Dalio’s Warning, Trump’s Tariffs, and Crypto Carnage

379: Trump Moves Markets, Crypto Bleeds, and Bezos Shifts Right

Good morning all.

If you missed our crypto guide Monday on cold storage/security, market expectations, and the assets I am picking for the rest of 2025 you can find it below. Highly recommend checking it out if you’re in crypto.

Boat load of news to cover today on all fronts — so let’s get into it. New episode of Risk On should drop today around lunch time covering the major news this week. Next week we have an episode of Risk On set with Random Recruiter — a headhunter for Tech professionals who has 700+ tech placements in F500, mid market, and startup companies. We will cover the job market, trends in the workplace, and what his expectations are moving forward for company culture, layoffs, and hybrid/remote work.

Attorney General Pam Bondi claimed on Fox News last night that parts of the Epstein Report are set to drop this week, while I am skeptical this could be huge. The individuals and organizations implicated in that scheme will shock many people, which is no doubt one of the major reasons it has taken so long for anything to come out on it.

Let’s get into markets and global news.

Markets

Markets continue to chop along with crypto remaining depressed. To make matters worse the S&P nosedived upon news that President Trump says 25% tariffs on the European Union are coming soon. Donald Trump has announced plans to impose 25% tariffs on the European Union, arguing that the 27-nation bloc was created to take advantage of the United States.

Speaking at his first cabinet meeting, he stated that official details would be released soon, confirming that the decision has already been made. The EU, one of the U.S.’s top trading partners alongside China, now faces potential trade tensions similar to those already brewing with Canada and Mexico, where 25% tariffs are set to take effect next week.

While tech got battered this week — NVDA 0.00%↑ delivered another blowout earnings report, solidifying its dominance in AI computing. The company posted $39.3 billion in Q4 revenue, marking a 78% year-over-year surge and a 12% jump from the previous quarter. The data center segment led the charge, pulling in $35.6 billion, a staggering 93% annual increase as AI demand continues to explode.'

For the full fiscal year, NVIDIA’s total revenue skyrocketed 114% to $130.5 billion, with earnings per share (EPS) soaring 147%. CEO Jensen Huang credited the growth to overwhelming demand for NVIDIA’s Blackwell AI supercomputers, reinforcing the company’s position at the heart of the AI revolution.

This beat gave a little bit of life to crypto in post market hours yesterday, though the market is still in the shitter.

New Home Sales 657K, Exp. 680K, Last 734K (ZeroHedge)

On Semiconductor is set to reduce global workforce by 2,400 employees, 9% (MacroEdge)

Google GOOGL 0.00%↑ cloud division cuts a large number of jobs

Salesforce stock, $CRM, fell over -10% after reporting weaker than expected revenue and guidance (Kobeissi Letter)

BlackRock dropped it’s DEI references from it’s annual annual report (WSJ)

President Trump is set to close over 120 IRS tax offices nationwide

Gainers:

Super Micro Computer (SMCI): Jumped over 20% after resolving accounting issues and filing delayed financial reports

Broadcom Inc. (AVGO): Climbed 5.1%, standing out in the semiconductor sector (this was one we covered in our Top Assets to Buy in 2025 Post)

Losers:

AppLovin (APP): Dropped as much as 23% after short sellers accused the company of exaggerating its AI capabilities.

Tesla Inc. (TSLA): Fell 8.4%, pushing its market cap below $1 trillion amid concerns about growth and brand perception with Elon’s involvement in DOGE

Hims & Hers Health (HIMS): Declined sharply as part of a broader sell-off in high-growth stocks

Lucid Group (LCID): Slipped after the unexpected resignation of its CEO, adding to investor uncertainty.

In a recent interview with Tucker Carlson, Ray Dalio sounded the alarm on America's mounting debt crisis, warning that the U.S. is heading toward a financial “heart attack” if drastic changes aren’t made. He emphasized that soaring national debt and fiscal mismanagement could trigger serious economic instability, while also highlighting growing internal divisions and the rapid evolution of AI as key challenges ahead.

Dalio’s Biggest Takeaways:

Debt Crisis Danger – U.S. debt has surpassed $36 trillion, with annual deficits around $1.8 trillion, an unsustainable trajectory that could destabilize the economy.

Bond Market Risks – If deficits aren’t reduced, the oversupply of government bonds could drive interest rates higher, putting pressure on financial markets.

Internal Division – The U.S. is experiencing a “civil war” of values and wealth inequality, which could deepen societal unrest.

AI Disruption – The rapid rise of artificial intelligence will transform industries but could also exacerbate economic displacement and job loss.

Urgency for Change – The government needs to cut deficits to 3% of GDP within four years to avoid a financial reckoning.

Crypto

The crypto sell off continues in earnest with Bitcoin falling below $83,000 as of 4pm ET yesterday. Ethereum is trading just over $2,200 and many alts are bleeding hard. I’d be remiss if I did not mention the strength on a relative basis that $PEPE is showing versus other peer meme coins and even Ethereum.

Still — the longer term picture looks bullish based on administrative, corporate, and regulatory updates that are coming out.

Bank of America CEO says stablecoins are inevitable which may suggest that the bank may launch its own token pegged to USD deposit accounts if regulations apermit

Bitcoin is only at 3% adoption in 2025 - just like the internet in 1990, social media in 2005, and online banking in 1996 according to River’s latest research (CoinTelegraph)

Justin Sun $TRON, and the SEC are reportedly exploring a potential resolution of a civil fraud case against the cryptocurrency founder, per Reuters/Unusual Whales

The SEC has closed their investigation into wifely used crypto exchange Gemini with no enforcement action at play

Mastercard's Multi-Token Network (MTN) is integrating with OndoFinance

as its first tokenized real-world asset provider (Satoshi Club X)

The first Solana Solana ETF has been listed on the DTCC (WatcherGuru)

Binance CEO Richard Teng said this week “It’s important to view this as a tactical retreat, not a reversal”

Uniswap Labs, the creator of Ethereum’s most traded decentralized exchange, is no longer facing legal action from the Securities and Exchange Commission as the agency’s Crypto Task Force overhauled enforcement actions from previous leadership (CryptoNews)

The latest on-chain data and wallet activity paint a clear picture of heightened volatility in the crypto market over the past week. Bitcoin holders have sent over 79,000 BTC to exchanges, signaling increased selling pressure, while whales have offloaded nearly 25,740 BTC, adding to downward momentum. Over $1 billion in liquidations have intensified the sell-off, with Bitcoin alone accounting for $323 million in forced selling — you can find updated liquidation levels on CoinGlass.

At the same time, large investors and whales are making moves, with over 8,000 BTC—worth nearly $739 million—withdrawn from Coinbase, suggesting potential accumulation at lower prices or transfer to cold storage. Altcoins have also taken a hit, as whales dumped 370 million XRP and large memecoin holdings, fueling further price declines. With exchange hacks adding to market jitters, crypto is facing a critical moment—one that could set up either a deeper decline or a strong rebound if we can just shake the tariff induced FUD. As I mentioned earlier $PEPE is holding up pretty well all things considered.

I have bought a few smaller clips of BTC in the past 48 hours and my next buy if anything will likely be AVAX or ETH.

On thing is abundantly clear in crypto — the SEC’s former attacks on crypto companies have fallen flat and the regulatory barriers once put in place are falling. This should aid the next pump and on-boarding of institutional clients in the near future. This is absolutely a pro crypto administration despite the tariff nuking of our bags in the short term.

Geopolitics & Global News

The U.S. and Russia are preparing for high-level discussions following key meetings in Riyadh, signaling potential diplomatic maneuvers amid ongoing tensions. Germany’s elections delivered a shake-up, with the center-right CDU securing victory while the far-right AfD surged to second place, reflecting a shifting political climate in Europe.

Meanwhile, Ukraine and the U.S. have signed a critical minerals deal 9with Zelensky visiting Trump soon), reinforcing strategic ties and long-term security commitments. China’s latest live-fire naval exercises in the Tasman Sea have escalated tensions, prompting concerns from Australia and New Zealand over military expansion in the region.

On the economic front, BP is shifting course, ramping up oil and gas investments after admitting its push into green energy may have been too aggressive (funny that everyone is realizing this NOW).

US Federal Agencies reportedly have been directed to prepare for large-scale layoffs over next 6 months in an OMB/OPM memo (Fox News/Macroedge)

HHS Secretary Robert F. Kennedy Jr. has paused a $240 million contract from the Biden administration to develop a new COVID vaccine (Leadingreport)

Fired USAID employees will be escorted to their desks and given 15 minutes to collect their personal belongings from the agency’s gutted Washington headquarters later this week, according to a notice from USAID (Leadingreport)

Syria’s new government launched a national dialogue conference to shape post-Assad reforms

Russia’s security chief visited Indonesia and Malaysia to strengthen defense cooperation as Moscow pivots toward Asia

Maine Governor Janet Mills is under federal investigation after opposing a Trump administration executive order banning transgender girls from participating in women's sports, leading to potential withholding of federal funds.

Oil traders are steering away from long-term tanker charters due to uncertainties stemming from U.S. foreign policy under President Trump, affecting global shipping and trade routes

The U.S. Attorney's office in Washington D.C. has initiated an investigation into Senate Minority Leader Chuck Schumer and Representative Robert Garcia for alleged threats against public officials, including Elon Musk

The U.S. Environmental Protection Agency is urging the reconsideration of the scientific finding that greenhouse gases endanger public health, a move that could jeopardize existing climate regulations

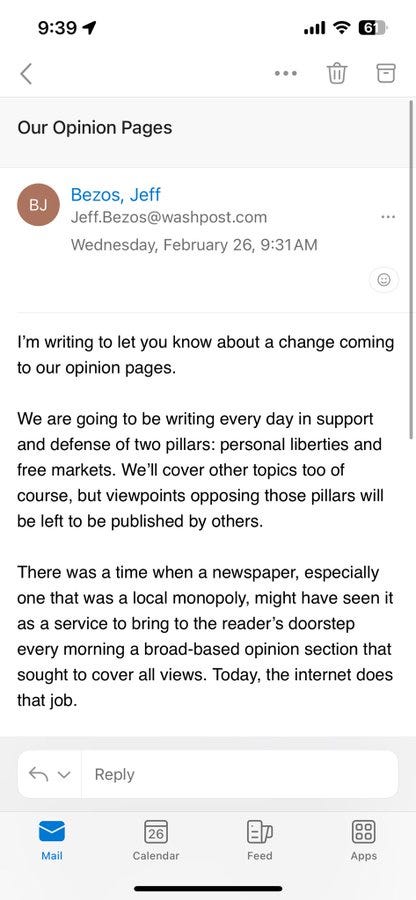

Jeff Bezos continued a trend that we have seen emerge with the onset of the second Trump Administration — the “de-woke-ification” of major companies and corporations towards more right leaning ideals. Bezos sent out an email in which he let the Washington Post know that “we are going to be writing every day in support of two pillars: personal liberties and free markets”.

Pretty drastic shift in tone. Employees took to X to vent their frustration. Expect more of this in the coming months. It really does highlight just how insane things got over the last 4 years but also how quickly people are willing to change their tune as soon as the optics benefit them.

Founder of Blackwater and former Navy SEAL Erik Prince recently put forth a proposal to deport 500,000 illegals per month for the Trump White House. Prince has suggested that the U.S. government leverage private sector resources (including his network) to accelerate mass deportations, arguing that outsourcing logistics could streamline the process beyond what government agencies can handle alone. His proposal includes using military bases as processing centers, deploying private aircraft for transport, and assembling trained private teams to assist in enforcement actions.

Prince claims this approach could deport up to 12 million people within two years, though legal challenges may arise due to restrictions on privatizing law enforcement activities. Despite potential hurdles, he insists that private sector efficiency is key to meeting aggressive deportation targets.

“This is not some idea of a private army. It was a memo generated to describe how to achieve the logistics necessary to move the millions of people that they intend to deport. If people think it’s a huge number, think about how we’ve been invaded. We’ve had millions of people float into the country illegally, actually paying the cartels to smuggle them in.”

On the government front we will look to see today if anything comes of the claims that the Epstein list gets dropped.

As I said I am pretty skeptical.

Look out for a new episode of Risk On later today. Next week on Tuesday I will be dropping a post on society and where I think things are headed in relation to relationships, family, and happiness. Should be an interesting one given recent events on X surrounding SEC frat/sorority drama (If you don’t know what I am talking about google Ole Miss or search it on X).

It’s obvious that we as humans have become a bit numb to the human experience and fellow people’s lives/struggles — whether that’s because of technology, recent events, or something else, it’s pretty unsettling and I think it deserves to be explored a bit more.

Have a great day.

Andy

BullX Crypto Trading Software

Gemini Crypto - Get Free Bitcoin

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before investing and ensure you have a good understanding of your personal risk tolerance.