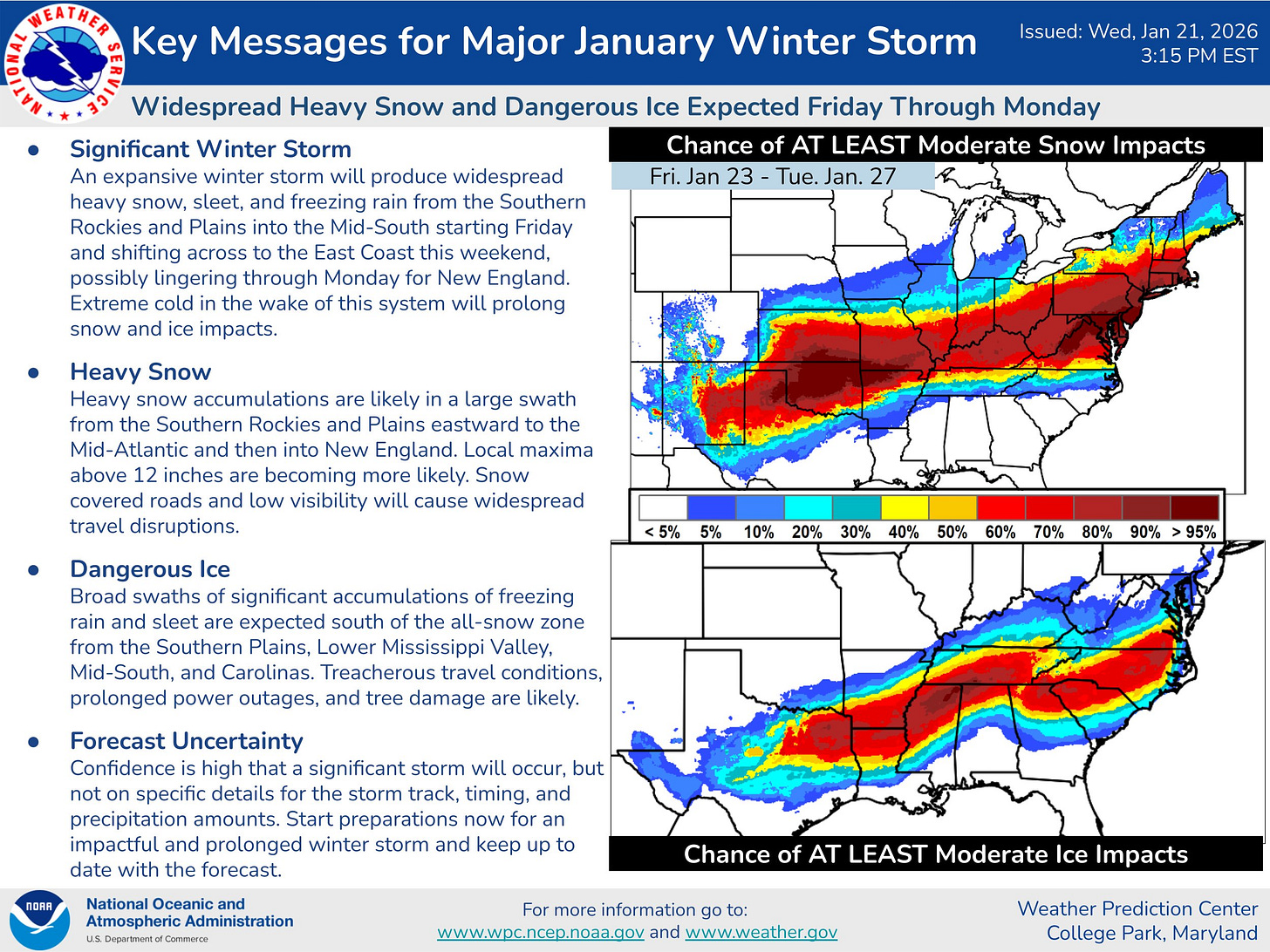

The US is poised to have a decent winter storm this weekend that could impact almost half of the country and disrupt power lines, roads, and infrastructure.

A major, widespread winter storm will hammer parts of the South, Midwest and Northeast Friday through Monday with potentially damaging ice and heavy snow for millions from New Mexico and Texas to parts of New England.

The storm has been named Winter Storm Fern by The Weather Channel. According to The Weather Company forecasters, Fern could affect over 180 million in the U.S. with snow and/or ice, over half the nation’s estimated population (Weather.com).

Right now it’s hilarious to see the weather nerds on X and other sites go at it. They are arguing about intensity, snow fall levels, and if this even is going to be that bad. As of this morning, it seems that it does have the potential to absolutely dump snow within the red band above. Some regions (and most of the northeast) might see around 12-24 inches total.

This isn’t a prepping Arb Letter (maybe we are overdue?) but it does pay to be prepared. You’re not just preparing for severe civil unrest, martial law, war, etc. — weather can also be one of the most serious adverse scenarios we encounter.

If the freezing rain/ice buildup is substantial enough in some of these states IT WILL cut power and cause some infrastructure damage.

Doesn’t hurt to prepare accordingly.

Couple days worth of food/water

Flashlights, lanterns, batteries, candles

Cash on hand, full tank of gas, prescriptions picked up

No need to go crazy but be practical about it and avoid travel if you can. Flight schedules will get absolutely clobbered.

That’s all I have for you guys today, going to try and get an episode of Risk On out first thing in the morning, if not it will be on Monday.

If we see any quick or notable market moves before the weekend we may put out another post before Saturday.

Enjoy the rest of the week and stay warm this weekend.

Andy

Good call on the storm prep! Definitely due for another general preparedness post, the last one was excellent.

Andy any thoughts on LINK recently. Can’t explain the way it’s behaving