Quiet Before The God Pump?

406: US inflation falls to 2.3%

Dear god we are pumping hard off the lows kings.

What an absolute bender and 180 off the tariff fear. Let that entire saga, regardless of what happens next be a lesson to you on the hyper emotional swings the majority of the population likes to have.

People got political, the left said Trump was destroying America, mainstream talking heads lost their minds, hedge fund managers shit their pants — everyone collectively lost their minds because we let some much needed air out of global markets and press checked nations taking advantage of us.

Hilarious.

Now we’re back.

Many people are sidelined. The cope is real, but the markets simply do not care.

Today we’re going to expand a bit on the post above I sent out on Friday and talk through crypto/equity plays, my expectations on where the market is headed next, and some of the more important global news headlines.

We’re cooking folks — now is not the time to let up off the gas. You need to be locked in and spending time with you ear close to the ground to take advantage of the volatility we’re getting in markets. Quite a bit of what’s going on is predictable.

The most recent panic dump and subsequent recovery was very Covid-esque in it’s nature.

Markets

Stocks ripped higher to kick off the week fueled by a surprise tariff truce between the U.S. and China.

Both sides agreed to a 90-day pause and steep cuts to existing duties, reviving hopes that the trade war narrative might finally cool off. Markets welcomed that reprieve, especially risk-on sectors like tech and consumer discretionary, with AI names and semiconductors leading the charge. Investors are now turning their attention to this morning’s CPI print, which could either extend the rally or spark a fresh wave of rate hike fears.

Either way, the tone has shifted — this week feels like a reset.

The CPI report indicates that headline inflation rose by 0.2% month-over-month and 2.3% year-over-year, slightly below expectations and marking the lowest annual rate since February 2021. Core CPI, which excludes food and energy, also increased by 0.2% on the month and held steady at 2.8% annually, aligning with forecasts.

This data suggests that, despite recent tariff implementations, inflationary pressures have not intensified as anticipated (and like JPOW has been saying). This could be attributed to factors such as businesses drawing from existing inventories and a temporary pause in certain tariffs.

JPOW might be running out of excuses…..

The S&P 500 jumped 3.35% to close near 5,850 yesterday

The Nasdaq soared 4.35%, driven by tech and AI names bouncing hard

The Dow rose 2.87%, lifted by easing trade tensions and improving macro sentiment

Nissan posted an annual net loss of $4.5 billion (SpectatorIndex)

The U.S. and China announced a 90-day truce on tariffs; U.S. rates on Chinese goods cut from 145% to 30%, and China cut its tariffs from 125% to 10%.

April CPI data drops this morning — a key inflation gauge that will impact Fed expectations and decisions moving forward

Energy stocks are lagging slightly despite oil holding above $78 a barrel.

Earnings:

Walmart reports Thursday — analysts expect $165.6B in revenue and $0.58 EPS.

Cisco releases Q3 results Wednesday — projected EPS is $0.92 on $14.06B in revenue.

Applied Materials reports Thursday — estimates sit at $2.31 EPS on $7.12B in sales.

Take-Two also reports Thursday, with a projected loss of $0.05 per share.

I closed out my shorter term call options yesterday morning on market open. These aren’t insane gains but they do add up — AMD 0.00%↑ 5/23/2025 calls for 60% with a 110 strike as well as some solid QQQ 0.00%↑ 6/20/2025 504 calls — I did over 600% gains on these turning about $250 or so into $1,536 — not shabby for a quick hitter. I have learned to sell into strength on options, too often I hold for fatter gains and end up with nothing. Brick by brick. These plays are just small bets within my larger brokerage account.

For now I am happy to be option free until we see some more volatility. Main point here was — when everyone was shitting their pants, there was free money to be had. Buy the desperation when you can — these option plays AND my common share buys on AMD, NVDA, MSFT, PLTR, etc. were all done when I dropped the “What I am Buying on The Dip” post.

If you listened you printed.

The over emotional panic sellers lost hard.

The tariff mania — at least in the short term was obviously an IQ test shakeout. Goldman and other banks posted hilarious flip flop commentary. Goldman had issued a report to the tune of a 20% correction and then followed up yesterday with one suggesting the SPY is going to rally 10-12% lmao. One week recession odds were mounting, then they publish retractions and updates — they’ll likely end up doing something similar in regards to gold price predictions. It’s comical.

Even hedge funds got shaken out of tech and other risk on names that have since rebounded aggressively. Ironically, retail bought the dip in stocks like maniacs which caused many to fear that they were being led to slaughter, but at least for now they’ve gotten the last laugh.

The MAJOR remaining question mark is going to be the Fed. A deal with China will be struck eventually, as will deals with other nations. We’ll probably still see some chop and volatility as headlines come out that make it seem like deal progress is fragile but eventually this is going to all blow over.

Jerome Powell has some tough calls to make and all eyes are likely on him now.

Markets are ripping higher after the U.S.–China tariff pause, pushing yields up as investors dump bonds for pumping risk assets. That complicates things for the Fed—rising yields tighten financial conditions even without a rate hike.

Expect more volatility in the equity markets until we get clarity on what the Fed is going to end up doing in the latter half of 2025.

Crypto

Not sure what else remains to be said on the crypto front I haven’t already hammered home in paid posts. Bitcoin is shining — moving more in tandem with M2 money supply (below) an imperfect proxy for global liquidity — which she desperately needs to continue running.

Ethereum has finally shown us a glimmer of hope, moving up to the $2,600 range. Alts are starting to show some life and some energy is returning to the meme coin trenches.

I mentioned our new Partnership with Gemini last week — in the coming days I will have a few new offers for you guys for free PEPE and Ethereum when you sign up. For now — you can get some free Bitcoin just for opening and funding a new account (takes like 10 minutes).

If interested you can do it HERE. Gemini has been my exchange choice for my on exchange balances since 2017 for their top notch security and reliability.

Coinbase announced after market close yesterday that the company is being added to the S&P 500.0

Crypto is here to stay. Question next is just how fast adoption is going to spread.

New York City Mayor Eric Adams said yesterday it is his goal to make "NYC the crypto capital of the globe…. I was the first American Mayor to have my initial three paychecks converted into crypto"

Dubai Finance signed an MoU with Crypto.com to enable cryptocurrency payments for its government fees (Cointelegraph)

The new SEC chair announced plans to clarify crypto token rules, aiming to legitimize on-chain issuance and trading.

Arizona launched a state crypto reserve fund, signaling growing institutional support for digital assets

Metaplanet has issued $15 Million in bonds to buy more Bitcoin

Nasdaq-listed company GD Culture Group is set to buy up to $300 million Bitcoin funded with a new share issuance (BitcoinArchive)

Crypto funds posted $882 million in net inflows last week (Kobeissi Letter)

As of 2:52pm ET Monday we are getting a bit of a pullback which is natural given how quickly everything pumped — it should be viewed as an opportunity for those that are sitting on the sidelines and want to get more exposure.

Let me make one thing super clear — I think Bitcoin is going to do what it wants to do regardless of equity movement or Fed decisions. Bitcoin has already begun to strengthen it’s narrative as a store of value. It began it’s move up BEFORE the China deal. The institutional demand and adoption is evident — it’s important for anyone in crypto to understand Bitcoin is in a league of it’s own.

ETH and alts are a different story but right now the strength we are seeing is encouraging.

All it is likely going to take for crypto to enter it’s next melt up move is one of the following:

A big executive order (capital gains, Bitcoin reserve, etc.)

Fed rate cuts or dovishness

Another major buy by a big company besides size lord saylor’s

Ethereum beginning a run to it’s all time high

Couple tokens/assets continued to show some good strength over the weekend into Monday.

Bitcoin, Ethereum, Pepe, and Chainlink have all made massive moves to the upside, and hopefully many of you had some exposure.

SUI is not stopping and has seen strong upside over the past few days, rallying alongside the broader crypto market pump. After touching recent highs near $4.25, it’s cooled slightly and is now hovering around $3.87. Trading volume and open interest both surged, showing clear momentum and renewed investor appetite. That said, a noticeable chunk of SUI — reportedly over $40 million — has flowed onto exchanges, hinting that some early holders may be locking in profits.

Technically, the token has broken out of what’s called a falling wedge pattern (for my nerds), a bullish structure, and if it can hold above that $3.85–$4.00 range, many are eyeing $5 as the next target — with many others are calling for $10+ this year. Sentiment remains firmly positive, social media hype is growing, and it’s supported by growing activity in the Sui ecosystem with continued interest in its on-chain projects and derivative tokens.

While recent paid posts will be the best source of specifics — I am getting close to adding some alt exposure as ETH looks ready to make its next leg up.

I am primarily focused on adding more SUI, AAVE, GRT, INJ, AVAX, XRP, and HBAR.

Global News & Geopolitics

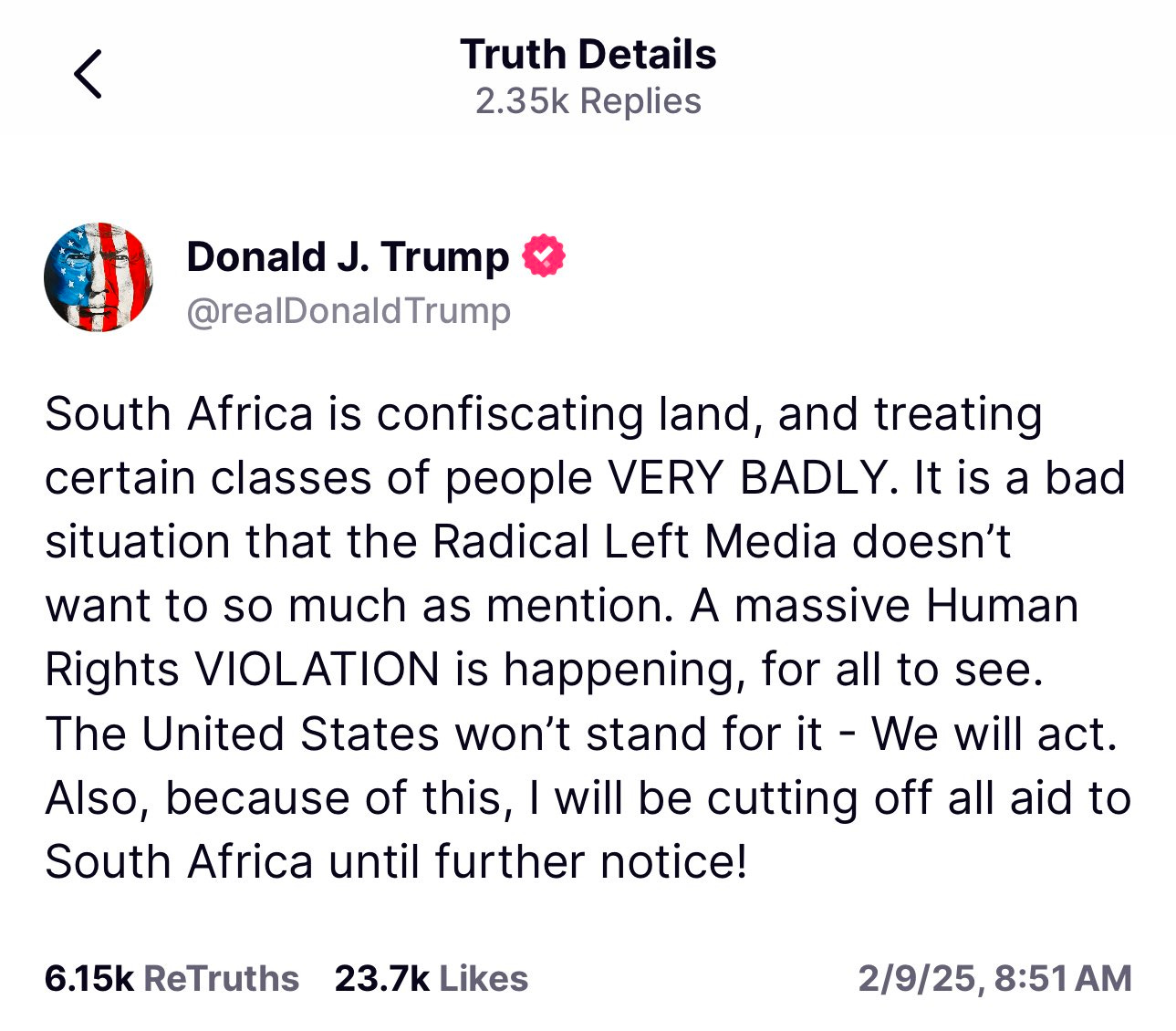

A group of 59 white South African Afrikaners arrived in the U.S. today under a new refugee program launched by the Trump administration. They landed at Dulles International Airport on a government-chartered flight and were welcomed by senior officials from the State Department and Homeland Security. Most of them were families.

This initiative stems from a recent executive order prioritizing refugee status for Afrikaners, citing claims of discrimination and targeted violence in South Africa. And of course if you’re even somewhat familiar with what’s been going on in South Africa recently you know these aren’t just claims lol. These people are being targeted.

South Africa is not a communist country, but its political landscape has strong historical ties to socialist and Marxist ideologies, especially through the ruling African National Congress (ANC) and its alliance with the South African Communist Party (SACP). Anti white rhetoric and sentiment is growing quickly in the country with slews of videos online showing the calls for violence against farmers in the country.

Farm attacks in South Africa are a serious and ongoing issue, involving violent crimes like robbery, assault, rape, and murder on rural properties, many times against whites.

The move has sparked controversy in the mainstream media. Critics argue the policy reflects a racial double standard (given almost all of the migrants are white) and undermines the broader refugee system.

Meanwhile, the South African government has pushed back on the allegations, calling them baseless and warning the U.S. decision could damage diplomatic ties.

The resettled families are expected to begin new lives across states like Minnesota, Idaho, and Nevada with support for housing and job placement. Social media is erupting with hot takes on the arrival of these immigrants.

India and Pakistan declared a ceasefire following cross-border strikes; skirmishes continue, with China’s arms exports to Pakistan drawing international and US scrutiny

The U.S. and Houthis agreed to a ceasefire in the Red Sea, halting attacks on shipping lanes but the Houthis say Israel remains a target

China is rapidly expanding renewable energy projects to cut their reliance on imported fossil fuels and strengthen energy independence

Xi Jinping visited Russia for Victory Day, signing new trade and defense deals as ties between the two countries continue to get stronger

Greenland took over Arctic Council leadership from Norway, a symbolic move amid growing interest in the Arctic and U.S.-Nordic tensions

Ukraine may shift its currency peg from the dollar to the euro, signaling deeper alignment with the EU

UN officials warned of a worsening humanitarian crisis in Gaza, urging immediate international intervention over rising number of civilian deaths

On the other side of the immigration coin — ICE has ramped up enforcement activity in recent weeks, setting off a wave of backlash across the country.

In D.C., agents showed up unannounced at several popular restaurants—including one owned by Norah O’Donnell’s husband—to demand employment records, spooking staff and drawing public criticism.

No arrests were made, but the message was loud and clear. Meanwhile, in California’s Central Coast, ICE detained several farmworkers—some of whom reportedly had prior legal protections like DACA status. Local protests in those regions followed, with media critics slamming the raids as heavy-handed and disruptive to immigrant communities.

ICE has also stepped up its crackdown on MS-13 over the past few weeks, arresting multiple members in high-profile operations. One recent bust involved Joel Armando Mejia-Benitez, a heavily tattooed MS-13 member who was previously deported (seems to always be the case) but snuck back into the U.S.—he was caught in Maryland and is currently wanted in El Salvador for weapons charges.

Back in March, a broader sweep in Northern Virginia ended up leading to 71 arrests, including members of MS-13 and the 18th Street Gang, with Homeland Security Secretary Kristi Noem overseeing the operation.

That’s it for today — new episode of Risk On will drop tomorrow and. I am joining my friend Will Tanner of the The American Tribune on his podcast this afternoon to talk Bitcoin, sovereignty, America in 2025, and more.

Have a great week — new post for paid subs drops on Thursday morning.

Andy

Gemini Crypto - Get Free Bitcoin

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before investing and ensure you have a good understanding of your personal risk tolerance.

As a South African who moved to the US 5 years ago, can guarantee that everything Andy said here is 100% true. The reality is that it's actually worse than that. I have family back home who are farmers - it's incredibly scary.

Proud and grateful to be here and looking forward to more who [legally] follow suit.

surprised you didnt mention the congresswoman that assaulted police then went on CNN and whined about ICE being aggressive....