Gym Bros, Gamestop, and Ghibli

388: GameStop buying Bitcoin, D.C. fumbles a group chat

Good morning,

Weather is beginning to get warmer, markets are staying volatile, and we’ve got a new slew of stories to cover. Outside the usual financial markets and global news sections today we’re going to dive into the most recent craze online — daily routines. Then we’ll do a refresher on my favorite resident meme coin, the recent Signal-gate scandal, and touch on Gamestop’s announcement to purchase Bitcoin this week.

Let’s get it.

Financial Markets

I can tell from general engagement across platforms that many are still licking wounds from the recent sell off and market volatility we’ve been seeing.

Fear not — as I detailed in last week’s post, I think brighter days are ahead for us in 2025. The tariff mania should begin to ease into the end of March and by mid April hopefully we will have some more clarity on the Fed’s next move.

If you guys missed the top posts from earlier in March you can find them linked below:

10 Lessons from Wall Street’s Greatest Legends

How to Make Your First Million Dollars

Janet Yellen, the former Treasury Secretary and Federal Reserve Chair, has joined PIMCO's Global Advisory Board. She'll be serving alongside Raghuram Rajan, the former head of India’s central bank. The board will now be led by former UK Prime Minister Gordon Brown, who takes over from Ben Bernanke after his ten years in the role.

The S&P 500 slid over 1% while the Nasdaq dropped more than 2% yesterday as investor uncertainty rose over new auto tariffs.

The US is rolling out 25% tariffs on imported cars in a bid to revive domestic manufacturing, triggering market volatility

Nvidia and Tesla both sank over 5% as tech names got hit in a broad market sell-off

Dollar Tree is offloading Family Dollar in a $1B deal to private equity as part of a streamlining push

Avon shares jumped nearly 10% after landing new defense contracts with NATO forces and European navies

23andMe filed for Chapter 11 and saw its CEO step down amid fallout from a data breach and plummeting trust in the future of the business

James Hardie is buying AZEK for $8.75B to expand in the US housing and decking space

Smiths Group is breaking itself up, spinning off new two divisions to simplify and hopefully boost returns

Napster got scooped up for $207M and is now pivoting into a music-led social platform under new ownership

HSBC has cut its US equity rating from overweight to neutral, citing macro risks and ongoing trade tensions — reports are also breaking HSBC fired a number of bankers on a recent Bonus day AND refused to pay out bonuses lmao

Many of you will remember from earlier in the year when I discussed the possibility of another company announcing bitcoin purchases — I even called out one day that it wouldn’t surprise me if it was GameStop given CEO Ryan Cohen’s penchant for thinking outside the box.

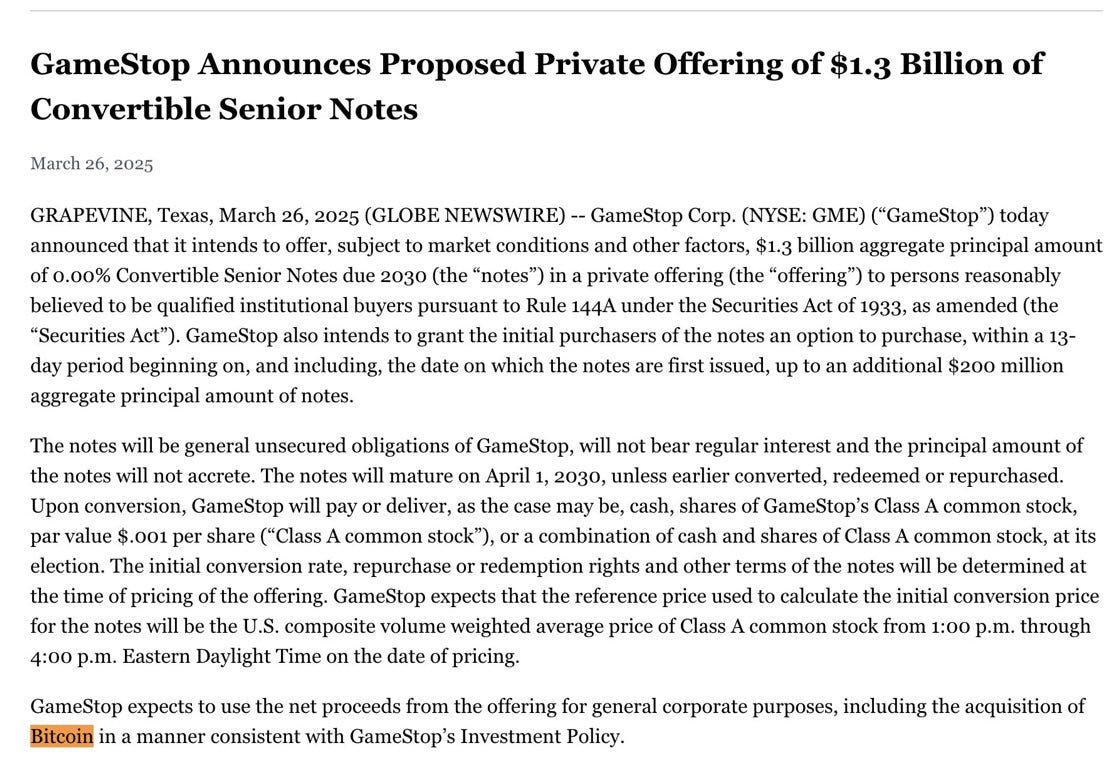

GameStop GME 0.00%↑ announced just that this week, with intentions for a private offering of $1.3B in convertible senior notes to fund the acquisition of Bitcoin, mirroring the same strategy that Michael Saylor has employed for several years now.

As we see the tariff mania and general macro uncertainty cool off we should see other companies procure Bitcoin in 2025.

While we’re certainly out of the madness we saw earlier in the year in the pump fun/meme coin era — I suspect we will see a resurgence some time in 2025. One of the particular meme coins that has held up VERY well over the past month or so is PEPE.

Price is up 20% in the last three days with market cap sitting around $3.62B, in the last 24 hours or so PEPE is the top performing meme coin. The daily trading volume for PEPE has surged by 30% to $630 million, indicating heightened market activity and investor/trader interest even with broader crypto prices down (Digital Watch Observatory).

I talk quite a bit about crypto survivors — you have to keep an eye on the most resilient coins/tokens when the major (BTC/ETH/SOL) bleed. Those are the ones that can catch an insane bid when the show starts up again. The PEPE meme is simply too strong and well known to fade away after one market pullback.

PEPE is an ETH Beta play — as ETH goes up PEPE follows. I remain bullish on ETH in 2025 and took the last 4 weeks to add more at some great prices.

Geopolitics

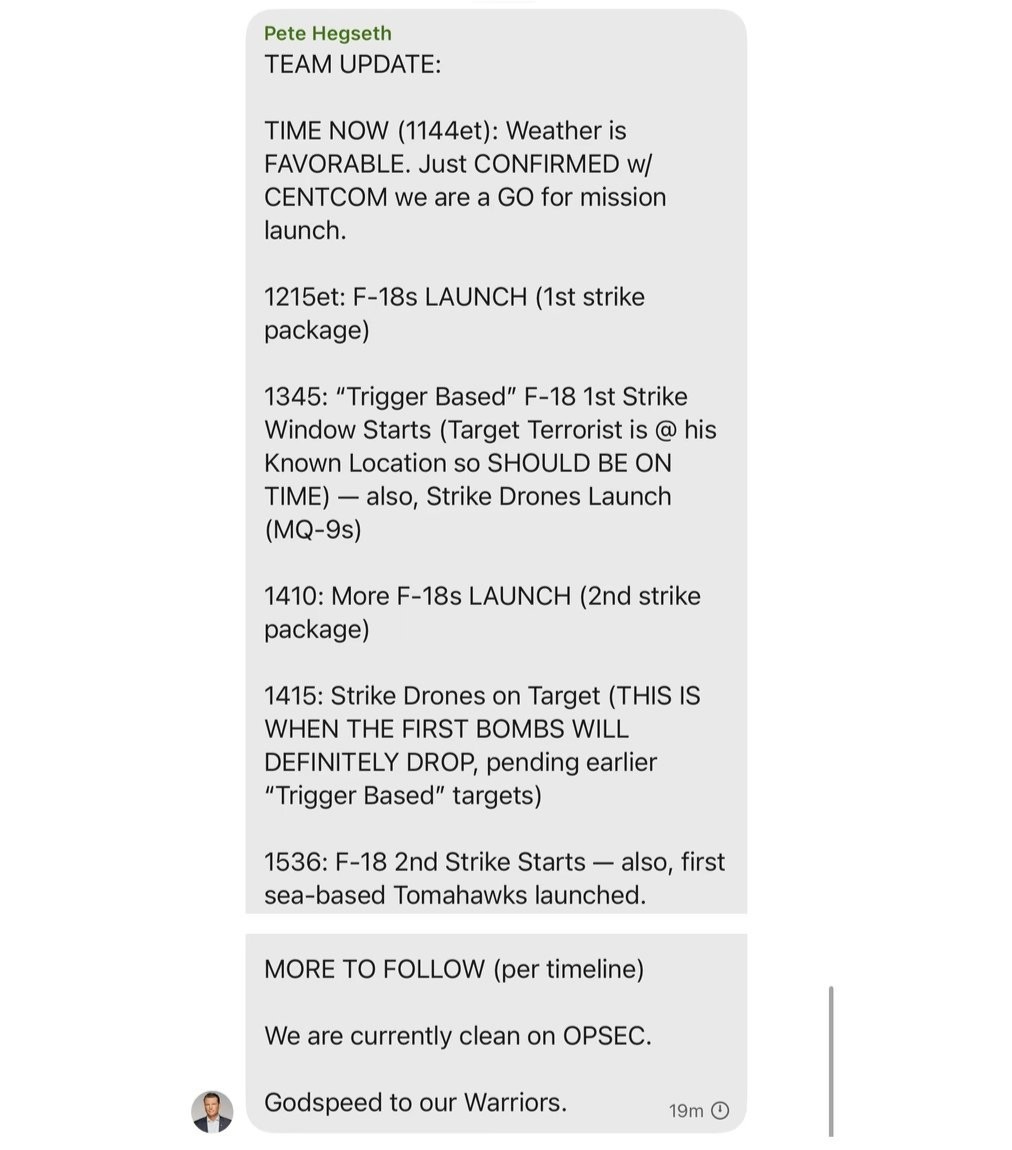

This week, a private group chat on Signal involving top U.S. officials was reported by The Atlantic to include a journalist (Jeffrey Goldberg, the editor-in-chief of The Atlantic) in a sensitive conversation about planned military actions and airstrikes in Yemen.

The situation has sparked well deserved criticism over how secure communications are handled at the highest levels, and the US government is said to be conducting a review to figure out how it happened and how to prevent it going forward.

The Signal group chat included National Security Adviser Michael Waltz, Secretary of Defense Pete Hegseth, Vice President JD Vance, Secretary of State Marco Rubio, Director of National Intelligence Tulsi Gabbard, CIA Director John Ratcliffe, Treasury Secretary Scott Bessent, White House Chief of Staff Susie Wiles, Deputy Chief of Staff Stephen Miller, and Special Envoy to the Middle East and Ukraine Steve Witkoff, along with staff members like Mike Needham and Joe Kent. It more or less read like a frat chapter group thread except with details of strike missions in Yemen.

If this went down the way it’s being reported — it’s obviously a major fuck up and is inexcusable. The event is obviously politically charged with theories surfacing that Goldberg somehow hacked access, or there is a broader plot at play. Of course it’s also possible somehow just fucked up and added the reporter.

Regardless of what happened this is a big slip up bringing heat on the Trump administration in it’s early months of foreign policy implementation.

The EU has reportedly asked for households to stockpile 72 hours of food amid ongoing war risks (Financial Times) the war prepping in Europe has ramped up alongside the defense mobilization efforts in Germany

4 U.S. soldiers apparently drowned during a training exercise in Lithuania this week according to multiple outlets

Americans’ approval of the Democratic Party is currently at around 26%, according to polls conducted by Rasmussen

Several people were wounded in Berlin last night after a man drove a car up on a sidewalk striking a large group of people — details sparse at this time

Turkey’s President is pursuing corruption charges against opposition leader Ekrem Imamoglu ahead of elections, triggering mass protests and concerns over democratic backsliding

HIV prevalence in Tigray has more than doubled since the recent war in Ethiopia, driven by mass displacement and widespread sexual violence. Damaged infrastructure and aid cuts are making the situation even worse

Social Media Crazes & Business Opportunities

The internet went crazy this week with two peculiar trends.

In the first instance social media entrepreneur/life coach Ashton Hall’s morning routines went viral recently — the videos were absurd featuring ice face dunks, banana facials, a faceless woman providing towels, cold plunges, business “deals” on computers, saunas, and 100M sprints in Florida parking lots. His instagram exploded to 9.9M followers.

It’s honestly tough to tell from the videos if this guy is serious or if it’s a giant show to drive more traffic to his accounts — which it absolutely is doing, along with driving sales of Saratoga water, the featured hydration medium in all of his videos. People have taken to the internet to post hilarious remakes of the video with some including degenerate morning activities like vaping, fapping, or dunking their face in a bowl of tequila and passing out.

It’s obvious to see why this is going viral aside from the clear comedic angles. People love this type of content — ASMR, high definition videos of other people’s lives — from appearances the guy is doing pretty well for himself and has an insane following. The new money crowd loves the seemingly endless boxes of luxury shoes and apparel that Hall puts in his videos — and I’m sure the metro sexual crowd loves the fact he’s a dude wearing Van Cleef (don’t do this fellas).

The “I am super rich, jacked, and successful” angle sells very well to people as does the meticulous and Patrick Bateman - esque routines he implements into his content.

We as humans are fascinated by what other people spend their time doing — because not only can we compare it to what we do everyday, but we can judge it from afar as well. To give credit where it’s due — Hall is clearly fucking jacked out of his mind and he’s constructed a blueprint to drive insane amounts of social media traffic.

Whether or not his business is a grift or legit is I have no idea — he could either be selling Forex guru type courses to make pencil neck weenies feel better about themselves or maybe what he’s shilling is actually valuable to people.

This should be an important lesson for those of you looking into starting businesses and launching products — couple things are obvious:

People love the idea of luxury lifestyles (real or perceived to be real)

Content that features ACTUAL people is on the rise in 2025

Fitness, health, and “aura” are major themes people are focused on

People look to lifestyle influencers and accounts for inspiration, products to buy, and trends to stay on top of

Hall puts out super aesthetic and high quality content people clearly love to follow

I didn’t have this on my bingo card as far as internet trends go but it’s a good reminder how fast new fads catch on.

The second major trend this week was a bit stranger. While I am NOT a consumer of anime, many people are and X along with other social media platforms are FLOODED with Studio Ghibli type images.

No clue what that is? Let me explain with the help of ChatGPT.

Studio Ghibli is a legendary Japanese animation studio known for its beautifully hand-drawn films, rich storytelling, and imaginative worlds. Founded in 1985 by directors Hayao Miyazaki and Isao Takahata, along with producer Toshio Suzuki, the studio has produced some of the most acclaimed animated/anime films of all time.

Some of Studio Ghibli’s most iconic movies include:

Spirited Away (won the Academy Award for Best Animated Feature in 2003)

My Neighbor Totoro

Princess Mononoke

Howl’s Moving Castle

Kiki’s Delivery Service

The studio is known for blending fantasy, environmental themes, emotional depth, and strong character development—often with a focus on young protagonists and subtle critiques/chirps of modern society. Its art style is instantly recognizable to fans globally: soft, water color like visuals with a deep sense of atmosphere and wonder.

Recently there was a new update to ChatGPT - this update, part of the GPT-4o rollout, includes native image-generation capabilities that have enabled users to produce and share these distinctive images (Axios).

People began turning their personal photos and iconic images into the classic dreamy, Studio Ghibli-style scenes using ChatGPT’s latest image feature. The AI-generated visuals capture the nostalgic and whimsical feel of classic Ghibli films, and users have been flooding the platform with their artistic transformations. Memes and knock off images followed within hours of the first ones breaking.

While the trend has taken off quickly, it’s also sparked some debate about the ethics of using AI to mimic such a distinct and iconic art style (and doing so within mere hours). Mike Tyson, major crypto companies, and other influencers have started to participate in the trend this week.

I am already tired of seeing hundreds and hundreds of these images all over Instagram, X, and other platforms.

Major takeaway from all of this?

The current “thing” is shifting quickly due to AI and the lightning fast attention span of the masses. It’s easier than ever to churn out content with AI and different tools.

If you are involved in media, social media, or online business — speed is going to be your ally these days but you also have to worry about saturation and noise. Consider automating aspects of your content generation or tapping extra help that can monitor trends before they explode like the ones this week. Despite being the “social media” space for 9 years, even I am finding it difficult to keep up with how fast things shift week to week.

Same thing can be said for financial markets/crypto. Understand that none of this data, content, or information flows is going to slow down, it’s only going to ramp up. You have to be able to quickly and decisively pick up on these trends in order to gain the edge.

I will see you guys Tuesday morning for a follow up post. I am interviewing Pete Tuchman (“Einstein of Wall Street”) the well-known stock trader and prominent figure who has worked on the floor of the New York Stock Exchange (NYSE) for many many years later today. I will aim to post this interview later today but if not first thing Monday morning.

Excited to announce a new AI series in the coming weeks as well that will look at every aspect of AI markets, development, stocks, and more.

Take care, have a good rest of the week.

Andy

10% OFF ALP POUCHES

Gemini Crypto - Get Free Bitcoin

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before investing and ensure you have a good understanding of your personal risk tolerance.

The fact that Napster is still around just blows me away. At least the name is still around.