Green Markets, Purple Dildos, and $87B into Crypto

427: Ethereum Approaches $4,000 Mark

Happy Friday everyone.

If you missed this week’s other posts you can find them below.

Tuesday’s (below) was a complete guide to get started making money online. If you want to reduce your dependence on 9-5 income, start your own thing, or just bring in some extra side income this is a great starting point.

How to Start an Online Business

Wednesday’s (below) was a look into how ridiculous and absurd some corners of financial markets have gotten in the last 5 years and why it might not be that unlikely that things just continue to get more and more unhinged.

Capitalizing on Market Degeneracy

Interesting week so far, markets continue to climb higher, Trump just opened up the 401K floodgates to crypto, new trade deals continue to unfold, and a fourth dildo was tossed onto the court during a WNBA game, those who ended up betting that it was purple on sites like Polymarket are rolling cash.

There are some reports that the trend appears to be linked to a group of crypto promoters, one of whom, going by the alias "Lt. Daldo Raine," claimed responsibility in a conversation with ESPN. He said the goal was to draw attention to a meme coin they’re trying to pump, sharing messages from a Telegram group where the stunts were allegedly coordinated.

FFS guys, this is why we can’t have nice things in crypto lmao.

Quick post to round out the week.

Markets & Crypto

The S&P 500 traded sideways to slightly down this week as investors digested mixed earnings and economic signals while the Nasdaq saw modest gains, driven primarily by strength in major tech names.

The Dow Jones edged lower, dragged by weakness in industrials and financials.

Traders and investors are monitoring the ongoing trade war developments as well as preparing for potential rate cuts in September.

Student loan delinquency rates have hit all time highs of 13%

Eli Lilly shares took a fat hit this week, dropping over 14% despite strong Q2 earnings with 38% year-over-year revenue growth. This sell-off was driven by disappointing trial results for its oral obesity drug, which failed to meet expectations and sparked concerns about its effectiveness and potential side effects

Over 10,000 hotels across Europe are launching a class-action lawsuit against Booking.com BKNG 0.00%↑ , accusing the platform of distorting the market through its dominant position and so-called "best price" clauses

"The US still has a 60% chance of entering recession in the next 12 months," per Peter Berezin, the chief global strategist at BCA Research (Unusual Whales)

Canada’s economy lost around 41,000 jobs in July, following a strong gain of 83,000 the previous month (biggest monthly loss since Jan 2022). Despite the decline, the unemployment rate remained unchanged at 6.9% (do the Canadians have fudged numbers that will get revised as well?)

The U.S. has imposed — wait for it — new tariffs on one-kilo and 100-ounce gold bars, reversing their previously exempt status and catching global markets off guard. This move, tied to a reclassification under customs law, triggered a sharp rally in gold futures, sending prices to record highs above $3,500 per ounce. Gold bugs are printing.

This decision has significant implications for Switzerland, a key global gold refiner, where bars are now subject to the existing 39% tariff. The surprise shift from papa Trump has disrupted bullion flows, distorted futures markets, and introduced fresh uncertainty for institutional gold buyers who have been hoarding for some time now.

Semiconductor stocks showed resilience this week despite growing geopolitical and policy headwinds. NVIDIA NVDA 0.00%↑ and AMD 0.00%↑ saw modest gains after some early week volatility, though sentiment remains cautious as the U.S. weighs stricter export controls on advanced AI chips to China, a move that could dent sales.

Super Micro SMCI 0.00%↑(one of my recent adds) dipped slightly, reflecting uncertainty around hardware demand and tightening margins in the server space. In contrast, TSM 0.00%↑ rallied on a bit of optimism around continued global chip demand and reports that potential tariffs on China-sourced components would likely end up driving more reliance on Taiwanese and non-mainland suppliers.

Broader sector momentum was also supported by the idea that any chip trade restrictions may be delayed until after the U.S. election.

In any case — I am staying long and strong in semis. Need to add some more AVGO 0.00%↑ soon as well.

Worth keeping an eye on our Defense Guide pick KTOS 0.00%↑ and a subscriber suggestion NB 0.00%↑ NioCorp Developments, after The U.S. Department of Defense recently granted up to $10 million to Elk Creek Resources, a subsidiary of the company to boost domestic production of scandium (and reduce US dependance on Chinese supply).

Scandium is used primarily in aerospace alloys and defense components.

Crypto

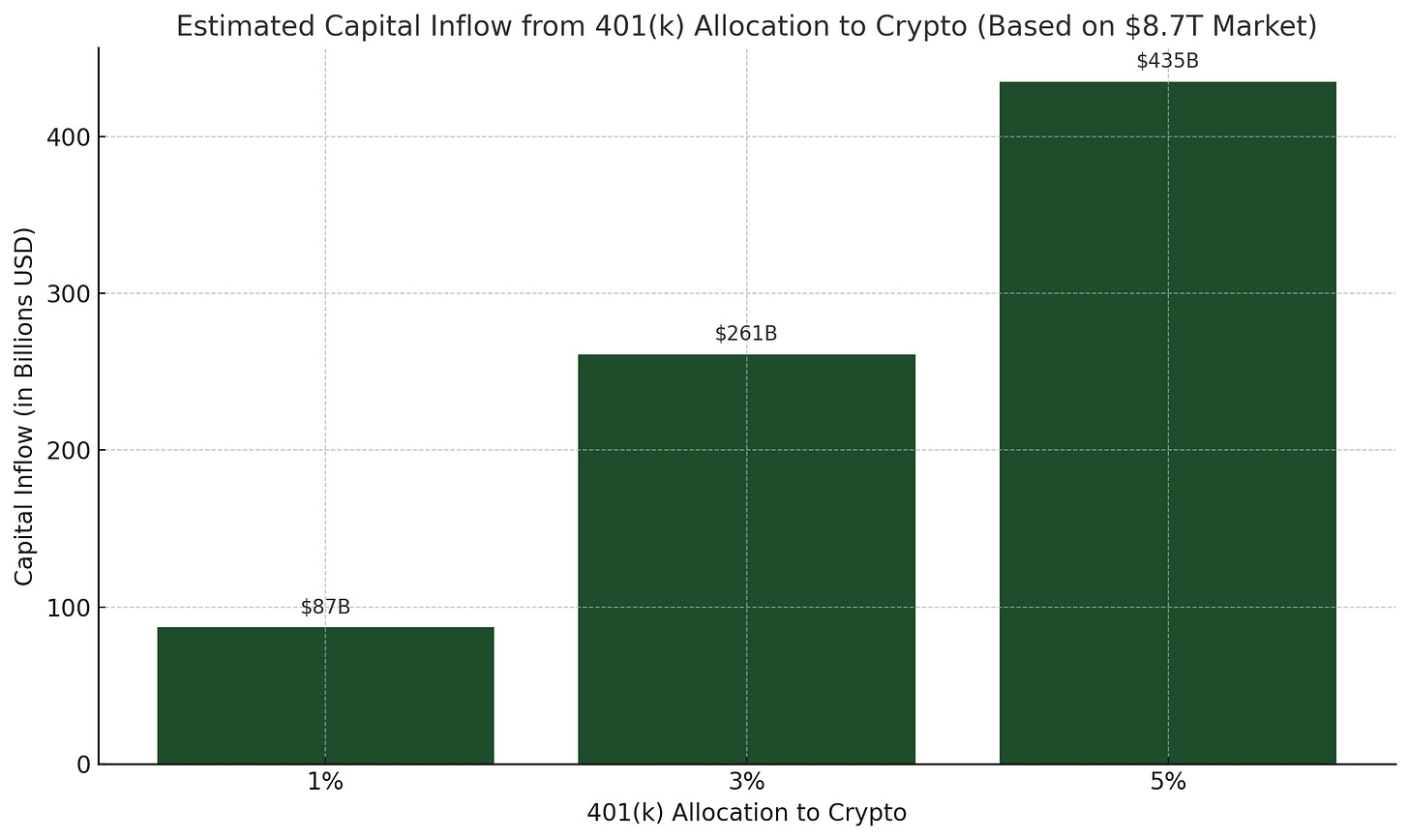

Massive week for crypto on the regulatory front, with President Trump officially signing an Executive Order allowing Bitcoin and crypto in 401(K)s. This is a nearly $8.7T market. To put this into perspective:

If roughly 1% (and it will likely be more) of total U.S. 401(k) capital were allocated to crypto, it would represent an inflow of approximately $87 billion into the market. That level of institutional capital could significantly impact liquidity, boost prices, and accelerate mainstream adoption—especially for leading assets like Bitcoin and Ethereum.

Absurdly bullish.

On top of that we have seen substantial institutional interest in Ethereum that appears to be driving the markets higher into the weekend.

Yesterday we covered the big news of Chainlink launching the Chainlink Reserve, a strategic LINK reserve supported by offchain and onchain revenue.

LINK is up 12% in the last 24 hours and 38% in the last month. Sergey delivered this time to the loyal link marines.

El Salvador is planning to launch the world’s first Bitcoin bank

Swiss bank Sygnum has announced SUI custody, trading, staking and lending services for institutions this week (CoinTelegraph)

Spain’s third largest bank BBVA has partnered with Binance to keep Bitcoin and crypto off exchange (BitcoinMagazine)

FLOKI and ONDO are now available to trade on Robinhood

Meme coin momentum continues to build—Little Pepe (LILPEPE) has raised over $13 million in presale funding, and Pudgy Penguins (PENGU) is seeing renewed interest following a large token airdrop on Solana.

Ethereum is battling to pass the $4,000 level, something that hopefully plays out in the next 12 hours. If it does, alts will likely send for a strong leg higher across the board.

Ethereum price targets have been trending higher among analysts and funds, with projections ranging from $5,000 to as high as $7,000 by the end of 2025.

Bullish forecasts point to the recent strong ETF inflows, rising futures open interest, and growing institutional demand the key drivers.

Some analysts highlight technical breakouts that could push ETH toward $4,000 in the near term (which I think happens in next 48 hours), while options traders are increasingly positioning for a fat $6,000+ move by year-end. Network upgrades and a more favorable regulatory backdrop are also fueling people’s confidence in Ethereum’s long-term upside this bull market.

Gemini is giving away 305 XRP ($1,000) to one person on X to celebrate the future of finance.

All you have to do is Like this post and follow on X to be entered.

Remember if you guys haven’t taken advantage of it — if you sign up for Gemini you get your free choice of PEPE, ETH, or BTC.

Free money.

Global News

Global tensions continue to simmer this week, with markets reacting to fresh regional flashpoints and shifting policy moves. On the war front, Ukraine’s battle lines remain volatile as Russia intensifies its push and humanitarian conditions worsen. Surprise U.S. tariffs on gold bars are sending shockwaves through bullion markets and various global trade routes.

China has intensified its military activity around Taiwan this week, deploying naval and air assets in designated zones that effectively encircle the island, including waters east and south of key urban areas like Taipei. These movements come amid rising regional tensions as Taiwan prepares for their upcoming elections.

Beijing’s flexing and show of force, including live-fire drills and deployments near Taiwan’s Air Defense Identification Zone signals a clear demonstration of power, raising concerns about potential escalation that could come soon. When this DOES eventually go down people are going to lose their minds.

President Donald Trump is set to meet with both Azerbaijani President Ilham Aliyev and Armenian Prime Minister Nikol Pashinyan at the White House today (OSINT Defender)

Belarus President Alexander Lukashenko has announced this week he will not run for a new term

Indonesia is moving closer to new trade agreements with the U.S. and Japan as part of their broader regional efforts to deepen economic integration and counterbalance China’s growing influence in the Indo-Pacific

The U.S. and Japan finalized a major trade deal this week, cutting tariffs on Japanese auto exports to 15% and securing new investment pledges from Tokyo

Brazil’s government has passed a sweeping new law that guts key environmental protections, sparking backlash from conservation groups who warn it could accelerate deforestation and threaten Indigenous territories

A 28-year-old active-duty Army sergeant opened fire at a unit area of the 2nd Armored Brigade Combat Team in Georgia at Fort Stewart on Wednesday, injuring five fellow soldiers

Russian President Vladimir Putin held a phone call with Chinese leader Xi Jinping on Friday to discuss potential paths toward resolving the war in Ukraine. During the conversation, Putin reportedly updated Xi on the recent visit to Moscow by U.S. envoy Steve Witkoff and shared Russia’s perspective on the ongoing conflict.

As the War in Ukraine slogs on slowly, Russian forces continue to push forward in key areas like Donetsk and Dnipropetrovsk, keeping Ukraine’s frontlines under heavy pressure. Despite high-level diplomatic meetings, there’s little sign of progress toward a ceasefire or resolution. Meanwhile, conditions in Russian-occupied regions are deteriorating, with civilians facing critical shortages, including limited access to clean water.

In the video below you can see a Ukrainian tank from the 1st Battalion of the 5th Separate Heavy Mechanized Brigade destroying a group of Russian motorcyclists with a direct shot near Kherson (WarTranslated)

Pretty wild.

See you guys early next week. My gut says it’s going to be a green fest for markets across the board but we will wait and see.

As usual you can follow with meme coin trading, geopolitical updates, and more on the Discord where 1,500+ psychos stay locked in throughout the day.

Have a great weekend.

Andy

Gemini Crypto - Get Free Bitcoin

Protect Your Crypto with Trezor

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before

$4,000 ETH breached!

It would be interesting to see how European betting markets for political candidates play out over the next 3-5 years. I could see a country taking major policy shifts and subsequent countries following in line.

I wonder if there would be either a corporate or just betting market play to make during that time.