The Fed Pivot Meets America’s Breaking Point

453: Tesla, BBAI, Kirk Developments

Morning all.

Hopefully this week shapes up to be a better one.

As we revert to focus back on markets primarily, a quick reminder that as the conditions in the US continue to change I will put out ongoing focus pieces like the ones from last week.

The Dark Beginning of America’s Next Chapter

Assets That Are Going To Send Now

Making money is great, but there comes a time when the immediate physical world merits some attention from those of us attempting to illustrate what’s actually going on.

We will have an update towards the end of today’s piece on new data from the murder of Charlie Kirk, new extremist threats in the US, and new trends to keep your eyes on. Some of these updates are pretty rattling and indicate that this threat from the far left in the US is widespread and growing.

We will talk about the latest we know, which organizations are linked to it, and the shocking patterns being displayed in similar events in the US. Some of this stuff is WILD.

Also - big week on the financial front.

We have the Fed’s two-day FOMC meeting from Today — Wed, Sept 16–17, with the rate decision due Wed, Sept 17 at 2:00 p.m. ET and a Powell press conference afterward.

Futures markets are pricing a very high chance of a 25 bp cut (some odds for 50 bp), but we’ll only know for sure at the announcement.

Markets are acting like the cut’s baked in, stocks are levitating, crypto’s drifting. The follow-through hinges on Powell’s messaging and if we get the vibe that he is committed to a hard pivot now.

Crypto & Markets

Alright gents the big week is here, rate cuts (or not).

Heading into Wednesday’s FOMC, consensus is a 25 bp cut with only a slim tail for 50. Most banks expect follow-on 25s into Oct/Dec (2–3 cuts total) given cooling labor/ revisions and sticky ~3% inflation. The tells are the dot-plot drift ( the chart the Federal Reserve publishes four times a year as part of its Summary of Economic Projections), Powell’s labor-first framing, and any dissent we see.

Tone from Jerome will matter more than the single move this week.

But it does beg the question, and I have seen more and more discussion about this online in the last 72 hours:

Are cuts already priced in?

Equities are trading like they are. The S&P is camped near record highs and dips keep getting bought, while crypto’s stalling out a bit with BTC/ETH chopping and alt momentum fading a bit since this weekend.

President Trump cannot fire Fed Governor Lisa Cook before FOMC meeting, an appeals court ruled this week (WatcherGuru)

The SEC says it is now 'prioritizing' Trump's new proposal to end quarterly earnings reports after his request this week (Unusual Whales)

China flagged Nvidia for alleged antitrust violations during U.S.–China trade talks, turning up the heat on AI chips

Beijing launched an anti-dumping probe into U.S. analog semis which puts fresh pressure on ADI, TXN, ON, NXPI

Oracle popped on chatter it could join a consortium to keep TikTok operating in the U.S.

The FTC is scrutinizing Google and Amazon over search-ad practices, including pricing disclosures and auction mechanics

Microsoft and OpenAI inked a non-binding MOU to reset their partnership, paving the way for a broader restructuring

Another early 2025 Arb Letter pick has ignited.

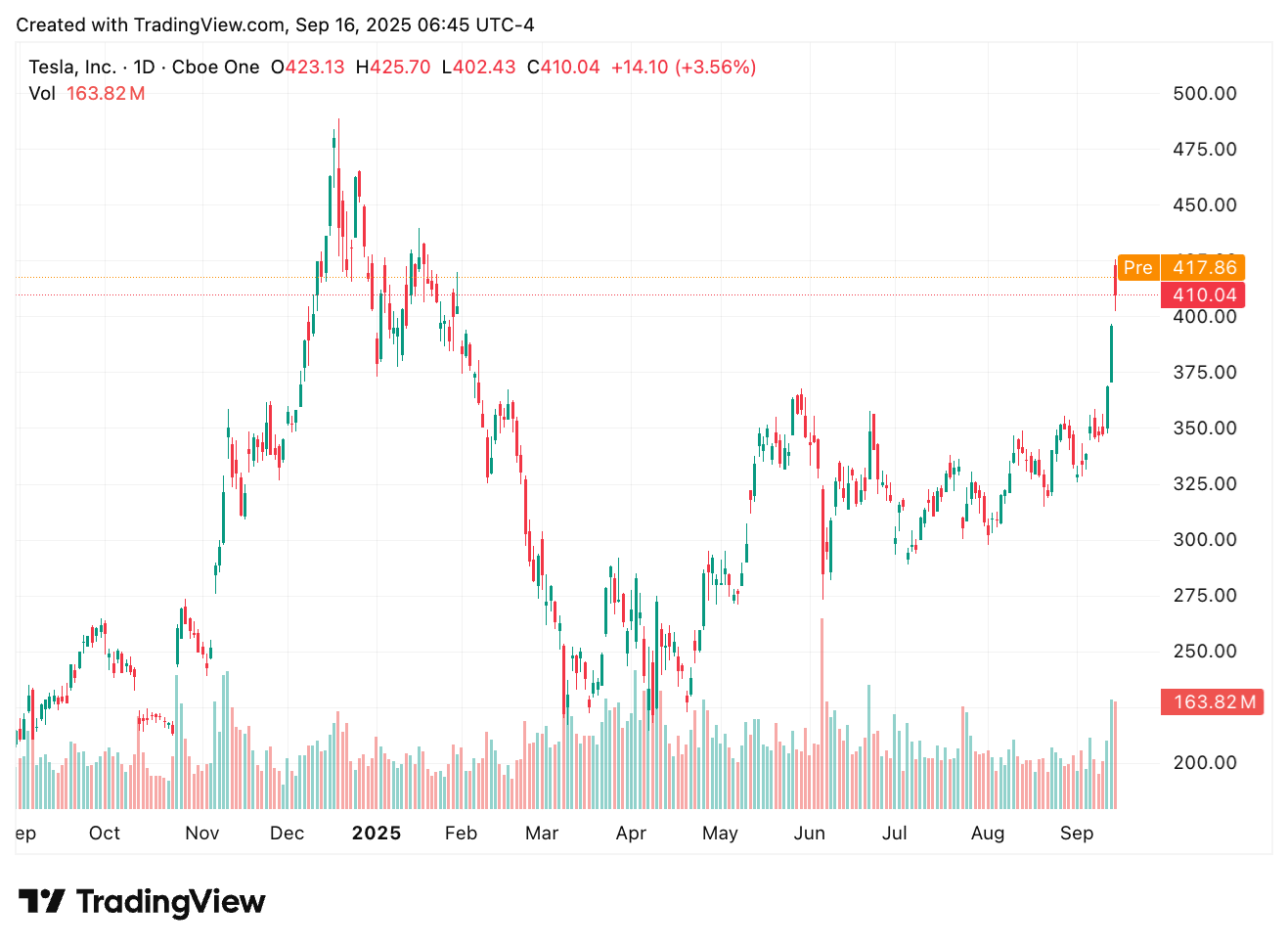

Tesla TSLA 0.00%↑ ripped higher last week, logging gains of around 12–13% and closing above $410 for the first time since January.

The rally was fueled by Elon Musk’s surprise $1 billion personal share purchase, his first open-market buy since 2020, which investors read as a major confidence signal. Once the stock broke through key resistance levels in the mid-$360s, momentum carried it higher, flipping Tesla positive on the year.

The move also came against the backdrop of rate cut optimism, which has been a tailwind for growth and tech names across the board.

Other names I am looking to add in the coming weeks include ASML 0.00%↑ AVGO 0.00%↑ and SSYS 0.00%↑.

I stand by some of my riskier bets on names like RGR 0.00%↑ and SWBI 0.00%↑ that unfortunately showed some movement last week, no doubt due to the unrest in the US and growing calls for gun control, with some strong initiatives coming out of Minnesota.

Portfolio anchors for me like AMD 0.00%↑ LHX 0.00%↑ and SMCI 0.00%↑ are all up big this week.

Some super interesting news just dropped on a stock that we’ve been talking about for a few months.