Microsoft Cuts 9,000, Alligator Alcatraz

246: State of US Labor Market, Political Update, Crypto Pump

Afternoon ladies, kings, and size lords. Welcome to the 200 or so new subs we’ve gotten since last week. You’re in good company with a bunch of size lords. Been a great week so far, busy, but solid — let’s all channel the energy and aura of the latest viral AI image online Bust Down Keanu Reeves. Except I did it for Jerome Powell.

Let me know if you guys want it on a shirt, I will drop it before EOD if so, just leave a comment.

Things are looking up as summer chugs along. Crypto has had a breath of life with some movement from Ethereum as Bitcoin encroaches on $110,000. The S&P 500 hit an all time high. Tariffs seem to be a distant memory (until they’re not again), the Iran x Israel x US beef is simmering, and people have forgotten all about the drama of the past 2 months or so like:

Immigration riots in LA

Ukraine drone strikes inside Russia

The bizarre hit jobs on Minnesota politicians

The strange shooting of firefighters in Idaho

All things considered, isn’t it remarkable how fast we end up moving on from seemingly massive headlines?

Almost like, the powers that be more or less control what we’re all focused on on any given day…..

In any case — let’s get into it. Markets close at 1pm ET today for the 4th of July weekend in the US and I have 10 liters of Casa Migos, Pineapple Juice, and Lime Seltzer calling my name.

Markets

Solid week so far for equities — our yolo AI play BBAI 0.00%↑ has been absolutely soaring as of late. Quick reminder — BigBear.ai offers specialized AI solutions for real-time battlefield awareness, logistics optimization, and autonomous mission planning.

I talked about the play a month or two ago and it’s seen some decent volatility but has bounced back pretty strong. They’re sinking their teeth into some Palantir - esque contracts as of late:

Major Contracts:

Recently landed a 5-year, $153 million contract with the U.S. Army to provide AI-enabled data analytics and decision support systems.

Previous $14.8 million U.S. Army Global Force Information Management contract for predictive modeling and automation.

Collaborating with Palantir and others to modernize battlefield intel systems under Project Maven–adjacent efforts.

With renewed emphasis from DoD leadership on real-time AI-powered battlefield tools being a major component of US military capability moving forward, BigBear could be in play as a niche provider with strategic potential to print us fat bandos.

AMD 0.00%↑ SMCI 0.00%↑ have also been pumping.

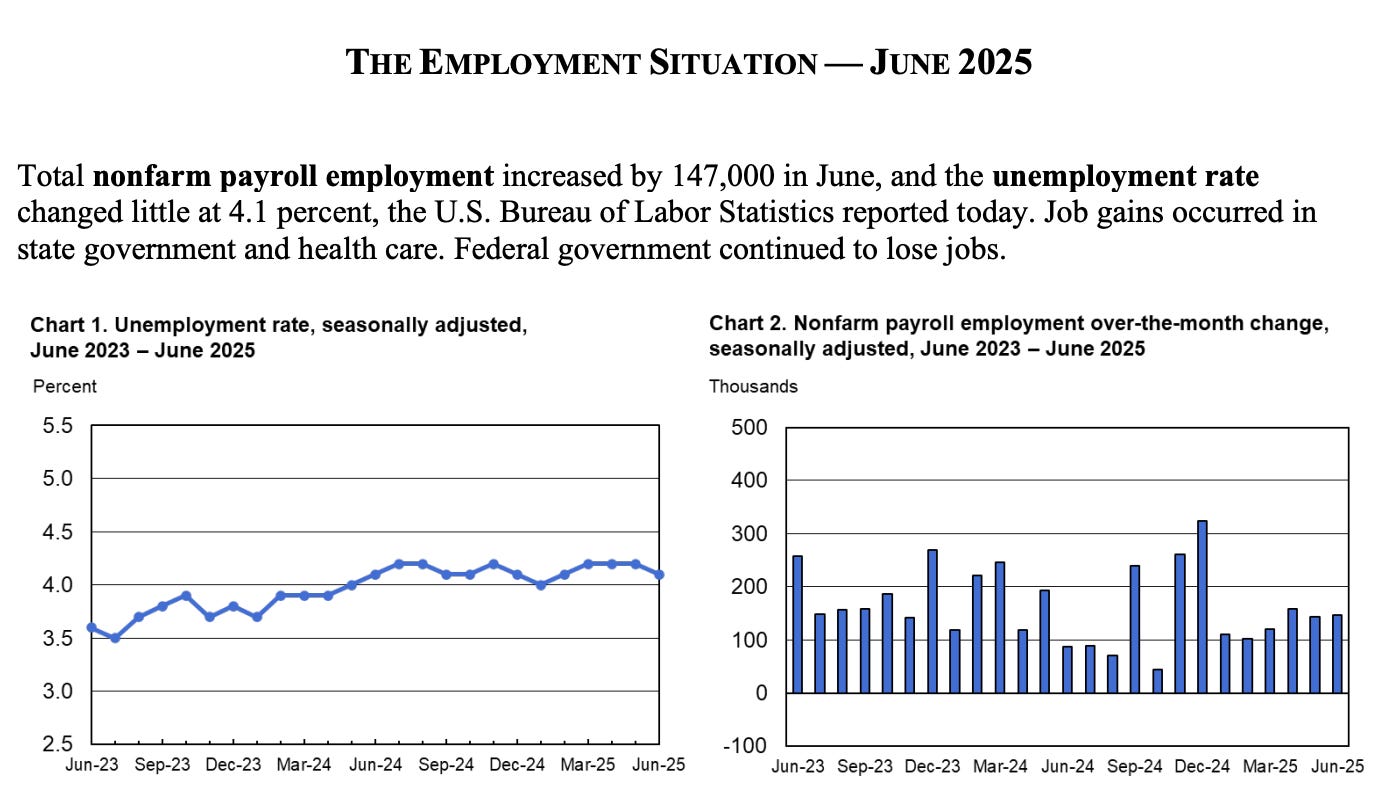

New jobs data dropped this morning.

With US economy added a stronger than expected 147,000 jobs in June with native-born workers gaining 830K while foreign-born lost roughly 348K jobs, no doubt due to the Trump Administration’s illegal immigration crack down.

Some people live and breathe these numbers, many online on saying this suggest rate cuts will be delayed yet again, my gut tells me these numbers don’t tell the full story especially given the past revisions we’ve had. There is surely some cooking going on to paint the optimal picture.

We’ll have to wait and see — as of now (10:30am ET) equities are slightly up.

Microsoft is laying off 9,000 — the AF Post and other outlets are reporting that the company is simultaneously seeking approval for a batch of 14,181 new H-1B visa hires in 2025 (more on this towards end of markets section)

The Senate Banking Committee is set to hold a hearing on crypto market structure on July 9, 2025 (Cointelegraph)

The US unemployment rate fell to 4.1% which was lower than expectations

Healthcare stocks are currently underperforming the S&P 500 by the largest margin in more than 24 years (BarChart)

Goldman Sachs flagged slowing consumer activity, noting weaker credit card spending in Q2 and trimming their growth expectations for its retail segment. Some analysts have interpreted the update as a leading indicator of broader demand softness

Morgan Stanley downgraded several regional banks, citing mounting pressure on net interest margins and rising commercial real estate exposure as risks heading into Q3

Citadel reportedly pulled back from certain AI-focused public equity positions, trimming stakes in high-flyers like Supermicro and SoundHound AI after a parabolic run in Q2

SoFi shares spiked over 7% midweek after the company beat earnings expectations and guided toward stronger deposit growth, benefiting from continued migration away from traditional banks

Robinhood stock moved higher following reports that its new tokenization framework is gaining traction with regulators, potentially positioning the company to capitalize on the next leg of on-chain finance adoption and defi

The Fed’s Conundrum

President Trump said this week Fed Chair Jerome Powell should "resign immediately” along with writing him a handwritten note with an image of other country’s rate levels as well that said he is too late.

Treasury Secretary Scott Bessent is also becoming more verbal on the situation saying recently, that the administration is seeking a replacement for Powell.

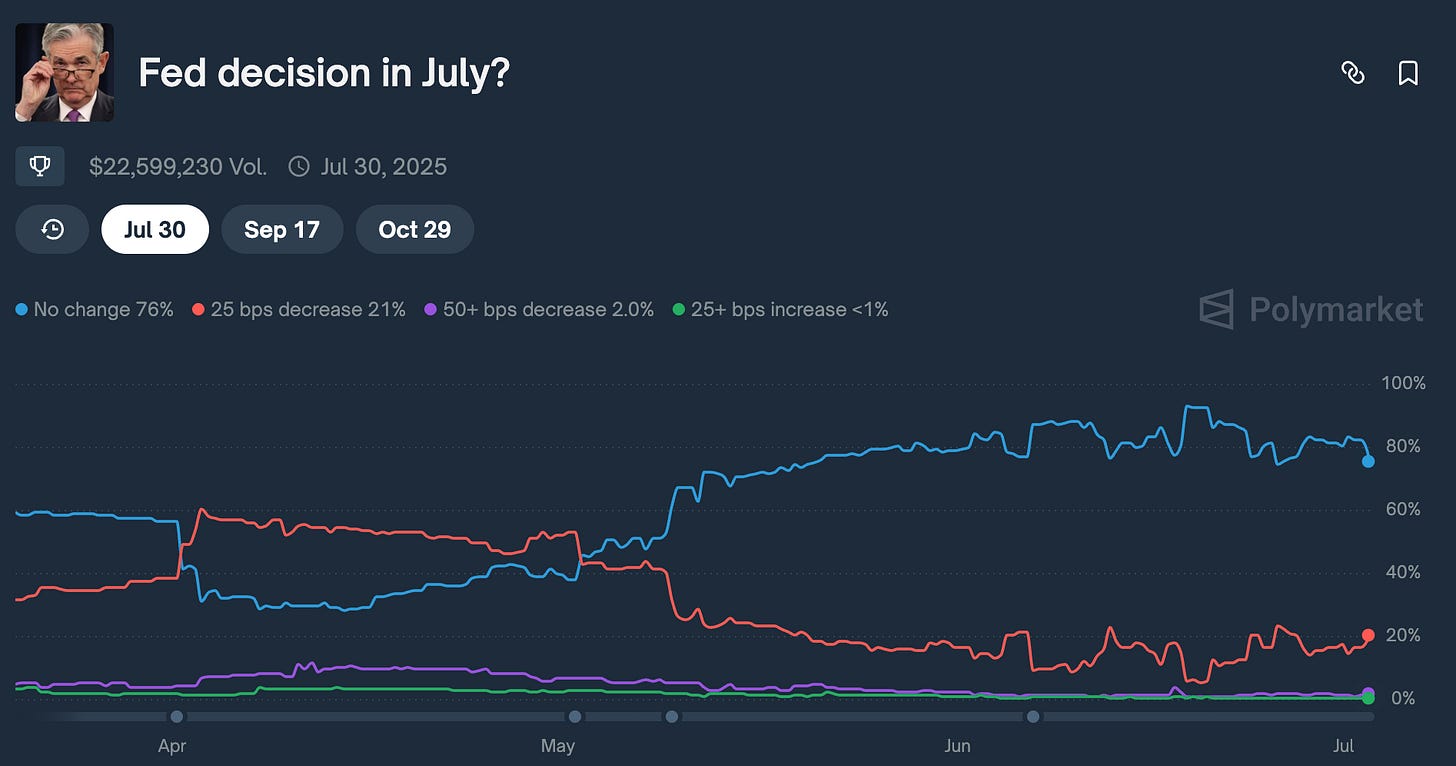

Polymarket, who recently announced a partnership in early June 2025 with X, has some excellent odds on all kinds of topics right now, including what is going to take place with the Fed in July.

Right now on the chart below you can see (as of 10pm ET last night) that the odds of a 25bps rate cut are at about 21% with the majority betting that there is no change still. This will be an interesting one as pressure from Trump and Bessent against Jerome is mounting publicly. You can check out the live odds HERE.

If you want the latest estimates by big bank — check out the markets section from Tuesday’s post.

Layoffs in Big Tech

Microsoft is the latest big tech company to have sizable job cuts.

If you’re paying attention you may be sensing that layoffs are accelerating despite the picture that official data paints. If you just talk to people in corporate they all have stories of layoffs, pressure increasing, and cost cutting initiatives across their companies.

A big component of this — is that it’s so much cheaper for corporations to leverage programs like H-1B for cheap outsourced labor. It can be for HR, IT, Marketing, etc. but the point is, it’s a whole lot cheaper than hiring Trevor from Rutgers or Marie from Penn State to do.

This post does a solid job of diving into the H-1B dynamic. All of this ties right back into multiple posts I have out out in past months but chiefly the United States of What, Exactly? post from last week.

Watching endless waves of foreigners come into your country unchecked is one thing, having them take your jobs at a cheaper rate while AI simultaneously eats multiple industries just adds insult to injury. Bleak indeed.

Something’s gotta give on this front.

Bitcoin, Crypto, and M2 Money Supply

US M2 Money Supply just hit a new all-time high of $21.94 trillion.

Crypto markets have been relatively steady this week and are beginning to show life, with Bitcoin hovering around key levels and altcoins showing mixed performance.

After months of contraction or flat growth, recent Fed data shows M2 expanding—a sign that liquidity conditions are easing at the margins. In simplest terms possible: when the money supply grows (which it will, because we are addicted to printing), risk assets like Bitcoin and crypto historically benefit from that liquidity boost.

That’s because more liquidity in the system means more capital looking for asymmetric upside and fat gains. It just so happens crypto, led by Bitcoin, is still the ultimate liquidity beta trade besides maybe AI and big tech.

Remember for Bitcoin in particular, M2 growth soaring is traditionally a long-term bull case. It underscores the original thesis I’ve spent 6 years talking about: Bitcoin as a hedge against fiat and currency debasement, which just keeps getting worse. Combine this with surging ETF flows and looming rate cuts, and you get a setup where macro + structural demand may push BTC and majors higher into Q3.

TLDR: things are bullish right now if you place heavy weighting on M2 trends AND global liquidity.

I continue to watch Ethereum. That is the spark for up only season.

I need more AAVE and PEPE.

See Tuesday’s post for my specific crypto holdings going into July. Wouldn’t be surprised to see a big 4th of July weekend pump from crypto while traditional markets are closed.

Global News & Geopolitics

The geopolitical powder keg we’ve all become numb to continues to simmer with flashpoints across multiple regions demanding investor attention.

This week, escalating drone warfare in Eastern Europe, sharpening rhetoric out of China, and renewed military posturing in the Pacific underscore a global shift toward confrontation rather than the years long détente strategy.

Meanwhile, Western defense budgets continue accelerating (yes you should have defense names squared away by now), and global markets are adjusting to the reality that war is no longer an outlier risk, it’s becoming a central feature of the decade and one that will likely intensify in the coming years.

Delta Flight 3247, a Boeing 737, lost a part of a wing flap while flying over North Carolina (BNO News)

US plans to engage in nuclear talks with Iran in Oslo next week (Axios)

A Small plane that was carrying 14 people crashed near an airport in Gloucester County, New Jersey yesterday

Multiple people were injured in a shooting at Oglethorpe Mall in Savannah, Georgia

Diplomatic ties between Russia and Azerbaijan are rapidly fraying following the death of Azerbaijani nationals in Russian custody and retaliatory cyber actions—highlighting Moscow’s slipping influence in the South Caucasus

President Trump confirmed he will speak with Russian President Vladimir Putin in the coming days, as European leaders reaffirm support for Ukraine and discussions continue around expanding drone production capacity for Kyiv

Oil prices have stabilized after a brief rally, with traders awaiting further direction from OPEC+ and key U.S. employment data that could shape future demand forecasts

Iran has officially suspended its cooperation with international nuclear inspectors, reigniting global uncertainty around its atomic program’s future. Does anyone know what actually happened to their facilities?

Espionage & China

This week, two more Chinese nationals were arrested for photographing U.S. naval installations and attempting to recruit Navy personnel on behalf of China’s Ministry of State Security. Yuance Chen, 38, and Liren “Ryan” Lai, 39, appeared in federal court June 31 to face charges issued by the Northern District of California regarding illegal clandestine activities on behalf of the Ministry of State Security, China’s primary intelligence agency (Navy Times).

“This case underscores the Chinese government’s sustained and aggressive effort to infiltrate our military and undermine our national security from within”

—Attorney General Pam Bondi

The case highlights a sharp uptick in foreign espionage activity and adds fuel to the already growing fire around domestic defense and intelligence funding. Will Tanner and I recently discussed the Wheat Blight bio-sabotage plot tied to Chinese nationals at the University of Michigan on Episode 33 of Risk On, just one of many asymmetric threats flying under the radar. One of the other major ones being the purchase of strategic land near US military installations by CCP adjacent parties and individuals.

In response, lawmakers are pushing for broader modernization efforts in surveillance, counterintelligence, and autonomous defense capabilities—further strengthening the long-term case for advanced defense contractors and next-gen tech firms in the space.

Make sure you get some exposure to this in the coming years through companies like PLTR 0.00%↑ and Anduril when they go public — this is going to continue to be a major focus and spending concentration for the US government. Classics like LMT 0.00%↑ RTX 0.00%↑ and others are great to hold as single names or in my favorite ETF PPA 0.00%↑ .

When Ukraine is resolved or fizzles out — attention is going to likely turn to the Pacific front and what China plans to do in the coming months and years. The book below, is the one that Will and I reference on Risk On — written in 1999 by two colonels in the People's Liberation Army (PLA), it gives a sobering insight into how China is playing the long game against the West and highlights the exact tactics being employed.

Alligator Alcatraz

In a diabolical move that I don’t even think I myself could have thought up, the strategy of using dangerous animals to deter AND contain criminals now seems to be fair game.

The Trump team just unveiled a dystopian new piece of immigration enforcement infrastructure in the heart of the Florida Everglades—a massive detention site dubbed “Alligator Alcatraz.”

"They're not serious people. What an embarrassment. Imagine the rest of the world looking at that. $450M a year of wasted tax money for pure theater”

— Gavin Newsom on Alligator Alcatraz

Built in just eight days at an abandoned airstrip surrounded by swamps, gators, and Burmese pythons, the site is essentially a natural prison. No fences or walls are reportedly set up, just miles of unforgiving terrain and dinosaur like apex predators.

Officials say it will soon hold up to 5,000 detainees, with the first group reported to be arriving imminently.

The facility was funded using state emergency powers and FEMA reimbursement mechanisms, bypassing the typical bureaucratic red tape (for obvious reasons lmao). Florida's leadership is calling it a model for future enforcement, while Trump himself toured the site this week alongside DeSantis and DHS Secretary Kristi Noem, joking that escapees would have to “run zig-zag” to dodge the dangerous wildlife.

Critics, including local tribal leaders and environmental groups, are already mounting for lawsuits calling the project ecologically reckless and politically “sadistic”. But for Trump and his allies, that’s part of the appeal—turning nature itself into a security system and making a brutal political statement in the process after years of people joking about putting machine guns and moats at the Southern Border.

It’s unhinged but pretty typical considering what we’ve seen so far in this administration, and remember — these aren’t innocent people being put here, they’re hardened criminals.

Personally if I was escaping from prison or a detention center I would rather get shot or tazed than dragged under swamp water and death rolled like a gazelle by a 12 foot gator but that’s just me.

That’s it for today folks — enjoy the long weekend, crush some units and tequila in the sun, and decompress. We will be back first thing next week. If you guys want to stay plugged in over the weekend just hop in the discord or follow on X for shitposting, markets/global news updates, and more.

Cheers

Andy

Gemini Crypto - Get Free Bitcoin

Gemini - Crypto Credit Card (Cybertruck giveaway)

Protect Your Crypto with Trezor

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before

"I have 10 liters of Casa Migos, Pineapple Juice, and Lime Seltzer calling my name." I am right there with you, I'm across the street from LI sound with only the swimming pool in my way! $BBAI sure looks like it's headed right back to it's highs of a few months ago. I actually bought some $SPY puts just before the close at 1 pm today, the 621's for 7/8 and they are already up 7%. Although the trend is def higher, I think we may see a pullback. - although I've certainly been wrong before. I will add that I have a nice cash position in my futures account waiting for an eventual rollover and when that happens, I will be selling $ES contracts at a life altering pace. Have a great weekend, God Bless America

R.e H1s - there are quite a few companies cutting perm residents of the US and replacing them with H1s (via outsourcing companies) right now