The Illusion of Stability Is Breaking

511: Markets Stall as the World Frays

Morning kings.

Another week upon us as we move quickly toward the Christmas and holiday season as well as one day closer to 2026.

It was a busy weekend for the news cycle and honestly, I could dedicate a full post to each of these topics:

European security officials are saying prepare for war

Radical Islamic terrorists are striking across the world

Crypto is selling off into year end

Equities, particularly tech is pulling back

Fed Chair nomination odds are changing daily

Brown University just had a tragic shooting (that looks political)

FBI officials foiled a New Year’s Eve terror plot in the US

It’s difficult to keep up with all of these headlines but today I will distill it into one Arb Letter this morning. Make sure you guys are following us on X and here as the usual big tech platforms are predictably in full on damage control trying to censor the facts.

Stock Market, Economy, Fed Chair Pick

Markets leaned risk-off yesterday, with both equities and crypto trading lower as investors pulled back ahead of key macro data and year-end positioning.

In equities, the weakness was most visible in tech and growth, where recent leaders continued to unwind as traders de-risk into thinner December liquidity. The broader tape felt cautious rather than panicked, more waiting than selling, but our momentum has clearly stalled a bit.

The U.S. economy added 64,000 jobs in November, slightly above the expectations of 50,000. However, the unemployment rate rose to 4.6%, surpassing forecasts of 4.5% and marking the highest level since September 2021. While payroll growth beat estimates, the broader signal is some gross deterioration beneath the surface.

TLDR? The labor market is continuing to weaken.

That backdrop matters, because a cooling labor market changes upcoming policy calculus for the Fed. As growth slows and cracks widen beneath the surface, the question isn’t just what will the Fed do next, but who will be the chair making those decisions that impact our bags.

With rate cuts, balance sheet policy, and political pressure all converging in 2025, the choice of the next Fed chair is about to become far more consequential than markets are currently pricing in (IMO).

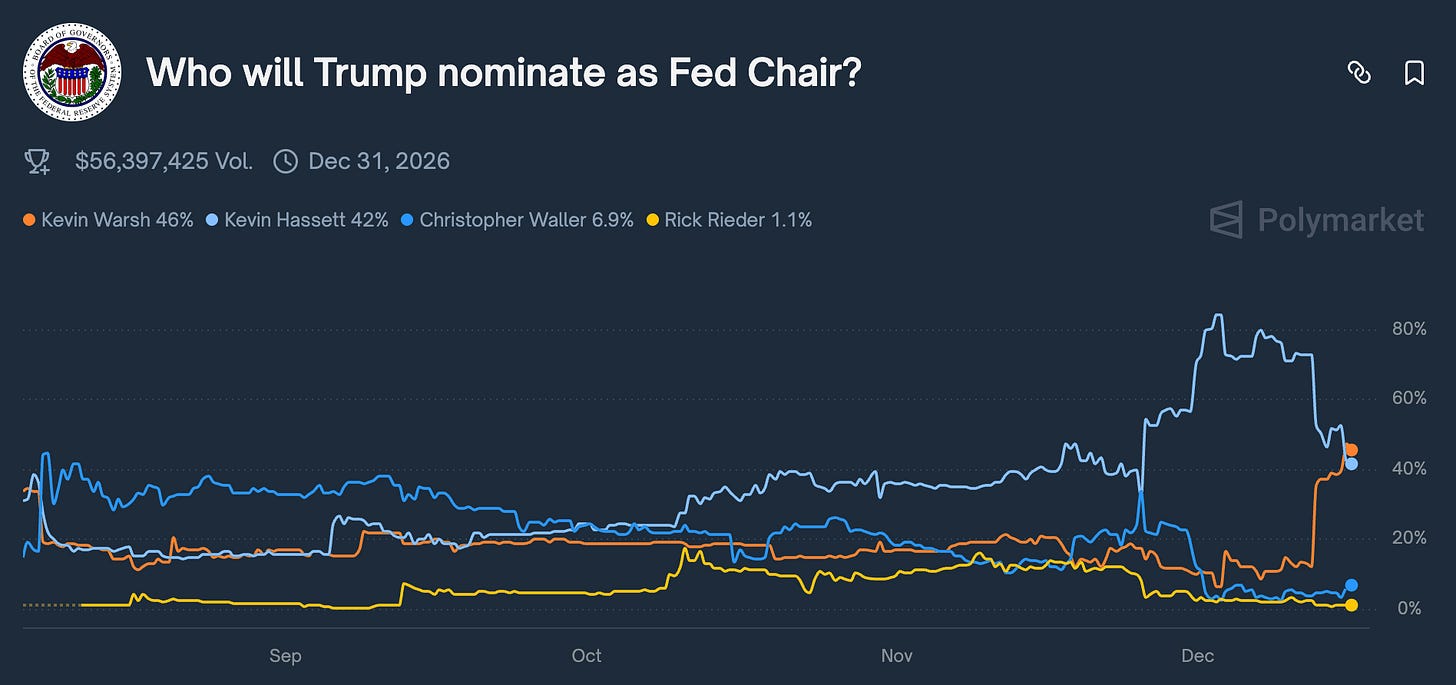

Polymarket odds are now shifting again with Kevin Warsh pulling ahead of Kevin Hassett as Trump’s soon to be Fed chair nomination.

Warsh is definitely viewed as a more hawkish, institutional figure. He is a former Fed governor with deep ties to Wall Street, a long-standing critic of post-2008 monetary excess, and someone who has openly argued that the Fed overstayed its welcome with zero rates and QE.

Unlike size lord Hassett, who is seen more as a political economist (and pro crypto candidate) aligned with Trump’s growth agenda, Warsh signals a return to tighter monetary discipline, greater skepticism of balance sheet expansion, and less tolerance for inflation being waved away as “transitory.”

Click here if you want to check them out, they may have shifted overnight even more.

McKinsey is set to reportedly cut thousands of jobs over the next 18-24 months

The Nasdaq is preparing filing to extend stock trading hours to 23 hours on weekdays. Not sure if this is going to end up being a good thing lmao

Paypal submitted its application to become a US bank (Polymarket Money)

President Trump has said he is looking to reclassify marijuana “very strongly”

Scott Bessent has said US citizens may receive refunds of $1,000 to $2,000 in first quarter of 2026 (Unusual Whales)

While I am mostly going to sit on my hands through year end, I think there might be an opportunity to scoop up some good names on the low in the coming days.

Equities I am looking at adding outside our list from 15 Stocks That Could be The Next Palantir include:

I took a YOLO position on some TLRY 0.00%↑ calls on Friday with a short expiry to see if I can print on President Trump signing marijuana legislation.

Just for fun. We will see.

DEI and The White Male

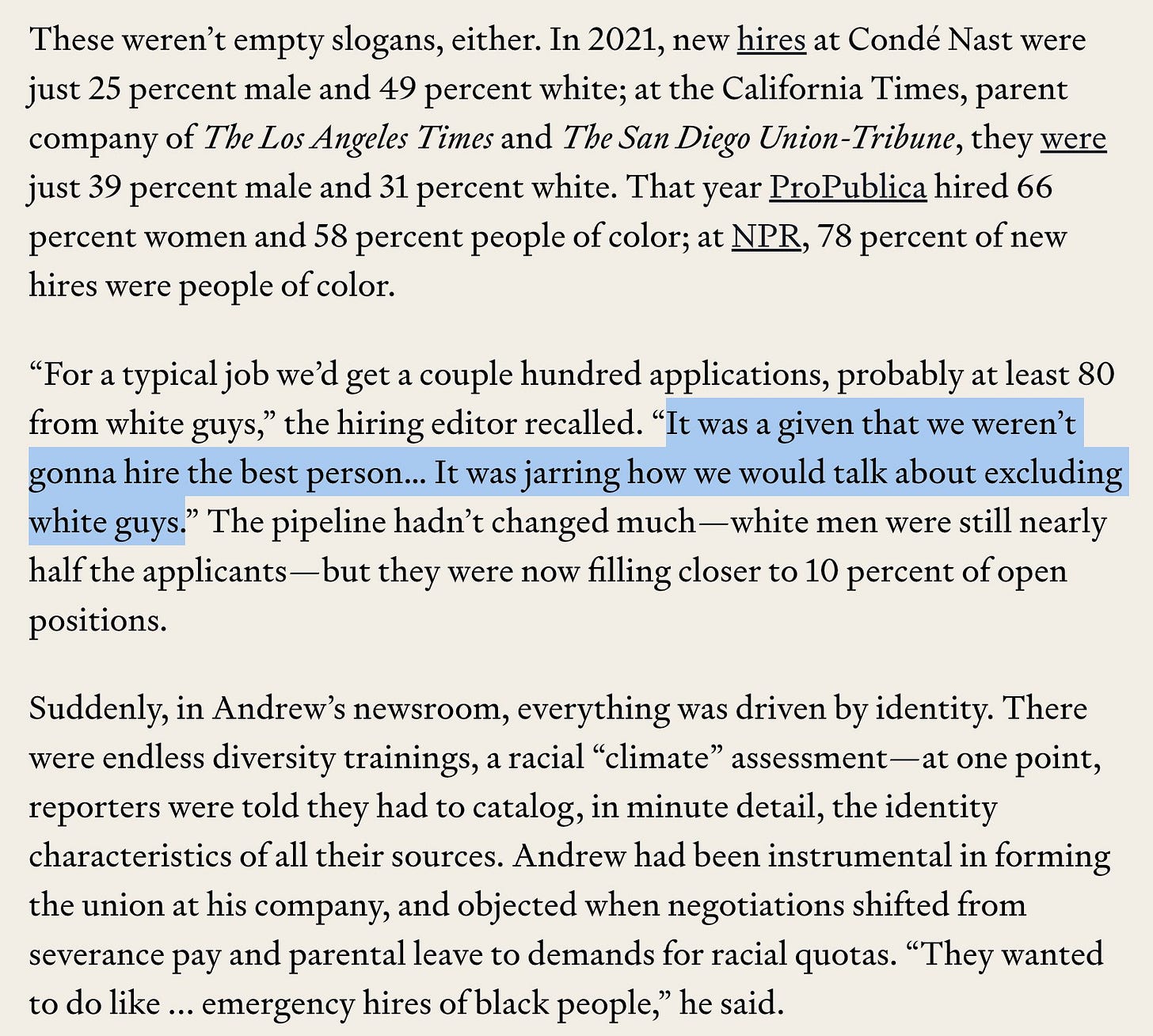

When it comes to the intersection of DEI, wokeness, and business Jacob Savage in CompactMag dropped an insane article this week that dives into the last 10 years of discriminatory hiring practices across the job world.

The article is insane.

And like various users pointed out, it’s tough to understand the world today unless you comprehend the scale and intensity of the efforts described in it.

We already know post BLM years, corporate America saw a ridiculous surge in minority and non white male hiring. This graphic circulates most often. The interesting dynamic covered in this article is actually the role White Boomer men had in enabling the adoption of DEI and marxist ideology in the workplace.

They quite literally pulled the ladder up behind them and saved their own asses as the cost of younger generations of men to save themselves (which as some aptly pointed out, explains much of the animosity and shift towards the right side of the aisle by that demographic in 2025).

Sometimes it’s crazy to see how much things have shifted from the height of that madness, but one thing is super clear.

These were not structural or organizational changes that can be magically undone. It will take years for merit to work it’s way back to the front of the line across all organizations in the US. When it comes to courts, judges, federal jobs, university positions, and healthcare, there’s still a ridiculous amount of consequence we have yet to fully see when you place people based on race, gender, and ideology instead of merit and results.

Some X users even pointed out the cascading effect this had on marriage rates, fertility, and stability across the country due to essentially barring a generation of men from access to the corporate world.

Bleak stuff and unfortunately something I witnessed frequently in my 9 years navigating corporate and before that in college.

Crypto

Crypto is yet again experiencing aggressive liquidations into year end as about $600,000,000 longs are liquidated over the course of the past 24 hours.

Bitcoin slipped below recent support levels trading around $87,000, while Ethereum underperformed, breaking lower alongside a broader altcoin drawdown. The move looks less like a fundamental shift and more like a positioning reset.

We had leverage coming out, liquidity thinning, and buyers stepping back in the absence of any clear short term catalyst.

The Crypto Fear & Greed Index continues to fall indicating some extreme fear in the market right now.

MetaMask now supports Bitcoin

American Bitcoin disclosed that it now holds over 5,000 BTC, placing it among the top publicly traded Bitcoin treasury companies

Visa now offers stablecoin settlement for U.S. banks using Circle’s USDC

Tether made a large all-cash bid to acquire a controlling stake in Juventus soccer club

JPMorgan rolled out a tokenized money-market fund on Ethereum, seeding it with internal capital and targeting institutional investors (yes you should re-read the tokenization post we dropped now)

The institutional and regulatory bull vibes are still cooking but interest in the markets just seems to be at lows.

SEC Chair Paul Atkins said just this week that “public blockchains are more transparent than any other financial system ever built” a statement that would have been unthinkable from U.S. regulators just a few years ago.

That tone is increasingly echoed everywhere we look.

Major asset managers continue to expand tokenization pilots and on-chain settlement programs, banks are quietly scaling blockchain-based infrastructure for payments and collateral management, and regulators across the U.S. and Europe are shifting from enforcement-first postures toward clearer rulemaking. The floodgates will eventually open for us and coincide with more retail interest and liquidity.

So what next for price in short term?