We are already in a recession

069: How to weather the current recession

Hope everyone is having an excellent week and happy Friday. Thought I would take this Arb Letter to mention how wild the times are in that we are living through, as a writer there is an absolute abundance of endless content to choose from.

Despite what many government and federal reserve officials might have you believe, we are likely already in a recession.

The U.S GDP actual for Q2 was -0.9%, and -1.6% in the previous quarter. Many consider this phenomenon, when the economy contracts for two consecutive quarters, the exact technical definition of a recession and yet The White House this week had the audacity to redefine the definition of a Recession, as they did with Vaccines. (See Below).

At this point it is comical how many definitions are being fabricated and how much word salad is being employed by government officials, elites, and Jerome Powell himself.

RECENT INTERVIEW

We did a recent interview with a friend of a friend Max Raskin (@maxraskin) who publishes some of the most interesting interviews on the internet. In addition to being a co-founder of QVIDTVM, an important buy-side firm that spun out of Morgan Stanley, he is a professor of law at NYU.

He’s interviewed everyone from Tucker Carlson to David Rubenstein, and so I was really excited to sit down with him to share a more personal side of my life and business.

Read the interview here

MARKETS

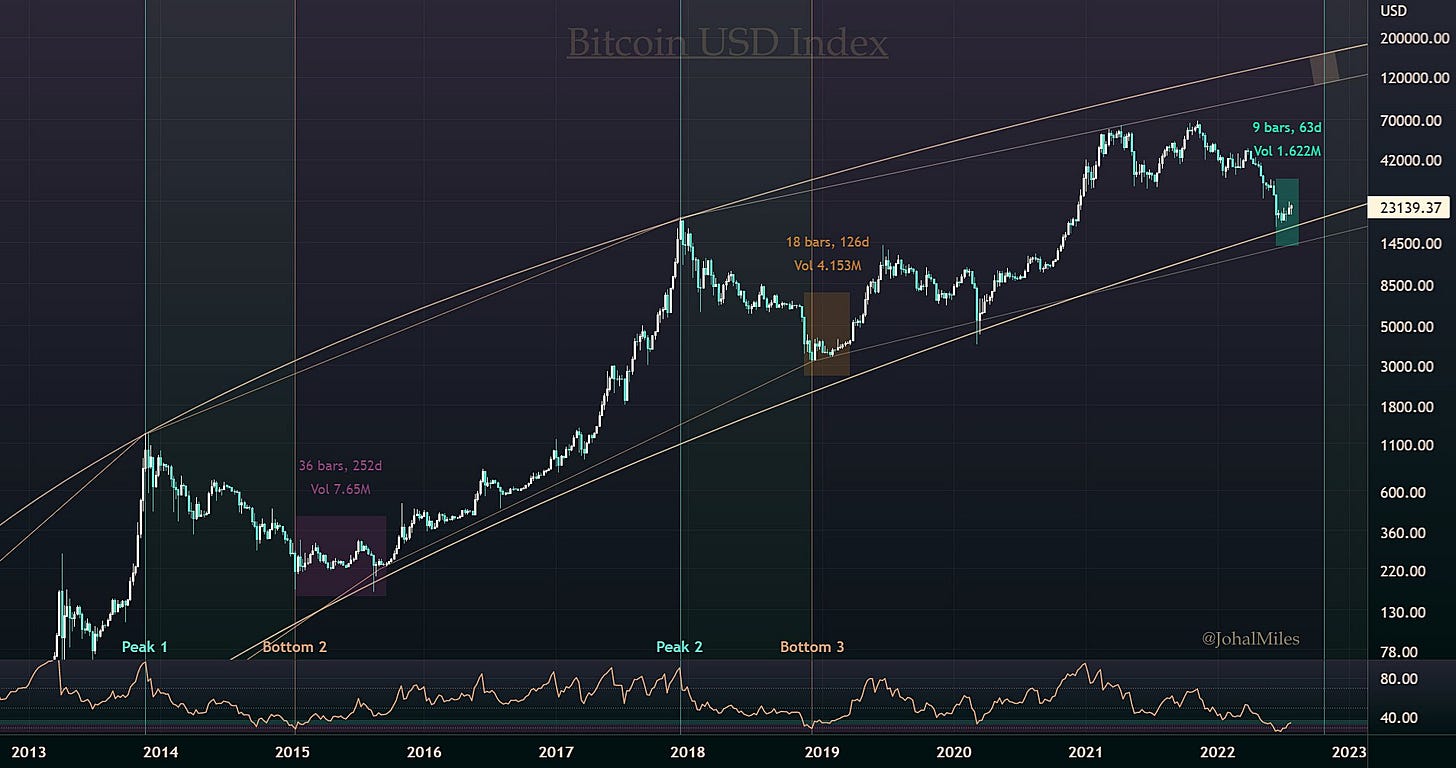

Markets responded positively to a 75 bps hike by the Fed on Wednesday amid some sentiment that future hikes could lessen in severity, causing cryptos to move much higher and select tech names bouncing nicely with some key earnings.

Bitcoin surpassed $24,000 reaching a 6 week high. The Nasdaq Composite is down roughly 18% despite having it’s best day this week since the low ranges of the pandemic which ranged around +4-5%.

I am bullish in the short term as I expect some folks to come to the bear party late and get into short positions that have for the most part already been juiced. Remember crypto and assets that large institutional investors consider very “risk on” have already fallen significantly.

We now wait for Real Estate, Cars, and other items to see the contagion impact of sky high inflation and waning demand. Many have been caught offsides with this pump upwards and that makes the rally interesting. Some folks including Bill Ackman and Elon Musk are turning to Twitter to voice their opinion on inflation and the Fed’s policy.

There’s been roughly $82M Bitcoin short positions liquidated in the past 24hrs with upwards price movement

DOCU (DocuSign) and PYPL (PayPal) are down 80% and 70% respectively over the last year

ARK Innovation Exchange-Traded Fund (ETF), or AARK, sold 1,133,495 COIN shares reducing their position significantly at near all time lows. Meanwhile, Cathie bought up 1,765,929 shares of SHOP (Shopify)

Coinbase shares dropped 21% on Tuesday and have slumped 79% year to date (The Street) amid an SEC investigation

A new CNBC poll finds that 65% of Americans earning $100,000 or more are 'very concerned' about inflation

AMZN (Amazon) shares soared 12 per cent higher in pre-market trading Friday after the e-commerce company beat analysts’ quarterly revenue forecasts - expect this to contribute to a market pump today into the weekend

Important to remember to try and not get emotional when trading any asset class - this may seem like basic advice that is commonly available but it bears repeating. Assuming this is a relief bounce and not a sustained pump, many will get emotional and FOMO in.

If we see the trend lose steam those people will likely panic sell AGAIN and compound their initial losses.

If a long term investor simply wait for corrections and red days to buy and dollar cost average. If you’re trying your luck at trading short term make sure to stay disciplined and sell into pumps like the one we are seeing now.

Remember most people buy at the highs and sell at the absolute lows - just buck this trend through discipline and you will be able to outperform 90% of people.

Microsoft, Amazon, and Google are still at great levels to average into in our opinion. You going to buy now and make great returns over the next 5-7 years or wait for another 10-20% drop?

As our friends at BowTiedBull would echo, make sure you are looking at stocks through the following lense: which products are people going to definitely use more of in the next 5-10 years?

Pet products? AI intelligence? Iphones? Home security? Monkeypox/virus Vaccines? Non lethal weapons (tazers, body-cams, etc.)? Electric cars? Outdoor equipment? Religious/spiritual items?

This requires you to have high awareness of the socio-economic and political trends that are transpiring to assess where the real opportunities lie and how humans are thinking about the world that they now live in.

Do that effectively through research and a bit of luck and you will be well positioned to take advantage of shifting markets in the coming years.

If you read Arb Letter you already know how we feel about crypto and defi. The quiet before the storm. The assets that persevere through this Fed-linked noise and tangle will see absurd inflows of institutional capital in the future.

SENTIMENT

“A neutral rate of 2.25-2.5% only makes sense in a world with 2% stable inflation. It makes no sense in a world with 9%, 6% or even 4% inflation. Powell’s views on the neutral rate have only served to materially ease financial conditions making the inflation problem worse and his job more difficult,

- Bill Ackman, Pershing Square

“Economic data has not been that strong [and] that was taken as less aggressive monetary policy going forward,”

- Antoine Lesne, head of strategy and research for State Street’s SPDR ETF business (Financial Times)

GLOBAL NEWS

The world continues to putter along amid the War in Ukraine, global supply chain problems, and most recently fears of Monkeypox, which has surpassed 20,000 global cases with the United States leading infections. In case you missed it we did a comprehensive post on Monkey Pox Monday.

San Francisco issued a State of Emergency on Thursday with reports the virus has infected the water supply in the city. The Biden administration is still contemplating whether or not to issue a state of emergency but we expect this to happen relatively soon.

Social media companies continue to tweak strategy models as Tik Tok continues to demand the lion’s share of attention from the younger generation.

Meta CEO Mark Zuckerberg said the company will more than double the amount of content from recommended accounts people see while using Instagram and Facebook by the end of 2023.

He said that such recommendations currently account for roughly 15 percent of the content on Facebook, and that the percentage is already higher on Instagram.

The push, which Zuckerberg calls building the “Discovery Engine,” is a radical departure from Facebook and Instagram’s historical focus on showing posts from a user’s social graph, or list of friends (The Verge).

Amid clear signs that we may very well already be in a recession the Biden Administration has chosen to deny and react in a rather puzzling way, downplaying hints that the US may be in for some more pain in the months ahead of mid term elections.

Biden is allegedly running again in 2024 according to white house officials

Shell Oil (SHEL) reported a record $11.5 billion in profits for Q2 2022

Eurozone inflation hits 8.9%, which is a new record high

A rare bipartisan agreement to subsidize the production of semiconductors in the US was driven largely by the realization that the American tech sector should be able to operate and manufacture more independently from supply chains rooted in China (CNN).

At Arb Letter we are large proponents of small government and for good reason. As illustrated over the last several years, things have begun to degrade in the US for everyday Americans.

The cover ups and obfuscation of true facts at this point by our government during the Covid 19 Pandemic, money printing induced - Inflation, and now full blown recession is truly mind boggling. This is absurd behavior tyrants utilize to control populations.

Changing the definitions of things to suit their needs and to fit select narratives. You should be pissed regardless of your politics as this is likely to continue despite the suffering of most common people.

Point is, by this time, if you’re paying attention you’ve begun to see a pattern in the way major events are being portrayed. It’s always to protect the elite, powerful, and those in the government/system.

Things are bad folks. Objectively. Crime is up, inflation is soaring and becoming entrenched, wars are raging that will alter the global order, and our most senior officials seem more interested in altering the way we view obviously concerning events than helping us get through them.

The issue we face are hardly limited to domestic ones. Across the globe the current administration is grappling with challenges from Russia and more recently China. Nancy Pelosi is planning a trip to Taiwan that is being met with stiff rhetoric from Beijing, who has shown increased hostility towards the island in recent weeks.

I feel like we are beating a dead horse here with Taiwan warnings - but the fact of the matter is we are likely to see some sort of military move by China soon.

The island represents a massive thorn in the side of Beijing both from an optics standpoint and from a nationalistic lense. They likely would love to cast that blow against the United States right now while we deal with the fresh wound of Afghanistan and try to deal with an increasingly unpredictable Putin in Ukraine.

Tensions are escalating over House Speaker Nancy Pelosi’s potential visit to Taiwan, the island with 24 million people that China views as its own territory but which has long been a self-governing democracy.

We will likely do a deep dive on China in the coming weeks.

E Commerce Post Dropping Monday

At Arb Letter we put out two posts a week - one free and one premium where we do deep dives, focus pieces, and offer alpha on markets and global news (we sometimes offer more than one premium post per week). I have always wanted to give as many people as possible access to raw unfiltered truths on markets, finance, life, and global news.

That being said we put a great deal of time and research into premium posts which is why we price them the way we do. Monday we will send out a paid post on how we built our Arbitrage Andy digital brand and how to get started in E Commerce. We have had high demand for this post with Covid and the rise of WFH. If you want to be financially free - this is a major step towards getting that journey started.

If you, like us, find yourself wanting side income and want to take a step closer to becoming less dependent on your boss or 9-5 this post will definitely be for you. We will walk through each step you need to take as well as the key elements required to making good money online.

69 LOL

So, you're just not going to make any reference to 69 anywhere in this Arb Letter? Jokes aside, great read as usual.