Don't Get Caught Shorting

247: Attacks On ICE, Bitcoin Hits New High, Shorts Get Nuked

Morning lords.

Some hot market action in the last 12-24 hours to take note of this morning — it’s looking like the chances of a seismic crypto bull pump are increasing.

Quick note.

I am still getting DMs and messages across social media asking BASIC questions about crypto.

GUYS.

Listen to me.

The best resources and commonly asked questions are all covered in past posts and in the full archive. All you need to do is go back and read them.

The Ultimate Beginner's Guide to Crypto

Make Money This Bull Cycle

Getting Rich in 2025

If you want to make sure you do not miss any Arb Letter posts, guides, or price targets as the market plays out in the coming weeks and months — make sure you bite the bullet and subscribe.

There are hundreds of folks here that can tell you how much they’ve made off bull cycles with Arb Letter.

Playbook and basics are there for you. Just read it and you’ll be aead of 99% of people before things get really crazy. It’s that simple. There’s a reason we are near the top of the charts for crypto on Substack.

I’m not repeating this over and over again for my health. I want you all to get a piece of what’s coming. Additionally — make sure you are following on X — it is the single best resource for tracking sentiment, following new tokens, and making sure you see breaking news related to markets.

Crypto & Markets

First things first — absolute scorcher all time high for Bitcoin pushing above $112,000 momentarily.

Ethereum pumped just shy of $2,800 helping boost alt coins and meme coins alike.

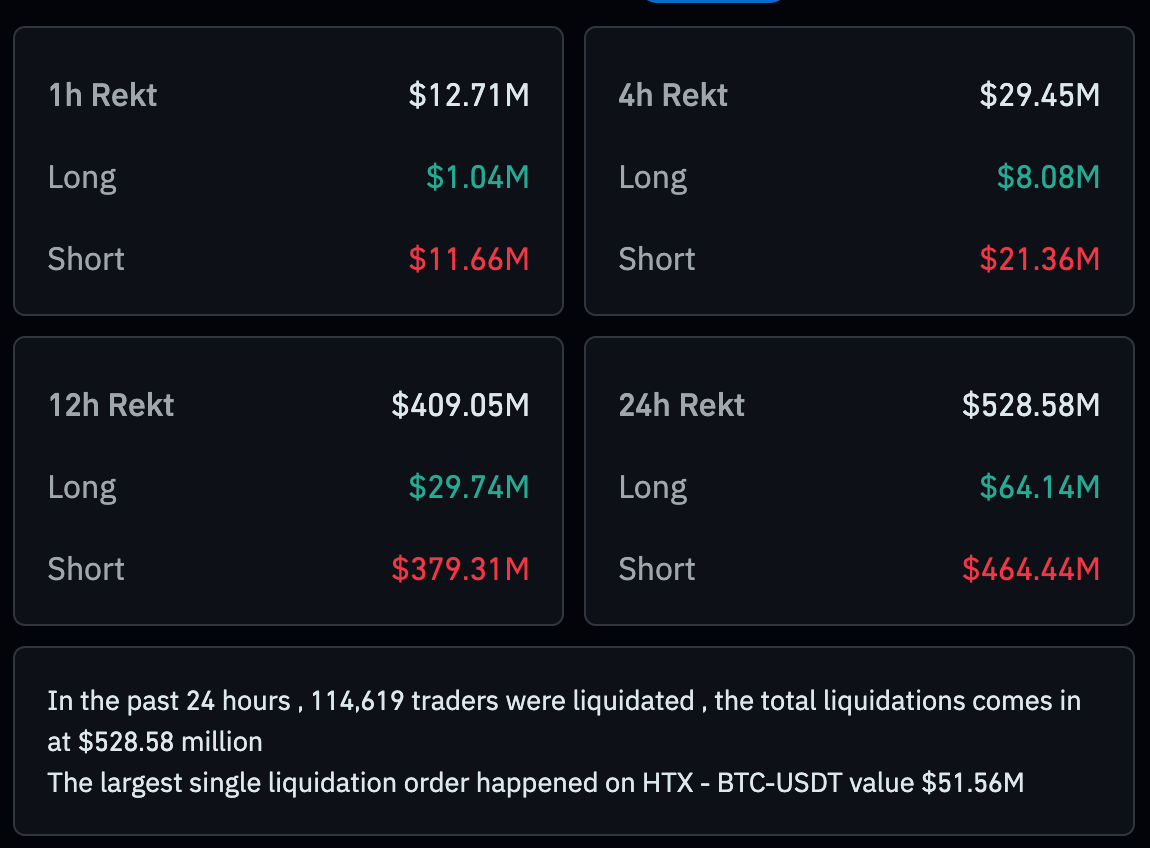

Short sellers got murked to put it lightly — as of 11:12pm ET last night, $464.44M shorts had been liquidated. Another reminder to not use leverage kids.

I was thinking about it in the car yesterday. The periods of crypto that suck (sometimes more than the incessant dumping) are when it just quietly chops along. People get bored so easily, the meme coin launches stall, influencers stop tweeting or posting, and the attention shifts — usually back to equities or major news headlines.

We have been plugging along through some serious flat price action and chop. Steady, but not super exciting for anyone holding anything besides Bitcoin.

As I have said before, that’s the time to get your ducks in a row and do your research. Bet on the majority losing interest. It happens over and over again and then out of nowhere comes some insane pump that leaves sidelined betas and shorts destroyed.

The basic basic plan here is as follows:

BTC new ATH → BTC Dominance eases → ETH pumps/ATH → Full blown alt season and meme coin insanity

Of course the major spark we now have this cycle on top of that traditional flow is that institutions are going buck wild this time around. This leads me to believe this “cycle” or whatever you want to call it, is going to be unlike previous ones.

I think when it gets going it lasts a lot longer and dips a lot less than people expect.

Also don’t forget our equity friends if you want to up your exposure.

COIN 0.00%↑ has soared since I mentioned it 2+ months ago. It will go parabolic if we see Ethereum and alt season kick it into high gear. Coinbase just announced a partnership with Perplexity AI to deliver real-time crypto market data/insights to traders. CEO Brian Armstrong said the aim is to "help traders access real-time, trusted crypto data for better decision-making."

If you want a look into sentiment on price targets — Polymarket’s data has some good clues. As of last night there’s a 36% chance Bitcoin hits $150,000 in 2025.

I’d say the chances are higher — but you can check it out below and bet on it if you’re as confident as I am or skeptical we reach that major milestone.

Besides Bitcoin my focus right now is on:

Ethereum

AAVE

Chainlink

PEPE (24H trading volume is up 116%, reaching $1.37 billion - Whale Insider) - PEPE seems particularly coiled to pump. As I have said before it trades like ETH mega beta.

I wouldn’t be surprised if PEPE pulls a 5-6x from where it is today by the end of 2025.

$7.4 Trillion is now sitting in Money Market Funds, a new all-time high (BarChart)

Linda Yaccarino stepped down as CEO of X

The US dollar has suffered its worst first half of the year since 1973, per (FT/Unusual Whales)

The Nasdaq hit a new record high, led by Nvidia NVDA 0.00%↑ briefly becoming the first company ever to surpass a $4 trillion market cap

Delta Air Lines beat Q2 expectations, jumping about 3%

Broadcom AVGO 0.00%↑ hit an all‑time high (one of our big dip picks from May) - Quiver Quantitative reporting that Nancy Pelosi just exercised up to $5M in Broadcom call options she bought last year

Most of our adds during the dips over the last two months are doing quite well including AMD 0.00%↑ SMCI 0.00%↑ BBAI 0.00%↑ LMT 0.00%↑ LHX 0.00%↑ and MSFT 0.00%↑

Trump Tariff on Copper

The tariff backdrop is chugging along as pressure mounts for Jerome Powell to cut rates.

Rumors swirled around X yesterday that JPOW is resigning, though as of this morning those seem baseless.

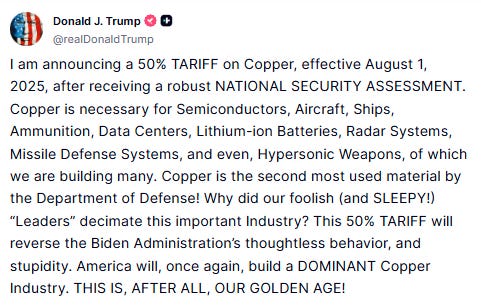

Trump recently announced a 50% tariff on all imported copper, citing national security under Section 232—a move set to take effect August 1.

The market response was immediate: U.S. copper futures exploded to record highs, with prices jumping over 25% and creating a massive premium versus global benchmarks.

While the administration is pitching it as a way to hopefully revive domestic production and reduce our reliance on foreign supply, the U.S. lacks the processing capacity to respond fast enough.

This will likely impact industries like housing, EVs, solar, and AI infrastructure, all of which rely heavily on copper for wiring, components, and power systems. Companies like Tesla, Nextera Energy, Enphase, and Nvidia could face margin pressure due to rising input costs. Homebuilders like D.R. Horton or Lennar may see increased construction costs, while utilities and data center operators may face project delays.

In the short term, U.S. copper miners like Freeport-McMoRan (FCX) might benefit, but the broader inflationary impact could weigh on growth stocks and industrials. We will of course have to see if Trump pulls a classic TACO reversal on this set of tariffs.

For my tactical and second amendment kings — you might want to pull the trigger on any ammo orders you’ve been kicking the can on (I did last night).

The tariff is likely to drive up ammunition prices, since many bullets and casings are made from copper or brass. With the U.S. relying heavily on imported copper, the tariff raises raw material costs that will ripple through the ammo supply chain.

Manufacturers may face higher production costs and longer lead times, impacting both civilian and defense markets. More weapons and ammunition to Ukraine (that Trump just announced) or further Middle East tensions will exacerbate this issue.

Global News & Geopolitics

The recent flooding in Texas left a trail of devastation. Homes were destroyed, roads washed out, and entire towns were overwhelmed by historic rainfall.

Just two days before the storm hit, a cloud-seeding operation was conducted in the region by a weather modification company called Rainmaker Technology Corporation.

Its CEO, Augustus Doricko, confirmed the operation took place but insisted on multiple podcasts and interviews there’s no evidence linking it to the flood itself. He stated the seeding was halted due to high moisture levels and that such techniques aren't capable of producing the scale of rainfall seen during the disaster.

Let’s back up a bit — after the incidents in North Carolina and Florida months ago, the weather modification critics and proponents hit the internet by storm. Now, we have the CEO of a company that modifies the weather coming out and saying that there’s no link between the company’s operations and the crazy weather we are seeing.

Yet another example of something people thought was insane, ending up to be true (cloud seeding that is). Was the cloud seeding solely responsible? Who knows — but it is definitely odd this dude chose to come out and say he had nothing to do with it.

Kind of like that old headline that the CIA investigated themselves and found no issues or wrongdoing.

Our piece earlier this week talked about the heroic efforts of Scott Ruskan, the 26-year-old Coast Guard rescue swimmer, who became the sole responder on the ground during the floods at a Texas summer camp. On his first mission, he coordinated helicopter evacuations and personally helped save over 165 people.

Based Chad.

In other news:

6 Secret Service agents have reportedly been suspended for security lapses that took place during the attempted assassination of President Trump

61% of Americans support the deportation of all illegal immigrants (Cygnal)

US regulators have approved Moderna’s Covid vaccine for children (Bloomberg)

Russia has launched another major drone and missile attack on Kyiv just days before planned talks with U.S. officials

France is battling large-scale wildfires that have injured over 100 people, forced evacuations, and disrupted airport operations amid extreme heat

Attacks on ICE

The rise in militant leftist groups continues in the US with several attempts to leverage violence against ICE in an effort to interfere with lawful deportations.

On July 4, a group of ten individuals launched a coordinated, military-style ambush on ICE agents and a local police officer at the Prairieland Detention Center in Alvarado, Texas.

Wearing tactical gear and armed with rifles, they used fireworks and property damage to lure officers into an attack, during which a responding cop was shot in the neck.

The DOJ has charged all ten with attempted murder and weapons offenses, describing the incident as a violent, organized assault, not a protest. Authorities recovered body armor/plate carriers, propaganda materials, and several firearms.

They say the attack reflects a growing threat to federal law enforcement, documented by other instances recently:

In McAllen, Texas, a man in tactical gear opened fire on Border Patrol agents outside a facility on July 7. He was killed by return fire from officers on the scene.

In Portland, Oregon, a separate confrontation took place outside an ICE facility the same day as the Texas ambush, leading to multiple arrests for alleged assaults on federal agents.

It’s obvious at this point the Trump Administration is going to have their hands full on this front for the duration of deportations and the presidency.

Far left political activists (though some would call them terrorists) that are willing to openly use violence against government officials and organizations.

That’s all for today kings — if necessary I will send out another quick recap tomorrow morning if we get some good action in markets today. Going to try and put out an episode of Risk On as well, though we have an interview scheduled for next week.

Take care

Andy

Gemini Crypto - Get Free Bitcoin

Protect Your Crypto with Trezor

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before

“There are hundreds of folks here that can tell you how much they’ve made off bull cycles with Arb Letter.”

100% can confirm.

I was curious what stock trading platform or app you would recommend for the average Joe? Gemini has been a great platform to use for crypto.

Many thanks in advance