The Next Generational Wealth Opportunity Part 2

523: Wall Street is Here

Good morning all.

Shoutout to Indiana’s QB for going dummy last night, that dive reminded me of playing NCAA in high school.

Quite a bit I could talk about today, including the wild weekend in Minneapolis, Minnesota. I personally think things will get even more out of control soon, but maybe I will save that for a Risk On rant mid week?

Back in May I dropped the post below (one of our all time most read posts we have out of 523).

We hopped into the world of tokenization, which I believe will eventually be an incredible opportunity inside the tech, crypto, defi space.

Crypto is choppy right now.

Last Thursday the Senate Banking Committee delayed its scheduled markup hearing for the Clarity Act. Brian Armstrong, CEO of Coinbase voiced opposition.

The Coinbase executive noted that the bill provides what he calls a "de facto ban" on tokenized equities, decentralized finance prohibitions, lowers financial privacy, erodes the Commodity Futures Trading Commission's authority, and would "kill" rewards on stablecoins, which Armstrong noted allows banks to reduce their competition. (Investors.com).

I have no doubt this passes eventually, and while crypto related equities sold off last week in response, crypto didn’t react much until Sunday. As of now Polymarket has 26% of bettors thinking Bitcoin could go below $85,000 by the end of January.

We are in another valley for now.

While this isn’t a generic post crypto sentiment post, I’m of the opinion that sentiment is pretty close to new lows. Interest is scarce, X and other online platforms are pretty quiet. Retail is nowhere to be found lol.

Now seems as good a time as ever to do part 2 on tokenization.

We sit on what might be the cusp of a solid year for crypto. It’s a nice little pocket before what could be the next hype cycle. Recently:

$5.1 trillion State Street launched a Digital Asset Platform that is offering institutional clients infrastructure for tokenized assets

NYSE is now building a platform for the 24/7 trading of tokenized stocks

Bitwise Asset Management launched the Bitwise Chainlink ETF on January 14th

BitMEX just declared they are implementing Chainlink Data Streams on the Ethereum mainnet to operate newly released Equity Perpetual Contracts (Blockchain Reporter)

BNY Mellon called tokenization a “megatrend”

In October IBM 0.00%↑ announced they are launching a digital asset platform to help banks, governments and corporations manage digital assets securely across blockchains (CoinDesk/IBM)

I’ve said it before and I will say it again, these dips and lull periods are the best time to educate yourself on these concepts. You get to operate in the calm as opposed to all out chaos when everyone is scrambling.

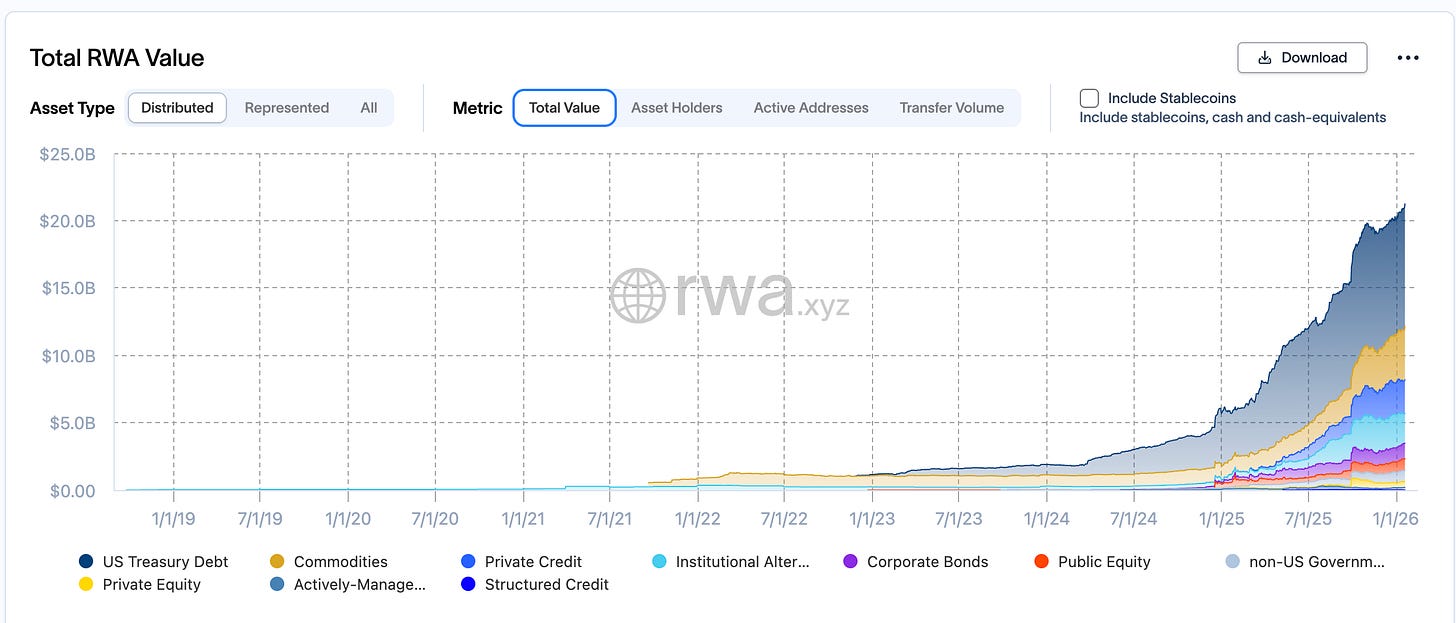

The market of tokenized assets, including stablecoins, is now projected to reach over $18.9 trillion by 2033, according to a recent report from Ripple and BCG.

That would mean an average 53% compound annual growth rate (CAGR).

The opportunity is here and based on recent updates we should have more conviction in the tokenization story and the chance it offers to have a part in a sizable technological revolution of financial markets.

We’re not talking one NVDA 0.00%↑ like multi bagger here, we are talking about the opportunity to have a stake in a wild digital gold rush we haven’t seen in some time.

So let’s take a look at what’s changed since we put out the first edition, then we will dive into the assets/tokens to hold, and identify some companies and themes you are going to want to keep an eye on in 2026.

No time to waste lords.

Tokenization Refresher

Still unclear on what tokenization is?

At its core, tokenization is about modernizing financial infrastructure, not reinventing assets.

Instead of recording ownership, transfers, and settlement in fragmented legacy databases, tokenization represents those same financial claims as programmable units on a blockchain. Ownership becomes digital native and instantly verifiable (important).

All without relying on a stack of intermediaries to reconcile records after the fact.

The real advantage isn’t purely novelty, it’s just efficiency.

Tokenized assets can move continuously, settle almost instantly, and plug directly into automated systems for lending, collateral, dividends, or compliance. It is a natural extension of financial ecosystems.

Capital then stops idling in annoying multi day settlement limbo and starts behaving more like software. It is always on, globally accessible, and composable with other existing financial tools Wall Street and institutions use.

Importantly, this shift has little to do with JPEGs, memes, or insane speculation. When people say “I’m in it for the tech” in crypto (which is often said ironically) THIS is what that actually might mean.

This is an actual use case for crypto/defi that doesn’t seek to replace but amplify and improve and more importantly for us, it looks like it could end up being a chance at ridiculous returns if you are exposed properly.

The type of thing that pays you for years if you get in early.