Shutdown Over, Markets Stirring

498: Trezor 7 Review, Battlefield 6 Review

Morning guys.

Quite a bit in today’s edition of Arb Letter, we will go over:

Recent market news and developments (shutdown ending)

A Trezor 7 cold storage crypto wallet review

An EA Battlefield 6 Review

If you guys missed this week’s paid post you can find it below, in it I talk about what I call the everything bubble. This is more or less the bizarre money printing dystopia we have found ourselves in since the beginning of the Covid pandemic and why nobody really knows what is going on beneath the surface.

I argue that there is really only one more option we have for trying to make it in this economy and market barring any biblical recession or black swan event.

It’s well timed given market sentiment right now which looks horrible across the board.

I have no doubt that in 2026 many will look back at this moment as one in which they should have gone against the masses and realized that the government, Fed, and elite really only have one more play if they want to avoid significant disruption and potentially even unrest.

Markets

The government shutdown finally ended after 43 days, removing one of the biggest near-term tail risks hanging over equities and credit.

Expect some sort of relief bump as traders price out the worst-case scenarios, but don’t expect euphoria.

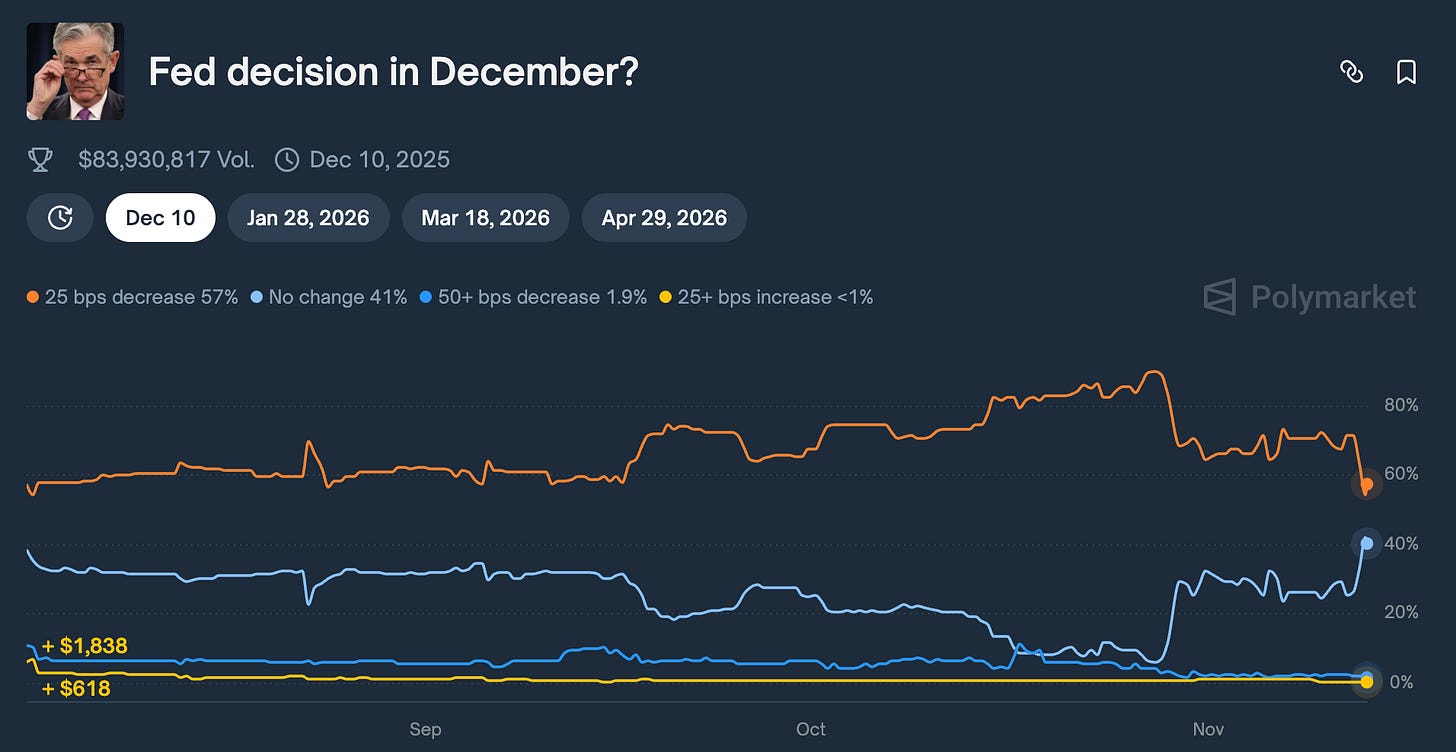

The deal only runs through January 30, meaning we’re basically trading into another fiscal cliff, and key data releases delayed by the shutdown will keep uncertainty elevated. In short I think we see a sigh of relief, not a full blown green light yet. A 25bps cut by the Fed is expec

Equities have been choppy but leaning bullish over the last few days.

The Dow ripped to a new all-time high above 48,000 as money rotated into financials and industrials on shutdown-relief optimism, while the Nasdaq slipped and the S&P barely moved, showing fatigue in crowded AI and megacap tech names.

Chipmakers were a rare bright spot with several names jumping on aggressive AI demand forecasts. With yields easing and the shutdown officially over, sentiment has improved at the margins, but the market is already shifting back to the real catalysts that remain ahead of us. Delayed economic data, the Fed’s next move, and whether this rotation has real staying power or is just a positioning reset as we move into the holiday season.

JPMorgan rolled out a deposit token “JPM Coin” on the Base network (Bloomberg)

Robinhood has said “crypto is becoming the infrastructure for the global financial system”

Polymarket posted the following to X yesterday - “We’re excited to announce Polymarket is now the exclusive prediction market partner for Yahoo Finance”

The unemployment rate for 20- to 24-year-olds in the US is now 9.2%, the highest level since 2016 (Yahoo Finance)

SEC Chair Paul Atkins unveiled a ‘token taxonomy’ plan set to modernize crypto regulation this week

A Japanese woman married her AI boyfriend recently, the world’s first human x AI marriage (Polymarket)

Apple has launched a Digital ID in the US, letting users add passports to Apple Wallet and use them at 250+ TSA airports

NioCorp $NB CEO Mark A. Smith will participate in the Morgan Stanley National Security & Critical Materials Symposium

The Czech Central Bank bought $1 million worth of Bitcoin and crypto

Crypto markets continue to remain mostly stagnant with pockets of alts showing decent enough strength despite Bitcoin and Ethereum’s relative weakness right now. We will do another deep dive on the state of crypto next week but for now I am sitting on my hands watching BTC/ETH closely.

Hedge funds are dumping consumer-services names like hotels, restaurants, and travel at the fastest pace in at least five years, and it might be a glaring signal about where smart money thinks the economy is headed.

When discretionary-driven stocks get torched like this, it usually means funds see the consumer weakening, margins tightening, and the post-Covid “revenge spending” era officially fading out (until the $2,000 stimmies hit lmao).

This rotation also lines up with a broader shift toward defensiveness. Capital is flowing into higher-quality, lower-beta sectors while anything tied to consumption gets treated as dead weight.

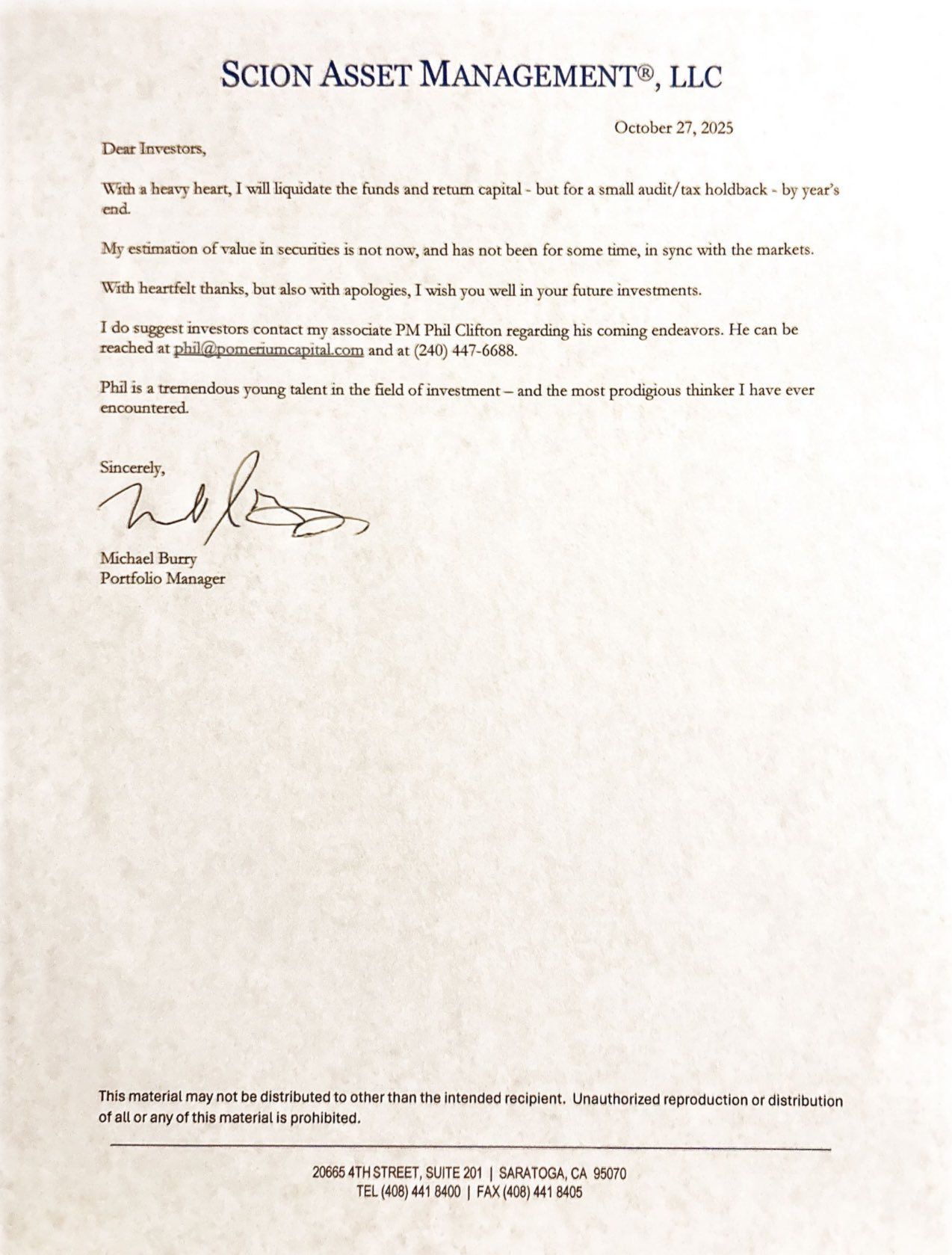

Michael Burry appears (key word since this is not verified) to be shutting down Scion Asset Management. This comes just a week after social media exploded with his purported shorts on PLTR and NVDA.

Is Burry tired of the game being played? Or does he simply just want out of it all, rsge quitting before the giga pump?

We will have to see how equities perform today but definitely in a bit of an odd holding pattern where most probably think rate cuts are fully priced in and the big remaining variables are economic data from Washington as well as the Trump administration’s final decisions regarding the trade war.

More updates on Tuesday.

Trezor Safe 7 Review

One of the prime considerations that many people ignore when they are first getting into crypto is cold storage or security.

They only retroactively look into these precautions after something happens to them personally OR after a major market issue like the one we saw with FTX.

The team at Trezor was nice enough to send me a sample of the Safe 7 for review so I could share my findings with you guys.

Let me start by saying first off — the touch screen is huge and the entire setup process took me 15 minutes from start to finish.

Follow these steps for super quick set up (follow the manual for any set up)

You check your package to make sure it is sealed

Take out the Trezor and instructions

Check the security sticker for no tampering

Plug it into your computer or MAC

Download Trezor Suite (the hosting software) ONLY FROM PROMPT OR TREZOR

Follow the instructions for setup

You will generate your 20 word back up (or multiple)

You will set the device PIN

And you are good to go

So why go with one of these bad boys over other options?

The Safe 7 incorporates a specially designed secure element (the “TROPIC01” chip) which is fully auditable and open-architecture, meaning users (and security researchers) can inspect the security design rather than relying purely on opaque “black box” chips.

The Safe 7 is marketed as “quantum-ready”. The idea being that even when quantum computing advances to the point of threatening current cryptographic standards, this device is built to receive firmware updates that support post-quantum algorithms.

A concept discussed frequently in crypto these days.

The Safe 7 supports Bluetooth Low Energy (BLE), wireless charging (Qi2-compatible magnetic pad), and traditional USB-C wired connectivity.

The Safe 7 body is milled from a single block of aluminium, with a glass backplate and Gorilla Glass 3 front. It works with the manufacturer’s companion app (Trezor Suite), plus supports third-party wallets and dApps (e.g., MetaMask, Rabby Wallet, etc) via WalletConnect.

Also - it supports staking of major assets (ETH, ADA, SOL) as per ecosystem listing.

Standout product from a company I now trust with my crypto bags for my cold holdings not kept on Gemini.

You guys can get 5% off with the code ANDY5

If you want an older version a few are listed below:

Take your security seriously.

I don’t want sob stories after the next hack or exchange blow up.

EA’s Battlefield 6 Review

Over the years first person shooters have been my main cup of tea when it comes to video games. Now in my 30’s with a family, I don’t have as much free time to dabble, but I had to try the new Battlefield given I have been a long fan of the series and I needed a desperate break from Call of Duty which is currently unrecognizable in it’s present form.

For those who may not know Battlefield is the major competitor to the Call of Duty franchise.

The first game in the series was Battlefield 1942 which dropped in 2002. I have fond memories of this WWII based shooter.

It’s kind of funny looking back, the maps were so big you’d run for minutes with 2002 graphics and controls to find a little bit of action and then die. Then run all the way back again.

Throughout the years the game has made big jumps and is preferred by FPS enthusiasts who want a less arcade like experience than Call of Duty (or one without Nicki Minaj and Seth Rogan skins).

Anyway Battlefield 6.

First impressions so far: it’s a fast paced modern combat simulator. Sure, it’s maybe less gritty than Arma or other hyper realistic simulators but it gets pretty close. If you play the larger game modes like Conquest or Breakthrough it is absolutely chaotic.

There’s a famous quote from Hemingway:

In modern war, there is nothing sweet nor fitting in your dying. You will die like a dog for no good reason.”

Sure this is a game but the quote is an apt description. You don’t know if a jet, helicopter, tank, sniper, frag, or RPG is going to take you out at any given moment (see the clip below). Battlefield fans will fondly remember Battlefield One, the WWI game that many of us loved. The environment and immersion was unmatched.

This gets close but adds in modern weapons which speeds up the ways you can die.

Couple tips for multiplayer:

Religiously use cover

Don’t stop moving

Change settings re: aim assist

Don’t get greedy with yours shots and over-extend yourself4

I usually play as assault or an engineer with occasional recon spats if I am feeling lazy, guns I like right now include:

KORD 6P67

M417 A2 (current)

DRS-IAR (overpowered, probably going get buffed soon)

Customization is extensive and the camo race is a grind (maybe too much of a grind tbh).

When I first hopped back in I was getting absolutely rocked. Granted, it’s been years since I played a Battlefield game. For Call of Duty regulars this is not similar. Sure it’s a shooter but it plays much less arcade - like. It has a more realistic feel.

By yesterday I had bumped my K/D ratio over 1.1.

The campaign was a 6.5/10 I won’t pull punches. While the units involved are cool (MARSOC), the storyline was a chatgpt derivative of a less than plausible mercenary group that manages to effectively start a global war.

My biggest critique and advice to these gaming companies is this — stop being politically correct. Make a game that just has the US vs. the Russians or the Chinese. Use real world groups and countries, stop trying to dance around it and give us entities like NATO and a mercenary group called Pax Armata lol.

I have no fonder memory than playing Call of Duty 4 as Spetsnaz, Navy Seals, or SAS.

But I don’t buy Battlefield for the campaign.

Their version of Warzone (which they shamelessly copied) is called RedSec (Redacted Sector). I haven’t spent much time but it seems cool and gives me the impression that it has a few deeper layers than Call of Duty’s version.

Over the holidays I suspect I will try it more as my buddies log on to try the game out for themselves.

All in all so far? I give the game an 8.5/10.

I think it comes at a time where Call of Duty and others are insistent on producing unrealistic Gen Z shooters. Battlefield 6 will be around for some time and the servers are sure to be overloaded around the holidays if you are looking to blow off some steam or fill some bad weather days with mindless fun.

Christmas list drops next week along with a new episode of Risk On with Adam Kobeissi of the Kobeissi Letter. I will be watching markets through week end and if we get something noteworthy I will drop a short update tomorrow or on Saturday.

Talk soon kings

Andy

Protect Your Crypto With TREZOR

Get Free Ethereum w/Gemini

Get Free PEPE w/Gemini

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before

"DRS-IAR (overpowered, probably going get buffed soon)" Nerfed* you are a bit out of practice lord Andy. Great stuff per usual!

I'm also enjoying BF6 but I've got a bug where a couple guns (KORD and SCW) are locked even though I've completed the assignments for them. Thankfully there are lots other weapons to choose from and I've found some favorites.