Crypto Poised for Comeback Season

295: Strategies for Surviving the Downtrend

If you’ve been in a crypto for 5+ years the recent sell off (that seems to never end) is par for the course. If you’re a new market entrant it’s painful, frustrating, and sometimes rage inducing.

One check across the crypto twitter timeline and you would think Bitcoin was trading at $10,000 again. In my opinion it’s arguably worse than some of the periods post FTX or even in the brutal bear market that preceded the Bitcoin ETF induced runs this year.

It’s a highly emotional time and I think that speaks to a number of factors including deteriorating macro conditions, a toppy stock market vibe ($NVDA putting the team on it’s back doe), and declining optimism in the job market and economy.

The good news is I think this dip is going to provide an excellent opportunity for most folks if they can keep their wit’s about them.

Later this week I will put out the presidential debate post complete with a drinking game and analysis of how I think it plays out. This will be free for all subs.

Today’s post is for paid subs. As a reminder, I’ve kept the cost low — on the lower end of Substack’s average — to make sure the most people have a chance to subscribe.

The cost covers the amount of time and diligence that goes into generating these guides, keeps ads to a minimum, and ensures that we don’t get a massive contingent of bums who only want things for free. It’s literally the cost of a cup of coffee per month — and my track record in crypto speaks for itself.

Had you been subscribed over the years you’d still be WELL into the money — and made 1000x minimum on the subscription cost. These aren’t super complex or mind blowing strategies — but they work.

Today we’re going to look into why we are dumping so hard, what you can do to mitigate losses, and examine the opportunities that are presenting themselves (there are many). I will also touch on a business update — reviewing why it is so critical to have side income coming in on top of your W2 salary or day job.

We will touch on it shortly but bottom line — it allows you to pull ahead SUBSTANTIALLY when we are gifted with these dips.

We will cover:

The causes of this sell off

Upcoming events to watch (ETH approval, Presidential Debate, BLAST Airdrop)

Why it’s so emotional right now

How to come out of it on top

Ways to bolster your ability to procure more assets

Expectations for the rest of the year

Why this could be the last chance to get positioned before mega adoption

“If most traders would learn to sit on their hands 50 percent of the time, they would make a lot more money.”

— Bill Lipschutz

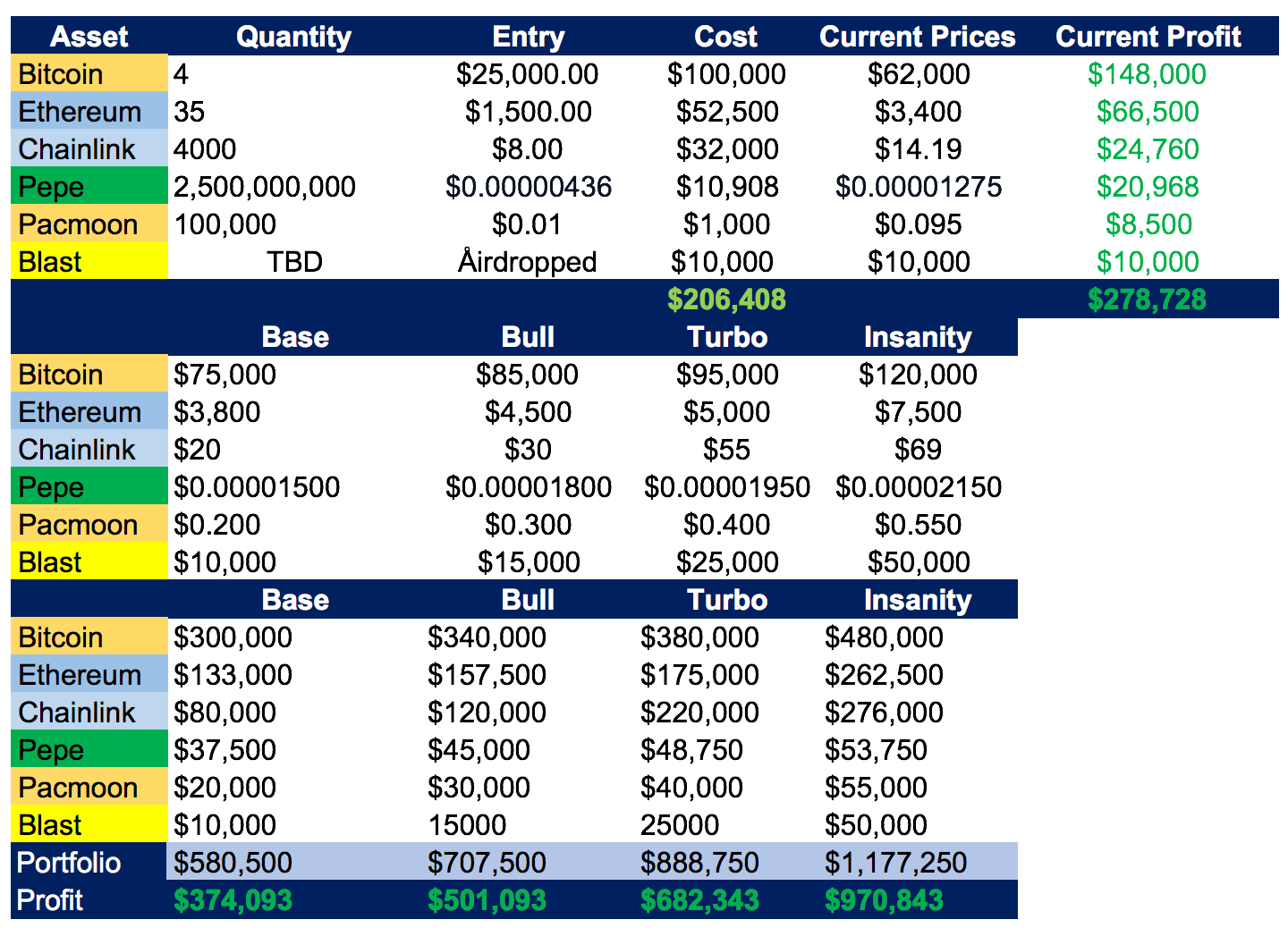

Quick Hypothetical Gains Chart

Fun exercise to start the day and spread some hopium.

Below is a crude chart showing a decent portfolio in many of the assets we have talked about in Arb Letter and the potential outcomes in the next several months in crypto — take it easy on me I made this on low sleep at 1am and remember it’s rough — everyone portfolios will be different, some higher some lower.

These quantities, entries, etc. are just random for fun but show what I decent portfolio might look like for someone who isn’t rich rich yet. I picked the assets that I currently hold save for a few random meme coins.

I thought the quantity numbers were a good starting point for:

a.) anyone who has been semi disciplined in DCAing

b.) anyone who has been risk on in crypto for the past several years

The assumptions on entry revolve around averages you should have been close to if you’ve been reading Arb Letter since inception and following my instagram loosely. I threw some PAC and Blast in here for fun — but you could substitute these for meme coins, higher risk plays, etc.

Bitcoin and Ethereum should be no brainers in anyone’s long term crypto portfolio right now. PEPE is my meme coin of choice, Pacmoon is a token on BLAST (which I have talked about), and the BLAST airdrop is tomorrow (that value is TBD but if you did it right $10,000 to $20,000 is doable for anyone who tried). Obviously subject to change.

(UPDATE - I received 156,000 BLAST - no clue where this trades, will update later) congrats to all who earned.

Free money.

At the bottom you can see several cases for where we end up — and while this is just speculation, you can see how $200,000 or so invested over the last 2 or 3 years could give you a shot at $800,000 to $1,000,000 portfolio. Not too shabby for 3 or 4 years.

Of course many have a lot more and some have much less — but if you work a decent front office job, have a side hustle, and invest over time this could’ve been feasible for many (maybe you got better entries than the ones I picked here). The bottom table is easily replicable in excel if you want to speculate and create a mini sensitivity analysis for crypto pricing and your holdings in the next few months or years.

Let’s talk about what’s going on in the market so we can get an idea of what’s to come next, and position ourselves properly in the event the Turbo or Insanity price levels end up coming.