What Happens If You Do Nothing?

527: AI, Automation, Future of Lower Class

Good morning.

Sovereignty, freedom, independence, and escaping the classic rat race have always been major structural themes of Arb Letter (and some Arbitrage Andy content if I am being honest).

The majority of you guys “get it”.

You don’t want to be stuck in the lower or middle class forever, you don’t want to miss out on the next tech or money trend. You realize that on all fronts things are accelerating and it’s getting more difficult to lock in upward mobility.

I’ve put out countless posts on these concepts and feel very strongly about them in the modern age. More recently Asset Owners vs Everyone Else and The 2026 Blueprint: Survive the Chaos, Profit From the Future.

However, in the last several weeks there have been some new developments emerging across technology, AI, and the macroeconomic world that confirm just how pronounced this divide we talk about is going to end up being.

Viral AI agent OpenClaw is dominating headlines and quickly becoming the poster child for the next wave of autonomous AI agents. It doesn’t simply answer prompts or act as your therapist, it executes a wide range of tasks seamlessly.

We mentioned it last week but it’s worth repeating. You have top execs from Microsoft and Anthropic predicting the mass white collar job replacement SOON due to AI leaps

META META 0.00%↑ patented AI that has the ability to continue posting and messaging from user accounts of deceased individual’s accounts by mimicking and replicating their past history of posting/activity

The Pentagon is reportedly threatening to downgrade or cut ties with Anthropic, despite Claude being deeply embedded in sensitive Defense Department workflows, because the company refuses to fully loosen restrictions on how its models can be used.

Roughly half of U.S. college graduates are underemployed, working in jobs that don’t require a degree. There are now just 1.6 job openings per 100 employees in the professional and business services sector, the lowest in at least 11 years (Kobeissi Letter)

The US National Debt is projected to surge $2.4 trillion annually over next decade, reaching record $64 trillion by 2036 (CoinTelegraph)

While I consider myself more prepared than most for this new world the speed of it all still unsettles me a bit lol.

It’s just lightning fast.

One second ChatGPT prompts are the rage and the next you have AI bots being used to trade money, use prediction markets on Polymarket, and design entire applications while their handlers go workout at the gym.

Something structural is happening beneath all of these insane headlines.

It’s not just the political polarization Ray Dalio is screaming about or technological disruption on our X timelines it’s an economic sorting that I think most people are just not seeing because it is starting to happen as I am typing this at 8:45 pm last night.

Increasingly, there are people who own productive assets and systems, and there are people who will rent access to them. This divide will define who ascends financially/socially and who falls far behind (likely permanently at some point).

The owners hold equity, businesses, intellectual property, automation, distribution, and hard assets that compound over time. The renters depend on wages (bad strategy cotton), platforms, employers, and institutions whose terms can change overnight. When inflation rises, policy shifts, or technology advances, the owners adapt and benefit. The renters feel it as pressure in tighter margins, less security, fewer options.

As AI accelerates and capital concentrates that divide widens quickly.

The danger isn’t some sort of dramatic collapse (though we can never rule this out entirely). It’s this type of slow immobility, waking up one day and realizing that most of the meaningful decisions about your economic future are being made somewhere else (by someone else). That you cannot afford a reasonably priced home. That your once secure corporate role now barely keeps you afloat because a 22 year old can do his new job AND yours with an AI agent.

That a handful of assets and sectors are now monopolizing all the gains in the market.

Good neighborhoods, healthcare, schools, goods, and quality of life just gets harder and harder to afford.

That you missed the boat on harnessing AI and technology for your advantage.

That’s what “being left behind” actually looks like.

Not actually eating bug porridge in an Amazon comfort pod.

But being managed, being stuck a perpetual consumer, and using constantly vs. creating and producing your way to wealth.

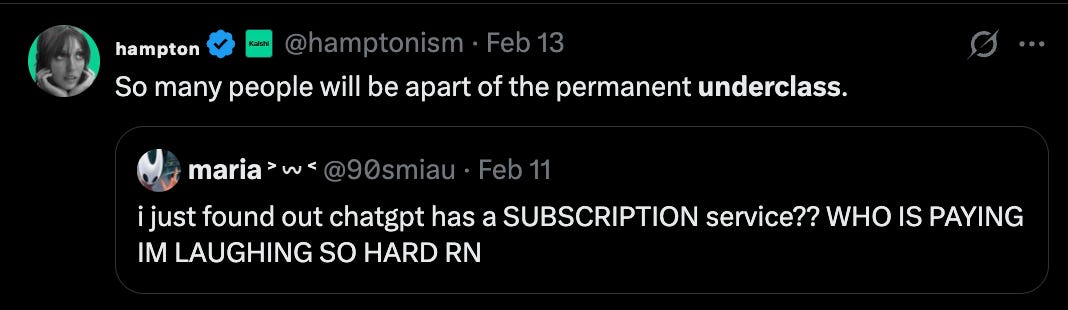

Being absorbed into a consumer class that exists to be taxed, monitored, nudged, and sold subscriptions, while the ownership class quietly exits into assets, automation, optionality, and leverage.

So when people say “don’t become a bug eater,” what they mean beneath the meme is: Don’t become a person whose entire future is decided for you.

We can’t all be AI titans or Mag7 company owners, but as we will discuss today, there are active steps you can take immediately to ensure that this does not happen (and we will talk about them today).

The first step of course is recognizing what’s actually happening in the first two months of 2026.

The Separation You Need to Watch

AI and the future of work got a wild surprise last week. The future of secure white collar roles looks sketchy at best now.

If you were on X, you saw the “Clawbot” discourse about Claude-style agents executing tasks, chaining decisions, navigating tools, doing the kinds of repetitive cognitive labor tasks that used to be “safe”.

It was mayhem.