Nvidia hits $5 Trillion, Robotics Surge

489: What to Expect Today in Markets

Morning savages.

Big day today so make sure you’re 3 espressos deep by 11am.

This week has been an explosive one across markets and today we get the next rate cut decision from the US Federal Reserve.

Additionally the dawn of the coming robotics bull market may have just shown its head with Amazon announcing layoffs and a robot reveal across its warehouses. 1X, based in Palo Alto, California has launched their new NEO humanoid robot that is designed to live with you in your house and can perform tasks like dishwashing, laundry, and cleaning.

All this comes as the government shutdown drags into day 29 and the data blackout leaves markets flying blind with little to no indication on how things might be trending.

Then we have some major earnings with tech behemoths Meta, Microsoft, and Alphabet.

Let’s get into it.

Tomorrow we will have a a new episode of Risk On and a markets update and 2025 book review list, including Jack Carr’s Cry Havoc, for paid subs. Without spoiling too much this book heavily dives into the little known history of MACV-SOG, special operations in the Vietnam war deep behind enemy lines.

Markets

The S&P crushed a new all-time high of 6,890 yesterday. That being said, almost 80% of S&P 500 stocks finished in the red yesterday, the worst breadth reading ever recorded, even as the index printed fresh all-time highs. Kobeissi Letter pointed out that ALL net wealth in the US stock market since 1926 has been generated by just 3.44% of companies.

Insane lmao.

That tells you everything you need to know about this market right now. The rally is being carried by a handful of mega-caps while the rest of the field quietly bleeds out. A house on stilts in some regards with most companies contributing absolutely nothing.

All eyes will be on rich homie JPOW today.

To be honest I’m expecting a bit of what we saw last time which was this all being more or less baked in. As of this morning a 25-basis-point cut is virtually guaranteed.

Futures are pricing in better than 90% odds that Powell delivers, with almost no one betting on a pause. Polymarket odds sit at 98% for 25bps cut.

A bigger 50-point move is still seen as a long shot, but traders expect this to mark the start of an easing cycle as the labor market cools and growth momentum fades.

I think any upwards movement we come to see in crypto is going to be lagged. Right now traders and retail are focused on names like $PLTR $NVDA and a handful of other tech runners. Eventually the attention will shift.

Pay particularly close attention to Jerome’s comments on the labor market and inflation. Both will be points in which he has the opportunity to cement the Feds pivot from QT.

The Dow Jones hit a record high this morning

OpenAI may IPO as soon as 2027 according to the WSJ

NVDA 0.00%↑ announced the company will invest $1 billion in Nokia as part of a new strategic partnership. Nokia will issue 166.4 million new shares to NVIDIA at $6.01 per share. NOK 0.00%↑ was up as high as 30% on the day yesterday

NVDA 0.00%↑ became the first company worth $5 Trillion, absolutely ridiculous run

Quite a bit of NVDA news this week as the company announces a partnership with Palantir. Palantir will integrate NVIDIA CUDA-X libraries, Nemotron open models, and GPU-accelerated computing into its Ontology framework, the core of its AI Platform (AIP) (QuiverQuantitative)

China purchased 180,000 tons of U.S. soybeans ahead of tomorrow’s President Trump and President Xi meeting as a sign of good faith

Short Sellers are on track for their worst year since 2020

Between 2020 and 2025 the wealth of the entire bottom 50% of the U.S. population has increased by a little over $2 trillion, per the Fed (Unusual Whales)

Gold has slipped to a three-week low as traders rotated out of safe havens ahead of the Fed’s expected cut and the growing optimism around U.S.–China diplomacy

My gut tells me chop or sell off even if JPOW announces a cut today. Just a hunch and I won’t be reading into the initial reaction too much.

If we do see a pronounced surge across risk assets (including crypto) I think it will come in November. The possible exception here is if Jerome makes it explicitly clear through his language that QT is over.

Robotics Surge

Do you have exposure to our clanker friends?

Amazon’s latest layoffs paired with a ramp-up in warehouse automation and the debut of humanoid robots like NEO by 1X signal what could be the next major productivity revolution.

As AI saturates the digital realm, robotics is set to bring that same exponential curve into the physical world. The machines are no longer just code they’re walking, lifting, and replacing human labor at scale. The elite will gobble this stuff up, to them it will be well worth the $20,000 to get a mechanical dobby around the house to do whatever they please.

*Cue the aftermarket Margot Robbie and Ana De Armas exterior upgrade kits.

For investors and degens, the early wave of exposure sits in names like Nvidia (NVDA), Tesla (TSLA), ABB, Rockwell Automation (ROK), Intuitive Surgical (ISRG), and Fanuc. Each of these names is playing different roles across industrial automation, sensors, semiconductors, and humanoid development.

If you prefer a basket or broad approach, look at ETFs like:

ROBO – Global Robotics & Automation Index ETF

BOTZ – Global X Robotics & Artificial Intelligence ETF (I own this one)

IRBO – iShares Robotics and AI ETF

All three offer diversified exposure to the sector that’s quietly positioning to become the next trillion-dollar theme in the coming decades.

This is the AI trade’s physical twin. I wouldn’t fade it. Our future may look like any number of director Neill Blomkamp’s films: a dystopian blend of UBI, slums, robot industry, and insane technological advances in travel, healthcare, and luxury.

Layoffs

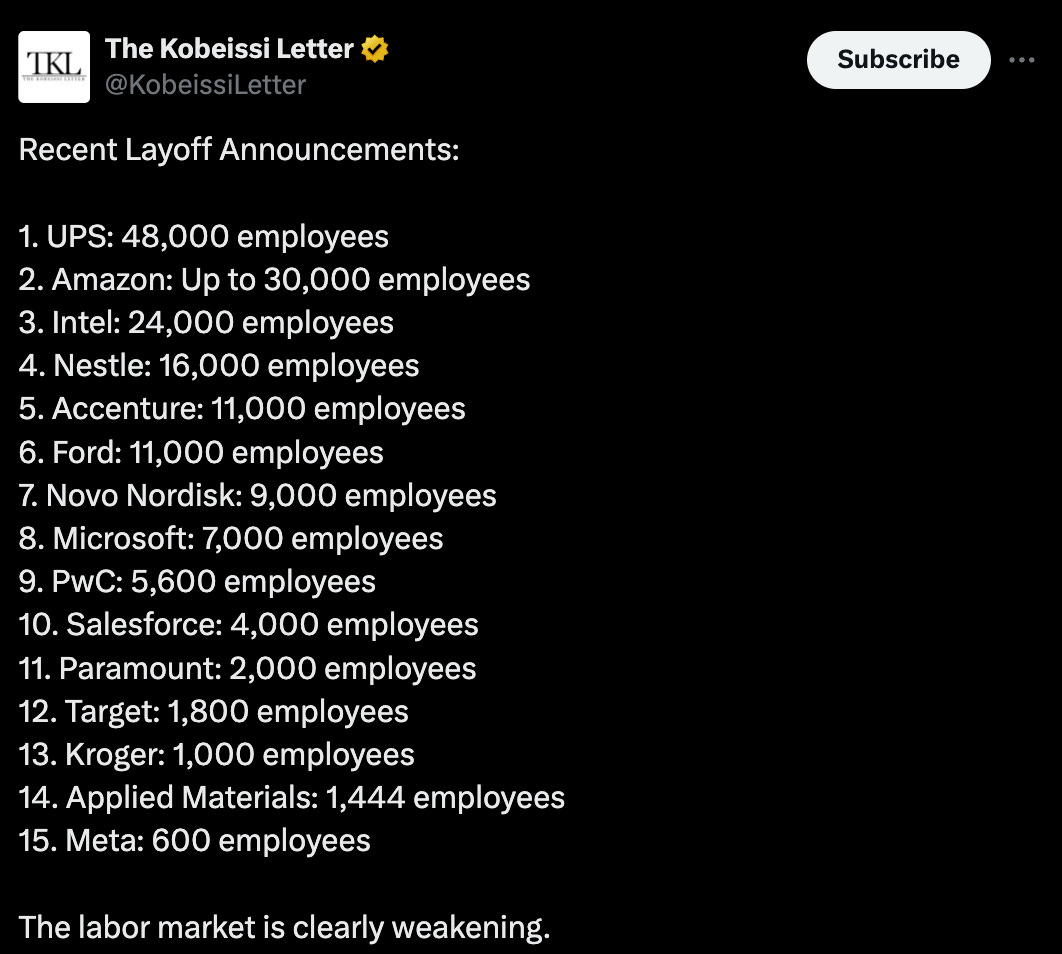

Layoffs are beginning to pick up at quite the scale. This week AMZN 0.00%↑ and other announced major cuts. UPS followed Amazon with an announcement of 48,000 to be cut and Intel, Nestle, and others followed suit. Kobeissi Letter outlines the announcements from the last several weeks below.

Outside the corporate cuts themselves, the job environment is awful for new graduates with only 30% of 2025 college graduates and 41% of 2024 graduates finding entry-level jobs in their fields (Forbes Report).

While this certainly strengthens the case for a Fed Cut today, it should be concerning to many people, including those who hold corporate roles. It is evident that companies are beginning to lean out for the next decade and factor in jumps in productivity (and cost cutting) they can gain from AI.

I haven’t been preaching how to start your own business and be more sovereign for my health. This isn’t going to magically get better in the coming years.

Rising unemployment, falling job openings, or slowing wage growth all signal that the economy is losing momentum OR entering a new era in which workforces can effectively be culled to free up resources and spend for other things (AI).

Cutting rates becomes the tool to cushion that slowdown, but underneath the surface this is not the world your parents grew up in.

Crypto

Crypto has softened a bit ahead of the Fed Rate cut and as the S&P has reached a new high.

Bitcoin dipped to $112,500 and Ethereum is hanging out around the $4,000 mark.

Alts remain in their lower ranges, clearly looking for some indication that: a.) attention is going to shift back to crypto and b.) that they’re going to get the liquidity boost they need from a Fed pivot to send them higher.

This week brings fresh signs that the macro tailwinds could tilt in crypto’s favor: liquidity conditions are tightening ahead of the Federal Reserve meeting, but flows into Bitcoin-spot ETFs are turning positive and trader funding rates are showing early signs of life.

The consensus is that a 25 bps cut is almost baked in, which could loosen dollars and hopefully revive appetite for risk-assets. If Powell-speak hints at a sustained easing path rather than a one-off move, crypto may be poised to break out of its sideways drift. But for this move to be sustained I think we need to see attention shift from super heated equities.

21Shares filed their S-1 for a Hyperliquid $HYPE ETF

Visa is set to enable payments in four stablecoins across four blockchains with fiat conversion support, its CEO announced

The Ethereum Foundation has featured Chainlink as a leading privacy and compliance solution for institutions building on Ethereum (Chainlink X)

Accountable raised $7.5 million in a round led by Pantera (BlockWorks)

$2 trillion Japanese payments processor TIS is set to launch a blockchain-based platform for stablecoins and tokens (WatcherGuru)

I am not actively buying crypto this week, instead my attention is on acquiring more niche defense/drone names like KTOS 0.00%↑

Remember, the periods when attention on crypto is at all time lows are EXCELLENT times to take positions if you lack exposure and you’re bullish.

Make sure you check out the Alt Coin list I published if you’re looking to position ahead of today’s rate cuts or a run we see begin in November.

Global News

This weeks news is defined by increasing chaos in Europe as the impacts of mass immigration become more and more evident and native populaces begin to reach their breaking points.

President Trump and Xi of China are set to meet which may bring some more clarity to the 2025 back and forth trade war we’ve seen.

As we approach voting day in New York City for the mayoral race, the internet is popping off with all kinds of threads, critiques, and warnings on Mamdani and his plans for the world’s heart of capitalism.

Trump and Xi are set to meet at 11am Thursday in South Korea

The US government says it will stop paying for food aid next week with some anticipating civil unrest as a result

The US Government shutdown has now stretched into its 29th day, leaving markets in the dark as key economic data releases remain frozen and federal operations grind to a halt

France’s ongoing budget standoff and political disarray are weighing heavily on consumer confidence and business investment, dragging forecasts lower and testing Europe’s second-largest economy

Flooding from Hurricane Melissa has killed at least 10 in Haiti

Hurricane Melissa, a record-breaking Category 5 storm, made landfall in Jamaica with winds nearing 185 mph, triggering massive flooding, power outages, and what officials are calling the island’s worst storm in modern history.

SNAP/EBT Unrest

With the government shutdown now stretching into its fourth week, the USDA has warned that SNAP food assistance may run out by November 1, cutting off benefits for over 40 million Americans. Pretty insane number, I never knew it was this high.

States are scrambling for emergency funding as the potential lapse sparks panic online, where viral posts and videos from frustrated recipients have fueled talk of theft, looting, and unrest if aid stops. Others are outright calling for social unrest online.

The impact would ripple far beyond households. It would hit grocery stores, local economies, and municipal stability. What was once a bureaucratic standoff is quickly turning into a social flashpoint, testing how long Washington can let this drag on before something breaks (and to be honest maybe that’s the intention).

For a program that should be designed for people who literally cannot work or provide for themselves, this entire racket has devolved into a scheme in which tax payers are funding the lifestyle of many who simply do not want to work and leech off the system.

Europe is at a Breaking Point

What’s happened in Europe is honestly just downright sad.

The UK experienced one of its more grisly knife attacks this week when a 22-year-old Afghan viciously went on a triple stabbing and killed Wayne Broadhurst of Uxbridge who was out walking his dog in broad daylight.

I highly suggest you don’t view the video as it’s absolutely fucked.

Knife attacks in Europe have skyrocketed in past years, coinciding with the massive immigration pushes we’ve seen from Africa and the Middle East. Rapes have also climbed to absurd levels. Just last week we heard about the maddening story of the poor 16 year old girl Meya Åberg in Sweden, who’s rapist and attacker Yazied Mohamed (an Eritrean refugee), will not be deported after serving his three-year prison sentence due to the “duration of the incident”.

To make matters worse in the UK thousands of small boat migrants will soon be transferred from hotels to military bases as part of the government’s new relocation plan. One of the initial sites is a training facility in Crowborough, which is expected to receive around 600 men next month.

Think about that. Literally hosting a foreign invasion force in a military base. You can’t make it up.

Something is eventually going to give here.

The situation in countries like the UK is complicated by the fact the populace isn’t allowed to own firearms, but that doesn’t mean we won’t see spurts of violence, mobs, and resistance.

Outrage is growing.

Videos on social media already depicted people gathering in public en masse to support Wayne Broadhurst. It’s about time Brits, you guys have some serious work ahead of you to stop this problem in its tracks. That goes for Germany, France, Sweden, and others as well.

Sad state of affairs, but a warning to us in the US on what can manifest itself when you import endless streams of unvetted or incompatible foreigners and expect “assimilation”.

Europe is magnitudes past Orwell at this point.

Have a great hump day.

See you guys tomorrow for a review of this week’s market action and the book review led off by Jack Carr’s Cry Havoc for paid subs.

Andy

Protect Your Crypto With TREZOR

Get Free Ethereum w/Gemini

Get Free PEPE w/Gemini

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before

Shit's getting serious. Time to do another audit of my guns and ammo.