What are the institutions telling us?

060: 3AC liquidated? Banks scooping. Hedge funds lurking.

Hope everyone is having a solid week - originally we were going to do a post on $MATIC and some of the other alt plays that I like at these levels for longer term holds but I thought of a topic to cover that would be much more valuable. We can always drop a post on $MATIC at a later date.

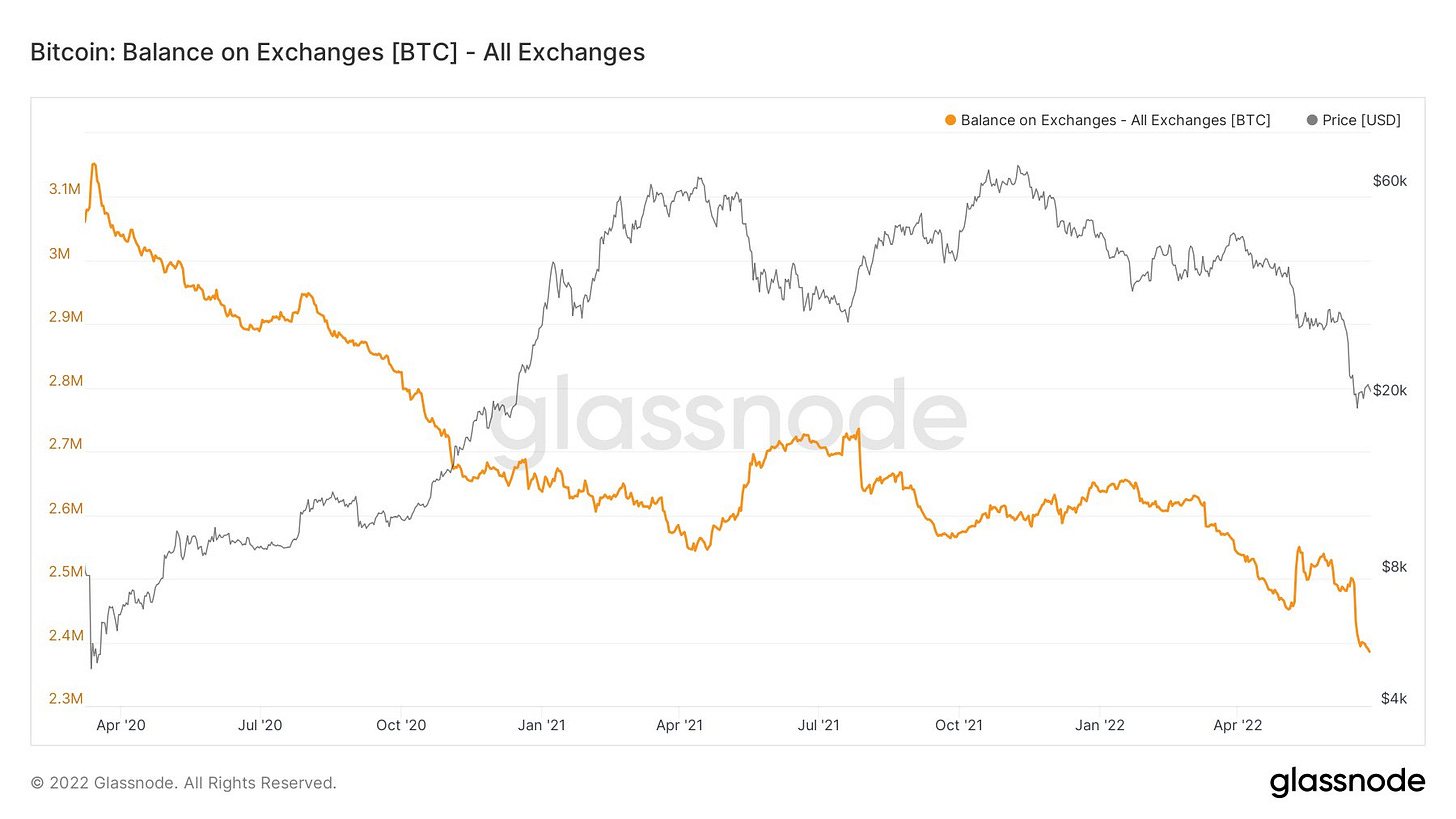

At the time I am writing this Bitcoin is at $19,971 and Ethereum is sitting at roughly $1,100. Far cries from where these blue chip crypto assets once traded only months ago. What we witnessed recently was a historic sell off that had a wide reaching and still unsettled contagion effect on those employing leverage in the crypto eco system. When the tide went out and the fed stopped printing money - many were caught naked. Hint: this is an opportunity.

This morning Bitcoin has dropped below $20K again and Three Arrows Capital was ordered by a court in British Virgin Islands to liquidate assets. We may very well see this play out directly in the market today with a price dump as assets en masse are sold. We are watching a real time purge of over exposed and over leveraged crypto shops who pulled an Icarus and flew too close to the sun. Always respect the crypto markets, they will humble you quickly, it’s not a matter of if, it’s when for every person in crypto.

I’ve continued to see dozens of headlines that involve both traditional finance institutions as well as their fast paced wild west brethren in the crypto world. The merging and interactions of these two groups are what will propel massive mind-boggling growth in the space in the coming years. The recent deleveraging and purge of crypto markets has revealed prey and predators quite clearly.

There’s been a murmur circling through corporate and institutional circles about blockchain and crypto. I have heard it and it’s not the usual “AdopTioN” hopium that bitcoin maxis mention every other month. This is genuine interest and exploration of protocols, balance sheet strategies, and entire new infrastructures being built for market making, lending, trading, and investing. The ball keeps accelerating despite this recent sell off.

If you have money in crypto you’re probably wondering where we go next in terms of asset prices and adoption. Let’s take a look at the current situation, why prices are currently dropping, and how big institutions fit into the picture. There may be some hints at when we see another pump. Michael Saylor just bought MORE Bitcoin, Bulge Bracket banks are setting up infrastructure, and regulatory clarity might emerge from this vicious sell off. Let’s get into what this all means kings.

*this is a paid post for Arb Letter premium subs. To access all the premium posts we put out you simply have to be willing to trade $5.00/month.