Parabolic Set Ups are Here

249: Crypto rips, Powell wobbles, Syria burns

Morning all.

I owe everyone the next episode of Risk On and will do so as soon as I can (hopefully Friday morning). It will be crypto focused, looking at alts, meme coins, and more.

Straight to it today.

I think we are close to full blown parabolic mode in crypto and potentially risk on assets.

Crypto markets are about as coiled as possible.

Bitcoin seems to be cooling off a bit. Ethereum is moving. Alts and memes are moving up quickly.

It’s coming folks.

Quick note since we’ve had an influx of subscribers and some folks asking about the difference between the free & paid sub models here. Free posts go out roughly once a week covering broad market trends, news, and updates. Paid subs to Arb Letter get everything — the deep dives, guides, portfolio specifics, and hot takes that I am known for (the two most recent are below):

We Are About To Get Very Wealthy

Seizing the Golden Bull Run

As I have said many times before — Arb Letter’s pricing is close to the MINIMUM substack requires. I kept it there to give everyone accessibility. For those asking why there’s paid — 10-12 hours a week goes into paid posts. While I hate the cheesy forex/guru shilly approach some take to paid content — the track record in Arb Letter speaks for itself (and you can ask paid subs).

Many of the calls, names, and assets covered in here have exploded the last several years and made many people a good amount of money. You’re getting straightforward, no BS commentary and analysis along with plays that continue to print.

Rip it or don’t. I’m not going anywhere. We will make money either way.

But I will say — there’s going to be a good amount of content dropping soon related to the crypto cycle and opportunities to take advantage of. The MAJOR differences in crypto vs. other areas like equities — is that you need to move fast to seize moves (seriously fast).

Paid subs who read the guides last week and acted are probably already up 20% on ETH and alt coins they got exposure to.

Anyway let’s get into it today, this shit is moving quick.

Markets & Crypto

While the reports and updates keep switching back and forth on the fate of fed size lord Jerome Powell, the sentiment around the Fed Chair is clearly deteriorating. Trump recently called Powell a “terrible Fed chair” and said he was surprised he was appointed—despite having nominated him in the first place. It’s obvious Trump wants rate cuts ASAP.

A wave of conflicting headlines this week claimed Powell was about to be fired, only to be retracted hours later. The drama briefly rattled markets, pushing yields higher and the dollar lower before rebounding. Behind the scenes, discussions around potential replacements have reportedly begun, with names like Scott Bessent and Kevin Warsh circulating.

Powell, for his part, insists he’ll finish his term through mid-2026, but the credibility of the Fed has already taken a hit for sure.

Even if the firing talk cools off, the political pressure likely won’t.

U.S. equity futures were relatively flat to start the week, with investors turning their focus to upcoming earnings reports from major tech firms, including TSMC and Netflix

The S&P 500 and Nasdaq remained close to all-time highs after a wave of solid Q2 earnings, led by companies like PepsiCo and United Airlines. Weakness in healthcare stocks kept broad gains in check

Amazon AMZN 0.00%↑ shares have been trending upward over the past month, prompting several analysts to boost their price targets into the $250–260 range

Eurozone inflation held steady at 2%, and with regional political risks lingering, the ECB is expected to hold rates steady at its next meeting rather than proceed to cut further

New threats of steep U.S. tariffs on allies including the EU, UK, and Japan caused a brief spike in volatility as investors reassessed lingering global trade risk

Crypto

I hope you degens are ready to print bands.

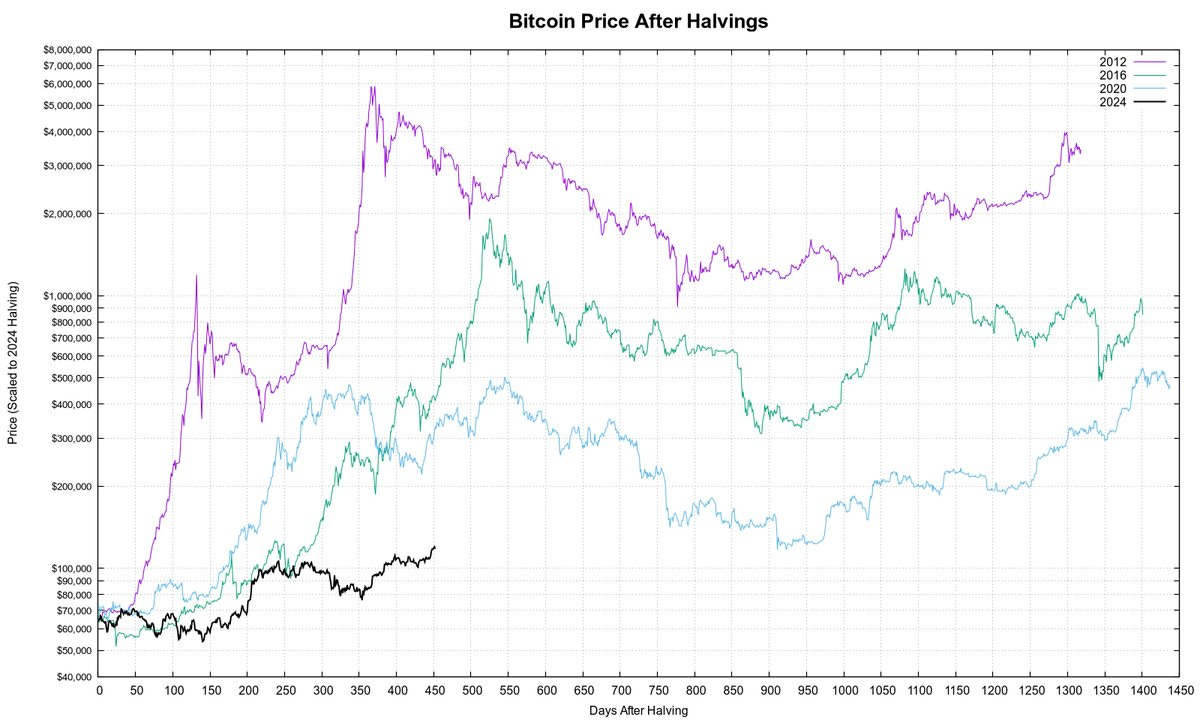

Crypto is red hot now — a few major moves until the return of retail and media panic mode. Bitcoin dominance is dropping though she is still hanging out at $119,000.

Perfect to be honest, if you want to see liquidity flow to other tokens and assets.

Bitcoin is not finished for the year in my opinion — but she may continue to chill which will allow the big opportunities to flourish if we can get continued momentum and an eventual cut from the Fed.

Ethereum is the star of the show now, which is just what we were waiting for if you’ve been reading the last couple of guides.

Ethereum is trading at $3,400 at the time I am writing this (8:00pm ET on Wednesday). This was the range I detailed in Tuesday’s post when we would start seeing alts and memes move as well — which is exactly what is happening.

ETH institutional demand is SKYROCKETING.

BlackRock scooped up nearly $650 million worth of Ethereum over a 48-hour window this week, marking one of the largest institutional ETH buys to date. The surge included a single-day purchase of nearly $500 million—its biggest on record. Their ETF now holds over $7 billion in Ethereum.

SIZE.

I expect the following to pump hard sooner rather than later:

Solana (SOL)

Chainlink (LINK)

Aave (AAVE)

Avalanche (AVAX)

Pepe (PEPE)

Ripple (XRP)

Cardano (ADA)

Tune in to the new episode of Risk On tomorrow morning for more picks and thoughts on these.

Do not miss it if you enjoy making money.

Some of the major crypto headlines this week include:

JPMorgan Chase CEO Jamie Dimon saying on Tuesday that the bank plans to get more involved with stablecoin soon (complete 180 on his historical words and viewpoints on crypto)

The US House advanced the Crypto Genius Act, Clarity Act & Anti‑CBDC Act yesterday

XRP Ripple surpassed a $190 billion market cap this morning — insane journey so far for holders of the controversial token (WatcherGuru)

BofA CEO Brian Moynihan has acknowledged that the bank is researching stablecoin applications, citing the recent GENIUS Act and broader regulatory clarity as prerequisites for their involvement (Investopedia)

Russia's largest bank 'Sberbank' is set to offer crypto custody services (WatcherGuru)

Volcan Inc has initiated a Bitcoin Treasury Strategy that is funded by a $500m stock sale (Bitcoin Archive)

We may very well end up getting the alt season we have all been hoping and praying for. It will be VERY hard to lose money at some point, everything will go parabolic — memes, new launches, shit-coins, you name it.

The market is sending signals.

Regulatory updates are cascading each day. Politicians are getting more positive about it. Retail is waking up, and you can expect things to kick into high gear should ETH and alts really start to move up in a next leg.

Geopolitics & Global News

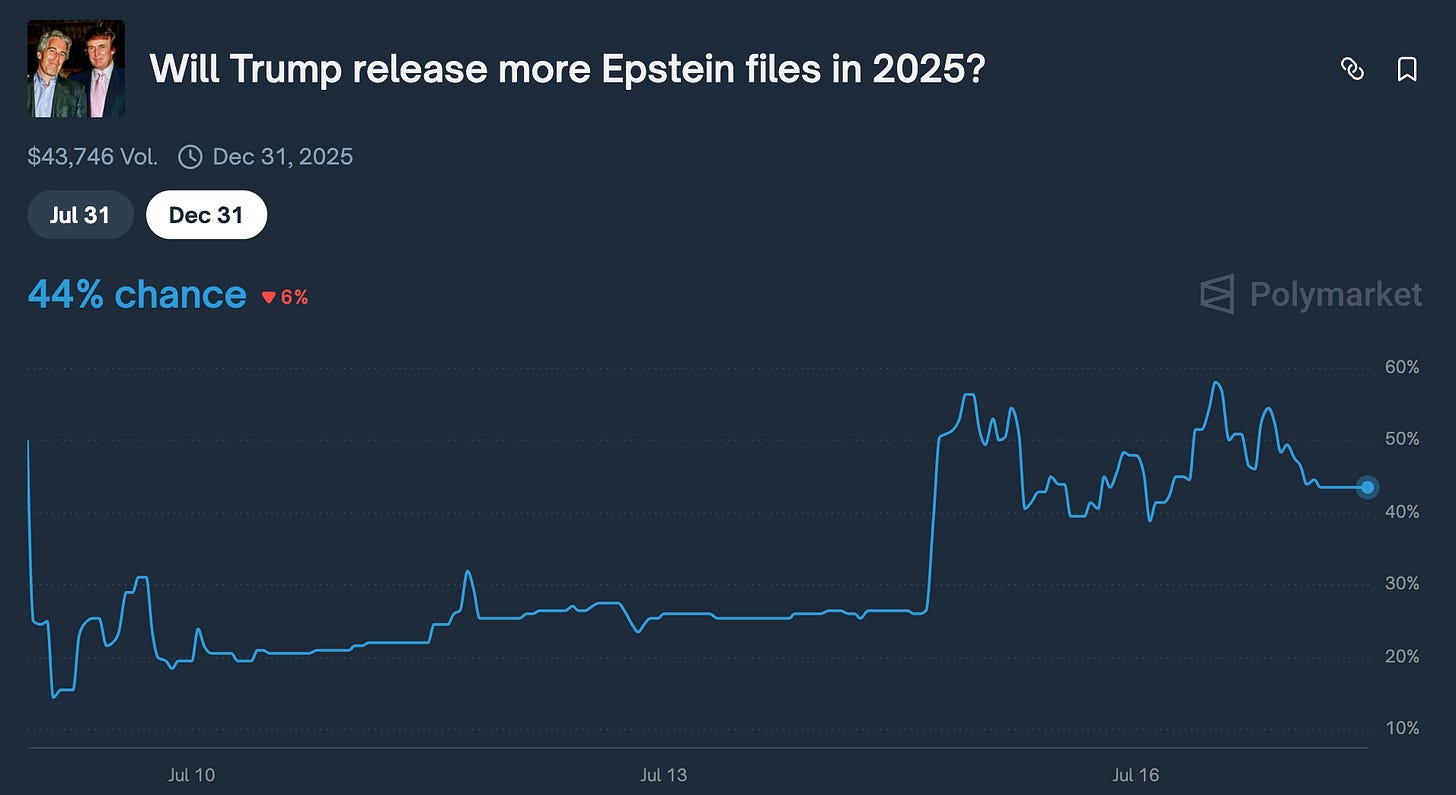

Continued debates are escalating over the existence and handling of the Epstein files. Trump’s attitude seems to be “drop it” but more and more pundits and some politicians are saying that’s not good enough. The newest psy op is that the entire thing was some Democrat Hoax.

The Democrats have had a significant number of hoaxes over the years, but the Epstein saga is not one of them. Trump said recently that the FBI should look at the 'Epstein hoax' — which is embarrassing.

At present there are a few helpful odds on Polymarket — the one below only has a 44% chance that Trump ends up releasing the files in 2025.

Entire thing is wack af. We all know what is going on — which is that incredibly powerful people are being protected globally.

US Congressman Tim “Based Af” Burchett said this week anyone found guilty in the Epstein Files should be publicly hung: "Find them guilty, hang them publicly."

Interestingly enough the US DOJ reportedly fired Maurene Comey, federal prosecutor in both the Sean "Diddy" Combs and the Ghislaine Maxwell cases yesterday (ABC).

I’m sure everything is on the up and up and this isn’t a complete cover up and burial process to move the public forward.

In other news:

U.S. Capitol Police reportedly detained a man with guns, bows and arrows in his vehicle this week

President Trump said this week that Coca-Cola has agreed to use real cane sugar in US going forward

The US Department of Transportation terminated a $4b for California Bullet Train (MacroEdge)

Oil prices climbed modestly this week as low global inventories, easing trade frictions, and fresh volatility in the Middle East collectively bolstered market sentiment

NATO Secretary-General Mark Rutte issued a warning to Brazil, China, and India that they may face secondary sanctions if they continue economic ties with Russia, urging them to pressure Moscow toward peace negotiations.

The UK lowered it’s voting age to 16 this week

Syria

Ah yes — a newly escalated conflict in the sandbox.

About 6 months after the fall of Syria’s long time leader Bashar al-Asad, Syria is seeing intense infighting amongst various factions.

Israel has proceeded with strikes in Damascus — arguing that they are defending the minority Druze sect in southern Syria.

The strikes came in response to clashes between that religious minority sect, the Druze, another group known as the Bedouin tribes, and Syrian government forces (ABC).

The power vacuum left by Assad’s downfall has unleashed a chaotic struggle for control, with ethnic, religious, and tribal groups vying for dominance. Iran-backed militias have also reportedly entered the fray, further complicating the landscape and drawing concern from regional powers.

Israel’s involvement has sparked a good deal of international debate, with some accusing Tel Aviv of exploiting the instability to expand its influence. Meanwhile, humanitarian conditions continue to deteriorate in country, with thousands displaced by the recent violence in southern provinces.

The UN has called for restraint, warning that the region is on the brink of a broader sectarian conflict that could spill across new areas.

I will see you guys tomorrow morning for a crypto focused episode of Risk On.

Remember — these opportunities are fleeting and don’t pop up every day. We will cover specific expectations for price, assets I am buying (today), and more. Make sure you are following on X and discord for live trading updates, meme coin picks, and news.

Godspeed

Andy

Gemini Crypto - Get Free Bitcoin

Protect Your Crypto with Trezor

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before

Quick question - would you wait for a LINK pullback (had to get $ in place so I missed the window 2-3 weeks ago) or start accumulating now?

the lead on LINK was well worth the cost of admission - ty sir