Into the Mouth of the Dragon

071: Pelosi to Taiwan, Top Buying Opportunities, What's Next

For those that are new to Arb Letter we’ve grown to a community of over 14,200 investors, traders, and individuals looking for an edge and unbiased takes on markets, crypto, global news, and life. Subscribe below to join the Arb Letter community.

China

While there is nearly no way for us to effectively broach the entirety of China in a single post this is going to be a quick update on several items including:

Nancy Pelosi’s recent visit to Taiwan

The best buying opportunities in Chinese Markets

What we think comes next

The War in Ukraine simply wasn’t enough, so the current administration has decided to taunt another of our major geo political foes by sending Nancy Pelosi to Taiwan amid threats by Beijing and the PLA.

In my opinion, outside her own business and political reasons for going, this was a publicity stunt, and a dangerous one at that. America media outlets are already praising her bravery for the trip, but the reality is it posed a serious threat to regional stability and likely undermined our relations with China even more for the months to come.

Though the Chinese have made many many warnings over the years, none have amounted to anything substantial - temper tantrums at best - at least so far.

House Speaker Nancy Pelosi landed in Taiwan late this past Tuesday in a relatively high-profile visit that has grown tensions even further between the U.S. and China.

The PLA and Chinese forces responded with several displays of military aggression over the past week including, Fighter Jet sorties, missile tests, and naval exercises around the island of Taiwan.

The visit was highly anticipated and wasn’t announced until the last moment, where it met aggressive backlash from China and worried many US policy experts that the visit could trigger a conflict and worsen relations with China in the region.

Spokespeople for China's foreign ministry said on Twitter, "The US & Taiwan have made provocations together first, whereas China has been compelled to act in self-defense."

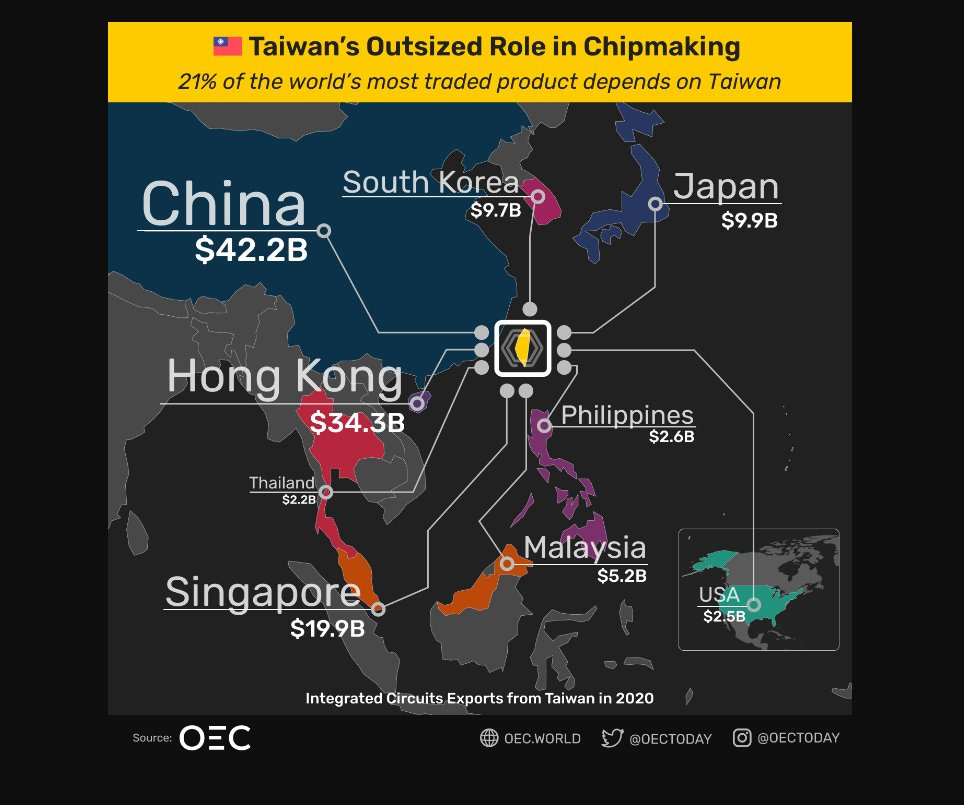

There are many signs China is preparing to ramp up economic pressure on Taiwan in the near future and Xi has mentioned multiple times that he plans to unite China and the island once again by peaceful or not so peaceful methods. Remember Taiwan is not only a stalwart of democracy in a communist nest, they also primarily export agricultural goods and electronics/ semiconductors to China and the rest of the world, making it a valuable lynchpin for several industries and a critical alliance for the United States.

It is no coincidence that Pelosi was visiting chipmakers on the island this week. Perhaps she was assessing if how the competition is faring against NVDA for the future LOL.

The day before Pelosi arrived in Taiwan, the Chinese government suspended 100+ categories of food products set to be imported from Taiwan to the Chinese mainland. Those economic constrictions will likely continue as Taiwan shows bold support for the West.

Despite the geo political turmoil, China is suffering from a number of domestic and economic issues that have only magnified since the onset of the Covid 19 pandemic nearly two years ago.

Remember, that the Chinese economy which is highly centralized (and by consequence efficient) is a beast and many are worried it will outpace the US economy and markets structure after dominating us in growth for 30 years, but that could be short lived if issues aren’t resolved.

The Chinese seem to have hit a hangover of sorts after years of aggressive growth domestically and centralized government policies. Major developments include:

Some 65 million housing units (20% of countries housing) are unoccupied in China - this leads to wasted resources and mounds of debt (Evergrande debacle)

Total debt rose from 180 percent of the nation’s gross domestic product (GDP) in 2010 to almost 300 percent at last measure (City-Journal).

Manufacturing data has recently slumped bringing fears of a worsening trend

Bank Runs in Henan and other provinces have begun as people try to secure their deposits

People are boycotting mortgage payments

A proposed incoming massive stimulus bill of roughly $220B

As Xi Jinping secures his third term (and likely becomes China’s most powerful leader since Mao Zedong) the country will undoubtedly shift it’s focus away from it’s historical economic growth and more into where it sits on the global power front.

While we are hardly experts on China we see several opportunities amid the chaos that we believe will be solid long term picks.

Some you’ve likely heard of, others maybe not. Remember this isn’t formal financial advice. We break down equities into simple to understand concepts that you don’t need a CFA or Portfolio Manager to read into.

For advanced investors this will serve as some good confirmation material for existing theses and for noobs this is great content to get started in how you think about opportunities in China. Let’s get into in our top 4 investment ideas in China for the short to medium term.