New Year, New Pumps on Horizon?

518: Crypto Showing Life, AMD Primed, Taiwan Rhetoric

Morning all.

Hope everyone had a good New Year’s celebration. I laid pretty low this week and enjoyed some college football while I worked on the website for my new business. This hit in the Georgia game was one of the gnarliest I have seen in awhile.

Now it’s back to it and we’re in 2026.

Today we’re going to do a quick run down of this week’s news and market action and next week we will get back to our usual schedule of Tuesday (paid posts) and Thursday (free posts for all subs).

New Episode of Risk On Tuesday as well, I apologize for the delays but I have a mystery virus/flu that has eviscerated my throat and sinuses.

If you guys missed our posts leading into 2026 that cover expectations, crucial forecasts, and plans in financial markets, business, and relationships you can find them below in the archive:

The 2026 Blueprint: Survive the Chaos, Profit From the Future

2026: Play Offense or Get Left Behind

BlackRock’s 2026 Forecast

I wouldn’t wait too long to read them as we will be referencing them moving forward in the coming weeks, especially on the geopolitical and crypto front.

Financial Markets

Markets wrapped up our final week of the year in quiet, holiday-thinned trading. U.S. equities slipped modestly into the close, with the major indexes finishing the week lower despite a strong year overall.

Globally, investor appetite for stocks looks to be remaining solid, as equity funds continued to attract new money heading into 2026.

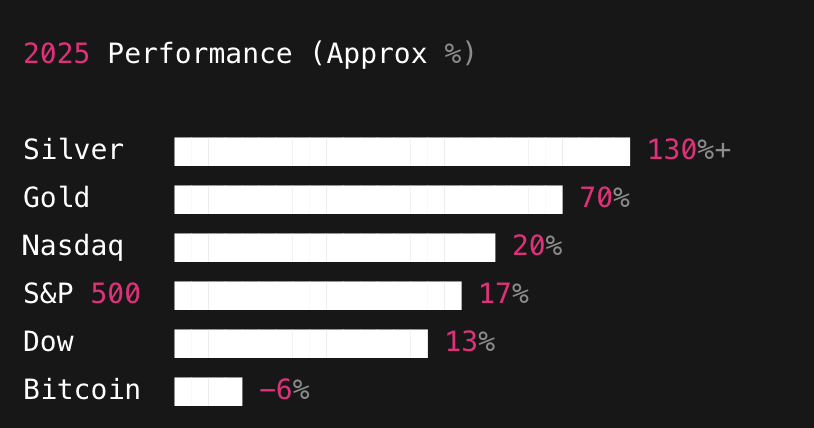

Precious metals climbed back a bit, with gold and silver supported by strong buying and safe-haven interest. Asian markets were generally upbeat, helped by optimism around growth momentum and widespread expectations for future rate cuts this year.

Overall the TLDR if you are just coming out of a Scotch infused coma, the tone was one of calm consolidation and anticipation.

We have light volumes, mild pullbacks, and investors largely staying positioned for another year defined by AI-driven growth themes and easier monetary policy.

Polymarket is giving us a current 89% chance of no change from the Federal Reserve this month with $120,606,087 of volume. In other words, real money is heavily skewed toward the Fed holding steady and that probability has barely budged despite recent macro noise, suggesting traders think policymakers would rather wait than risk jolting the economy this early in the year.

Global stocks opened 2026 on a strong footing, with major European indexes pushing to fresh record highs as trading resumed after the holidays. Defense, energy, and industrial names were among the early leaders

61% chance Elon Musk becomes the world's first trillionaire this year (Polymarket)

Chinese EV and tech names saw heavy trading action, including Tesla’s China-focused competitors like NIO and XPeng, while Baidu jumped after reports tied to its AI division dropped

Storage and data-infrastructure plays continue to shine, with names like Western Digital and Seagate extending last year’s fat surge

AMD 0.00%↑ CEO Lisa Su is expected to make some sort of a big announcement next week at the Consumer Electronics Show (CES) in Las Vegas. Worth remembering AMD outperformed NVDA in 2025

Oil majors rallied this week, with Exxon Mobil and Chevron outperforming the broader energy complex

Retail and consumer discretionary stocks led sector performance, with Nike, Lululemon, and TJX Companies all gaining

I am optimistic that between new Fed liquidity and a new Fed Chair 2026 will be another year for the books ahead of mid term elections.

We will expand on some equity plays next week, covering drones again, storage, and tech names I am adding in the first several months of 2026.

Crypto

Alright here’s the deal. I am getting that feeling deep in my plums again.

It’s true, the delay of alt season shafted us a bit in 2025 (though many of you still printed in BTC/ETH).

But I want you to entertain a theory I’ve been talking about for at least 6 months now.

The old cycle theory is dead now, that is, the traditional 4 year cycle everybody on X and on the Youtube love to talk about. Two things to keep in mind if you buy this:

Bitcoin’s price action has diverged from prior halving-cycle rhythms

Institutional adoption, ETF flows, AI-wealth, macro liquidity etc. THESE now matter more than miner supply dynamics

The consolidation phase we’ve been in for months on BTC and ETH alone make me think this is the new normal.

If that is true, 2026 could be mega bullish (and sooner rather than later) and that would honestly catch the most people with their pants down.

Our favorite neighborhood meme coin PEPE (which you can still get free when you sign up for Gemini and trade $500) outperformed almost everything the past 48 hours, up almost 40%.

The frog is back and he is angry for gains which is usually a sign other memes ill follow suit soon.

ETH is on a nice little run at the time of me writing this as well.

But it’s not just meme coins and ETH showing a little spark, on chain data is also indicating that long term Bitcoin whales are buying now.

Has the sentiment shifted for the new year?

My bet is yes.

The Kobeissi Letter shared some stats re: Bitcoin ETFs that might suggest our pain is close to being over. For example $IBIT has now experienced outflows in 8 of the last 10 weeks, with a total of just 20 weekly outflows since its introduction in January 2024.

There will be a reversal soon and it will likely be swift.

People have been dogging hard on crypto for months now, we’ve had down or sideways price action, and attention on the space is near all time lows from retail who are busy chasing lofty tech and AI names or metals.

Trust me on this, there is no better feeling than having your crypto portfolio/positions squared away when the masses flood back in. You avoid emotional panic buying and you get more time to decide when and how you want to cut your winners as the bids flood back in.

Alt season will require liquidity and it will require retail to shift their attention, two things I think we are going to see early this year.

I’m not telling you what to do, but if you are bullish like me, we are still in the value zone for many alts, memes, and Ethereum.

This is very much the “fuck I should’ve bought more” level people look back at when we’re 50% higher across the board lol.

I will be buying more Avalanche (AVAX) and Ethereum this weekend while watching some positions closely. Over $250,000,000 in short positions were already liquidated in the past 24 hours according to Whale Insider.

Wouldn’t be surprised to see a good pump into Sunday.

Global News & Geopolitics

It’s tough to imagine that 2026 is going to be more volatile geopolitically than 2025, but that very much appears to be the case. The world feels tense, jumpy, and one bad decision or impulsive move away from something bigger.

Europe

Europe is continuing to prepare for war as the Ukraine Russia conflict continues to drag on nearby.

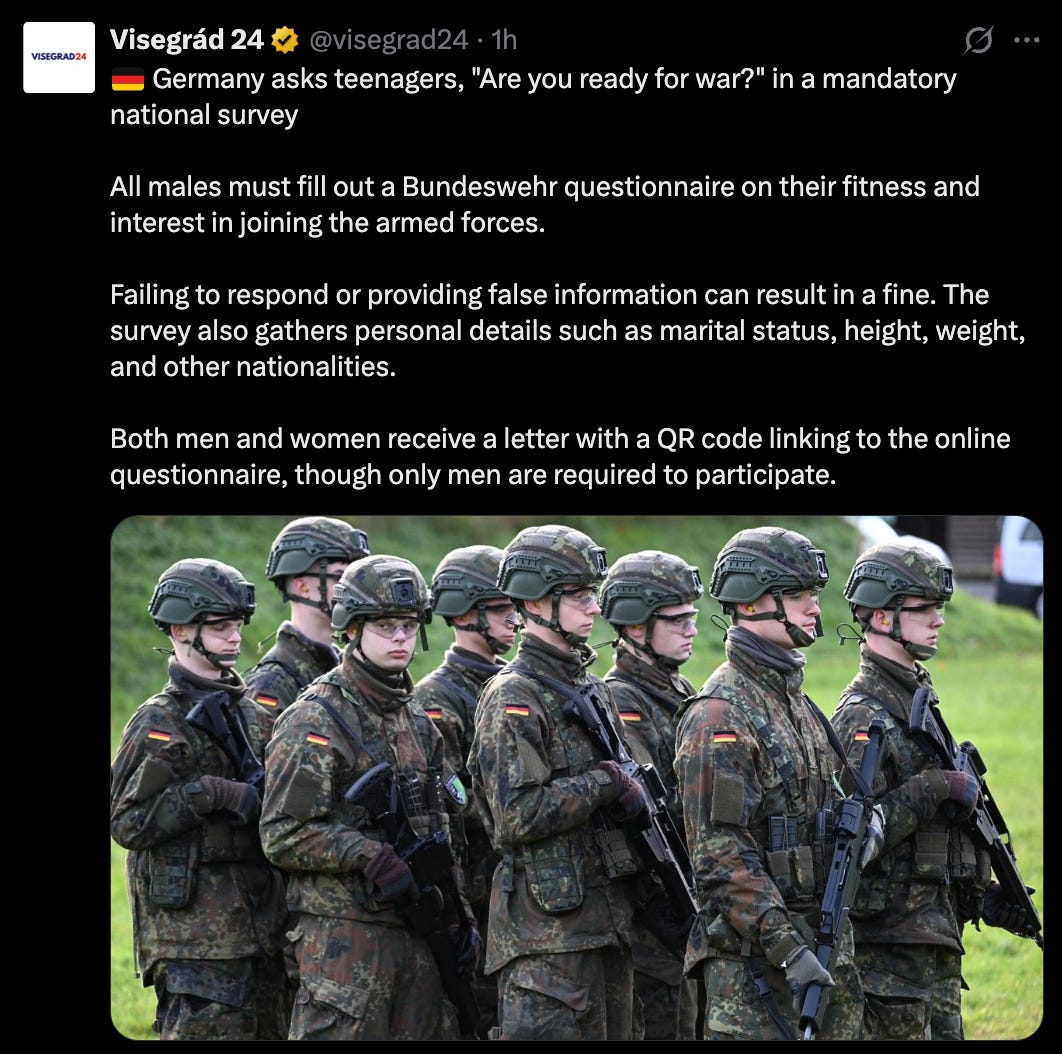

Germany is now introducing a new mandatory survey for 18-year-olds that asks young men about their willingness and suitability to serve in the military. Beginning this week, every male citizen will receive a questionnaire from the Bundeswehr assessing their fitness and their interest in potential service once they reach adulthood.

Ominous for sure.

Germany has recently transformed its defense posture in a way few would have expected just a few years ago. Reports suggest Berlin has massively expanded its military budget, allocating record new amounts for the Bundeswehr and boosting procurement of weapons, vehicles, and ammunition as part of a new sweeping rearmament drive.

The 2026 federal budget devotes tens of billions more to defense than ever before, and long-term plans envision hundreds of billions in new equipment and capability investments.

Hopefully it’s clear to you guys (regardless of what ACTUALLY happens) why I am turbo long defense in the coming years.

At the same time, recruitment efforts are definitely intensifying, with goals to grow active forces by roughly 30% and major outreach to young people, even as the country debates mechanisms to broaden service if volunteer numbers fall short (draft time).

And it’s not just Germany:

Several European governments are now telling households to be ready for days-long disruptions to power, water, and communications in the event of war or major attacks

In the Netherlands, every home recently received a government booklet explaining how to survive at least 72 hours without basic services

Other EU countries are issuing similar guidance and encouraging citizens to assemble emergency kits and resilience plans

National leaders across Europe have begun openly warning that large-scale conflict is now a realistic risk, reviving Cold-War-style civil-defense messaging

France and others are even considering distributing survival manuals to all residents — something that would have been unthinkable a few years ago

Taiwan

The Taiwan question is heating up again and China is bringing back inflammatory rhetoric about when they may be planning to take the island.

Insider Paper and others reported this week on the growing tension.

The U.S. warned that China’s latest military drills around Taiwan have ratcheted up tensions in the region and urged Beijing to back off. Washington said the exercises, which included missile launches and large-scale deployments of aircraft, naval vessels, and coastguard ships encircling the island, amount to unnecessary military pressure and called instead for continued dialogue.

The reunification of our homeland is unstoppable.

— Xi Jinping

China’s show of force followed the U.S. approval of an $11 billion weapons package for Taiwan. Washington has long maintained a policy of helping the island defend itself while remaining deliberately vague on whether it would intervene militarily.

People have been obsessing over this possibility for quite some time and I think most of us forget about it and think “oh yeah maybe that happens in the next 10 years”.

But the mood definitely feels different now and as the Venezuela debacle plays out, we are getting some glimpses into what the CCP is up to on the other side of the world and where their mindset sits.

The drills are larger. The rhetoric is definitely sharper than what we’ve seen. Western governments are openly talking about military readiness again. You have corporations in certain regions that are building contingency plans. Leaders are sabre rattling more.

It definitely feels like something is coming.

But this isn’t to say war is inevitable.

It’s just to say we all should think a bit more about what this move would mean, for our portfolios and for the region.

Iran

I mentioned Iran in Tuesday's post noting that I expect some escalation in country in 2026.

Could be more Israeli/US strikes or it could be CIA fueled regime change at its finest.

President Trump himself has already suggested the US might get involved saying: "we are locked and loaded and ready to go."

Protests across Iran have grown sharply in recent days, driven by widespread frustration over a deepening economic crisis and the plunging value of the national currency (Iranian rial (IRR) which hit a record low vs. dollar this year).

Demonstrations that began with strikes by shopkeepers and workers in Tehran have ended up spreading into multiple cities and smaller towns, with large crowds taking to the streets to demand economic relief as well as political change.

"The people of Iran want freedom.

“They have suffered at the hands of the Ayatollahs for too long”

—Mike Waltz, U.S. Ambassador to the United Nations

Clashes between demonstrators and security forces have turned pretty violent in several regions, and at least several people have been killed as unrest has expanded beyond the capital into rural provinces. Protesters are increasingly voicing anti-government slogans and challenging the ruling system itself.

The response from authorities has been unsurprisingly forceful, with security deployments and arrests reported as officials try to contain the unrest.

At the same time, international attention has intensified this week, with political leaders publicly warning Tehran against using lethal force against civilians.

Probably not going to help much.

Other Global News:

A strong earthquake hit Mexico city today

Flaming champagne bottles at a Swiss nightclub roof set the roof on fire, killing 40 and injuring over 100

Incoming NYC Mayor Zohran Mamdani’s inauguration started with the "Socialist Anthem" Bread and Roses, supposedly people were complaining about lack of restrooms and food at the event

Russia's 2025 territorial gains in Ukraine were the highest since first year of war (Insider Paper)

A pair of married Space Force officers had their DC home torched recently in a targeted anti Trump attack. Attackers burned their home, wrote “f*ck Trump” and “f*ck space” on their car, and looted their home. The couple’s cat was burned alive but fortunately they were out of town with their two year old daughter

Finland arrests suspects linked to undersea internet cable sabotage and investigations are now underway

FBI Director Kash Patel announced on X: The FBI and partners foiled another potential New Year’s Eve attack (in North Carolina) from an individual allegedly inspired by ISIS

See you guys next week for the full first week of 2026.

We will have a crypto deep dive and some more insight into business trends for those of you starting or running online businesses this year.

Enjoy the weekend

Andy

Trade With Polymarket

Protect Your Crypto With TREZOR

Get Free Ethereum w/Gemini

Get Free PEPE w/Gemini

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before\

Pepe lives

Be sure to use Betadine iodine gargle and nasal spray. Helps kill viruses. Best used early on.