Getting Rich AF on Meme Coins

267: Too Absurd To Ignore At This Point

If you had any remaining doubt about the utility of meme coins let me just step in here and say the utility is fat stacks of cash.

Just this week I have made 5 ETH on APU, PEPE, and PACMOON.

But let’s set the scene for this madness, as many are still skeptical of the entire phenomena.

Back in the day — say in the 60’s or 70’s or 80’s most people were well positioned to take on reasonable jobs and in reward, be able to afford a high quality of life in the United States.

The Boomers are the classic targets — drawing resentment from a large contingent of Millennial and Gen Zers who are struggling to achieve the same level of economic prosperity as their parents and grandparents.

Boomers and others had the opportunity to take a job, invest into equity markets, buy homes, and accumulate assets that were exposed to the largest economic boom in history. Boomers are by far the richest generation.

Even Gen X caught some great times economically. Back then the dollar was worth so much more.

As long as you invested in good companies or bought a decent home and just waited — you gained exposure to the largest economic booms on the face of the planet.

Not to say older folks didn’t work hard — but everything was less saturated and chaotic.

There are people making $100 to $150K in major cities that may as well be poor.

The most robust and enduring periods of economic growth in the US occurred during three distinct time frames: from early 1961 to mid-1969, with a growth rate of 53% (5.1% annually); from mid-1991 to late 2000, with a growth rate of 43% (3.8% annually); and from late 1982 to mid-1990, with a growth rate of 37% (4% annually).

Owning a home wasn’t some distant goal — it was relatively easy to do if you had a decent job. Home prices were lower, and there was less competition.

Boomers and other generations have billions upon billions of assets in real estate, equities, bonds, metals, and businesses.

Fast forward to today — in the unclear post Covid 19 landscape of Fed money printing, a surging national debt number, high consumer costs, entrenched inflation, and a looming US Election. CPI increased 3.5% year over year last month marked by sticky supercore items. Not too long ago average 30-year fixed mortgage interest rates went from around 2.8% in winter of 2021 up to a 21-year high of 7.7% in October of 2023.

Inflation is entrenched and the Fed’s dream of a quick pivot after Covid is all but shot now. Hell another hike could be on the way.

The big sigh of relief folks want in markets and monetary policy just isn’t coming soon enough.

Society is getting more and more degenerate — people are gambling on meme coins of animals to try and make it big or transcend social classes. There aren’t a whole lot of ways faster to be honest. Homes are mostly unattainable for the average person — layoffs are increasing and high costs are hurting everyone except the wealthy who do not need to work for income. BowTied Bull has documented this phenomena and so have other high profile crypto influencers like Anthony Pompliano .

You could make the argument that this elevated interest in trading and investing really started during Covid 19 when the AMC/Gamestop frenzy began and everyone from your cab driver to your grandma were downloading Robinhood to get in on the action.

This degeneracy is sure to continue — as people look for new ways to supplement less effective day job pay and higher costs, they will inevitably turn to the new penny stock casino that is meme coins.

About 39% of Americans are not contributing to any retirement fund and 30% believe they will never be able to retire comfortably, a recent MSN article says. Twenty-eight percent of Americans between the ages of 18 and 65 say they have nothing saved for retirement, according to the article (RepairDrivenNews).

People don’t even have enough to live comfortably right now let alone in retirement. Factor in future inflation or currency devaluation?

Future is bleak.

When crypto breaches new all time highs and the euphoria really sets in you’re going to see a mania like you never thought was possible. In crypto rising tides do truly lift all ships and meme coins will be no exception when BTC/ETH start to really run.

Can you afford to not have SOME exposure to these explosive magical internet coins?

That decisions up to you.

I vote no.

You can get set up in 10-15 minutes.

Some of The Top Meme Coins

So let’s talk specifics.

But first a disclaimer.

As I have stated many times before meme coins are simply a small piece of the equation for me. I have maybe 5% of my total crypto portfolio in the “meme” category. The majority of my stack is Bitcoin, Ethereum, Chainlink, Filecoin, and The Graph. For those of you who are new — I like to be completely transparent about my personal allocations.

The only new update to my portfolio is that I liquidated my 10,000 MATIC in order to throw some stacks at meme coins. MATIC wasn’t moving fast enough for me and I figure if I rip some quick wins on memes I can get back in for the longer term.

Back to meme coins — DO NOT INVEST MORE THAN YOU CAN AFFORD TO LOSE.

I could lose all of my meme stacks and be fine — annoyed — but fine. Don’t go gambling your rent or savings you cannot afford to lose chasing green candles. The emotion you bring into it will ruin your judgement.

That being said — meme coins offer huge upside if you time them correctly. Even if you are a little late to the party you can ride the momentum and make a nice profit before a big correction or sell off. People are getting ridiculously wealthy off meme coins — you should simply view it like you would any gamble, except if you time meme coins right you have an edge.

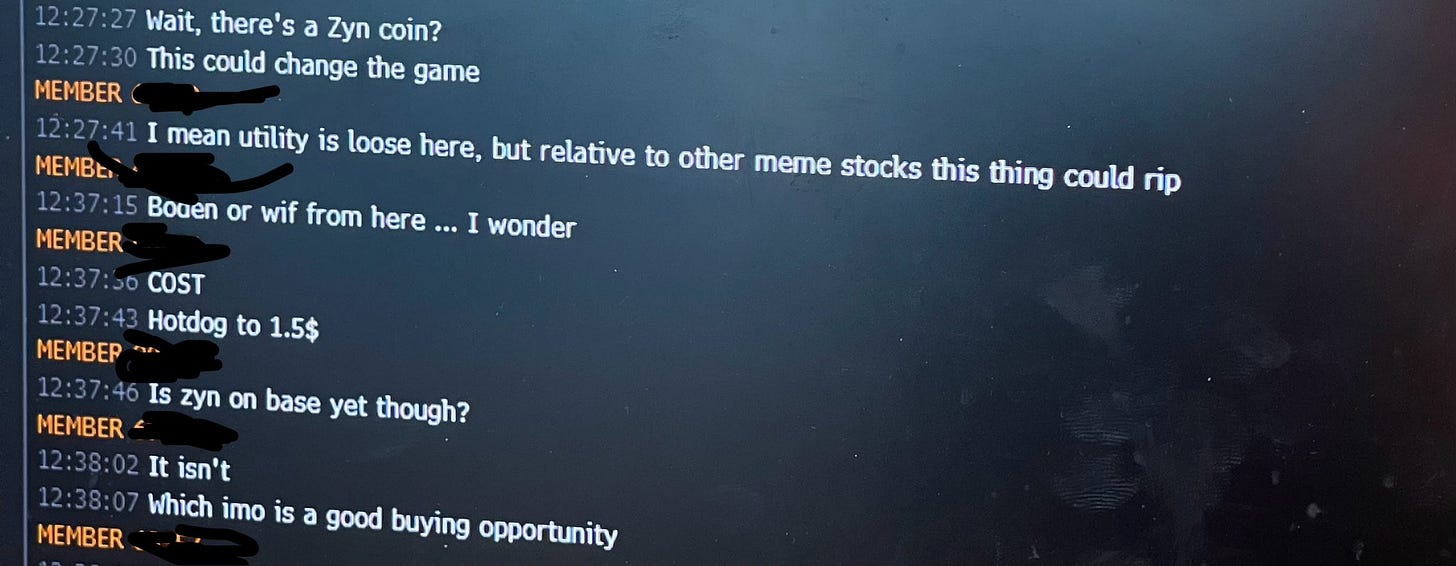

Meme coins are beginning to bleed into main street and Wall Street circles. Bowtied Night-owl of DeFi Education posted the following screenshots on Twitter this week during the peak of meme coin madness. Truth is — these types of insane gains are hard to ignore even if you do work in tradfi and think crypto is a scam or fad. I expect more and more critics to start getting into meme coins as the gains start to add up in the next few weeks.

Below are a list of the most talked about and trending meme coins. Let me be clear — I am not endorsing you to ape into these at current levels — some are up thousands or hundreds of percentages already.

Do your own research (whatever that means for meme coins) and only invest what you could be okay losing. A couple high level pointers when investing in meme coins:

Keep an eye on market cap — DOGE and SHIBA are former examples of how high some of these market caps can go (billions) but you can eyeball the math and get a sense for what multiple you might be able to make if you’re early enough. For example while the market cap of APU is unclear — it likely only has a 10-20x left. Any higher would be utter insanity (not impossible).

Look for meme coins that have strong cultish followings or cultural significance — PEPE and Zyn are good examples. The stupider the better in meme coins. I won’t go down the rabbit hole of the insane and sometimes racist Solana meme coins that surfaced weeks ago but many of them ran hard for a week or two

Always have a rough exit plan — selling some on a double or higher is generally good advice — just know that oftentimes when you sell it’s too early. Inversely you could end up bag holding a worthless token if you time it wrong. This is gambling make no mistake.

The rule of buying ultra red days and selling euphoric green days is doubly important in meme coins. Don’t let FOMO or panic drive you into apeing in at the ultimate top. Don’t let local corrections scare you off of gems

If you copy the address listed below - DOUBLE CHECK that it is correct. Cannot emphasize this enough. When you’re dealing with meme coins there are plenty of knock offs and scams that will attempt to catch careless traders or apes by surprise. Always double check.

These are meme coins I think are worth considering either for local short term trades or for longer term holds as we look for a new ATH from both BTC and ETH.

BODEN - Jeo Boden

Market Cap - $562,160,142

SOL Address: 3psH1Mj1f7yUfaD5gh6Zj7epE8hhrMkMETgv5TshQA4o

I missed BODEN but the way in which it ripped so fast should warn you of what could happen with other undervalued or fresh meme coins. Oftentimes the dumbest shit rips the hardest. It’s all about how culty the community is and how much control of price whales have.

Boden was one of the early meme coins that took off after fanatical buyers aped into it. I remember seeing it at around a 50M market cap. Boden and similar Trump cryptos may do very well leading into the next election.

WIF - dogwifhat

Market Cap - $3,532,571,870

ETH Address: 0xd1d2eb1b1e90b638588728b4130137d262c87cae

Another that I was simply too late too — WIF made many traders and investors who got in early pretty rich. After rejecting the $3.30 support level yesterday, WIF has surged past its 20-day exponential moving average (EMA) on the 4-hour chart, a bullish technical signal (Watcher Guru).

$4.00 is the next level most people are hoping for.

PAC - PACMOON

Market Cap - Unknown

Blast Address: 0x5ffd9ebd27f2fcab044c0f0a26a45cb62fa29c06

If you read our paid posts (which I highly suggest doing) you are well aware of the Blast Airdrop coming up in May and all of the dApps (decentralized applications) that live in this ecosystem. There are countless ways to airdrop farm and make money — and I mean make literal free money. PAC is the community token of PACMOON.

Two airdrops have already happened and a third is scheduled for the end of April. If you want to participate and become eligible just go to the PACMOON website and check out the details for airdrop 3. You basically just post content. So far I have made 40,000 PAC for free and PAC is trading at $0.10 — so a literal free $4,000. I of course wasn’t happy with just he airdrop so I bought more and sit on a nice bag of about 110K PAC all of which I have staked on Wasabi to earn both yield AND points/gold that will increase my Blast allocation in May.

PAC is in it’s true infancy but the community on District One and Twitter is insane. Highly suggest taking a look.

PEPE - Pepe

Market Cap - $2,886,637,314

ETH Address: 0x6982508145454ce325ddbe47a25d4ec3d2311933

Pepe has always been a meme that I have loved online — be it on the depths of 4chan or on various business forums. I have always found PEPE memes to be hilarious and the fact they were controversial and banned from twitter at one point makes the joke even better. I am turned $5,000 into $15,000 with PEPE in a matter of days — for now I am holding this position for much higher.

ZYN - Zyncoin

Market Cap - $63,611,366

ETH Address: 0x58cb30368ceb2d194740b144eab4c2da8a917dcb

I obviously love upper decky’s so when I came across Zyn Coin a few months ago I had to part ways with some of my ETH to get in on the action.

The project is innovating in some cool ways as well — touting an effort to allow investors to redeem actual Zyn cans for more shares in the project. Meme coins gain a large part of their potential pump power from cultural significance and awareness and if you work in finance or tech chances are you know about Zyn.

I think I will back another upper decky and buy some more today.

APU -Apu Apustaja

Market Cap - Unclear

ETH Address: 0x594daad7d77592a2b97b725a7ad59d7e188b5bfa

APU is arguably one of the best options on this list. For those who aren’t familiar with the lord APU is the internet frog meme and the little brother of PEPE. There’s a competitive race between APU and PEPE on 4chan and Twitter. The communities are both fanatic. I hold both and think they’ll both turbo pump in the coming month or two. One check of twitter or other channels will show you just how psychotic and fanatic APU shills and traders are. There has been some massive whales accumulating this during the last several days.

SQUID - Squidward Coin

Market Cap - $2,350,000

ETH Address: 0xa1a92f15c24ad358c3a4d0a8ba4f7db18fbfab2f

Don’t know much about this except for my brother having a position. Could be a solid low market cap pick. 4Chan is discussing the merit of picking SQUID over APU. Pay attention to blogs, 4Chan Biz channels, and twitter to get the latest sentiment check on some of these smaller coins.

ANDY - ANDY

Market cap - $46,000,000

Address - 0x68BbEd6A47194EFf1CF514B50Ea91895597fc91E

Andy is not affiliated with Arbitrage Andy - it is the brother token of PEPE. With a smaller market cap this could be one to keep on eye on — today the chart looks solid with a pullback from local highs over the last week or so.

If you want some ideas of others to look into check out this list of the top performing meme coins from Coinmarketcap. The top ones as of now are listed below.

If you want to get fully up to speed on meme coins and the craze in markets right now check out the post below after today’s.

What’s Next

If my hunch is correct long term holders of Bitcoin and Ethereum are going to become incredibly wealthy in the coming. If you can supplement those positions with gains from some meme coins you will be in a much better position than others. The ideal situation is this — you use about 5% of your capital you’re willing to put into crypto to pick a few meme coins that turn into winners. Once you’re happy with the gains you swap them for ETH ahead of the Ethereum approval.

The Ethereum ETF will get approved — it’s just a matter of time. BlackRock is already in the mix. They are not going to get denied.

That’s the primary alpha in the market right now.

Eventually a time will come when capital moves from meme coins to quality but for now it’s safe to say that “meme coins” will be a narrative for this cycle. People love to say “retail isn’t here yet” or “retail will be our exit liquidity” but the truth is retail is already back in crypto — they just aren’t apeing into quality alt blue chips or BTC/ETH right now. They want the higher risk and profits that meme coins offer and they want them now.

One things for sure — meme coins offer a rare opportunity to multiply capital very quickly. There are not many other ways to do this in the current world aside from dealing drugs, insider trading stocks, or being an absolute monster at options trading.

With meme coins you are betting on hype and the social phenomena of degeneracy which looks like it is here to stay until markets and monetary policy get back to some semblance of reality.

Can you really afford to scoff at these while you make a measly 8% in your 401K?

Those willing to take the risk and be prudent when it comes to cutting winners will outperform most others.

See yall next week for two paid deep dive posts. subscribe to receive.

Andy

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur. Nothing I say should be considered formal financial advice - always do your own research and diligence before investing and ensure you have a good understanding of your personal risk tolerance.

Doubled my $ZYN bag after reading this. They launched on base today as well, things are about to get real crazy.. avoid max pain kings.

$AMP

Amp is an open-source, decentralized protocol that aims to provide collateral as a service. It is a digital collateral token that aims to provide instant, verifiable assurances for any kind of value transfer. Amp's primary function is to quickly and irreversibly facilitate transactions for a wide variety of asset-related use cases. It was launched in 2020 with the intention of providing a fast, efficient, and transaction platform. Amp's unique interface allows for verifiable collateralization through a system of collateral partitions and collateral managers. These partitions can be designated to collateralize any account, application, or transaction, and their balances are directly verifiable on the Ethereum blockchain.