The Pump is Coming - Are You Sidelined?

401: The Shakeout is Nearly Finished

Morning folks — lots to cover on the financial front after the piece I dropped yesterday on the growing trend of far left violence in the United States. If you want a detailed overview of the factors driving left wing violence, race crimes, and the growing aggressive rhetoric across the nation make sure to give it a read.

Let’s talk bandos today — because many of my regular readers are printing as crypto and other assets are bouncing hard off the lows of the past two months. If you were patient and didn’t shit yourself or panic during the sell off, you’ve now reclaimed some paper gains by holding strong.

You might recall if you read my 2025 Predictions & Mega Guide in December that I said the following:

We get one sizeable equity market pullback similar to the Covid 2020 pullback. People shit the bed and the smart ones buy the dip (if this happens we get a shakeup at the Federal Reserve)

The pullback came — markets have been under pressure for the past two months, with the S&P and Nasdaq both entering bear territory amid trade war fears, inflation jitters, and Fed uncertainty.

But in the last 48 hours, sentiment has shifted. Trump struck a more conciliatory tone on China, voiced support for Powell, and stocks have bounced off recent lows. With the S&P climbing back above 5,200 and Bitcoin reclaiming the $90,000 range, this could mark the beginning of a short-term reversal.

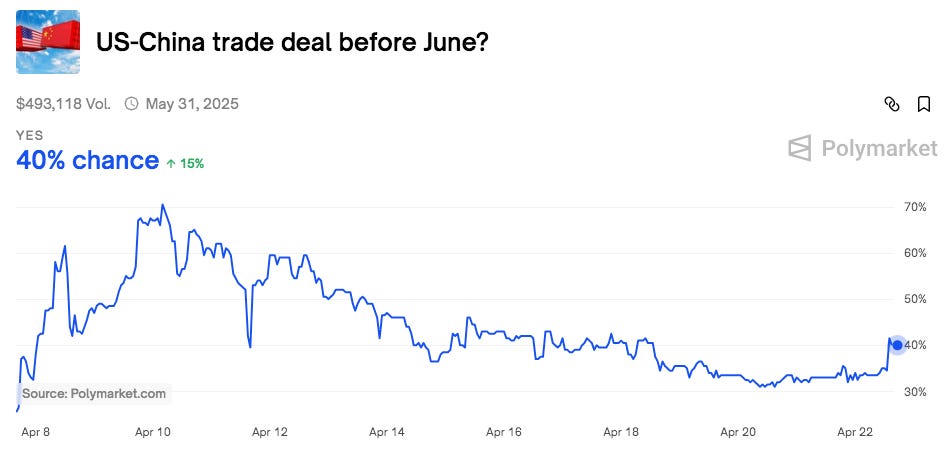

On top of the reversal we also now have China relations possibly easing, which I highlighted was one of the major headwinds for a broader macro recovery.

This morning we get the update that President Trump is now considering cutting tariffs on China, down to a range between 50% and 65%, to help ease tensions according to the Wall Street Journal.

Can you feel the incoming pump?

Many, many signs are pointing towards new highs in 2025 in my opinion.

Bitcoin, the king, is now the world’s 5th largest asset by market cap surpassing GOOG 0.00%↑.

I talk frequently about the day where it might appear that Bitcoin begins to decouple from stock indices and that day may be here finally. Bitcoin has decided to move in tandem with Gold’s parabolic run, pumping from it’s local low around $75,000 up to $92,000 in the past few weeks. US spot Bitcoin ETFs pulled in $936M Tuesday, the largest since January, with $1.4B added over three days. (Cointelegraph).

Up until this morning where it appears equities are rebounding, it did this despite equities remaining rocky and fear gripping investors in legacy assets.

Even Ethereum looks to be joining the party hanging out around $1,800.

Markets received a boost in trading on Tuesday due to a slew of tariff and US policy updates including news that Trump and Chinese President Xi are set to meet in early May. Trump also gave us some clarity on his relationship with big papa Jerome Powell saying: I have no intention of firing him.

Markets reacted well to this news.

Unfortunately Jim Cramer is running around saying that the bear market rally could become a real recovery which might absolutely wreck our chances for a sustained pump but let’s cross our fingers and pray.

Today let’s talk alpha, let’s revisit some expectations for where the market is headed, and let’s take a look at what is driving us immediately higher in the short term. This may be the perfect opportunity to print in 2025, there is money to be made in between the games that our politicians and the elite are playing.

Just yesterday US Treasury Secretary Bessent said at a closed door investor summit he sees "de-escalation with China" and that the current situation is "unsustainable” — would’ve been great for you to tell all of us that as well brother, thanks for the heads up.

Couple questions people should be asking themselves right now:

Am I sidelined from crypto/risk on assets if the reversal continues?

If I’m not, how is my allocation performing in the current market?

Will I profit if we get a breaking piece of news on China or tariffs?

Am I paying attention to some of the key indicators that might suggest a strong rally soon (DXY, M2 Supply, Exchange Balances in crypto, etc.)

I am begging you to take stock of the changing financial landscape. Each passing day tells us more what the future is going to look like.

The global financial landscape is shifting at breakneck speed. From the largest institutions to state actors, we’re seeing a forced evolution—where legacy systems are being dragged into the future by necessity, not choice. Blockchain rails, AI-driven analytics, tokenized assets, and hard digital money like Bitcoin are no longer fringe—they’re becoming the infrastructure right in front of our faces. Those who adapt early will ride the exponential curve of value creation.

Those who hesitate? They’ll wake up priced out of both relevance and opportunity.