They Are Telling You What Comes Next

425: Bullish Crypto Regulation, Big Tech Rips on Earnings

Afternoon all.

It’s one of those Thursdays that feels like a Friday, so we’re going to act accordingly at around 5pm ET.

But before that — we’ve got some big updates to cover that suggest more of our plays might get the catalysts they need to send us to valhalla.

Three posts total this week but quite a few important market developments we can’t afford to ignore.

Two bigger posts for premium subs from earlier in the week are listed below in case anyone missed them. The first was a look at all asset picks for my “god bundle” for the next 5 years or so. These constitute long term holdings that I will have no problem hodling for 5+ years. Includes crypto, defense, AI, cloud, and other sector picks. Some good tickers most people might have overlooked so far in 2025 (Uranium, Defense, Commodities).

Assets I’m Holding Into 2030

The Window Is Closing

This morning going to do a quick run down of markets and then we’re going to dive straight into the White House Digital Asset Report that dropped yesterday.

Some major alpha to be found in it.

There’s a reason I called Tokenization the next General Wealth Opportunity. Hopefully some of you listened and started researching and taking action because this report validated quite a bit of what we suspected.

Once this really hits stride, it’s going to move quite quickly.

Ridiculous amount of bullish crypto updates to cover today towards the end of the post.

I also owe you guys an episode of Risk On today or tomorrow morning, just putting some final edits on an episode I just did with my homie Carson J. Becker so look for that in the next 12 hours or so.

Markets

Alright so what’s the Fed up to this week…..

The Fed held interest rates steady at 4.25%–4.50% yesterday, sticking to a cautious stance despite growing internal and political pressure to cut. Two governors broke ranks and called for a rate cut which was the first dual dissent in decades. This hints at rising tension inside the Fed as political heat and softening growth collide.

Economic data remains mixed. Inflation is still elevated around 2.7%, likely due to tariffs and higher import costs, while the labor market holds steady with unemployment near 4% (although I am not sure what to believe on this front).

GDP rebounded a bit in Q2, but broader momentum is cooling. Markets reacted with mild hesitation as the hopes for a September cut were dialed back with rate futures now show less than a 50/50 shot.

The next few months will be all about data and whether Powell can hold the line.

Equity markets are seeing some insane action this week on the heels of major earnings.

META 0.00%↑ and MSFT 0.00%↑ skyrocketed after hours on 7/30.

Meta crushed expectations in Q2 with over $47 billion in revenue and earnings per share of $7.14, fueled by strong ad performance across Facebook, Instagram, and Reels. The company continues to pour billions into AI, aiming to build personal “superintelligence” systems and expand its ad tech capabilities. Shares jumped double digits after hours on the beat and bullish Q3 guidance.

Microsoft also delivered a blowout quarter, with nearly $76.5 billion in revenue and 39% year-over-year growth in Azure. Its cloud dominance and massive AI infrastructure push are paying off, with capex expected to hit record levels next quarter. The stock popped nearly 9% on the news, and analysts are raising targets across the board.

Make sure to check out the bigger equity related posts from this year including the must hold assets post and the one from this week — many of the names we’ve picked are doing fat daddy runs the last several weeks including:

Carvana CVNA 0.00%↑ has staged one of the most shocking stock comebacks in recent memory.

After collapsing over 98% from its pandemic era 2021 highs during the used car meltdown, the stock looked literally dead. It was buried under debt, saw crashing demand, and there were bankruptcy whispers.

But in true bizarro-market fashion, it’s exploded off the lows, driven by aggressive cost-cutting, a surprise return to profitability, and a massive short squeeze. It’s a reminder that in markets and in them modern era, the most hated names can become the biggest winners when the narrative flips and investors decide to ape.

Other market news from this week:

Congressman Thomas Massie has called to end the Federal Reserve

Pending home sales are near their cycle low (MacroEdge)

Palantir PLTR 0.00%↑ surged another roughly 6% this week, following new defense contract rumors and some renewed hype around its battlefield AI dominance after Piper Sandler slapped a $170 price target on it

Morgan Stanley strategist Mike Wilson raised his year‑ahead S&P 500 target to 7,200, citing stronger earnings, more AI adoption tailwinds, favorable tax policies, and dollar weakness as key support (MarketWatch)

President Trump has ordered pharmaceutical companies to lower prices within 60 days or "every tool" will be used against them (Polymarket)

President Trump signed an executive order implementing an additional 40% tariff on Brazil this week (Kobeissi Letter)

Crypto & Blockchain

The White House released its long-awaited digital asset report, outlining a broad framework for crypto regulation and infrastructure development. It supports shifting oversight of most crypto assets to the CFTC, introduces strict backing rules for stablecoins under the new GENIUS Act, and reaffirms opposition to a U.S. central bank digital currency.

"Together, we will make the US the crypto capital of the world!"

— The White House

While the idea of a Strategic Bitcoin Reserve was mentioned, no specific details or timeline were provided much to the dismay of hodlers (though I am sure eventually we will get clarity).

Overall, the report signals a pro-innovation stance with an emphasis on integrating blockchain into finance, taxes, and banking.

Several crypto assets or protocols were mentioned including Chainlink, so let’s talk about how hyper bullish this is for our favorite oracle.

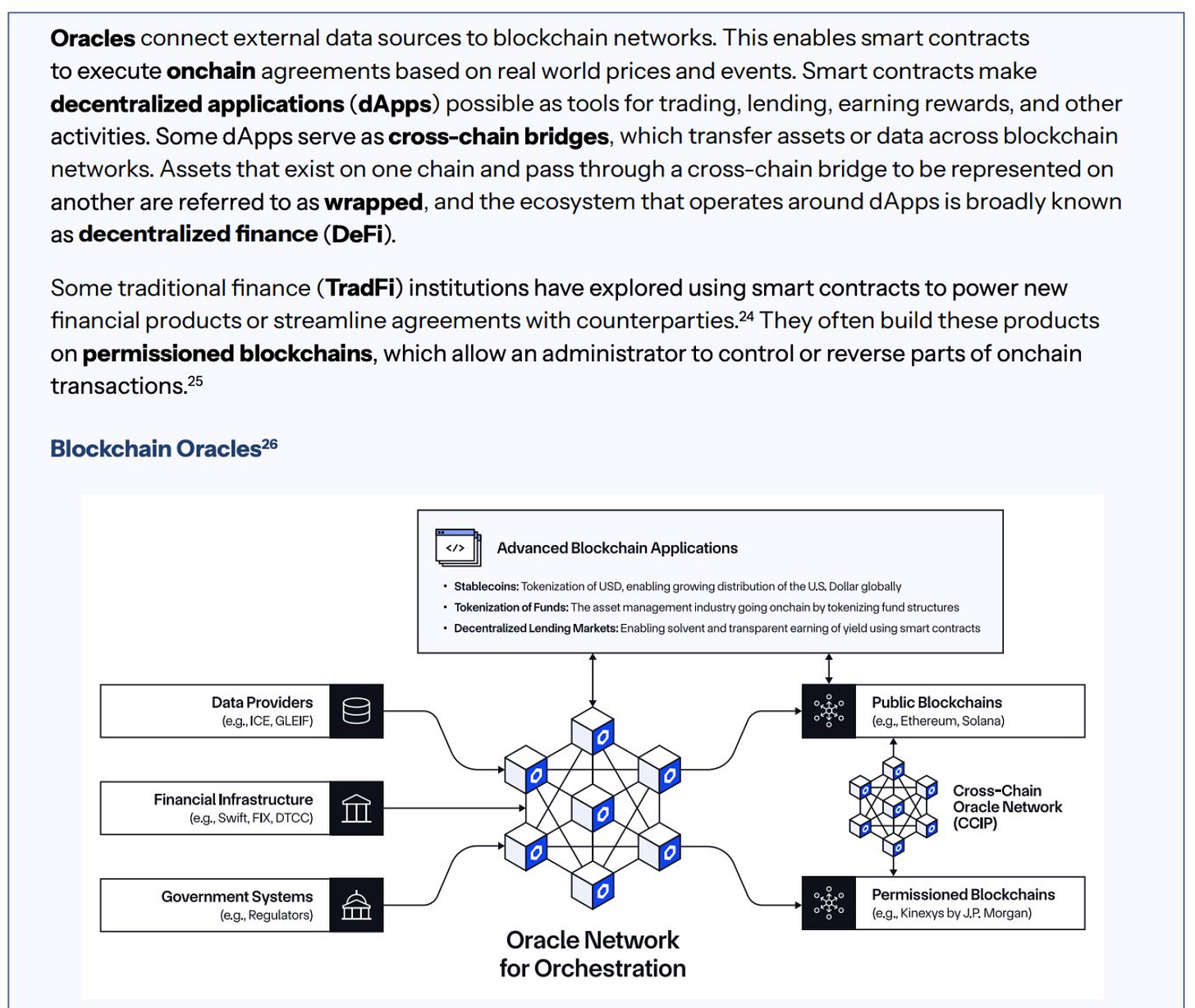

You’ll notice a few things on the page from the report below:

CCIP (Cross Chain Oracle Network) is referenced (CCIP is a universal messaging standard that allows blockchains to talk to each other — securely and reliably. Think of it like the “TCP/IP” of crypto, the same way the internet needed a standard protocol to connect different computer networks, crypto needs a secure way to connect different chains, and CCIP is Chainlink’s solution to that problem.)

JPMorgan is mentioned under “Permissioned Blockchains” (same week that CEO Jamie Dimon said he is a "believer" in stablecoins and blockchain)

Ethereum and Solana mentioned as examples of public blockchains

The White House report’s mention of Chainlink and CCIP is bullish because it signals that U.S. policymakers see Chainlink as critical infrastructure for the future of digital finance. By highlighting CCIP as a secure way to move data and value across blockchains, the government is effectively validating Chainlink’s core value proposition: being the plumbing that connects real-world assets, stablecoins, and financial systems on-chain.

If the U.S. pushes forward with tokenization (which they will), cross-chain asset flows (which they will), and regulated stablecoins (which they will), Chainlink becomes the default middleware layer.

That could drive massive adoption, integrations with traditional finance, and ultimately demand for $LINK as the gas to fuel the network. In short: this isn’t just a casual mention, it’s a sign Chainlink is on the shortlist for institutional-grade blockchain infrastructure.

Buckle up marines.

You can read the full Chainlink X Account summary HERE.

Tons of bullish news popping up everyday for crypto at this point. After yet another BTC buy we have Michael Saylor saying that the earnings call today for Strategy "will be the most important event in the history of Strategy."

Other news:

Visa has added support for PYUSD, USDG, and EURC stablecoins

On the Visa earnings call CEO, Ryan McInerney also confirmed pending support for Avalanche AVAX

SEC Chair Paul Atkins said today Wall Street & Silicon Valley companies are "lined up at our doors with requests to tokenize” (WatcherGuru)

The Avalanche Network AVAX passed 500 million monthly transactions for the first time in July 2025

Blackrock bought $375m of ETH this week (Arkham Intel)

SEC Chair Paul Atkins is absolutely on one today — besides a multitude of hyper bullish comments he made this afternoon — he has also unveiled “Project Crypto” which is a commission-wide push to modernize securities rules and move U.S. financial markets on-chain (CoinTelegraph).

“America must do more than keep pace with the crypto asset revolution—we must lead it. I stand ready to help get the job done.”

— SEC Chair Paul Atkins

The era of mass adoption is here. The chart above in simple terms shows you the sheer scale of capitulation taken by traditional finance institutions.

I think some people are still in disbelief because Bitcoin is the only major crypto asset that has pumped hard so far (and to be honest its definitely got more in the tank lol).

Once ETH runs and the alts really start cooking you are going to see a scramble and panic from retail and late laggards like you’ve never seen before. It will be all out chaos as people realize this isn’t a fad anymore.

Prepare now — because when the pumps come it will go higher than you can even reasonably imagine and it will happen QUICKLY.

At the moment it might seem like there is an abundant amount of market noise and uncertainty (and some are calling for the top), but my gut instinct is that this is part of a prolonged shake out, especially on the crypto front.

I've often said that boredom is a trader or investor's worst enemy. I'm not saying don't be aware of risks or potential black swans that could drag us lower, but I think that it is more likely that we continue to chop or move up slowly as more and more pressure mounts on the fed to cut rates at the end of summer and early fall.

This is a waiting game for high growth tech. They HAVE to print more money.

And we HAVE to continue to accumulate assets to win this game.

That’s it for today, nice and short. I will be online tomorrow on X and the Discord as we monitor markets into the weekend.

Take care speak soon.

Andy

Gemini Crypto - Get Free Bitcoin

Protect Your Crypto with Trezor

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before

$LINK is going to be like SOFI and HOOD and eventually explode.

Andy I’m still not totally understanding the wealth opportunity with tokenization if the token is 1:1 with the underlying stock?