Surviving The Crypto Carnage

502: Friday Crypto Report

Good evening.

Today is a rare Friday in which we have two Arb Letters but market conditions merit it. Hopefully I catch the majority of you before you enter the liquid vortex and enjoy your Friday night. We could all use some solid decompression and degeneracy to blow off some steam.

If you missed the earlier post on US news updates covering some of the insane headlines this week you can find it below, though this is the more important post if you care about your crypto bags.

Corruption, Chaos, and a Market in Freefall

Going to try and keep this concise while also comprehensive.

Here is the deal.

This is a brutal fucking sell off.

No doubt about it.

Traders and investors are getting slaughtered.

Even crypto veterans and OGs have been left stumped by the speed and viciousness of this pullback. Many are calling for a new 4 year bear market, some are calling this another bull market sell off, and opinions vary on when we might see a recovery.

One thing is for certain — this dump and speed with which it came (gigity) are almost entirely unprecedented, even when you look back to true max fear scenarios like FTX.

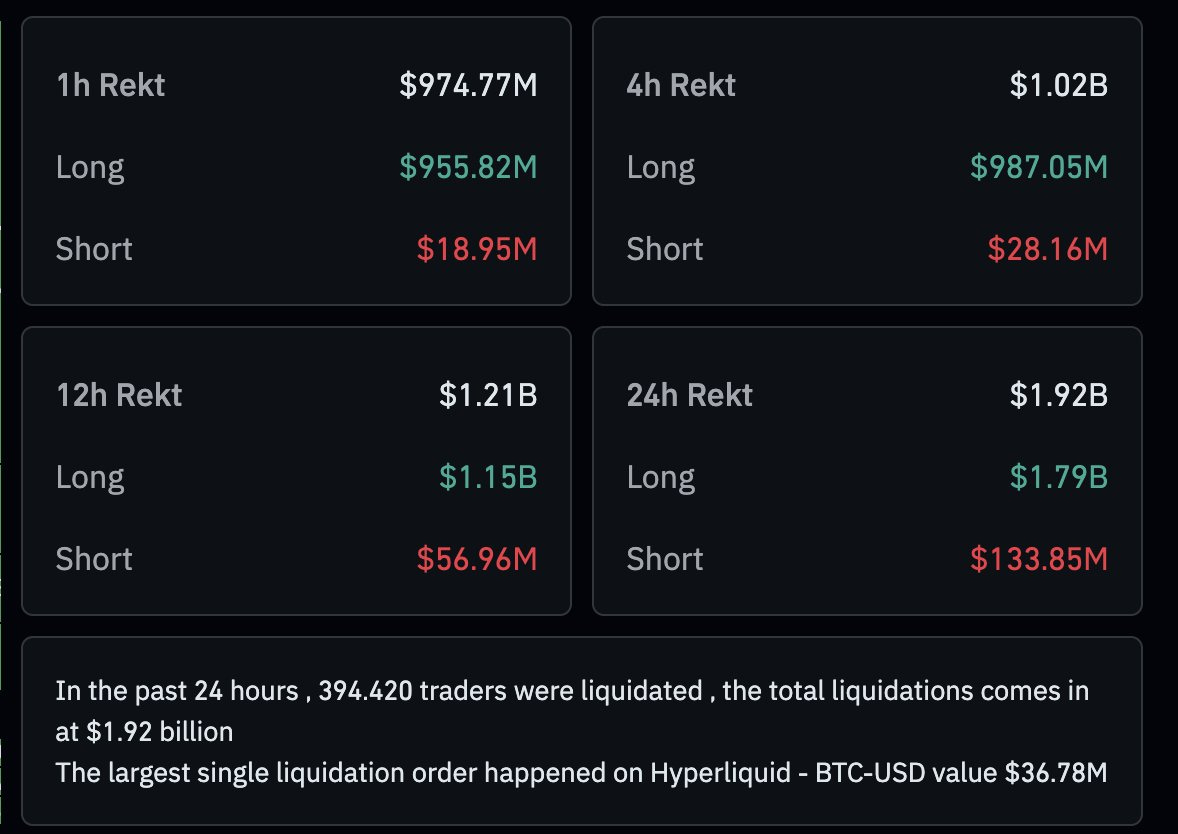

Coinglass shows almost $1.9B liquidated in the last 24 hours.

People just aren’t learning their lesson and the market keeps eating them alive. Institutions have also changed the game permanently and many have been selling into this dump along with big exchanges.

This is the part of any cycle where people lose faith and do dumb shit.

They overreact emotionally, panic sell, or make stupid moves that look horrific in retrospect.

This of course is the exact opposite of what you want to do.

The State of Crypto

Well boys it’s grim out there.

It’s never fun watching your magical internet coins go down in price, you get a pit in your stomach, you tend to get more irritable, and if you really went all in, you start to get a sense of impending doom.

If you can say one thing about the “cycle” it is that it was marked with a strange sense of calm rather than the straight up euphoria we have seen in the past.

In October things were cooking pretty good and now?

Fear and panic is strong.

Bears are celebrating and calling for much lower by the end of the year. Tourists and casuals have been obliterated.

As of the last hour or so a quick look at some of our favorite crypto assets is painful:

Bitcoin (BTC): ~$85,079

Ethereum (ETH): ~$2,769.63

Solana (SOL): ~$128.55

Chainlink (LINK): ~$12.11

Aave (AAVE): ~$158.52

Avalanche (AVAX): ~$13.27

You can feel the shift in tone across the entire market. Sentiment has flipped from “buy the dip” to “get me out,” to liquidity is retreating, and every minor bounce is getting sold into. This is what true fear looks like when even rational traders begin preparing for the worst and positioning goes from offensive to purely defensive. Polymarket odds show a good amount of traders convinced that we may dip below $80,000 in November.

The tape hasn’t even attempted a recovery. No bounce, no rotation, nothing resembling any sort of relief bid. Just a relentless staircase down with forced selling, a momentary stall, and then more downside.

The most savage of market conditions.

As Bull Theory on X pointed out:

This kind of repeated behaviour usually points toward one of three possibilities: a major entity unwinding positions, structural deleveraging inside large trading firms, or a series of systematic liquidity gaps triggered by thin order books.

After the October 10th liquidation event it’s safe to say we are seeing a combination of these factors on top of less certainty in markets more broadly (Rate cuts/AI bubble claims/etc.) although nobody has floated to the surface, we still have no idea what actually happened.

For those of us who are bullish on crypto, it has been a frustrating few months. Sure, those of us with super solid BTC averages have done super well and are pretty comfortable, but we were left waiting for a super leg higher that never came.

It’s fair to say this has been one of the most unusual stretches of the entire cycle, a period defined by confusion, false starts, and price action that doesn’t fit neatly into any familiar pattern. And because of that, a huge number of people are genuinely unsure of what comes next.

I’ve been in crypto since 2017 and do not plan on leaving anytime soon. The volatility, unpredictability, and big swings are part of the game.

If you want the chance to print big you have to ride the waves.

Only those with absolute concrete hands outperform over a longer time frame.

Still most right now are probably wondering:

Is it over?

Will we end up getting a bounce?

Will I ever get a girlfriend now that my bags are down?

Will alt season ever come back?

Is Ethereum a stubborn piece of crap forever?

What is going to happen in 2026?

Let’s take a look at some of the good news in front of us and then we’re going to review why we might be seeing such a violent sell off that seems uncharacteristic when we look at past crypto dumps.

I do hope most of you take the time to read through this despite it being Friday night. The most important thing you can do in downturns in crypto is stay on top of catalysts, potential bullish news points, and take some time to identify where a thesis went bust and where the opportunity might lie be better prepared for a bounce or the next leg higher.

Let’s rip it.

One of the important factors behind the fluctuation between bull and bear markets, between booms and crashes and bubbles, is that investor memory has to fail us – and fail universally – in order for the extremes to be reached.

Howard Marks