Asset Owners vs Everyone Else

522: Gold & Silver Tell Us What Happens Next

Welcome all and good morning.

There’s typically a handful of times each year when we watch the existing financial norm and order get absolutely defiled with degeneracy.

When market conditions leave sidelined softos panicking and retail scrambling for exposure as select asset prices, stocks, companies, or tokens go sicko mode into the heavens.

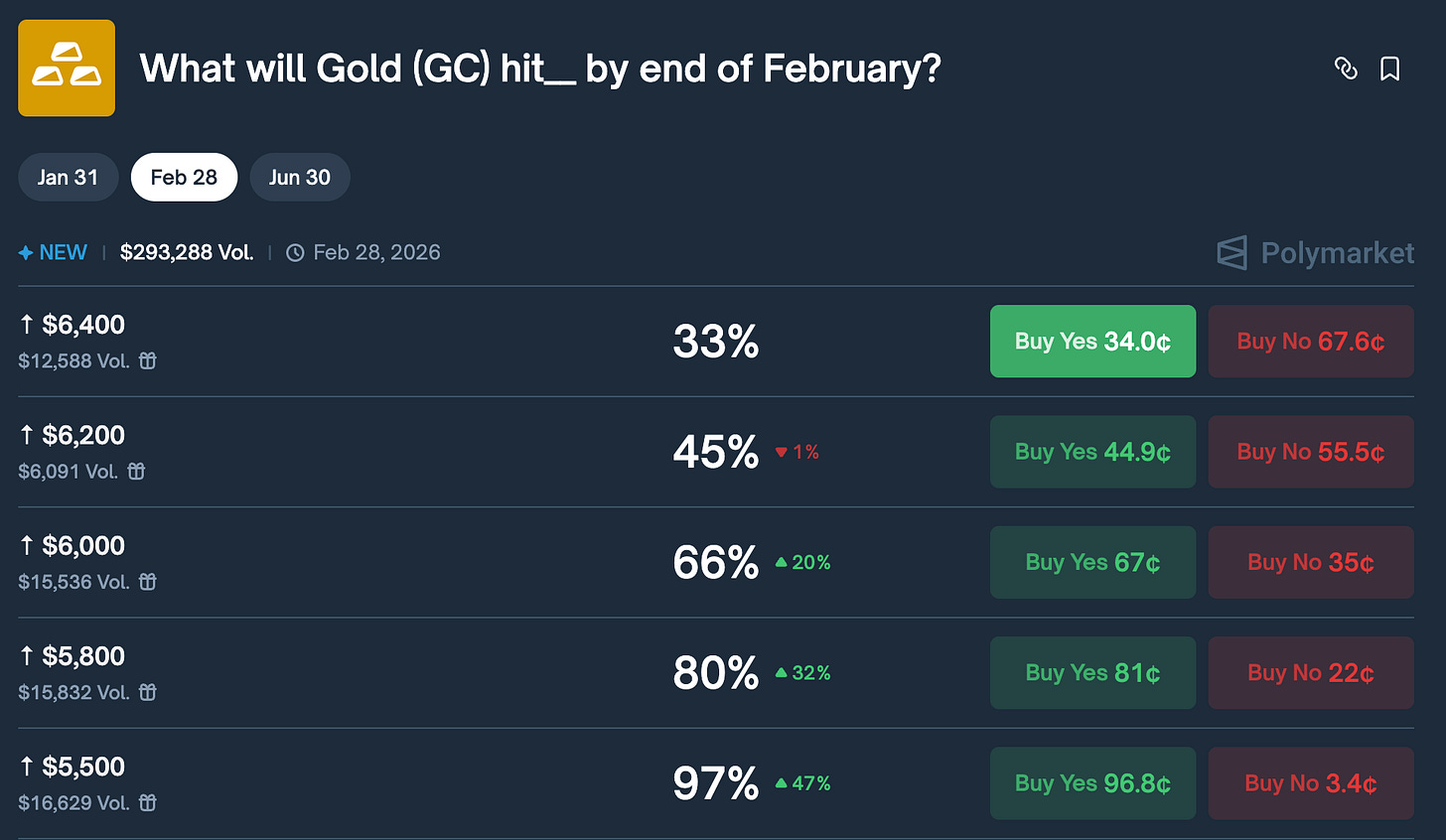

This year metals and more specifically, gold, takes the cake. It added the entire market cap of Bitcoin in a single day yesterday lol. Silver just reached a new all time high of $120.

People are panicking, doom posting, and brooding because they missed out on one of the most diabolical pumps we’ve seen in a long time.

But the insane ascent of gold and silver is likely not a fluke. There are strong undercurrents driving price action, themes that we have covered before and big names have been yelling about for close to a decade.

Fiat debasement as the US dollar falls to a 4 year low.

Geopolitical instability. Wars.

The drive for people to flee to safe haven assets.

The digital transformation of money.

What you are watching is a paradigm shift that has caught a good deal of people entirely offsides. But it’s not over. There will be additional opportunities that stem from this. Which is good news for anyone who missed the metals play. But regardless, it is important we take a moment to grasp what insane surges in metals usually tell us historically.

Sentiment gauges such as JM Bullion’s Gold Fear & Greed Index are now signaling extreme bullishness in precious metals, even as similar crypto indicators remain stuck in fear (CoinDesk).

Among others things like currency debasement, economic pivots, geopolitical volatility, metal surges generally precede a widening gap between asset owners and wage earners. This is the quiet one people miss and in my opinion the most relevant for all of us. After legendary runs like this (and this one is truly insane) you tend to see asset price inflation, stagnant real wages, and social/political tension.

Things are moving rapidly in 2026:

Banks are experimenting with stable coins and tokenization

Investors are fleeing to historical safe haven assets (metals)

AI continues to to hollow out white collar labor, compress margins, and force companies to choose efficiency over headcount

Layoffs are accelerating into month end

People are falling behind. They are wondering what comes next? How do they preserve their purchase power and make sure that they do not miss the next big market move. On the flip side, some are calling for a biblical crash.

What can we actually expect this year?

Today we’re going to cover the following:

Gold and Silver - are we witnessing a blow off top? Is there still time to buy? Is it worth shorting? What do these price movements suggest about the economy and future of fiat?

Equities - where can we see continued outperformance? Will AI cool in 2026? How will select sectors react to the new Fed Chair? Which ones will perform regardless of Fed antics or short term volatility? Do you own them?

Crypto - why are Bitcoin and other crypto assets lagging compared to other sectors? Are we overdue for a fat Bitcoin moon? How quickly might be we see a catch up rally?

You cannot afford to not be on top of these themes in financial markets this year. We are entering a period that is going to separate winners and losers in a massive way.

Asset owners are going to come out on top. Everyone else is going to find themselves in a brutal position as wages lag, savings are silently diluted, and the cost of simply standing still rises faster than most people can comprehend.

This isn’t theoretical. It’s already happening in real time and we are watching it play out in real time. Cash is losing purchasing power. All of this has gotten worse since the last time we dropped a post like this.

Paid subs have not just stayed afloat but outperformed and caught some of the momentum of meaningful market narratives in defense, metals, commodities, and energy.

There is no doubt - fiat systems are being stress tested by debt, deficits, and political incentives that make discipline impossible. Meanwhile, capital is flowing fast toward hard assets, scarce assets, and digitally native systems that sit outside the legacy financial order our parents and grandparents lived through.

2026 is shaping up to be a year where doing “nothing” is no longer neutral.

Sitting in cash, waiting for clarity, or hoping for a return to the old normal is increasingly a losing strategy. The window to reposition before the next leg higher, before the next shock, before policy makers pull another lever is still open, but it’s narrowing kings.

We’re going to break down where capital is actually moving, what that tells us about the future of fiat, and how to position intelligently across assets so you’re not one of the people waking up six months from now wondering how they fell so far behind.

This isn’t a doom post and it’s not a hype piece. It’s a field guide for navigating a period where the old playbooks are breaking and you need to recalibrate. You don’t need to predict the future perfectly (nobody can do this) you just need to understand where incentives are pointing and position accordingly to print.

Let’s talk about how you can take advantage of the current market to position yourself for what is going to happen next.