The Files, the Fallout, and the Lie of Stability

524: Regime Shifts, Metal Wars, and a Market That Refuses to Die

Morning guys.

If you missed it over the weekend, I dropped an emergency crypto post related to the aggressive selloff we endured in the last 72 hours or so.

Read it if you own crypto. Everyone is DMing me variants of the following questions:

Is the bear market here?

Are my alt bags cooked?

Is it time to buy more?

How long will this downtrend last?

The post will help you answer these question and manage expectations as well as provide some good pointers on what to do and NOT DO during this period.

Markets

U.S. equities shook off some of last week’s volatility and pushed back toward highs, showing that dip buyers are still hungry and risk appetite hasn’t vanished yet. Stocks remain somewhat resilient, but leadership is narrowing and positioning feels increasingly selective rather than broad apeing.

The real volatile action was in commodities, where some crowded trades finally snapped. Gold and silver saw violent sell offs after an extended run (then bounces), triggering forced unwinds and spilling over into broader metals.

Oil and industrial commodities followed lower as the dollar strengthened and rate expectations reset.

JPMorgan's Jamie Dimon has said that the bank will have fewer jobs in five years than it does now due to AI

PYPL 0.00%↑ is down almost 18% in pre market after earnings miss

Elon Musk's SpaceX to merge with xAI (Bloomberg)

Trump announced he will be launching a $12 billion minerals stockpile to counter China

Elon Musk has confirmed that SpaceX is in advanced talks to merge with xAI

US manufacturing expanded in January at its strongest pace since 2022

The Bureau of Labor Statistics will reportedly not release the January jobs report on Friday given the government shutdown (Solid Intel)

Eddie Bauer is reportedly preparing to file for Chapter 11 bankruptcy and will move to close all of its 200 North American stores (MacroEdge)

The latest ISM print was stronger than expected and, more importantly, pushed manufacturing back above the 50 level. For those unfamiliar - ISM is the monthly survey from the Institute for Supply Management that tracks U.S. manufacturing and services activity, with readings above 50 generally signaling economic expansion and below 50 signaling contraction.

That latest print matters (and might be bullish) because 50 is the line between contraction and expansion. After a long stretch of sub 50 readings, this suggests U.S. manufacturing activity may no longer be shrinking.

New orders and production both improved, which points to real demand rather than a one off statistical bounce. When factories start seeing new orders come in, it tends to flow through to higher output and hopefully better margins.

Trump announced a major push into metals and critical minerals yesterday, centered on a $12 billion strategic stockpile designed to reduce U.S. dependence on China. The initiative, framed by some as a “Strategic Petroleum Reserve for metals”, targets rare earths and other inputs essential for defense systems, semiconductors, EVs, batteries, and advanced manufacturing.

NB 0.00%↑ UAMY 0.00%↑ and some other Discord picks from our community popped on market open yesterday.

We are still long both and some of these plays are mooning today.

Nobody should be surprised here. Zooming out, this fits squarely into Donald Trump’s broader posture. Economic nationalism, supply chain sovereignty, and treating energy and materials as national security assets (which they very much are). Metals are being reclassified as strategic infrastructure.

If you missed it in Fall of last year on metals and companies that might be the Trump Administration’s next target for investment or acquisition check out the post below:

10 Stocks Trump Might Target Next10 Stocks Trump Might Target Next

Who is Kevin Warsh?

Markets definitely reacted last week on the news of Trump’s Fed Chair pick, Kevin Warsh.

Kevin Warsh is a former Federal Reserve governor, longtime Wall Street insider, and one of the most openly critical voices of the post 2008 central banking regime. He’s been vocal about the distortions caused by zero rates, endless QE, and the Fed’s quiet expansion into fiscal policy by other means.

So why did markets react a bit negatively? Probably because HISTORICALLY Warsh represents discipline, not political accommodation (yet). He’s associated with a Fed that is willing to tolerate asset price pain (not good for us) in order to restore credibility to monetary policy (whatever that means at this point lol).

For markets that have been conditioned for over a decade to expect bailouts, liquidity injections, and rapid pivots at the first sign of any stress, that’s a regime shock that sends us lower.

Now in practice? It could be entirely different. Trump didn’t pick the guy to go against him at every turn, so we will have to wait and see.

Government Shutdown

The federal government slipped into a partial shutdown after Congress failed to finalize funding on time, with disputes around immigration and homeland security spending driving the impasse.

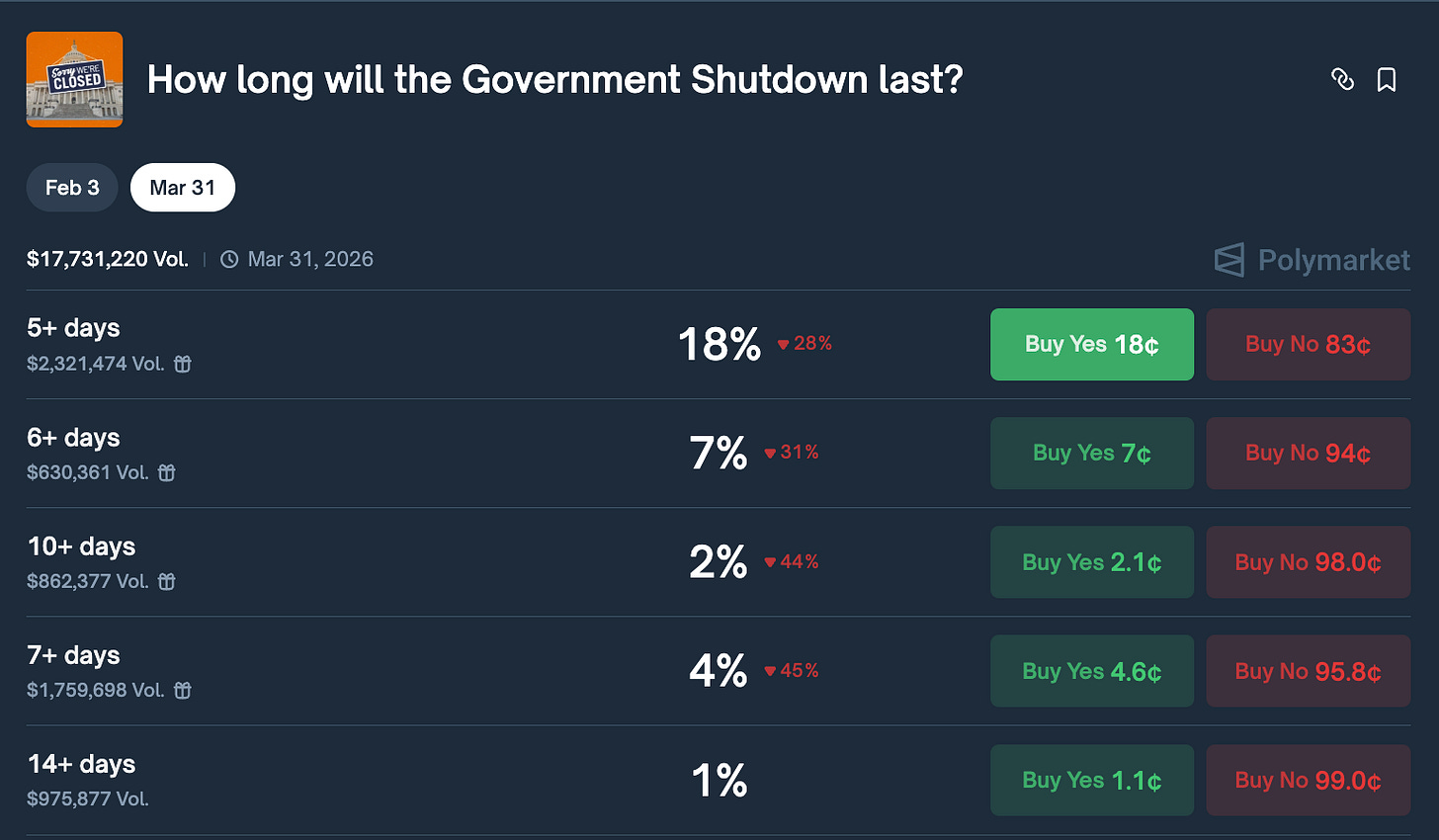

You can check Polymarket odds right now for the duration of this shutdown based on this morning’s data most expect it to last longer than 5 days (18%) right now.

While past shutdowns have tended to be more noise than substance for markets, the episode underscores the ongoing dysfunction in Washington (and uselessness of our politicians) and adds another layer of uncertainty as policymakers debate fiscal priorities & block opponent’s moves.

Crypto

For our present and detailed crypto thoughts read this past weekend’s post and any posts from the month of January.

Bitcoin is trading around $78,000 this morning and Ethereum is bouncing around the $2,300 level. Alts are predictably depressed with HYPE being a major outlier, up 30% this week alone despite the broader sell off.

Hyperliquid is a decentralized exchange (DEX) built on its own Layer-1 blockchain.

HYPE’s move wasn’t a random alt squeeze. It was driven by real protocol news and follow through on execution. Hyperliquid rolled out a major upgrade that expands the chain beyond perps into outcome based trading and prediction style markets, signaling a broader derivatives roadmap rather than a single product platform.

That drove buyers because it showed the team is building horizontally while volumes remain elevated and other assets dump right now.

Hopefully you got some exposure when we first mentioned it last year. Definitely one to keep an eye on. If it is ripping in this environment, imagine what it might do once majors and the market bounce.

Michael Saylor announced “Strategy has acquired 855 BTC for ~$75.3 million at ~$87,974 per bitcoin” yesterday morning. Which is hilarious given we missed this prediction by $26 dollars in a qoute from this weekend’s post

Elon Musk says SpaceX might put a Dogecoin on the moon next year

Switzerland’s largest bank UBS acquires 3.23M additional Strategy shares (CoinDesk)

ING, one of Germany's largest retail brokerages, has rolled out access to crypto ETPs including Bitcoin (CoinTelegraph)

Aave founder Stani Kulechov bought a five story Victorian mansion in London’s Notting Hill for £22 million (about $30M US)

"I'm a big crypto person…..I helped crypto more than anybody because I believe in it."

— President Trump

Epstein Doc Drop

Major document dump on the Epstein saga.

Last week the Department of Justice today published over 3 million additional pages in relation to the Epstein Files Transparency Act, which was signed into law by President Trump on November 19, 2025.

I’ve read through some of it, and beyond warning you, understand you can’t un-read some of the things contained in these documents.

I want to be a bit careful here because the truth is we don’t know:

what’s real

what’s been altered

what might be AI

what else is redacted/withheld

And to be honest, perhaps that’s the point of it all.

Release it in a time where people know things can be AI or altered in the hopes the core pieces get muddied and forgotten. This drop was also rampant with redactions, which is pretty enraging.

The DOJ added:

This production may include fake or falsely submitted images, documents or videos, as everything that was sent to the FBI by the public was included in the production that is responsive to the Act. Some of the documents contain untrue and sensationalist claims against President Trump that were submitted to the FBI right before the 2020 election. To be clear, the claims are unfounded and false, and if they have a shred of credibility, they certainly would have been weaponized against President Trump already.

In re: to Trump (politics aside) I do tend to believe this. He would have been FINISHED by now if there was a shred of wrongdoing on his part related to any of this.

Doesn’t mean it’s not possible, I am not that naïve. People from all ranges of the political spectrum are implicated in this.

Still, we know some of the events and disclosures in the new dump are likely true when paired with context we already had.

What is obvious to me after reading through more than enough emails and documents is that this was an expansive, widespread operation involving hundreds, if not thousands of people (many rich/elite) globally.

It’s sick shit man, I don’t have to tell most of you.

It’s like the Truman Show except extreme fucked up deviance outside normal life.

For normal people, this stuff is so absurd and depraved that they won’t believe it even if you show it to them.

Some of the most extreme conspiracy theories, stereotypes, and concepts people laughed at or dismissed for years are contained in these emails and documents. This is a significant amount of validation for the people who were warning the public for years about what goes on in elite circles.

You have cannibalism, ritual sacrifice, sex trafficking of children, and more demonic activities rampant in these documents. PizzaGate and former “conspiracy” theories don’t look so crazy in the aftermath of this release.

You have, among other things:

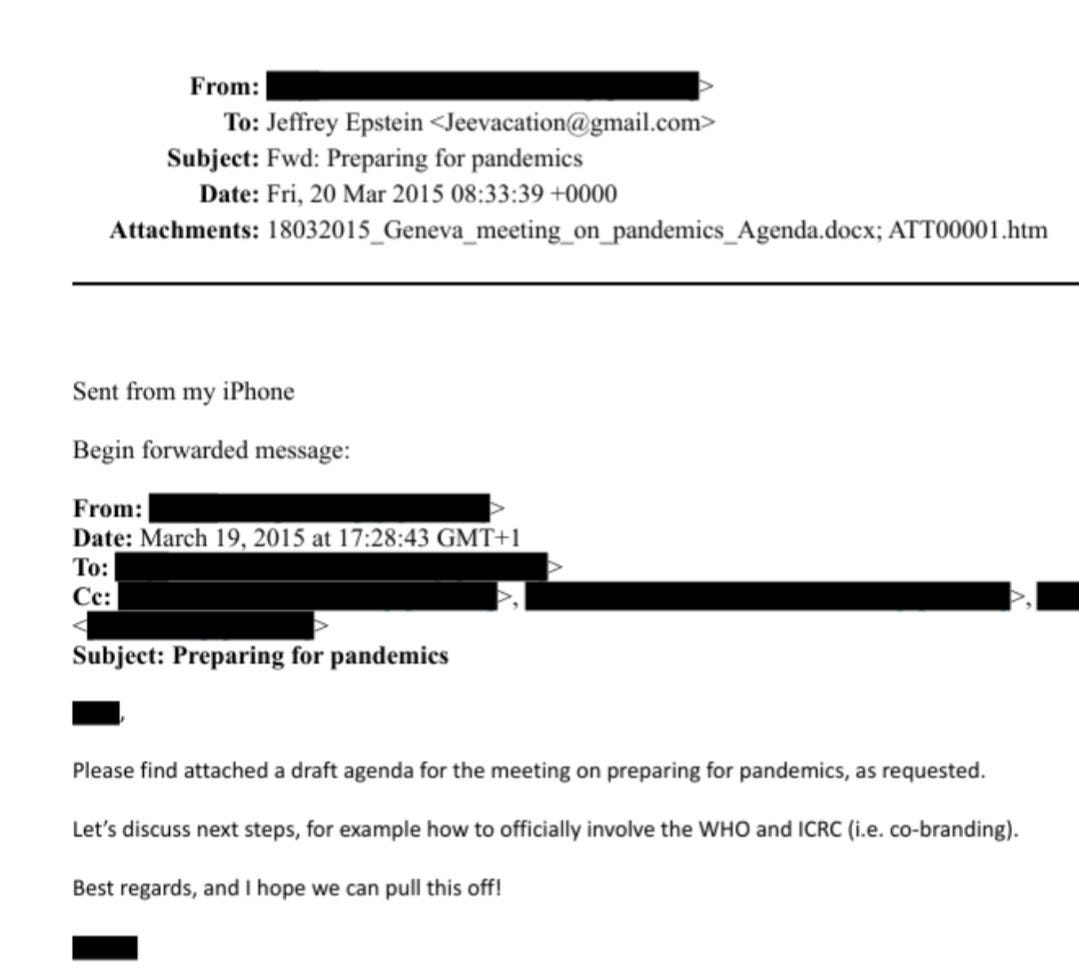

Emails that show a pandemic was being planned as early as 2015

References to Pizza, Steak, Hotdogs, and Muffins that are very clearly referring to children

An extensive sex trafficking and breeding/eugenics type scheme described

References to world leaders, corporate CEOs, and families. Epstein says in one email to Peter Thiel, “as you probably know, I represent the Rothschilds”

An email from Epstein to theoretical physicist Lawrence Krauss that was asking him to debunk out of body experiences, alien abductions and ghost stories

References to the CIA created Maidan 2014 colour revolution in Ukraine

A professor at Harvard saying in an email “did you torture her”

One of Epstein’s account was named after a biblical demon

The two photos I have shared here are some of the TAMEST examples from the drop. If you really want to dig them up, you can find them HERE or just go on X.

It’s why me and others have alluded to the fact that we are in a spiritual war. This struggle between the masses and those who control and influence us, is a fight between good and evil in many regards.

I would echo what some said online.

This can be the ultimate blackpill. It is dark dark stuff. The majority of normies cannot handle or comprehend the type of things that are likely occurring in these circles.

To put it bluntly it’s anti human. It goes against all decency, norms, and civility. In addition to that, there’s a gross double standard present. When reading through it all you can’t help but begin to notice that these people live in a completely different universe - one entirely devoid of rules, accountability, or shame.

They do what they want, when they want, and they laugh at anyone not in the “club”. People these days really wonder why institutional and government trust is near all time lows lol. Look no further than the major stories within these files.

So what happens now?

My bet, as dark as it is, is largely nothing. There have been some resignations in the aftermath of the release including:

Joanna Rubinstein — Chair of the UN Refugee Agency’s Swedish branch resigned after documents confirmed she visited Epstein’s private island and later acknowledged the trip

Miroslav Lajčák — Slovakia’s former national security adviser stepped down after newly released communications showed contact with Epstein. He denies wrongdoing but resigned amid political pressure

Peter Mandelson — Veteran UK political figure resigned his Labour Party membership following renewed scrutiny of his long-standing association with Epstein

The biggest takeaway for us?

It’s a safe bet at this point that a f*cked up group of elites control and run most of what you see in the modern world. Many of them have extreme ideologies that creep into downright evil. It is a nest of intelligence agencies, influential world leaders, business people, and criminal organizations. Much of what took place and continues to take place is likely almost incomprehensible to normal people.

I know it’s dark but it’s true (and its likely always been this way to some extent).

Other Global News:

French authorities raided X’s Paris office as part of an investigation into algorithms and automated systems. They cited it is a “cybercrime probe into algorithm issues and data extraction.”

China reported weaker than expected industrial activity, renewing concerns about global demand even as Western markets price in some resilience

Oil prices moved lower after signals that the U.S. and Iran may be exploring diplomatic off ramps

Anyway, have a good Tuesday.

Going to try and get another episode of Risk On out by Thursday evening. We will be back with a post for paid subs Thursday morning centered around preparing for the rest of 2026.

Best,

Andy

Good morning my fellow goyim!