Was That The Top?

467: Russian Military Activity, Far Left Violence, Markets Slow

Morning all.

Rainy day here and I want to make sure we are able to put out some geopolitical updates on Instagram/X so going to keep this one brief and concise.

Episode 40 of Risk On on Spotify dropped last night in which I comment and explore the rising trend of political violence across the US as well as reemerging threats from terror groups highlighted by congress and terror studies centers.

We are absolutely in a heightened threat environment if that wasn’t already apparent. If you give it a listen, feel free to comment, share, and leave a review. Podcast stats are kind of hard to decipher but so far we’ve surpassed 40,000+ downloads and listens and amassed 2,500+ followers on Spotify so I think it’s worth continuing!

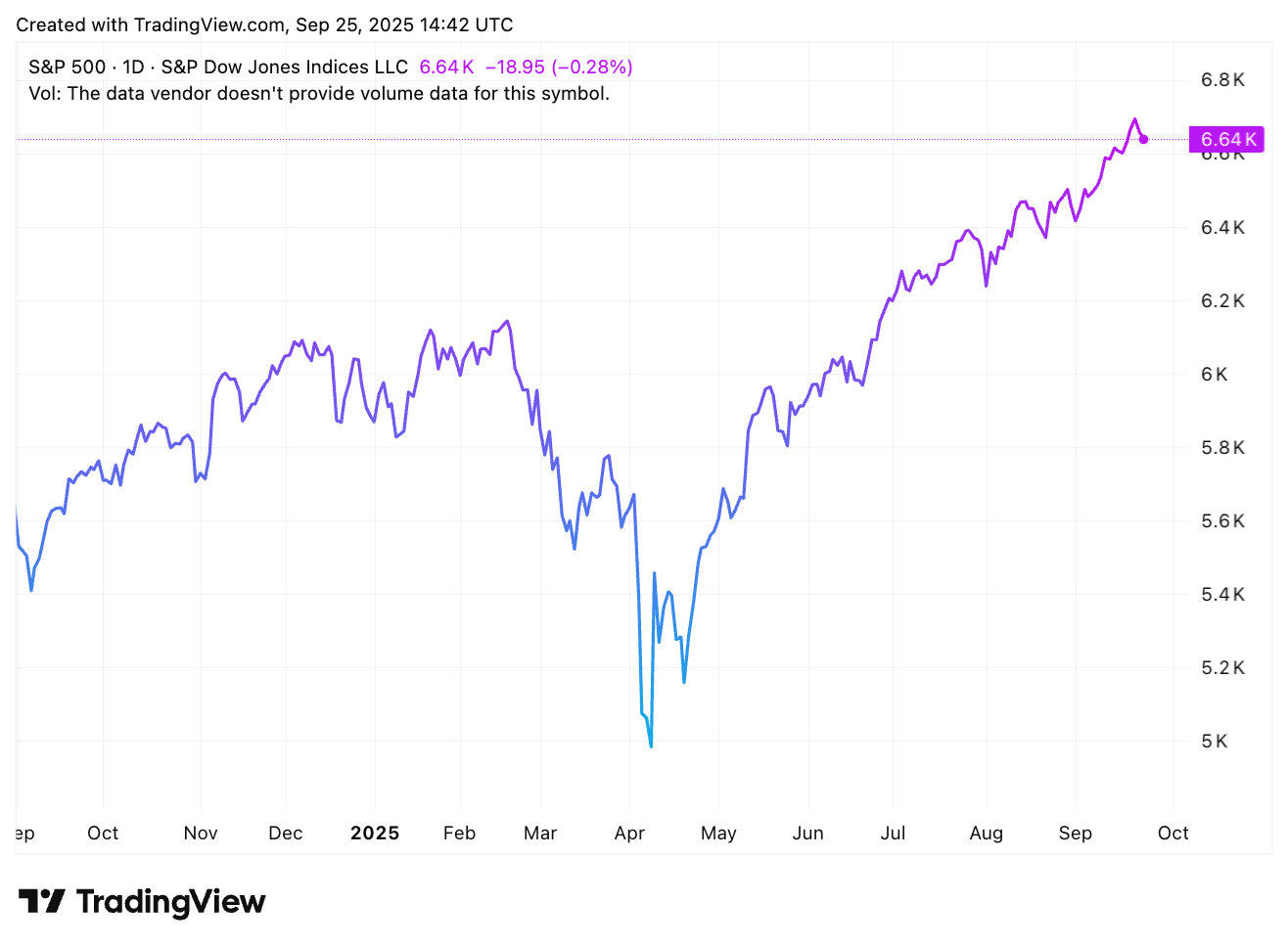

On the markets front as you might have been able to ascertain from the title of today’s post — people are starting to panic and sell, with many saying that the top is in.

Today we will discuss my brief thoughts on that sentiment and cover the major news stories from this week with a handful of highlights from around the world as well.

If you missed this week’s paid posts you can find them below. If you want to spend some time in a useful way while the majority of people shit their pants and say the bull run is over, highly recommend checking out the Alt Coin guide:

Arbitrage Andy’s Alt Coin Master List

Violence, Ideology, and the Dismantling of the West

Markets & Crypto

Markets are in a fragile mood this week, with traders digesting the Fed’s latest rate cut while questioning whether it’s enough to cushion slowing growth.

Equities have been choppy as investors rotate between tech strength and broader concerns about earnings, energy costs, and geopolitics.

Safe havens like gold remain bid while crypto has been volatile, reflecting both risk appetite and potential fear of a deeper downturn (which is a good time to go against the herd in my opinion).

The dominant worries right now are political instability at home with increased violence becoming more common, global conflict spillovers, and whether liquidity injections will actually translate into real growth. Overall, sentiment feels uneasy, optimism is present in pockets for sure, but the prevailing tone is defensive, watchful, and suspicious of any rallies.

The US revised Q2 GDP growth up to 3.8% from 3.3%

AI adoption is linked to a 13% decline in jobs for young US workers” (Stanford and CNBC) (Unusual Whales)

Starbucks SBUX 0.00%↑ announced significant store closures and layoffs this week (not a great sign but to be fair how sustainable is it having homicidal homeless people dropping 10 pound dumps in your restrooms and harassing customers endlessly?)

Best Buy Co. is moving towards reducing its workforce across multiple departments, including its Geek Squad (MacroEdge)

Google GOOG 0.00%↑ is set to gain rights to a 5.4% stake in Cipher Mining by backing $1.4B in obligations under a Fluidstack deal (CoinTelegraph)

Last week and earlier this week many of our equity calls were absolutely printing for paid subs:

BBAI 0.00%↑ NB 0.00%↑ OPEN 0.00%↑ INTC 0.00%↑

Some of them worth paying attention to are the names that are ripping as the US Government begins to announce more and more strategic stakes in companies they feel are critical to US independence and security.

This is already playing out in semiconductors, with Intel INTC 0.00%↑ leading the way and likely followed by players like Micron and GlobalFoundries as Washington locks in domestic chip capacity.

Lithium and the broader battery supply chain are another hot lane. Lithium Americas has become a case study, and Albemarle or Sigma Lithium could be next in line if financing support expands. After reports emerged that the Trump administration is in talks to acquire up to a ~10% stake (via equity or warrants) in LAC 0.00%↑ as part of refinancing/loan restructuring for its Thacker Pass project, the stock surged at one point rising +80% to +90% intraday lmao.

Rare earths are also in focus, with MP Materials showing how mining, refining, and magnet production could get bundled into equity-style government support. No doubt NB 0.00%↑ is benefitting from this catalyst.

Defense primes and missile/energetics suppliers are on the radar too, given pressure to guarantee production backlogs, and uranium/advanced nuclear fuel names like Centrus may eventually see similar backing in my opinion.

Some good plays here if you do your research, we have 3 more years of this admin which is plenty of time for more publicly announced stakes.

Broadly speaking equities were overdue for a pullback in my opinion (though there are already signs of dip buying today). I think everyone needs to calm down a bit and stop trying to chronically call the pico top of everything (goes for crypto as well).

This is a healthy pullback.

Are there red flags in the broader economy? Yeah of course.

Have there been red flags for 4+ years — yes lol.

We will look to the next rate cut decision for more clarity moving into year end.

Crypto

The panicked bears and soy boys are running around in a frenzied state saying that it’s all over.

To quote the Notebook (shoutout Rachel McAdams) “it’s not over” “It was never over”.

People need to take a step back and look at the bigger picture. It always cracks me up when they’re acting like the world’s ending because Bitcoin pulled back a few thousand but still hangs comfortably above $110,000. Think about that. Think about how far the market has come in the past few years lol.

Historically, this is a crypto dip for ants but still, over $1.5B in derivatives positions were liquidated in one session amid broad risk-off sentiment. Leveraged psychos trying to time the next leg up getting blown tf out.

Nothing has changed for my medium term to long term view. If anything the timeline bumps forward a few months, placing the sweet spot in Q1 or early Q2 of 2026. Stick to the plan.

We will have MUCH bigger problems on our hands if all markets go risk off for 3-4 months with no end in sight. But it’s a good reminder of why you never want to over-extend when you get excited. If you can just sit on your hands and weather the volatility you are going to outperform 99% of traders. Buy on the red days when sentiment turns to shit and sit on your hands when things get too frothy or cut what you want to take profits on.

Circle is now considering reversible USDC stablecoin transactions

The SEC is streamlining the approval process for crypto ETFs, which could trigger a wave of new fund launches and institutional inflows

The U.S. Senate has slated a hearing targeting the taxation of digital assets next week, think Coinbase execs, policy experts, and edge cases like stablecoin transfers to be in the crosshairs

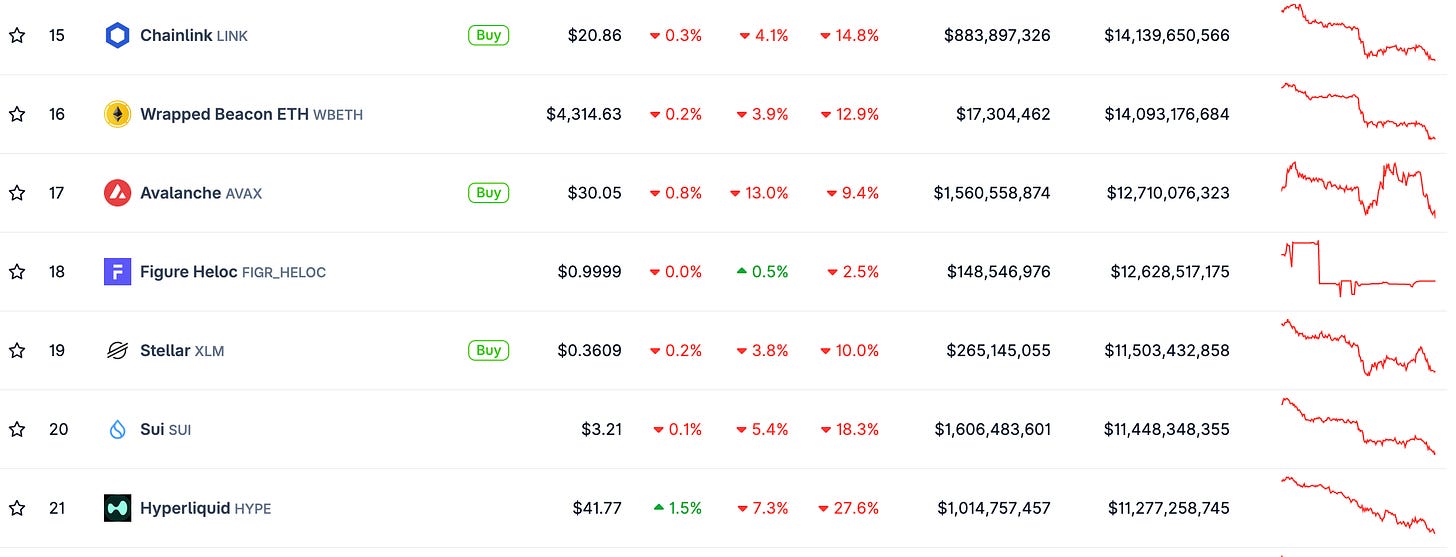

Caliber boosted their LINK stack this week. There treasury now holds 467,632 LINK ($10.1M)

Trading volumes spiked sharply during this recent selloff, showing that forced selling, not fundamentals are what was driving the price action we see.

On-chain data also shows long-term holders locking in profits after the recent run, adding to short-term pressure.

At the same time, ETF inflows that had been a powerful tailwind have slowed a bit, creating a sort of tug-of-war between those profit-taking and those entering the market as new demand. Again I am not some technical wizard but at a high level, key support levels around the $111,000 short-term holder cost basis are now in focus.

If they hold, this pullback becomes a healthy consolidation rather than a breakdown. Many traders view this kind of reset as bullish in the bigger picture, since it clears excess leverage and hands the market back to stronger hands.

As I said, not much from me in the short term for my outlook.

If this dip is sustained I will be making some purchases including Ethereum, Chainlink and Avalanche.

It should be obvious by now if you are bullish medium to long term on this industry those are multi year holds, not shitcoins to trade short term.

More next week on Tuesday morning on the crypto front.

Global and US News

The theme of the week is mounting geopolitical tension in Europe and the Middle East, along with rising political violence in the US, committed exclusively by far left lunatics.

As I said on Risk On episode 40 — this is a new paradigm. Do not take all of this lightly and be on the lookout for major events on the horizon. In my humble opinion we are entering false flag and psy op season with so many competing political and social issues at play.

After committing to changing their ways in the wake of huge disclosure about big tech and Google de-platforming people in the Biden years, YouTube has already shut down the newly created channels of Nick Fuentes and Alex Jones

Federal prosecutors are close to a decision about whether to seek an indictment against former FBI Director James Comey (CBS)

Pete Hegseth has called for hundreds of generals and admirals to attend an urgent meeting at a Marine Corps base in Virginia next week, prompting concerns about upcoming military activity, potentially in response to Russian activity. A senior Pentagon correspondent has said, “I’ve never seen anything like this in the past 30 years. We might be going to war” (AFPost)

Adding to the concerns above, Russian bombers and fighters made incursions close to Alaskan airspace this week heightening tensions with the US after odd activity in Denmark

Trump said this week Obama will be charged with treason

Europe & Ukraine

Russia has escalated gray-zone pressure across Europe using drones and airspace violations, pushing NATO to stay on edge. While it may not be related, there was at least one airport shutdown tied to drone sightings in Denmark.

Aalborg Airport was closed for several hours after drones were detected nearby; Copenhagen Airport also saw a multi-hour shutdown when unidentified drones hovered near its airspace. UFO type vibes but maybe it’s just Russia probing the region.

A major swarm over Poland forced consultations and a rapid NATO response, while the Baltics continue to see military flights slipping across borders with transponders off to test reaction times. In Northern Europe, unexplained drone activity near airports and military sites has been framed as deliberate intimidation, meant to rattle civilians and strain defenses.

I have talked about the signals coming from various countries preparing for a larger conflict in Europe, and this is showing no signs of slowing down. Germany and others now warn of a creeping drone arms race, accelerating counter-UAV development as a defensive measure. In turn, NATO has reinforced its eastern posture, signaling that it views these incursions as part of a broader Russian strategy to destabilize without triggering direct war.

The below video is wild showing troops trying to evade a drone strike.

More Far Left Violence

The trend is undeniable.

Violent leftists struck again this week, this time in Dallas Texas at an ICE operations center when a shooter took pot shots from the top of a building hitting three detainees instead of ICE agents (which I think we can all presume was the intended target). The shooter had voted Democrat and had shell casings with the inscription “Anti-ICE” which to be honest strikes me as a bit too obvious considering this keeps happening but who knows.

Very odd gaps of information and coincidences in these shootings.

I went on one of my trademark rants last night on Risk On discussing the growing instances of far left violence, the debacle at the UN conference in NYC this week (and the security lapses), as well as the resurgent threat of terrorism from Al Qaeda.

You can listen to episode 40 HERE.

The pattern is obvious.

Two attempts on President Trump’s life

The murder of UNH CEO

Multiple trans shootings at schools and churches

Multiple antifa attacks on ICE facilities, including an ambush with signal jamming equipment and ambush tactics back in July in Texas

The murder of Charlie Kirk

Bomb threats after Kirk’s death

Shooting in an ABC building in Sacramento

A new shooting at an ICE facility in Dallas

The media, as I discuss on Risk On, is entirely complicit and holds a large amount of responsibility for creating an environment in which lunatics on the left feel violence is justified in their glorious revolution against “Hitler” “White Supremacists” and “Fascists”. Last night New York Mets broadcaster, Gary Cohen tried shaming Matt Shaw for going to Charlie Kirk’s memorial calling it “weird” that he did that.

Rep. Pramila Jayapal (D) called on Democrats to be “strike ready” and “street ready” on a recent zoom interview.

You have Gavin Newsom on talk shows ramping up violent rhetoric against ICE and the administration. You have Hakeem Jeffries who is saying he will go after ICE agents and the usual clowns AOC and Ilhan Omar continue their divisive rhetoric in the aftermath of the Kirk assassination.

Then we are surprised when unstable people go and actually kill people?

Ghouls man. All of them.

Take stock of this guys, do not take it lightly. This is a quasi, if not full fledged, insurgency we are living under.

Be smart about where you are in public, keep your head on swivel, and understand that you do not need to be some high profile figure to find yourself caught in the crossfire.

Without swift and all encompassing crack downs and arrests by the Trump administration, sadly, you can expect this to continue. The perpetrators are now emboldened by the complete limp dick response to their campaign of violence.

Make sure to take advantage of the offers below for cold storage from Trezor and free crypto bonuses from Gemini when you sign up today.

See you guys on X and Tuesday morning. Have a great rest of the week!

Andy

Protect Your Crypto With TREZOR

Get Free Ethereum w/Gemini

Get Free PEPE w/Gemini

Get Free Bitcoin w/Gemini

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before

What about Polygon (Matix)? Any views on your side