What I’m Buying Before the Breakout

403: Locked and Loaded

Good morning.

We’re going to start with a quick and dirty run down today and then we will get into portfolio specifics — for both crypto and equities, where I walk through everything I am long and everything I will be looking to add as soon a we start to see a shift in momentum (and to be honest I think we’re getting close).

As I said the major turning point for the sentiment bogging down markets will be some sort of positive announcement with China. The residual effects of tariffs won’t be shed in a day or a week, but the market will absolutely love the uncertainty that disappears if we can just get trade deals being announced.

Episode 27 of Risk On is live on Spotify — I sat down with Patrick Curtis, the founder of Wall Street Oasis — the internet's most iconic finance career platform. We talked about Patrick’s journey in investment banking at Rothschild and Private Equity, to his efforts building a powerhouse community for millions of aspiring financiers. Patrick shared how WSO evolved from a niche forum to a full-scale prep ecosystem offering elite coaching, resume reviews, and courses.

We discuss Wall Street recruiting in 2025, the rise of AI in the job hunt, shifting Gen Z attitudes, and how investment banking has changed — or hasn’t.

Make sure to check it out after today’s post.

Markets

Markets got a nice boost yesterday on the heels of solid earnings from META 0.00%↑ and MSFT 0.00%↑ Meta beat expectations with $42.3 billion in revenue and strong ad growth, while also raising its 2025 capex forecast to as high as $72 billion to scale its AI infrastructure—despite continued losses from Reality Labs.

Microsoft also topped forecasts, posting a size king worthy $70 billion in revenue and strong gains in its Azure cloud business, with plans to invest around $80 billion into AI this fiscal year.

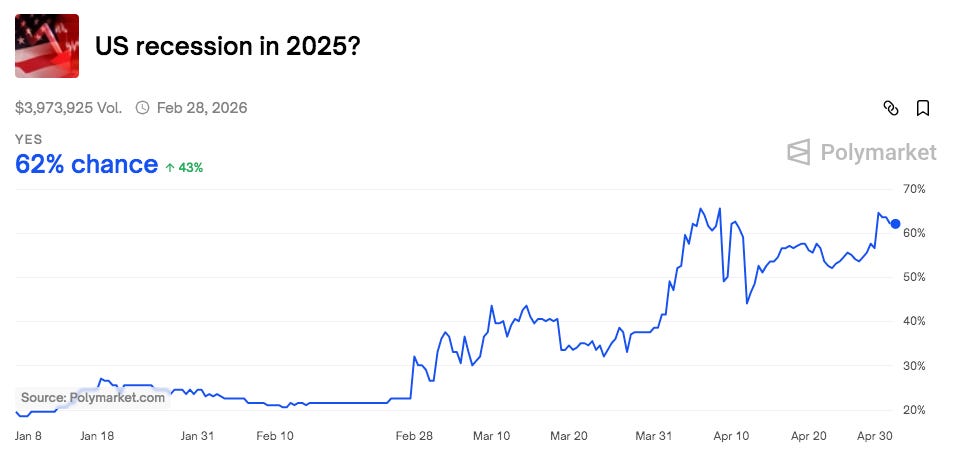

Polymarket is showing 62% chance of a recession in the US in 2025 with almost $4,000,000 in volume.

China has reportedly secretly created a list of US-made goods that are exempt from 125% tariffs, Reuters reports. (BRICSnews)

Financial stress has more Americans that are beginning to tap into their 401Ks according to a report by Bloomberg (Unusual Whales)

Ripple (XRP) made a bid this week between $4B to $5B for Circle but was ultimately rejected (Bloomberg)

With ongoing volatility on the auto market front this week Ford’s F 0.00%↑ CEO said in an interview President Trump’s tariff policy are “great for the country.”

The North Carolina House passed a bill this week to create a Strategic Bitcoin Reserve.

The Tesla, TSLA 0.00%↑ Board of Directors have just reportedly opened a search for a CEO to succeed Elon Musk, (WSJ)

British American Tobacco has received a buy rating from Bank of America, highlighting its strategic shift toward smokeless nicotine products like Vuse, Glo, and Velo (Investor’s Business Daily)

Despite volatility in U.S. markets, emerging markets such as India, Brazil, and China are showing surprising resilience. Factors like a weaker U.S. dollar, easing borrowing costs, and favorable trade dynamics are contributing to this performance, making emerging markets an attractive potential option for those looking for some diversification during these uncertain times in markets

KKR Getting Active

In April, KKR ramped up its deal activity with two major acquisitions aimed at expanding its footprint in both healthcare and financial infrastructure. First, the firm teamed up with Stonepeak to acquire UK-based healthcare property group Assura plc in a £1.6 billion deal. The offer came at a significant premium and is expected to close later this year, pending various approvals.

Shortly after that, KKR struck a $3.1 billion agreement to acquire OSTTRA, a post-trade services platform previously co-owned by S&P Global and CME Group. The move positions KKR more deeply in the plumbing of global markets, as OSTTRA handles clearing and data services across various key asset classes.

Both deals signal a clear push by KKR into essential, cash-flow-heavy sectors.

Starbucks Dump

Starbucks SBUX 0.00%↑ stock sank over 8% this week after the company reported a surprise drop in sales—global same-store sales fell 1%, and U.S. customer traffic dipped 2%. The miss highlights a broader emerging trend that could be concerning: consumers are pulling back on premium purchases and becoming more cost-conscious, favoring value over convenience in a tighter economic environment globally.

Coffee is often considered a "small luxury," and during economic downturns or periods of financial strain, spending on these types of things tends to decline. Historically, consumer research and reports have shown that when wallets tighten, people cut back on habitual premium coffee runs before eliminating larger expenses—making it a potential real-time indicator of consumer sentiment and discretionary spending trends. Much cheaper to make coffee at home.

Global News

The U.S. and Ukraine just signed a new minerals deal yesterday that could reshape their economic partnership.

They’re launching a joint investment fund to tap into Ukraine’s natural resources—everything from rare earths to oil and gas—as part of Ukraine’s broader reconstruction effort. Profits from any new projects will be split 50/50, with Ukraine keeping full control over its current reserves.

Unlike earlier proposals, this version doesn’t saddle Ukraine with new debt or repayment tied to past military aid. Instead, it’s structured as a clean forward-looking investment agreement—designed to align with EU rules and Ukraine’s long-term goals.

While the deal signals continued U.S. support, real-world development will be tough to pull off while war still rages on with Russia. As of April 2025, the war in Ukraine has led to an estimated 790,000 Russian and 400,000 Ukrainian military casualties, with tens of thousands more reported missing and over 12,000 Ukrainian civilians killed.

Another conflict may soon be breaking out — as of April 30, tensions between India and Pakistan are heating up after a deadly attack in Indian-controlled Kashmir killed 26 people, mostly Hindu tourists.

India blames Pakistani-backed militants and has responded swifly by expelling diplomats, closing its airspace to Pakistan, and suspending a key water-sharing treaty. Pakistan has issued a warning that India may launch a military strike within 24 to 36 hours, citing intelligence reports, as both sides ramp up military activity along the border and mobilize troops and various units.

Tim Walz said this week he was selected as Kamala's running mate so he could "code talk" to white guys lmfao “I could code-talk to white guys watching football, fixing their truck - I could put them at ease.”

India closed airspace to all Pakistani aircraft, including commercial airliners, through May 23 yesterday — IndiaToday

Various reports on Wednesday have said that the FBI agents photographed kneeling during George Floyd protest have been now removed from their positions (CNN)

Pete Hegseth in between signal chats took the chance to threaten Iran on X this week saying:

Message to IRAN:

We see your LETHAL support to The Houthis. We know exactly what you are doing. You know very well what the U.S. Military is capable of — and you were warned. You will pay the CONSEQUENCE at the time and place of our choosing.

So do we have yet another Middle Eastern debacle on our hands? I pray not. But all the same — probably not a bad idea to maintain some exposure to defense with the world where it is right now. Different regions are highly unstable right now (we’re not even mentioning China). Worst case you hold defense positions for a few years, best case you’re in before the shitshows potentially start.

Where I’m Positioned and What I’m Watching Next

While pieces of my net worth and portfolio are probably not too dissimilar from what many of you hold, today I have highlighted a number of equity names, crypto plays, and other assets that I would shift into (have shifted into) as soon as we get the green light with tariff mania subsiding and more direction on where the Fed will take fiscal policy in 2025.

When you turn on the afterburners is up to you — but there’s already been a bounce many took advantage of (my QQQ 0.00%↑ calls are printing off lows).

Almost all of my tech “bottom” calls including AVGO, PLTR, META, MSFT, COIN, and TSLA and others look just like the NVDA 0.00%↑ chart below.

As you’ll see you had two local bottoms that have proven to be solid areas to add. Had you acted on the 4th when this post went out, you’d be comfortably in the money on all of these positions.

What I am Buying On the Dip was sent out on April 4th.

I’m a huge proponent of transparency and I really have nothing to hide plus I feel like this might be a good blueprint/idea generation opportunity for those that are still feeling more uncertain about where things are headed and what they should do.

With that, let’s start with my equity picks.