15 Stocks That Could be The Next Palantir

512: Drones, AI, Defense, Logistics, and Wartime Tech

Morning guys,

Hope the week is going well so far.

Lot of content this week as I dropped the two part series on what to expect in 2026 and how I am thinking about the various areas and disciplines of life.

In past years subscribers have enjoyed these and used them as a mental reset BEFORE the year begins so check them out if you want below:

The 2026 Blueprint: Survive the Chaos, Profit From the Future

Today I want to drill into one of the topics we covered in the equities portion of the second post we dropped Tuesday morning.

High growth equity names that sit at the intersection of defense, AI, cyber, and drone technology.

Palantir had one of the most insane stories of the past several years and it was one of our biggest wins for paid subs. Many of you absolutely printed on it given we began talking about it as a long in the $20’s.

Palantir went from a misunderstood government contractor to the undisputed operating system for AI deployment across the public and private sector.

Over the past two years it flipped sentiment and bodied the doubters, blowing out earnings, landing massive defense and enterprise contracts, and becoming the go-to platform for governments navigating geopolitical chaos. Just yesterday Palantir announced:

The United States Navy announced a groundbreaking partnership with Palantir Technologies Inc. (NASDAQ: PLTR) to deploy Palantir’s Foundry and Artificial Intelligence Platform (AIP) across the nation’s Maritime Industrial Base (MIB). The initiative, ShipOS, authorizes up to $448 million to accelerate the adoption of artificial intelligence and autonomy technologies across the industrial base.

The stock completely rewired how the market thinks about AI infrastructure. What looked like a niche software company in 2023 (back when Karp was pretty normal) became one of the most aggressively compounding winners of the decade.

Many of you printed fat bands on it.

Markets are shaping up to be interesting next year and my bias is that we’re going to continue to see spending and money pour into defense and related themes. The Federal Reserve cuts interest rates by 25bps yesterday and announced they are set to buy $40 billion worth of treasury bills over the next 30 days.

They won’t call it QE because they’re buying short-term bills instead of long-dated bonds, but the effect is similar: more money flowing into markets, lower funding stress, and a friendlier environment for risk assets.

The new Terminator tech world is exploding with geopolitical uncertainty and new conflicts popping up left and right.

The House just passed a massive $900 billion defense spending bill, and yes kings that’s broadly bullish for defense stocks, especially anything tied to drones, sensors, autonomous systems, or next-gen warfare. This comes amid growing conflict around the world.

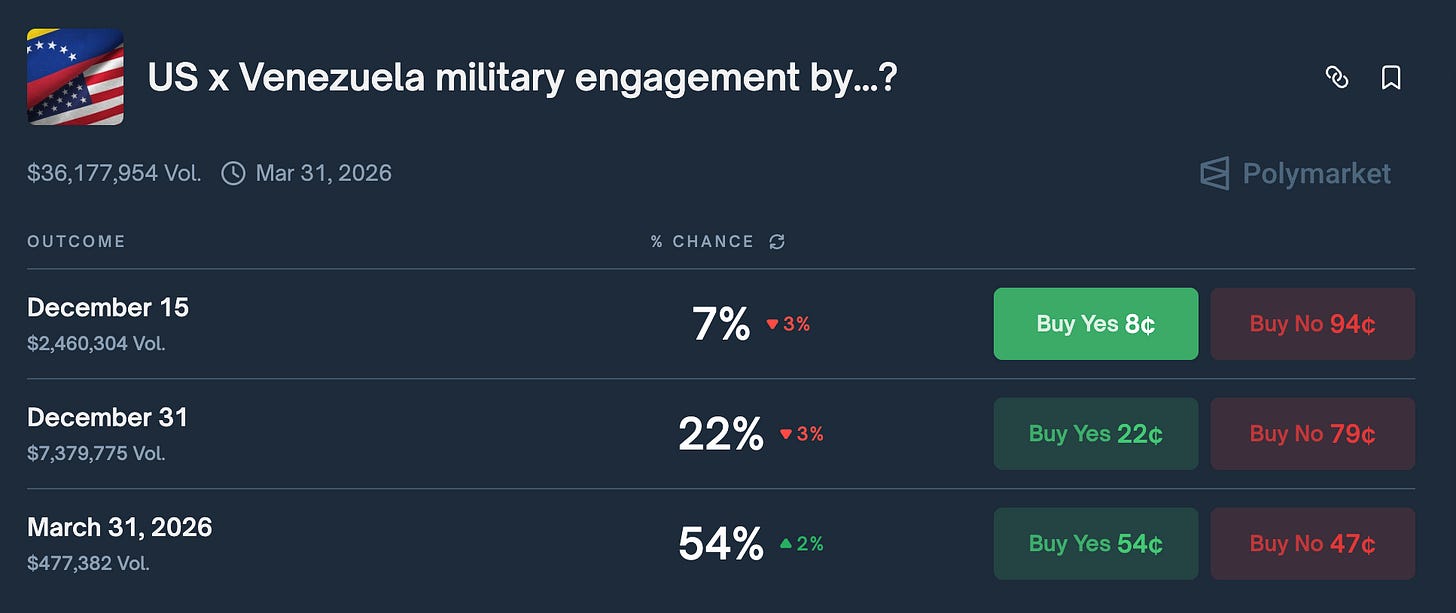

The US is raiding tankers off the coast of Venezuela, border conflict is erupting between Thailand and Cambodia, and the usual hotspots across Africa and the Middle East are simmering preparing for their next escalation while Ukraine and Russia continue to send men into the meat grinder.

Record spending levels signal years of steady demand for the exact technologies these companies build, and the modernization push inside the Pentagon only amplifies that tailwind. It’s not an automatic payday by any means. The actual dollars still depend on contracts, timelines, and execution but the direction of travel is unmistakably positive.

We can run to where the ball is going to be young kings.

In short we have the budget growing, the mission set expanding, and the kinds of companies we will highlight today are positioned right in the blast radius of that sweet sweet federal capital.

I still think Alex Karp’s baby is a buy and long term hold but what other names out there might have Palantir-esque potential to rip to the high heavens?

Well quite a few in my opinion…… and I have been keeping an eye on them to add along defense staples like LMT 0.00%↑ LHX 0.00%↑ RTX 0.00%↑ and NOC 0.00%↑ as we move into 2026 and beyond.

Let’s review shall we?