The Great Shakeout Before Liftoff?

452: Price is down but whales are buying

Morning lords.

Coming to you live from the Jersey Shore (though I’m not where Snooki and The Situation tore it up). I’ve had 20 pacificos, 15 tequila pineapple sodas, and so far the sharks have entirely avoided my bunker and mackerel rigs I keep throwing into the ocean (there’s always tonight).

One of my flaws (or good qualities idk) is that I physically cannot stop working when I am on vacation which is good for all of you this week because there’s money to be made.

Arb Letter is back to #1 rising in crypto on Substack, we may have gotten the all clear for a rate cut, and panicked paper hands softos keep coughing up their tokens and selling them to whales and institutions.

Some dude unsubscribed from Arb Letter last week (before the pump) and said “All you talk about is crypto”.

Well my brother in christ — we’ve been PRINTING for months on crypto. Do you hate money lol?

If 3D printing stocks were aggressively printing, guess what we’d be focused on?

3D printing stocks.

People amaze me sometimes. The answer is right in front of them and they remain in denial. That’s fine for politics and social issues but in markets? Why be stubborn and continue to miss out? Makes zero sense.

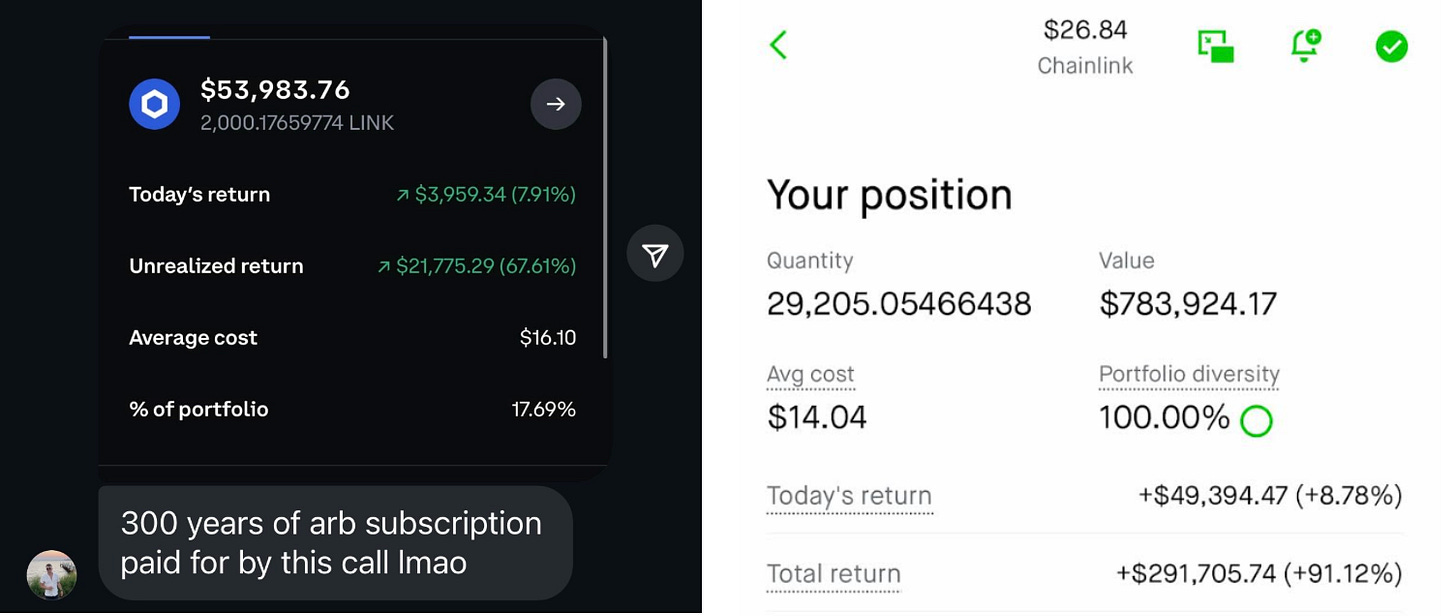

In this case the wins for Arb subs keep pouring in.

Check out some of the profits Arb Letter paid subs posted Friday for Chainlink (something I’ve been saying to buy for 3+ years now). What we talk about in this publication isn’t cap my friend, sure, you can go find some nerdy technical analysis out there from a quant or former hedge fund analyst (and that can be excellent color) but here?

Here we are focused on identifying the broader trends earlier than the crowd, and capitalizing on the technology that is inevitably going to consume the world of finance, technology, and markets. It doesn’t have to be hyper complex or overthought, just keep it simple remember, patience is key.

Readers of Arb Letter are up bigly so far in 2025 because they stuck to the plan, had patience, and researched many of the assets we discuss in these posts regularly.

Bulls have reason to be happy again after the Jackson Hole Symposium last week in which Jerome Powell said:

“The stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance…… while the labor market appears to be in balance, it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers. … downside risks to employment are rising. And if those risks materialize, they can do so quickly.”

Powell reiterated the Fed’s 2% inflation goal but struck a softer tone, stressing it’s not a rigid ceiling. He noted that with policy already restrictive, the Fed must balance inflation risks against rising threats to jobs and growth. In effect, he signaled the Fed could tolerate inflation running modestly above target if cutting rates becomes necessary to protect the economy.

TLDR: it seems Jerome may have caved a bit and while a rate cut in September isn’t completely locked in, odds jumped once again.

The bulls got what they wanted into the weekend and now the only questions are how high are we going to pump and when is the money printing going to fire up again in the next year or so.

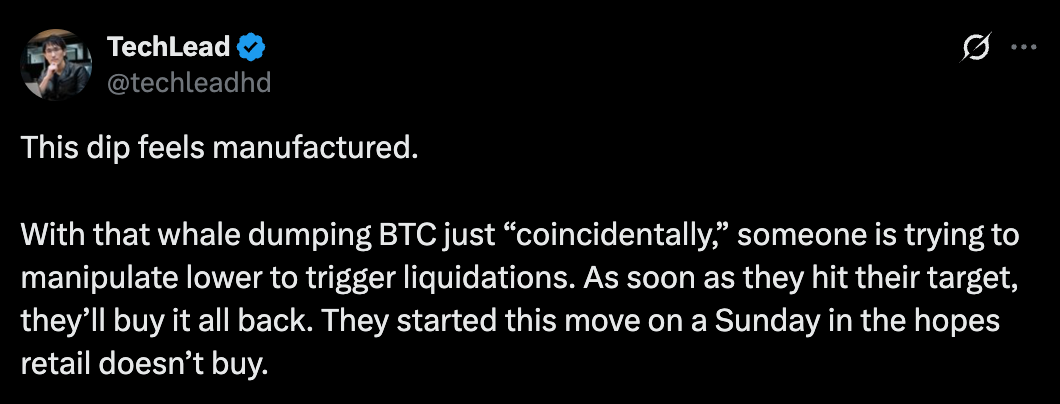

In the meantime, folks are still getting headfaked and shaken out by the games being played by market makers and institutions.

Ethereum hit a new all-time high on Saturday, August 24, 2025, reaching nearly $4,954. It looked like we were going to immediately carry that momentum into this week and then……… we got another curious (key word) reversal.

Crypto markets and stock market futures flipped bearish late Sunday night erasing all gains and shitting in our cereal. A fat daddy whale dumped 24,000 Bitcoin and the market teetered again (though he bought Ethereum hours later).

Many people are getting scared and panic dumping.

They’re getting liquidated long using leverage (over $600M+ liquidated in last 24 hours).

They think the pump is over (it’s not).

Today we’re going to talk about how to not get manipulated by the big swings we are seeing in the markets, where the opportunities lie in the next couple weeks, and what is actually going on beneath the surface.

We’re going to cover:

The battle between Donald Trump and the Federal Reserve

The upcoming potential rate cut in September

The games institutions and market makers are playing in crypto

Alt coin and Ethereum price action this week

What comes next for our bags

Let’s start with crypto and then we will move into a quick look at equity markets. There’s one crucial lesson in business that not enough people learn early. If you want something (or desire it), you need to take careful approach to not telegraph that to the person that has it (or they will bump the price and gain all negotiation power).

That, in my opinion is what is going on in crypto at the moment. People have no clue what they are sitting on and the big players are insatiable in their desire to scoop up as much as humanely possible before the legendary liftoff.

This is one of those rare windows where fear in the market is actually opportunity. Institutions are buying, Powell just cracked the door open on cuts, and whales are shaking weak hands for cheap entries. If you’ve been waiting to load up, this may be the moment to stop watching from the sidelines.

Let’s get it.