Technology Super Cycle is Cooking

410: BlackRock, Microsoft, Robinhood Crypto Moves

Morning lords.

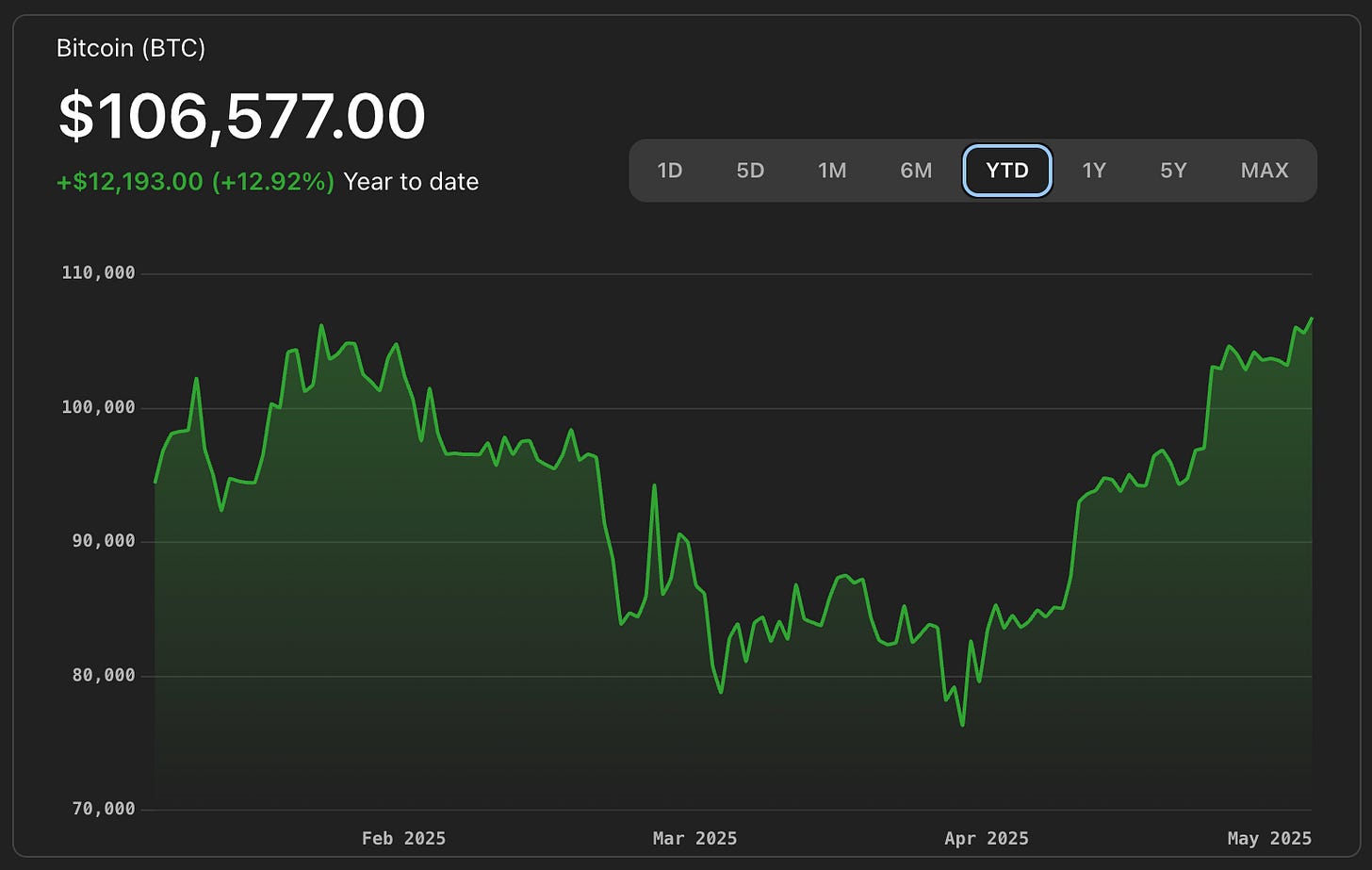

As fate would have it — the signs that the digital asset and tech space is priming itself to turbo pump keep coming, particularly on the tokenization and RWA front. On top of that Bitcoin recorded it’s highest daily close in history.

Today we’re covering Japanese Bonds, RWA/Tokenization updates from Robinhood and Blackrock. Blockchain moves by Microsoft. Israel’s potential strikes on Iranian nuclear facilities, and more.

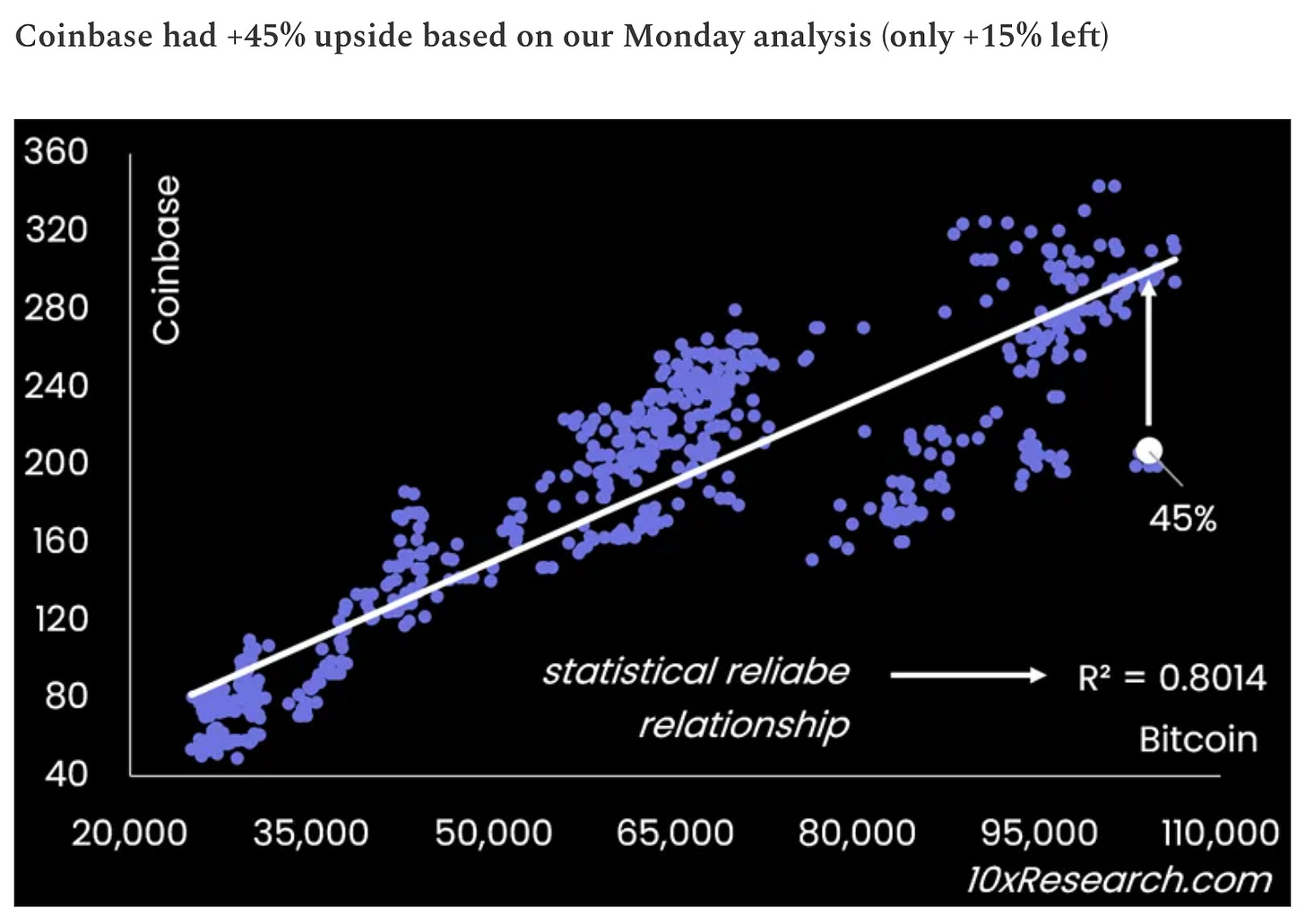

Also make sure you check out some of the recent reports from our boys at 10x Research as well if you want a look into some of the more technical indicators in the crypto space. They focus on empowering traders with data-driven crypto Insights and have a community of 61,000 strong.

Crypto & Defi

Vlad Tenev has been busy since the GME 0.00%↑ days.

Robinhood just submitted a detailed proposal to the SEC pushing for a unified federal framework to regulate tokenized real-world assets (RWAs). The idea is simple but powerful: treat tokenized versions of assets like Treasuries, stocks, and real estate as legally equivalent to their traditional forms—not as synthetic derivatives.

As part of the plan, Robinhood is aiming to launch a new exchange called they will call the Real World Asset Exchange (RRE), which would run on both Solana and Base blockchains. It’s built for speed targeting 30,000+ transactions per second with ultra-low latency and will include built-in KYC/AML compliance components through partnerships with firms like Jumio and Chainalysis.

The proposal is also calling for scrapping the patchwork of state-by-state regulation in favor of a streamlined federal system, and emphasizes how tokenization can open up previously gated asset classes to retail investors through fractional ownership.

This is a huge validation of where things are headed—and exactly what we called weeks ago in our deep dive on tokenization. If you missed it, catch up here:

CEO Sergey Nazarov is meeting with Joseph Chalom Head of Strategic Ecosystem Partnerships at BlackRock today for a fireside chat at Digital Assets Week New York — a major moment for both TradFi and DeFi and yet again more fuel to suggest that our previous post on the Tokenization gold rush isn’t hyperbole.

They are set to discuss:

• Accelerating tokenized asset adoption

• Convergence of TradFi & DeFi

• The future of digital assets

Both the Robinhood news and the upcoming discussions between Chainlink leadership and massive tradfi institutions indicate a defining moment in the potential merging of defi and tradfi paradigms.

On top of that — Microsoft MSFT 0.00%↑ is now integrating real-time blockchain data from Bitcoin, Ethereum, and Sui into its Fabric analytics platform, thanks to a partnership with Space and Time. This move will allow businesses and developers using various Microsoft tools to pull in verifiable blockchain data directly into their applications and analytics workflows.

Space and Time provides the whole backend infrastructure, using zero-knowledge proofs to ensure that the data has accuracy and integrity. Then the integration opens up a range of new enterprise use cases—from financial modeling to building Web3 applications and training AI systems with on-chain data.

It’s another major step in bringing blockchain into the heart of enterprise technology and merging it with classic tech.

Bitcoin dominance is flat to up in the last 48 hours or so as Bitcoin plays with the $107,000 to $108,000 range (TradingView shows Bitcoin dominance at 63.91%). You’ll remember me discussing this data point and it’s relationship to an eventual alt season and run for ETH.

That being said — BlackRock has ramped up its Ethereum exposure this week with some serious size, purchasing nearly $66.75 million worth of ETH over several days. The buys included a $13.1 million allocation early in the week, followed by a $45 million investment on May 21.

Important to understand — for now, Bitcoin is still the king of the show. It very well could put in a new all time high soon and until it lets some air out of it’s sails, Ethereum’s pump and any major alt coin movement might be put on hold.

You can check out the mega guide for my detailed thoughts on price targets — but she clearly wants $115,000 to $120,000 in my opinion and I think that move could happen sooner rather than later.

Hopefully Ethereum follows suit relatively soon.

Other headlines:

1,000,000,000 USDT (1,000,323,168 USD) was minted at Tether Treasury this morning (Whale Alerts) remember this can be a sign of liquidity demand: Large Tether mints often correlate with bullish momentum or upcoming moves in crypto markets. It doesn’t guarantee price increases, but historically it’s been associated with inflows and higher trading activity

Blackrock’s Bitcoin ETF is now in the top 5 ETFs in YTD flows (Bitcoin Magazine/Bloomberg Data)

JPMorgan is now allowing clients to buy Bitcoin, a notable reversal from CEO Jamie Dimon's previous stance

The U.S. Senate passed the GENIUS Act, establishing new rules for stable coins and paving the way for clearer regulation

Hong Kong approved a stablecoin bill that will require licensing for issuers, aiming to attract more crypto firms

Coinbase is investigating a security breach involving bribed support contractors that may have exposed user data

Equity Markets

Markets opened the week with modest gains on Monday, supported by optimism around cooling inflation and potential Fed pauses.

But that rally quickly faded—major indices pulled back on Tuesday, with the S&P 500, Dow, and Nasdaq all closing lower. Rising bond yields and caution ahead of Fed commentary weighed on sentiment with mixed sentiment on rate cuts through the end of 2025.

An interesting data point posted by BarChart on X shows that hedge funds have added $25 Billion of short equity futures exposure over the last 3 COT reports — this is the largest increase in at least the last decade. Will hedge funds end up getting their faces ripped off or is retail being led to slaughter?

Klarna reported a sharp rise in missed payments this quarter, with credit losses jumping 17% year-over-year to $136 million. The increase comes as more users rely on BNPL for essentials, and broader consumer stress starts to show. The Klarna CEO said this week that AI has helped company shrink workforce by 40%

Global debt hits new all-time high of $324 trillion, according to Reuters (Unusual Whales)

Lowe’s beat earnings expectations and reaffirmed guidance; shares moved higher. Target lowered its full-year forecast after a revenue drop, sending shares down

Apple AAPL 0.00%↑ reinstated Fortnite to the App Store after a federal ruling on recent antitrust violations

Kraft Heinz shares gained slightly on news it’s exploring strategic moves.

Asian markets were mixed to start the week as MSCI Asia-Pacific edged higher, but Japan’s Nikkei slipped

European markets traded flat, with investors watching for upcoming UK inflation data

Gold prices climbed as the U.S. dollar weakened and the EUR/USD topped 1.13 for the first time in two weeks

Arguably the biggest story to pay attention to in global markets is the Japanese bond story. Yields on Japanese government bonds have climbed to their highest levels in decades, with the 30-year reaching around 3.14%—a record since its launch.

This move follows weak demand at the recent 20-year bond auction and probably signals growing investor unease around Japan’s long-term debt sustainability and economic outlook.

With the Bank of Japan now scaling back bond purchases, markets are now playing a bigger role in setting rates. The spike in yields is raising borrowing costs for the government and could have ripple effects globally, given Japan’s outsized role in international capital markets.

Japan is the largest foreign holder of U.S. Treasuries, with over $1.13 trillion in holdings as of early 2025. Japanese institutional investors—like pension funds and insurers—have long played a key role in global bond markets, allocating substantial capital to U.S., European, and emerging market debt.

TLDR - shifts in Japanese bond yields can trigger reallocations that ripple across global asset classes.

Global News

Geopolitical risks and economic uncertainty are dominating global headlines this week.

Tensions are rising in the Middle East amid reports that Israel may be preparing for a strike on Iranian nuclear sites, pushing oil prices higher. In the U.S., the Pentagon is reviewing the Afghanistan withdrawal, while lawmakers clash over new tax proposals. Humanitarian concerns are also mounting in Gaza, with the UN warning of worsening conditions if aid access doesn’t improve.

Recent U.S. intelligence suggests that Israel is preparing for a potential military strike on Iran's nuclear facilities in country. This development arises amid stalled nuclear negotiations between the U.S. and Iran, with Israeli officials expressing concerns that a potential agreement may not sufficiently limit Iran's uranium enrichment capabilities and infrastructure.

In response to these tensions, oil prices have surged due to fears of supply disruptions in the Middle East, as Iran is a major oil producer. While Israel has not made a final decision, the situation remains fluid, with significant implications for regional stability and global energy markets.

Former President Joe Biden, 82, has been diagnosed with advanced prostate cancer that has spread to his bones. While the cancer is aggressive, doctors say it remains hormone-sensitive and can hopefully be treated with therapies to slow its progression. The internet has erupted with debate about when this information was confirmed, with some saying the administration and officials knew this awhile ago. Regardless it’s sad news and I wouldn’t wish it upon anyone.

The U.S. Senate passed No Tax on Tips Act this week, 100-0

Oil rose briefly on reports of a potential Israeli strike on Iranian nuclear facilities

India and Pakistan agreed to a ceasefire, though tensions remain high after reports of drone sightings and explosions in the Kashmir region. India emphasized that the deal hinges on Pakistan halting support for cross-border terrorism

Massive protests erupted in Mali after the military government dissolved all political parties and proposed extending the president's term to 2030, raising alarms about democratic decline

France, Germany, Poland, the UK, and Italy announced the formation of a new organization dubbed the “Weimar+” alliance aimed at strengthening Europe’s strategic response to global threats, amid concerns over reduced U.S. engagement

Chinese battery giant CATL completed a successful IPO in Hong Kong, with shares jumping about 16% on debut—highlighting investor appetite and the city's growing importance as a capital hub despite ongoing U.S.-China tensions

This week at the Qatar Economic Forum, Elon Musk criticized South Africa’s Black Economic Empowerment (BEE) laws, calling them “racist” and comparing them to a new form of apartheid. He claimed the rules—requiring companies to sell a portion of local equity to historically disadvantaged groups, are the reason Starlink hasn’t launched in the country and got testy with the panelist interviewing him.

She of course had no response to Musk’s question “do you support racist laws?”.

South African officials pushed back, stating Starlink hadn’t applied for a license. He also took the time to address DOGE efficiency and other topics.

The controversy came as Musk’s AI chatbot, Grok, faced backlash for referencing “white genocide” in South Africa in unrelated queries.

His company has blamed the responses on unauthorized internal changes and promised tighter oversight. Meanwhile, South African leaders are reportedly exploring options to allow Starlink access ahead of meetings in Washington aimed at improving U.S. ties.

Huge W for US law enforcement, this time in Las Vegas.

Vegas police shot and killed 34-year-old Daniel Ortega after he opened fire inside the Las Vegas Athletic Club, attempting what authorities say could have been a mass shooting. Ortega entered the gym with a rifle, exchanged brief words with staff, then fired 24 rounds in the lobby.

He fatally shot 31-year-old gym manager Edgar Quinonez and wounded three others before his weapon jammed. Police believe the malfunction likely prevented further casualties.

One of the officers waited behind a brick column and quickly dispatched the scumbag as he attempted to run out into the parking lot.

We will be back tomorrow with another post later in the day to wrap up this week’s news. If you haven’t — make sure to check out the Gemini Cyber Truck Giveaway going on this month, details can be found below.

Have a good one,

Andy

Gemini Crypto - Get Free Bitcoin

Gemini - Crypto Credit Card (Cybertruck giveaway)

Protect Your Crypto with Trezor

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before investing and ensure you have a good understanding of your personal risk tolerance.