Capitalizing on Market Degeneracy

426: What if Up Only is the New Normal?

Good morning all,

Got hit with some nasty sinus infection this week, or maybe it’s a 10th derivative of the Pangolin Fever.

No way to know for sure but it doesn’t matter — going to power through this morning’s post as we have quite the week shaking up.

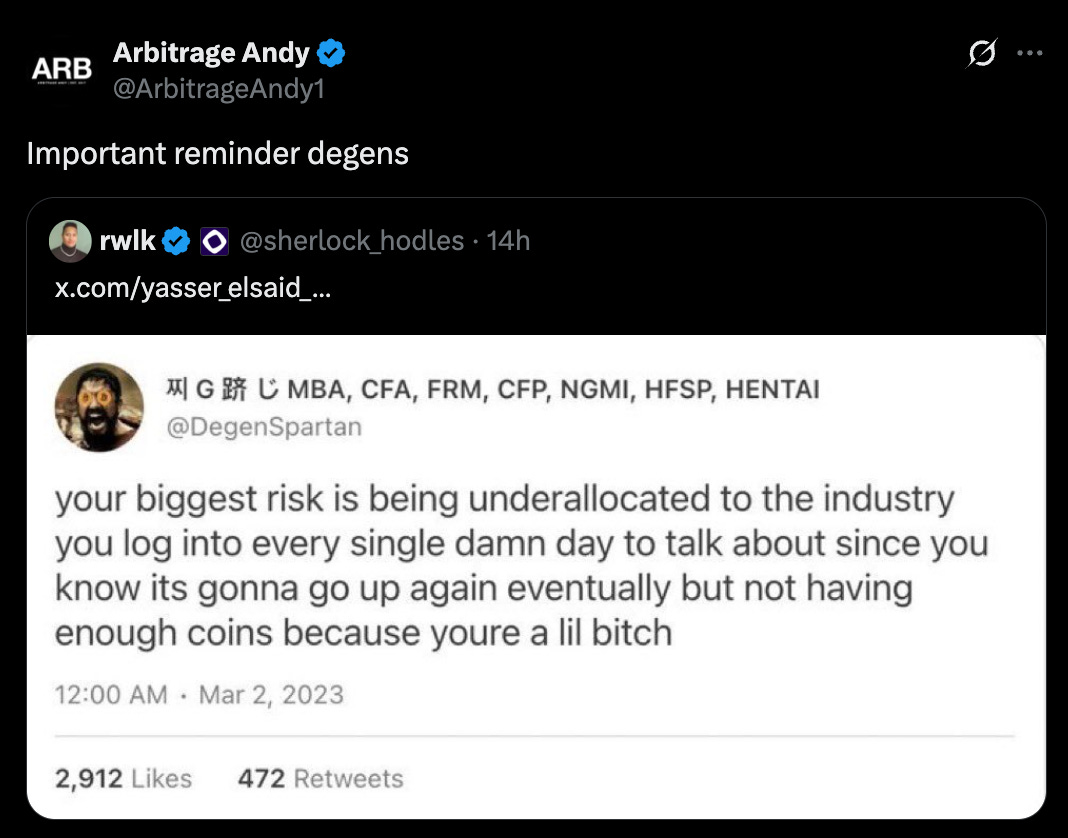

A lot of times in life we have doubts and we overthink things.

We wonder what if, we extrapolate out and try to forecast outcomes, worry about things we have zero control over, and then we paralyze ourselves from making good decisions going forward because we dwell on anxiety.

The financial markets and economic situation before you (if you care about making money) in my opinion, is not something you should overthink.

That mistake will end up being quite costly.

Markets have reached absolute degenerate levels

Over the past couple weeks, multiple WNBA games have been disrupted by fans tossing lime-green sex dildos onto the court. It started in late July and has since happened in several cities including Atlanta, Chicago, Phoenix, and New York. The phallic objects have landed dangerously close to players and even kids in the audience. At least one person has been arrested, and league officials are now cracking down with ejections, bans, and possible legal action against new dildo bandits.

The trend didn’t go unnoticed by the crypto prediction market Polymarket, where traders began betting on whether more sex toys would be thrown, what color they would be, and when they would be slung. Some of these “dildo markets” saw more action than the actual game outcomes.

LOL.

Insanity.

But the situation in traditional markets and crypto isn’t so much different.

This year alone, traders on Robinhood dumped over $250 million into zero-day options, essentially lottery tickets with the lifespan of a mayfly in a single week. Nvidia briefly surpassed the entire German stock market in value. Meme coins like $PEPE and $BITCOIN CATS did billion-dollar volume in days, with no roadmap, team, or purpose beyond pure degeneracy.

Meanwhile, Polymarket didn’t stop at dildos. Users are betting on everything from alien disclosure, Trump’s next arrest, and whether Biden survives the year. The line between entertainment, trading, and collective psychosis is getting thinner by the day.

At this point, the markets aren’t just pricing in risk they’re pricing in absurdity and degeneracy.

And if you want to make money moving forward that’s exactly what you need to acknowledge and take advantage of.

We’ve been long departed from any semblance of normalcy and fundamentals (in markets as well as society). Continuing to look for signs of that archaic system is going to leave you poor and confused. Those who try to explain what is happening with pragmatic logic and approaches are just going to: a.) stay poor and b.) stay frustrated.

Sure there’s some alarms sounding:

U.S. credit card delinquencies just hit a 12-year high, and mortgage defaults are back on the rise

Retail trading volume on platforms like Robinhood and SoFi is up 40–70% YoY. It’s just not slowing down

The U.S. federal deficit is now running at $1.9 trillion annualized

But markets?

Keep chugging higher, the truth is they don’t care.

Just go with it man.

Embrace the lunacy, because the truth is, that’s really all there is left until the MAJOR systematic meltdown, that may come next week or never come at all. If and when that comes, there will be bigger societal issues than your Schwab account balance.

Tariffs? They flip 24 hours after they are mentioned, or they get delayed.

Earnings dumps? Most of these stocks pivot and rip just 48 hours after.

Crypto sell offs? It’s obvious investors think this goes MUCH higher soon and they’re happy to buy the tokens and assets sellers are coughing up.

Over $4.3 billion has flowed into digital asset funds since May, the largest wave since the 2021 bull run began.

Coming out of the pipeline today is a handful of some of the single most bullish crypto catalysts we have ever seen while equities bounce yet again and continue to chug higher. We’ve got rumors of the next Fed Chair and right now a roughly 85-90% chance of a rate cut in September.

While it might seem like we are closer to the top of a bubble than the start of some ungodly bull runs, you have to ask yourself this question:

Are you positioned to print if the all out degeneracy pumps us higher than most of us can even imagine in the coming months?

What if the new norm is literally up only?