Assets I’m Holding Into 2030

424: The God Pack

Morning kings and queens.

If you missed the post wrapping up news from last week and Monday, including the shooting in Midtown NYC at the Blackstone/NFL offices, you can find it in the archive.

Today is purely markets focused, looking at the “package” or "set” of top assets I think will generate size lord worthy returns in the next 1-2 years.

I did an interview with a buddy of mine, Carson Becker who just launched his Substack Carson J. Becker. Make sure to give him a follow — one of his major side projects over the past few years was interviewing dozens and dozens of WWII veterans from across the globe (Japan, Poland, etc.) — some super interesting conversations.

In the interview — we discuss my time in corporate, my views on Bitcoin and risk assets, and a whole host of other topics if you’d like to check it out.

A major theme is sovereignty in the new age, more specifically:

How can young people create wealth in this economy?

What roles and moves can people make to come out on top?

How do digital assets and equities help propel net worth?

You don’t need me to continue to harp on the severity of the financial landscape yet again.

This is a big week — we have a Fed decision being made, economic data (that just came out) some substantial crypto news dropping from the White House, and a slew of major earnings that could provide some opportunities in equity markets for those looking to scoop up shares of target companies.

Expect some volatility this week and look to capitalize on it.

Put simply — the assets covered today, which include some we’ve covered before and some we haven’t, represent an outsized long term opportunity. These are assets I will hold for many years and ones that I believe can provide an excellent base into the next several decades.

Buy these or some makeup of these and I bet you outperform 99% of investors in the coming decade. Which of course is not formal financial advice.

We’re going to start with crypto allocations and then we will move straight into equity picks, with about 13 major tickers and 27 total listed today.

Crypto & Defi Essential Picks

On the crypto front — there is zero (I REPEAT ZERO) doubt remaining that we are on the verge of one of the largest bull runs in history that is going to be fueled by the largest financial institutions on planet earth.

The regulatory updates and progress are moving with increasing speed each and every day.

The White House is expected to release its long-awaited digital asset policy report today, laying out the administration’s stance on stable-coins, market structure, and how crypto fits into the broader financial system.

The report may also explore the idea of creating a strategic Bitcoin reserve using seized government holdings which would be an unprecedented move that would signal formal recognition of BTC as a strategic asset.

Additional guidance is likely to cover stablecoin licensing under the new GENIUS Act, potential regulatory clarity between the SEC and CFTC, and a reaffirmation of opposition to a U.S. central bank digital currency.

Investors are closely watching for mentions of infrastructure-related tokens like Chainlink ($LINK), which plays a key role in enabling tokenized assets and cross-chain data feeds, as well as projects connected to stablecoins and various other tokenization platforms. If the report delivers a favorable regulatory roadmap or hints at institutional accumulation, it could serve as a bullish catalyst across the crypto market.

Institutions are completing their infrastructure, preparing to launch stable coins, and buying up what they consider to be institutional grade assets like Bitcoin and Ethereum.

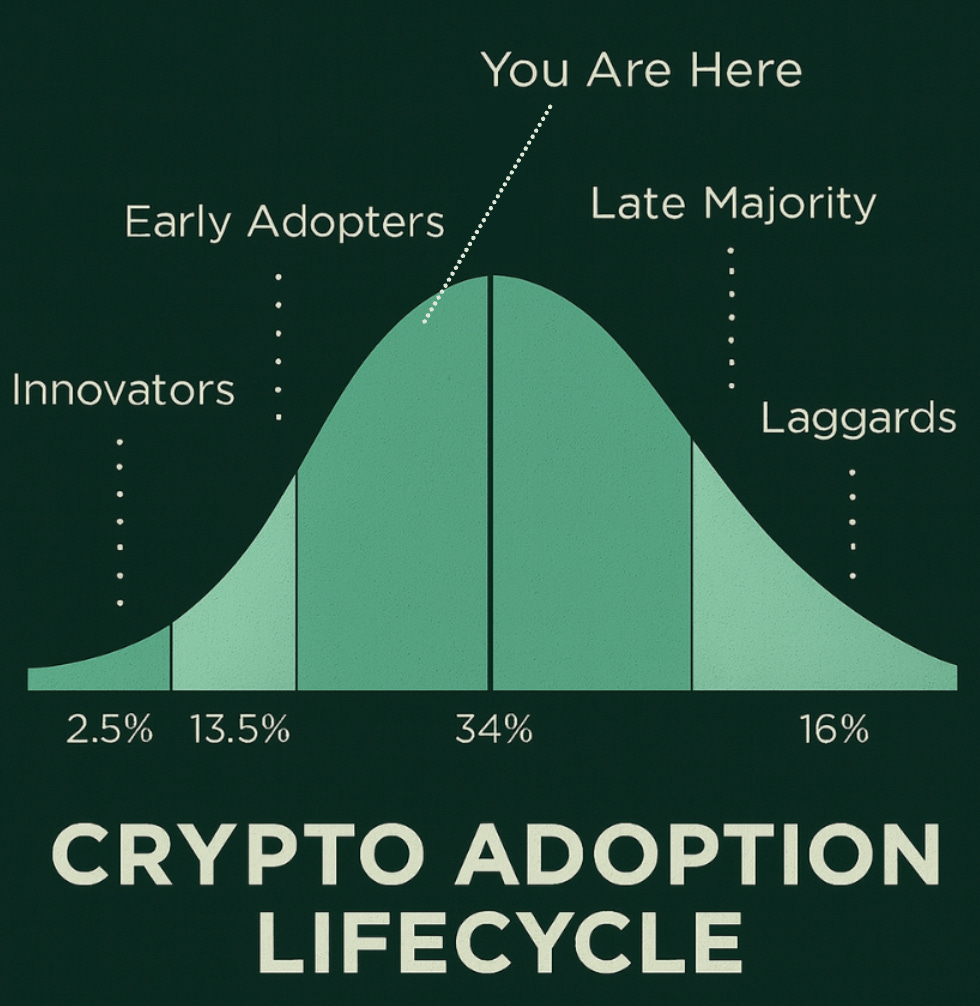

Around 562 million people globally now own digital currencies, accounting for roughly 6.8% of the world’s population. That figure might seem impressive until you realize what it really means: we're still early.

Dangerously early if you're sitting on the sidelines, which poses a unique situation.

Wait too much longer and you might get priced out of the remaining plays in the short to medium term, act quickly and you just might catch the moment right before the hockey stick move higher as the stars align.

What happens when that number doubles? Triples? When pension funds, sovereigns, and megacorps start allocating 1–5% of their portfolios to on-chain assets not because it’s trendy, but because it’s survival?

Then you have Alt coins which in my opinion are the garden of eden — a fertile and prosperous land that is yet to even be seen by mortals. Alt season is creeping around the corner, teasing us with fat gains that could come with as little as a whisper of adoption by mega corporations and Wall Street.

Look at it all — it’s just so beautiful:

Just announced this morning — JPMorgan will partner with Coinbase "to make buying crypto easier than ever."

The SEC voted to approve in-kind creations and redemptions for crypto ETPs — allowing crypto ETFs to both create and redeem shares using Bitcoin and Ethereum directly, instead of cash

BlackRock said this week crypto stable-coins are a "payment method in the future of finance”

Michael Size Lord Saylor has announced — Strategy has acquired another 21,021 BTC for ~$2.46 billion at ~$117,256 per bitcoin and has achieved BTC Yield of 25.0% YTD 2025

Publicly traded BTCS Inc. is setting up to raise $2,000,000,000 to buy more Ethereum

Blackrock bought over 4x as much ETH vs. BTC last week — they purchased over $1.2 billion of ETH last week, against only $267m of BTC (Arkham Intel)

We’ve beat crypto to death like a rabid farm dog that just murked our prize chickens, so I am going to keep this shorter relative to the equity picks coming up.

You could know NOTHING about crypto and buy the following, and in my opinion you are going to watch this portfolio explode in the coming years.

The highest conviction/safest options in the long term in my mind:

Bitcoin

Ethereum

Chainlink

Aave

Avalanche

Ripple

Polygon

*if institutional adoption continues at the rate we are seeing, this package here likely represents a similar opportunity as MSFT, AMZN, META, NFLX, GOOG, NVDA did years ago. My opinion, but one I have a high degree of conviction in. You don’t need all of them to hit. Just two to three. Bitcoin and Ethereum kind of already have.

The riskier/higher payout options:

Cardano

Monero

Sui

Injective

Arbitrum

Render

Synthetix

Thorchain

Stargate

I am excluding meme coins, not because I don’t think they can print in the short term but because I want this list to be a primarily long term focused bundle.

Equity Make it Stack

Alright stocks stocks stocks come get your stonks.

Below constitutes what I like to call the “god pack” or in laymen’s terms the package of equities that I intend to hold indefinitely so that my kids can avoid living in dystopian favelas eating cricket Ramen because Tesla robots have replaced the entire white collar workforce.