Global Markets Crater on Tariff Mania

392: Losses mount as liberation day rolls out

Good morning,

Crazy 24 hours.

Markets are bleeding hard after receiving more details on Trump’s global tariff rollout.

2025 Arbitrage Andy Watch Review drops next week but this morning we need to review the aftermath of Trump’s liberation day which has had an immediate impact on markets.

Now is an excellent time to check out the Arb Letter archive — specifically the posts on emotional management, downturns, crypto sell offs, and more. The masses are beginning to panic not realizing that we should be getting some excellent entries and opportunities popping up in the next few weeks.

I personally recommend the recent post that compiles lessons from some of Wall Street’s most successful titans — all of them without exception weathered some of the most seismic market corrections, disasters, and calamities, managing to come out on top over a longer time frame.

Markets & Crypto

Any hopes that the tariff regime from the Trump admin were going to be “not a big deal” are out the window now. Yesterday’s announcements from Trump jarred the market and gave details on the scale of rollout being enacted. We hinted at what could be coming in Tuesday’s post and it seems the reality is extreme — we discussed hedge fund exposure and equity opportunities in China in that post, those will undoubtedly be impacted by the developments yesterday.

I’ll be posting updates all day today on X if you want to follow along.

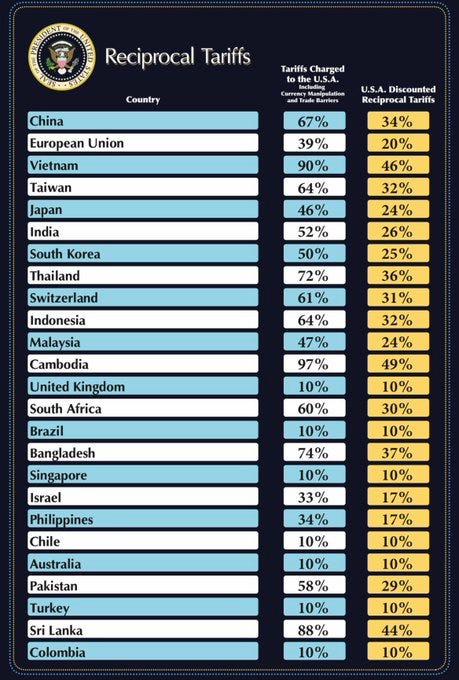

President Trump rolled out sweeping tariffs yesterday, imposing a 10% base rate on all imports as well as targeted hikes including 34% on Chinese goods (on top of existing 20%), 25% on South Korea, and 20% on the EU, sending shockwaves through global trade and markets. U.S. stock markets swung wildly today as investors digested President Trump’s sweeping new tariffs. Major indexes recovered during the regular session, with the S&P 500, Dow, and Nasdaq all closing higher.

But that optimism quickly faded—after-hours trading last night saw sharp declines, with futures on the S&P 500 dropping over 2% and small-cap futures falling nearly 4%. The irreverent tone with which administration officials are responding is escalating fears.

Treasury Secretary Bessent even said yesterday "the stock market selloff is a Magnificent 7 problem, not a MAGA problem".

I went out late last night to grab a gatorade from our local CVS (something I do when I want to just think and drive) and tried to think through this entire saga in the most plain terms possible. Casting aside political bias I have the following high level thoughts on what’s going on. This is an ideological initiative by Trump clearly geared at attempting (key word) to restore American dominance globally.

He’s not doing this for fun or for shits and giggles — there is clearly end goal at play. It’s already clear countries contributing to the US trade deficit are being targeted aggressively and there’s certainly some overlap from Trump’s previous comments on Europe’s need to stop leaning so heavily on the US.

If the plan is to let the stock market go and drive bond yields lower to make the trillions in debt that needs to be rolled over this year more manageable, it is being executed flawlessly by Trump and Bessent.

“If the administration follows through on these higher tariffs without significant carve-outs, it’s going to be very difficult for the economy to digest this. A recession seems more likely than not,”

—Mark Zandi, chief economist at Moody’s Analytics/CNN

This is as much a war on globalism as it is an attempt to decompress markets, make US debt more digestible, and potentially force the Fed to cut rates.

Trump wants his own record of economic prosperity and in order to do that, he feels he needs to clear the stage and flush out the fluff. I’m not saying he’s right in that regard — but it’s obvious that’s his game plan.

Today is a mess — the S&P500 is down 4.39%, the Nasdaq is down 5.6%, and the Dow Jones is down 3.66%. $2 Trillion in market value has been wiped from markets as of about 11am ET.

Gold hits $3200 yesterday, a record high

China is urging the US to "immediately" cancel reciprocal tariffs or they will take "counter-measures” (Kobeissi Letter)

South Korea’s acting President Han Duck-soo ordered the government to “exert all its capabilities to overcome the trade crisis” (CNN)

Despite reporting a 13% drop in deliveries, Tesla shares bounced back on Wednesday before tariff news following reports that Elon Musk plans to step back from certain day-to-day roles in the Trump admin, though this was refuted later on in the day

French financial regulators are launching a probe into the influence of non-bank financial institutions, highlighting concerns about systemic risk and hidden leverage in global markets

Turkey’s currency plummeted to record lows after the arrest of Istanbul’s mayor, igniting fears of political instability and financial contagion across emerging markets

Restoration Hardware stock, RH 0.00%↑ , collapses as much as -44% with tariff fear and missing their earnings expectations (KL)

PayPal has bumped its range of supported cryptocurrencies adding Solana (SOL) and Chainlink (LINK) for it’s customers in the United States and U.S. territories

Fidelity has launched a no-fee crypto IRA that allows U.S. adults to invest in bitcoin, ether and litecoin (Coindesk)

JPMorgan says 14 public Bitcoin miners lost 25% of their market value in March, or $6 billion, their worst month ever (Cointelegraph)

Amazon AMZN 0.00%↑ submitted a last-minute offer to acquire TikTok’s U.S. operations just days before a looming government deadline that could see the app banned nationwide. The proposal was formally sent to key U.S. officials, but insiders suggest the bid isn’t being taken seriously by major stakeholders. The deadline for a sale is currently set for April 5.

Let’s take a look at the responses from major countries in the last 48 hours as a result of Trump’s announcements:

China

China has condemned the new tariffs, calling them a violation of global trade rules. Officials signaled that retaliation is likely, which could range from tariffs on U.S. goods to restrictions on American companies. This move sets the stage for renewed trade tensions, risking a deeper rift between the world’s two largest economies. Keep an eye on NVDA 0.00%↑ BABA 0.00%↑ AMD 0.00%↑

European Union

EU leadership responded firmly, warning that retaliatory measures are on the table. European policymakers are preparing tariffs of their own, targeting key American exports. The standoff raises the risk of a broader trade war that could hit sectors like agriculture, autos, and tech on both sides of the Atlantic. Still think it’s worth looking at various European Defense opportunities in coming weeks.

Japan

Japan expressed disappointment over the tariffs and is pushing hard for select exemptions, particularly for its auto industry. With Japan’s economy being heavily reliant on exports, the government is expected to engage in direct talks with U.S. officials to avoid disruptions to its key manufacturing sectors.

South Korea

South Korea announced last night it will pursue an “all-out” response, including negotiations and potential policy moves to protect its industries. The country’s tech and steel exports will likely be hit hardest, and officials are exploring ways to cushion the blow and diversify trade partners in the coming months.

India

India is taking more of a measured approach, reviewing the impact of the tariffs while continuing trade talks with U.S. Officials, viewing the situation as mixed but aiming to preserve momentum in ongoing bilateral discussions. Indian exporters in pharmaceuticals, textiles, and chemicals are likely to face major headwinds if these tariffs remain.

Canada & Mexico

Both countries voiced disappointment and are weighing their options despite some progress made so far. While no specific retaliatory actions have been announced from either country yet, there's talk of them escalating through trade channels or pursuing their own countermeasures. The tariffs have the capacity to strain North American supply chains and trade relations under our existing agreements.

Crypto

First things first — crypto is a risk asset class. If investors aren’t apeing into risk on assets and if global liquidity is tight, crypto is going to suffer. There’s not many of us that could’ve predicted the extent of the Trump tariff regime. All hope is not lost — but you might need to adjust your expectations moving forward.

I don’t want to sound repetitive but this should be a lesson in how you are allocating with crypto as a whole — alts and defi are getting crushed because they are further out on the risk curve than something like Bitcoin. Bitcoin, all things considered, is holding up well. Does that mean she doesn’t give one last capitulation to $65,000? No. But for the time being I haven’t touched anything.

It’s important to consider the cyclical nature of crypto with this macro backdrop — is it possible Bitcoin chooses to decouple and outperform vs. the Nasdaq and other major indices? Certainly. Is that likely to happen? Probably not. Understand that crypto as a whole will be one of the first asset classes to turn if we get some sort of indication of Fed policy changes in the coming months.

Patience is required right now — even for something like Ethereum which is getting killed. As I said in my last post — if you had FOMO months ago when the market was ripping and Bitcoin was at all time highs NOW or soon is the time to start looking to get your entries, not when the coast is all clear and everyone knows we have the green light.

While trying to time anything perfectly is futile a many of us know — we are likely going to see some excellent levels for buying on tech, AI, and crypto soon enough. Question is, can you stomach holding the positions long enough to reap the rewards, the biggest key to making sure you can, is to not over-invest.

More to come on crypto and tech next week.

Next Tuesday I will be dropping the 2025 Arbitrage Andy Watch Review for paid subs — this year should be solid given the recent release of a whole range of new watches from Rolex, Cartier, Tudor, and other brands as well. I’ve spent an inordinate amount of time compiling all new launches, prices, availability, options, etc. If you’re looking for a new watch in 2025 this should be the best comprehensive resource you can find online.

After that, likely beginning on Thursday we will launch the first of a multi part series on AI. We hear about AI all the time these days but it’s an incredibly complex topics, I want to walk through key themes to help people understand the scale and intricacies of the industry.

The series will include an intro, The AI Stack: Understanding the Tech, AI Market & TAM, Top Public Companies in AI, and How to Invest in AI. At the very least should help readers understand more about the changes AI is going to bring about in our jobs and the opportunities to invest in the coming years. Hopefully the timing will conicide with some solid entries on AI and related names as markets continue to decompress.

See you guys on Tuesday — by the way a handful of you have asked about the Discord link so HERE it is if you want to join. We’re talking meme coins, crypto, equities, geopolitics, and more all day in there.

Godspeed.

Andy

GET 10% OFF ALP NICOTINE POUCHES

Gemini Crypto - Get Free Bitcoin

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before investing and ensure you have a good understanding of your personal risk tolerance.

1) Is Trump doing this to reshore manufacturing and at the same time trying to stop kicking the can down the road even further monetarily and economically? Not posing this as a direct question to you. If he can accomplish either before the mid terms he will be seen as a revolutionary president. If he cant, mid term bloodbath followed by another new Leftist leader in 2028 in which all bets are off and the country is weaker and even more economically compromised.

2) Saw the Rolex Land Dweller and other "new" models and kinda just shrugged. Nothing amazing IMO. The Land Dweller looks like a Vacheron. Underwhelming.

3) The Tudor Pelagos Ultra looks promising. I have an FXD MN and love that watch. The pass through strap can be a bit annoying but its a great everyday wearer.

4) Will be eager to read your AI series. You may be interested in the AI research Elon University just dropped, you can find it here: https://imaginingthedigitalfuture.org/reports-and-publications/being-human-in-2035/the-18th-future-of-digital-life-experts-canvassing/