Markets, Minnesota, and the Breaking Point

521: There Is No Middle Ground

Morning everyone.

Hope you stayed dry and warm if you were impacted by the spurt of cold weather and snow across the US this weekend. We got about a foot and a half where I live.

The last several Arb Letters have done very well from a visits and reader perspective, so make sure to check them out in the archive. We cover tokenization, crypto, stock picks for 2026 and more.

We are going to start today with a quick summary of market action in the last several days before diving into the very critical issue present in Minnesota.

What’s going on there is an early indicator of the future of movements that are growing not just in the US, but around the globe.

Where Do You Make Money Right Now?

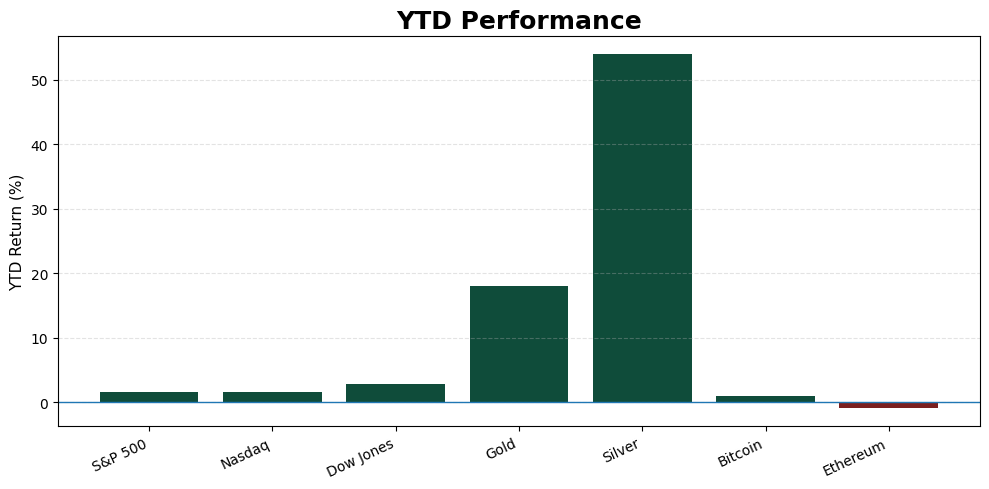

Pretty insane 2026 for markets so far. We will do a comprehensive guide on Thursday.

Whether it’s Uranium, metals, crypto, or equities, it’s difficult to even get an idea of where the puck is headed next.

Uranium isn’t ripping on hype. It’s moving because years of underinvestment is now finally colliding with rising demand. Governments are reopening the nuclear playbook to secure power, meet climate targets, and support surging electricity needs from AI and data centers.

Some of the more popular plays from our Discord include:

I am still DCAing into defense names like KTOS, PPA, and LMT/LHX right now.

Polymarket has a 79% chance of a US Government shutdown by Saturday you can view the odds here

Yale tuition price being lowered to $0 for any families making under $200k/year (Polymarket)

A Goldman Sachs report suggests that hedge fund hiring and allocation in Asia should spike in 2026

UNH 0.00%↑ stock is down 18% today so far after a miss for revenue estimates for fourth quarter

Google has agreed to pay $68 million to settle a class-action lawsuit that alleged the technology giant's voice assistant had illegally recorded users and then shared their private conversations with advertisers (CBS)

The Federal Reserve's next FOMC meeting is taking place on January 27-28, 2026. The policy decision and interest rate announcement will be released at 2:00 p.m. ET on Wednesday.

Markets broadly expect rates to be held steady, with the focus shifting to Powell’s tone around inflation persistence, labor market softness, and the timing of any eventual cuts later this year.

In other words, this meeting is less about the decision and more about the messaging. Any hint that the Fed is growing uncomfortable with financial conditions easing too quickly, or that the inflation risks remain asymmetric, could move markets fast. Silence or vagueness likely keeps the maddening chop we are experiencing intact.

This week I am closely watching SWBI 0.00%↑ AVGO 0.00%↑ NAK 0.00%↑ and NB 0.00%↑

We will talk more about SWBI and related names Thursday, I think there’s a play to be had there heading into midterms.

Crypto

I said on X last night that I think we are getting close to all time low local sentiment on crypto. I see so much despair, cope, anger, and apathy now on the X timeline.

Crypto looks different this “cycle”. Bitcoin is holding levels with Ethereum lagging. Institutions are allocating through ETFs, custody, and tokenization infrastructure while retail remains largely checked out.

To me it feels like positioning for what is to come, not speculation.

I am buying some more ETH this week and will potentially top off some of my LINK wallets as well.

In crypto news this week:

Chainlink has added 14 new integrations across 8 chains recently

Tether announced the Launch of USA₮, the federally regulated, dollar-backed stablecoin

$15B Bitwise partners with Morpho to launch onchain yield vaults targeting 6% APY (CoinGecko)

Nasdaq moved to remove position limits on Bitcoin and Ethereum ETF options

Spot Bitcoin and Ethereum ETFs have seen roughly $2B in weekly inflows

BitMine Immersion Technologies disclosed it holds over 4 million ETH

PYUSD, by PayPal has crossed $400M deposited on Aave

My full crypto thoughts Thursday.

Minnesota, ICE, and Violent Resistance

In Minneapolis this month, aggressive federal immigration operations have culminated in two highly controversial and fatal encounters between U.S. Immigration and Customs Enforcement (ICE)-affiliated agents and residents, igniting national outrage and political conflict.

The first incident occurred in early January during a broad immigration raid, when ICE personnel shot and killed Renée Good, a 37-year-old U.S. citizen after she accelerated her car towards an ICE agent.

People are still debating if she hit the agent and if the response was proportional. The shooting intensified scrutiny of the federal crackdown, fueling protests and debates over use of force and civil rights in immigrant communities.

Then last week on the 24th a second fatal shooting further escalated tensions. Alex Pretti, a 37-year-old Minnesota resident and ICU nurse, was confronted by Border Patrol and ICE agents amid the ongoing enforcement presence.

Eyewitness accounts and video footage claim Pretti was moving to help others during a chaotic encounter that were being pepper-sprayed and physically subdued by agents. Within seconds after a struggle, officers fired multiple rounds, killing him. A photo of Pretti’s reported carry gun (a Sig Sauer P-320) circulated the internet after.

The Trump administration defended the agents’ actions as necessary, but some have pointed to the circumstances as evidence of excessive force against someone who posed no clear threat. Several theories are floating around about what happened, my final read is that Pretti’s personal firearm misfired (and agents reacted) or they thought he was reaching for a firearm and responded.

One thing is apparent (and maybe more so in the Renee Good shooting). We are all seeing the same videos but people have wildly different interpretations. The Pretti shooting was more likely a “bad shoot” than the Renee Good shooting. BOTH were the result of protestors inserting themselves into unpredictable and volatile situations to begin with.

I talk all about the two realities in the US and across the world all the time in Arb Letter. These realities are driven by political views, the reality is if you’re anti ICE you don’t care if ICE is justified in these shootings.

Broadly speaking if you’re a leftist, you think these are executions, inexcusable.

If you are to the right on the political spectrum, you see little to no issue even if you concede one or both might of been “messy” from an optics standpoint.

What disheartens me a bit is that it really seems like nobody learned their lesson in 2020, Covid, and similar events we have watched play out in the last ten years or so.

Most do not understand how close we are to what’s happening in Minnesota breaking out all across our country.

You’re allowed to have your own opinion on all of this of course, but mine is pretty straightforward: