US Airstrikes, Crypto Stamina, MIT Brain Warning

421: Bullish Crypto Regulations, Straight of Hormuz

Good morning all.

One of those weeks where everyone’s kind of wondering what the hell is going on.

As of this evening (Wednesday) strikes on Iran by the US are anticipated, reported by Bloomberg and other outlets late yesterday evening.

Markets have been super choppy as the world looks to the Israel Iran saga for a hint on if it will accelerate or fizzle out in the next few days.

Free subs can check out the most popular posts in the Substack archive — this week the most read is our Defense Stocks & Investments post below:

Markets

Global equities have struggled to find direction as geopolitical risks push oil higher and investors lean into safe havens. The S&P 500 has been flat to slightly weaker, small caps have lagged, and traders are digesting the Fed’s cautious signals on rate cuts later this year.

Yesterday Fed Chair Jerome Powell signaled a cautious but steady hand, keeping interest rates unchanged while reaffirming the central bank’s plan for two rate cuts later this year despite lingering inflation pressures.

Powell acknowledged that “inflation remains elevated” and described tariff-driven price risks as “meaningful,” but he did emphasize that the Fed would remain “data-dependent” (something he says all the time) and not rush to ease until they see “greater confidence that inflation is moving sustainably toward 2%.”

“Powell is the worst. A real dummy, who’s costing America $Billions!”

— President Trump

He also noted that economic growth has slowed and risks remain from global tensions and residual trade policy, but said overall uncertainty has “diminished somewhat” (whatever that means). Markets responded with muted moves at best: stocks churned sideways, Treasury yields bounced as traders weighed his measured tone, and expectations for a first cut in late summer stayed largely intact.

In the short term, this just sets the stage for choppy trading as investors watch incoming data for signs that would either force the size lord Powell’s hand sooner or keep rates higher for longer.

Worth mentioning though, there is a camp that sees no rate cuts for the rest of 2025.

This week:

Global equities slipped this week as fresh conflict in the Middle East fueled a flight to presumed safe havens and pushed oil prices higher.

The S&P 500 stayed stuck in a tight range, with gains earlier in the week erased by cautious Fed signals

The Federal Reserve held rates steady but hinted at two possible cuts before year-end, while warning that tariffs and global tensions could keep inflation sticky which is a bit odd given stagflation is rising and JPOW himself said that overall uncertainty has “diminished somewhat”

Treasury yields dipped and the dollar strengthened as investors piled into lower-risk assets amid the uncertain global backdrop

Energy and defense stocks outperformed thanks to surging oil prices, which have climbed about 9% since mid-June

U.S. economic data was mixed this week: jobless claims fell but retail sales dropped nearly 1% and homebuilding slowed, highlighting a patchy consumer picture

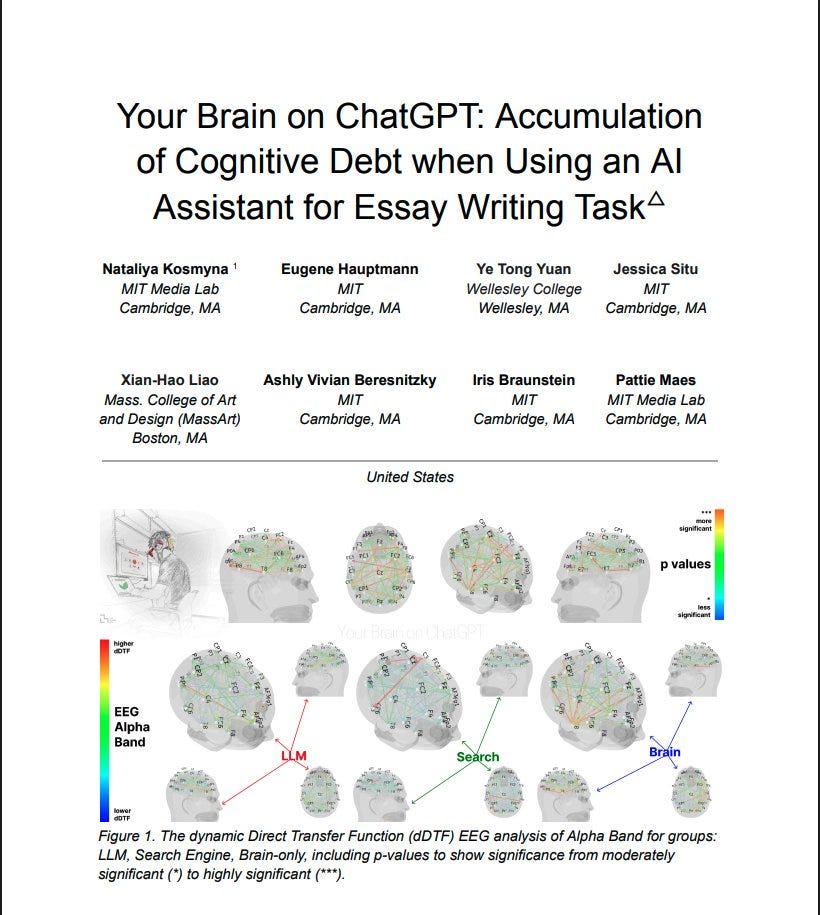

MIT researchers recently found that students who used ChatGPT to write essays showed lower brain activity, weaker memory recall, and more generic writing compared to those who wrote unaided or used traditional search engines.

Even after stopping AI use, these students’ neural engagement stayed lower than their peers’. In contrast, students who wrote without AI showed stronger mental connections and more creative thinking, suggesting that relying too much on ChatGPT might dull critical thinking and make people less original over time.

AI can be very powerful if you're using it in a supplemental or supportive role or to get administrative tasks done quickly, but in my experience, it's fairly obvious who's using it as a proxy for genuine or unique thought or content.

Kids these days are using it for papers, assignments, and tests, and there's no doubt that this kneecaps them from developing critical thinking skills as well as the ability to actually think. The consequences of this will likely not be obvious for another 5 to 10 years.

You can read the full thread on X here.

Crypto

Markets have been choppy so far, with crypto swinging between risk-off panic and policy-driven optimism fueled by non stop positive news for the crypto and defi space on the institutional and regulatory side of things. The Senate advanced new stablecoin legislation, lifting names like Coinbase and Circle double digits on fresh regulatory clarity.

Bitcoin has hovered around $104,000 to $106,000 (which is pretty impressive all things considered), weighed down by Middle East tensions — while Ethereum has stayed above $2,500 with relatively muted movement since it first showed some life 2-3 weeks ago.

Kraken-backed Ethereum Layer 2 Ink Foundation is set to launch and airdrop $INK token with token supply permanently capped at 1B (CoinTelegraph)

An Ohio bill that would exempt taxes on Bitcoin payments under $200 passed this week in the state House (BitcoinMagazine)

The British listed company The Smarter Web Co. — added 104.28 Bitcoin to it’s holdings this week

Coinbase shares surged over 16% this week after lawmakers advanced new stablecoin regulations and the company rolled out a USDC payment tool for Shopify, boosting confidence in its regulatory footing and growth prospects.

XRP got a lift of about 7% after Canada greenlit the world’s first spot XRP ETF, which began trading on the Toronto Stock Exchange, marking another step forward for mainstream crypto investment products.

This week, BlackRock has been on a Bitcoin buying spree through its iShares Bitcoin Trust. Over the past six days, they’ve snapped up roughly $1.4 billion worth of Bitcoin, including around $250 million on Monday and another big chunk—about $638 million or over 6,000 BTC—on Tuesday alone.

This aggressive accumulation has pushed daily inflows for their Bitcoin ETF to record highs and highlights the sustained institutional appetite for crypto exposure right now.

It cannot be overstated how bullish the institutional and regulatory developments are, the reality is, in an environment devoid of all of this macro shit and unclear Fed policy, we would be god pumping.

The major development this week on the crypto front was Tuesday’s 68-30 Senate vote on the Genius Act — for those who are unfamiliar, GENIUS is a new U.S. law designed to regulate dollar-backed stablecoins. It requires issuers to fully back tokens with safe, liquid assets, publish regular audits, and follow strict anti–money laundering rules. Bigger issuers will need federal licenses, while smaller ones can operate under state oversight.

The bill also blocks Big Tech firms from launching their own stablecoins without high-level government approval. Supporters say it brings much-needed clarity and consumer protection, but some critics argue it favors established players and could limit competition in the space.

Circle — the issuer of USDC — which is the second-largest stablecoin by market capitalization, is mooning on this news CRCL 0.00%↑ as it is set to benefit given most of its revenue comes from interest earned on the reserves backing USDC (CoinTelegraph).

President Trump said on Wednesday "We are going to show the world how to WIN with digital assets like never before."

COIN 0.00%↑ is up since our call to paid subs a month or so ago — in my opinion you’re still early on this one, as retail is nowhere to be seen yet. HOOD 0.00%↑ probably a decent proxy for the return of the masses as well.

I am of the opinion that bitcoin and Ethereum have held up extremely well despite the macro uncertainty war, and lack of clarity from the US fed. Most crypto veterans would probably agree that historically when similar events or circumstances are taking place crypto usually takes a big punch on the nose. I think this is indicative of a maturation of the industry as well as a title wave of institutional interest that is not as skittish as your average retail investor.

I am still in buying mode if we get any sizable pullback, I will be adding to Ethereum Chainlink, Avalanche, and other all coins/tokens that I am bullish on for the duration of 2025. In retrospect, it should be obvious that all of this was one long drawn out, shake out to see who has the conviction to hold until market conditions improve, and the green light flashes for the entire market.

Geopolitics

High-ranking U.S. officials and heads of key federal agencies are reportedly getting ready for the potential launch of a strike against Iran in the near future, with some indicating that an operation could take place in the next 72 hours.

Israel and Iran have been trading strikes back-and-forth for multiple days now, but what remains to be seen is if the US is going to directly get involved — my guess? They potentially join this fight by the end of the weekend with air power and the use of a bunker buster against Iranian nuclear facilities.

While this conflict is far from ideal — there might be a situation where the US can directly assist Israel with a knock out punch to Iranian nuclear capability WITHOUT putting troops on the ground.

Recent Israeli airstrikes have targeted several of Iran’s key nuclear and related sites. So far, hits have been confirmed at the Natanz enrichment complex (which we discussed on Risk On) — damaging surface-level centrifuge facilities and power infrastructure — and at Isfahan, where uranium conversion and fuel fabrication buildings were struck. Fordow’s underground enrichment site appears mostly untouched, though minor surface damage has been reported (I could see this getting hit this weekend)

Video footage available online appears to show that Iran has been relatively successful with their strikes in the last 48 hours — recent reports indicate larger targets in downtown Tel Aviv, including the country’s stock exchange building have been damaged by Iranian missiles. This morning an Iranian ballistic missiles hit the Soroka Hospital - near Beersheba.

Last night (east coast time) the IDF ordered the evacuation of the Arak nuclear power plant and as well as it’s surrounding areas in Iran ahead of an strike that likely comes soon.

This could be a driving factor of the US getting involved in the coming hours. A major macro implication in this conflict aside from the war itself, are the possible shocks to oil and energy markets. Iran has reportedly threatened to close the world’s most important oil lynchpin known as The Strait of Hormuz.

Such a move would instantly disrupt about a fifth of the world’s oil and gas shipments, likely pushing crude well above $100 per barrel and fueling panic buying and market volatility. Tanker rates would soar, insurers would hike premiums, and energy-importing economies could face higher fuel costs and renewed inflation headaches globally.

While some supply could definitely be diverted through pipelines bypassing the strait, the capacity gap means any prolonged closure would squeeze global energy flows and test Western military resolve to keep vital shipping lanes open.

“They’re totally defenseless, they have no air defense whatsoever, totally captured… we’ve totally captured the air.”

— President Trump on Iran

May not be a bad to idea to have some YOLO longs open on the oil front right now in the event strikes take place this weekend and Iran gets aggressive in it’s responses. Defense names we’ve highlighted in paid posts are soaring for the most part and I would expect that to continue.

49% of American registered voters support Israeli strikes on Iran, 46% oppose, according to Fox News poll (Spectator Index)

2,000 more National Guard troops are being deployed to Los Angeles

The U.S. officially removed Colonel Nathan McCormack from his position at the Joint Chiefs of Staff for comments calling Israel a “death cult” and said that “America is acting as Israel’s proxy”

Russian President Putin said this week he is willing to find a solution and end the conflict with Ukraine "as soon as possible” (BRICS News)

Hong Kong’s FWD Group is moving ahead with a $500 million IPO next week, marking its third attempt and signaling renewed investor appetite for Asian insurance deals

South Africa’s rand ticked up modestly after steady inflation and retail sales numbers, though funding concerns and global rate expectations continue to cloud the outlook

Several Latin American countries announced plans to launch a region-specific AI model, dubbed “Latam-GPT,” later this year to better handle local languages and contexts.

All I have for you guys today, trying to squeeze out an episode of Risk On before the end of the day but if not, will likely do a quick Friday morning release forecasting some of the events that might take place this weekend.

If you guys want to keep up with all updates related to markets and global news, make sure that you follow us on X and access the discord a bunch of you have been asking so here is the official link.

Have a good rest of the week talk soon.

Andy

Gemini Crypto - Get Free Bitcoin

Protect Your Crypto with Trezor

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before

Keep hearing people talk about how quantum computers are eventually going to crack bitcoin. Any good sources to read up on this?

$SWBI earnings was a disaster lol. Adding more sept. expiry calls?

I think it will benefit from Grab a Gun SPAC ($CLBR). Think I’ll dabble some more.