Where Do We Go Next?

450: Jackson Hole Fed Meeting, Crypto Outliers, AI Bubble

Happy Thursday lords.

Markets are getting volatile again, we’ve got Jerome Powell speaking this week, and some select assets are showing some real life despite recent selling which means opportunity is right in front of us.

Couple housekeeping items to go over regarding our past calls, posts, and what to watch this week, etc. that you should read over before we get into the post today:

Hopefully you took some profit on PLTR 0.00%↑ when we said to last week, it was frothy and bound to correct at some point. I have no doubt it will bounce back but it may visit $100-$120 first

There are some STRONG outliers in crypto right now — primarily Chainlink which decided to pump the last few days while everything else dumped hard, this is a major indicator that when ETH and the market pops again it is going to lead the charge

AMD 0.00%↑ SMCI 0.00%↑ and some other names I like are starting to dump a bit, might be a solid chance to add

Tech is selling off a bit alongside crypto, while some of the valuations were getting ridiculous I do not expect this to continue. Yes AI may be a bit toppy, but long term you want exposure to these names. I would set some price notifications for levels you’d add at

The Fed’s Jackson Hole Symposium starts today, which will offer us clues on the upcoming Fed policy decision in September. Opinions on what comes next have shifted with PPI

I am always reminded just how emotional most people are when we get pullbacks like the one we’ve been in the last 96 hours or so.

The flip flopping and top calling is insane. People’s attention spans are like schizophrenic meerkats right now.

Based on Google search results, interest in alt-season has dropped an astounding 55% in just one week — people are like monkeys looking at the next coconut or banana tree as soon as something sells off.

Not a good way to trade or invest.

When we pump again they will come crawling back to buy higher.

Speaking of the pump — if you missed the Crypto Part I and Part II guides last week make sure to check them out. We cover basics, portfolio allocation, alt coins, and more.

Arbitrage Andy Crypto Guide Part I

Arbitrage Andy Crypto Guide Part II

And don’t forget to grab your free crypto with Gemini (links at the end of today’s post). Best time to redeem those offers is when we pull back a bit.

Markets

Well here we are. A nice little crossroads before JPOW dictates the tempo for markets through the end of 2025. Is this a momentary pullback or the start of a fat correction?

Personally I think this is a BS head fake + a nice little shake of the Apple tree to root out weak hands but what do I know.

You really think Trump and his cronies are going to let the entire market dump hard?

I don’t lol.

Maybe this sell off persists into early January but I am of the opinion that we are going to pump in the fall.

Now look I am bullish — but we cannot ignore some of the obvious red flags popping up, to do so would be reckless and I try not to run that kind of outfit here.

There are some initial signs of an AI hype slowdown, a bit more risk off appetite than some of us may have been expecting, and growing murmurs that Jerome is not going to be cutting rates anytime soon.

The odds of a September cut likely just thinned out. Odds are sitting in the 80–90% range for a 25bp move, with only a small chance the Fed holds steady and virtually no belief in a bigger 50bp cut.

The Fed isn’t hiding the fact that inflation is still their top concern, and with core CPI stuck north of 3% and PPI spiking almost a full point in a month, the data (if it’s real or not) is backing them up.

Markets want to pretend the labor market alone can force Powell’s hand, but that’s a stretch when price pressures are flaring again. The September jobs report will be the big swing factor, but unless it comes in weak enough to outweigh inflation risks, the Fed likely has every reason to sit tight. For now, the “pivot trade” looks more like hope than probability.

To be honest that doesn’t change much for us — it probably just pushed back a few of our timelines regarding risk assets that need the retail flood and good headlines to pump.

META 0.00%↑ has frozen hiring in their AI division

Japan’s 20-year government bond yield is at the highest peak since 1999 (Unusual Whales)

Sony is raising the price of all PS5 models by $50 in the US citing tariffs

Sam Altman made remarks raising questions about an AI “bubble.”

Morgan Stanley has said the Federal Reserve will not cut interest rates this year

Cracker Barrel has revealed new logo spurred by woke CEO Julie Felss Masino who says people love their new rebrand

$IBM and NASA rolled out Surya, an open-source AI model on Hugging Face to forecast solar storms and protect satellites, grids, and telecoms

NVIDIA launched its new Blackwell-powered cloud gaming upgrade (5K at 120 fps), but recent bubble chatter is heating up as big names warn of “AI winter”

Kairan Quazi, the 16 year old prodigy who joined SpaceX at 14 has now joined Citadel Securities as a quant developer

TGT 0.00%↑ CEO Brian Cornell will step down in February

INTC 0.00%↑ has the market jittery after last week’s reports the U.S. government may take a 10% equity stake, sparking worries about political interference in markets

Our good ole dog PLTR 0.00%↑ has finally come back down to earth. It was a glorious ride but all good things must at least cool off eventually. The stock is down 14% in the last 5 days

Another quick point.

Liquidity signals are flashing yellow heading into September. Reverse repo usage has collapsed to multi-year lows as cash floods into record Treasury bill issuance, while recent 10- and 30-year auctions showed weak demand with primary dealers forced to take down more supply than usual.

Andy what the f*ck does that mean?

In plain/monkey brain terms: the system’s excess liquidity cushion is thinning at the same time the Fed is apparently doubling down on their inflation vigilance. With Powell signaling no apparent rush to cut and supply still ramping, September could bring a tighter funding backdrop just as markets are betting on some relief. For investors and us, that mix suggests volatility risk is actually building and not easing until either labor data breaks or inflation convincingly cools.

Against that backdrop of unpredictable capital markets and economic policy, we also have the increasingly dire front in which things just keep getting more expensive and young people are asking themselves if certain milestones will ever be achievable.

Take a look at this recent data — the percentages of people who owned a home by 30 years old in America are as follows according to MacroEdge:

1950: 50%

1960: 52%

1970: 48%

1980: 45%

1990: 43%

2000: 35%

2010: 25%

2025: 12%

Pretty grim stuff.

The only real options to combat this reality (that we discuss frequently) are starting your own business, continuing to accumulate assets, and/or figuring out a way to gain equity. Without some pretty massive structural changes and depressions in markets I wouldn’t expect miracles. This is the new reality and we simply need to figure out ways to adapt — quickly.

In any case:

The Fed’s Jackson Hole Symposium runs August 21–23, centered this year on the theme of labor markets and long-term economic shifts.

The main event for markets is Powell’s keynote Friday at 10 a.m. ET, where he’ll deliver his outlook on policy and the economy. This is his biggest stage before the upcoming September decision, and traders will be dissecting every line for clues on whether cuts are still on the table or being pushed further out (expect some chop into the weekend).

Beyond near-term rates, Powell is also expected to touch on the Fed’s long-term framework and its “independence”, with his legacy increasingly in focus as him and Trump continue to beef.

We will have to see if he comes out a bit more dovish than usual or if he crushes some of our short term dreams with his stubborn nothingburger hawkish talking points.

Yesterday I added SMCI 0.00%↑ SSYS 0.00%↑ and QQQ 0.00%↑

Crypto

Well we got a pullback (as half expected) but it wasn’t or hasn’t been, nearly as bad as we have seen in previous bull runs.

Bitcoin is now trading down around $114,000 with Ethereum down to the $4,300 range (which is not bad all things considered).

Alts took a decent hit but a handful of them are up anywhere from 2-5% as of 11pm ET last night.

Once again, the LINK marines are celebrating and the boys are printing (hopefully you rolled your PLTR profits straight in).

Chainlink has been one of the few coins ripping higher while most of the market sold off. In just the last two days, LINK jumped from around $23 to the $26 range, an 11% surge that pushed it to fresh multi-month highs.

The move has been fueled by news of the upcoming staking upgrade, heavy whale accumulation, and steadily shrinking exchange balances that point to real conviction among long-term holders.

With momentum building and some key resistance zones in sight, LINK looks primed to be one of the first assets to really rip once broader market conditions flip risk-on and it doesn’t hurt that we should get a fresh buy number for the Strategic Reserve at some point today, taking even more stinky linkies off mark.

The hype on LINK on X and other platforms recently is soaring as well. According to LunarCrush Social Analytics Chainlink’s share of social activity vs. all of crypto just hit the highest point in the last year.

AAVE, LINK, and AVAX look primed to move higher if we can reverse this sell off by the end of the week. After that I will start to look at some AI plays and Solana, which we can get into next week.

Senator Cynthia Lummis said this week, “We will have the crypto market structure bill to the president’s desk before the end of the year.” (CoinTelegraph)

Kanye West launched a memecoin $YZY on Solana last night which pumped from $200M to over $2B+ within about 5 minutes of him posting the CA to X lmao. Do me a favor and don’t buy this guys, it’s riddled with insiders and it’s going to rug hard. Save your money for quality

Since its January 2024 launch, Pump.fun the Solana-based memecoin creation platform, has pulled in over $800 million in lifetime revenue

Stay the course boys, that’s my informal advice.

It’s evident to me based on the amount of activity from institutions that another leg up awaits us.

Whether that comes in October or next year, who knows, but right now weak hands are getting shaken out of the market and focusing only on the short term.

I should have a Risk On interview done soon with NEAR Protocol, for those interested.

Geopolitics, US News

On the heels of my post earlier this week on immigration, cultural issues, and societal tension in the US we have gotten some fresh new reminders of how certain camps of people think in the US.

Fresh off the press last night was a textbook example of the mindlessness that people bring to the table in response to logical enforcement of US immigration laws in the US (and furthermore, the removal of CRIMINALS from the country).

In the video people you can see federal agents and law enforcement detaining a man in Washington DC and he makes a run for it screaming like a maniac.

Despite having ZERO clue what was going on in the video leftist accounts immediately took to X to criticize the detainment.

One account said:

“Just saw DC Police + federal agents detain a man on the National Mall. He appeared to try to escape, then was quickly tackled to the ground by several agents + was screaming in Spanish “please, I’m not a criminal, I work here, I want to be with my family”

Another account responded:

“This is just so heartbreaking and not what I voted for. We as a country are so much better than this. All of us need to just look in the mirror and ask ourselves if this is who we are. It's just completely unconscionable that they didn't pull out a taser when fattie tried to run”

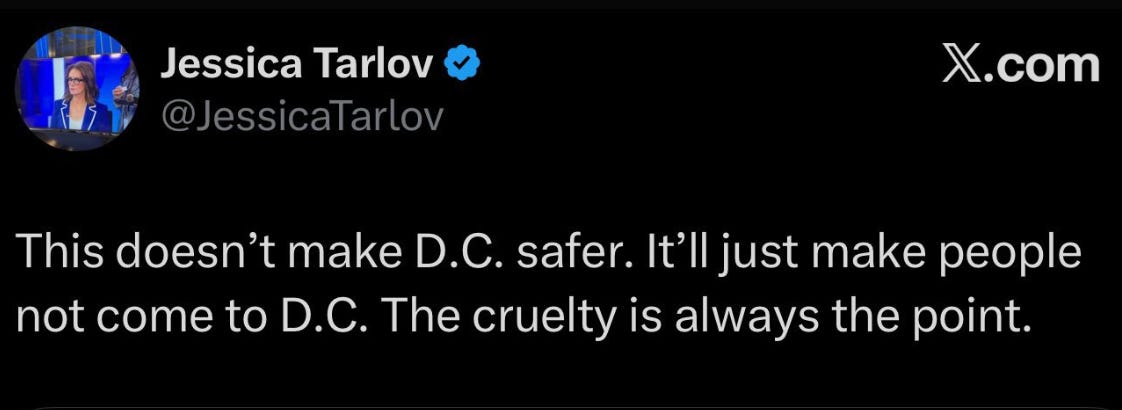

Jessica Tarlov of Fox New's’ The Five, the lone lib of the bunch who is constantly getting into arguments with right leaning personalities on the network, got absolutely mogged and pwned by Trump’s White House deputy chief of staff for policy Stephen Miller.

Turns out the guy is not only an illegal alien but he was charged with aggravated sexual battery against a minor under 13. He’s a POS scumbag who entered the US illegally 3X previously and is on his final order of removal status.

Tarlov quipped the tweet below in response to the video.

Miller responded an hour later:

Why are you defending a criminal illegal alien invader charged with sexually assaulting a child?

(information that was released shortly after the video was released)

Tarlov immediately panicked, deleted the tweet, and said “I didn’t know he was - the DHS memo on him came out hours after the video. Wouldn’t ever defend such a person! Hopefully you guys will only go after these types versus hardworking folks that have committed no crimes! Will delete my original tweet.”

That last sentence cracks me up — it’s a way of trying to save face and backpedal.

It’s like I said in Tuesday’s post. The far left LOVES criminals. They choose to defend them any chance they get. They continue to try and defend the lawful deportation of illegal aliens and criminals.

It really is just wild. It’s some odd disconnect they have with reality where cause and effect is not understood fully. They can’t conceive a world where bad actors exist and need to be punished and deterred.

The Trump administration is reportedly revoking licenses of the employer of the foreigner who kiIIed three people while U-turning a semi-truck in Florida

A drone, likely Russian, detonated mid-air this week in rural eastern Poland

In a bid to diversify its defense partnerships, Canada is seeking closer military collaboration with Sweden and Finland

After Trump’s tariffs shook global alliances, New Delhi and Beijing quietly agreed to resume trade, flights, and border patrol coordination

India’s External Affairs Minister is currently in Moscow for a high-level visit, signaling deeper strategic ties as India navigates growing tension with Washington

Quick one today — if there’s some major news, I will see you guys in the morning, otherwise stand by for some more updates regarding Risk On interviews. I am on vacation starting Saturday and will be doing some ocean/bay fishing — for those interested in if I am successful and what I do for the 6 hours I spend NOT catching, I will likely drop a more personal post Sunday or Monday. Maybe it’ll be day in the life of a 32 year old dad at the beach.

Stay tuned,

Andy

Make sure to take advantage of our partnership with Gemini, you can get your choice of crypto free when you sign up and trade.

Get Free Ethereum w/Gemini

Get Free PEPE w/Gemini

Get Free Bitcoin w/Gemini

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before investing or trading.