Crypto Cycle Guide: Part I

246: Ethereum All Time High, September Rate Cut

Welcome.

You’re going to want to set aside some time in the next 48 hours.

With the crypto bull market in full swing it’s going to be a big two days for Arb Letter coming up. Additionally I just dropped Episode 36 of Risk On (above).

Today is our free note to all subscribers, part 2 will drop tomorrow morning at 8am sharp for all paid subs.

I cannot stress this enough. Regardless of what happens next in markets, there are finite windows of opportunity to take advantage of. Speed kills in crypto and it doesn't hurt in equities.

The goal of this post and the one coming tomorrow is to give you the most comprehensive picture of potential scenarios that are gonna play out in the coming weeks and months bearing in mind major events like the federal reserve meeting scheduled in September.

We can expect some pivotal moments to play out in the near future, whether that means we go up only or we see some sort of severe correction remains to be seen.

It's interesting given you have an entirely split camp right now. One camp is comprised of people that are screaming from the mountain tops that absurd valuations, PE multiples, and price ranges are simply unsustainable and representative of a bubble.

Then in the other camp, you have people making the argument that market simply will not go down and to be honest there is no shortage of hyper bullish news for risk assets. It's a sort of mania that we haven't seen since the money printer induced pumps of the Covid era.

Time will tell but in the meantime let’s rip it.

Markets & Equities

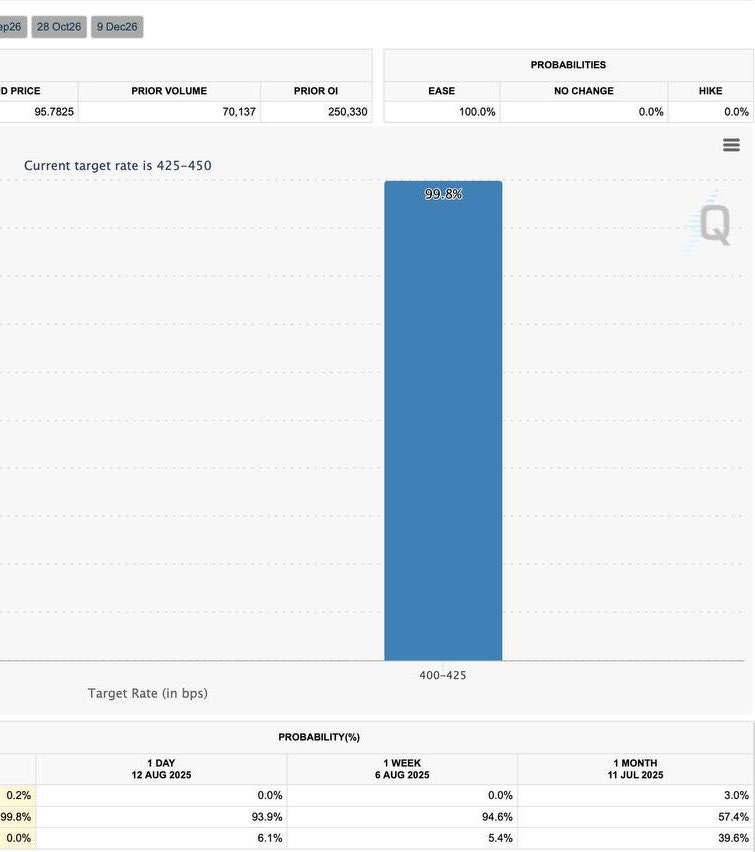

U.S. equities powered higher today, with the Dow jumping over 1%, the S&P 500 continuing its streak of record closes, and the Russell 2000 soaring about 2% on renewed hopes for Fed rate cuts in September.

Treasury Secretary Scott Bessent further bolstered optimism by publicly urging a half-point cut publicly fueling investor enthusiasm across global markets despite elevated valuations and cooling tech names.

Volatility remains pretty subdued, while the softer inflation data and easing consumer pressure have reassured markets that sustained monetary easing may be on the horizon (September). That said, muted earnings and an overheated rally serve as subtle reminders that the road ahead may not be entirely smooth.

Who knows maybe papa Jerome sticks the middle finger to Trump at the next meeting.

Donald Trump said he will name a new Federal Reserve chairman early, with the shortlist narrowed to three or four candidates

A former Goldman Sachs & JPMorgan executive indicted for gambling away $4 million in investor funds for his online casino company (WatcherGuru)

Volatility has collapsed, with the VIX hitting its lowest level of the year and bond market volatility following suit

BlackRock’s CIO, Rick Rieder, said this is the most bullish investing environment ever, citing record corporate buybacks, over $7 trillion in cash waiting on the sidelines, and a wave of beating earnings from Big Tech

Goldman Sachs flagged potential triple moves (three 25-bp cuts) from the Fed

To give a preview of tomorrow’s post — there are about 3 ways I see things shaking out in markets in the upcoming months. I won’t pretend to know exactly how all of this plays out.

My gut is telling me that this surge in risk assets (tech/AI/crypto) in the past few weeks and months is likely a front run of the rate cut news.

Many people, but mostly retail traders in the mainstream media are under the impression that markets are going to react violently upwards in the event of Jerome Powell finally capitulating and announcing rate cuts at the next fed meeting in September. This seems too easy to me.

I think it's more likely that we continue to pump in the weeks leading up to this meeting, and we very much have a sell the news event, at least for a short time.

Now I'm not saying to sell out of everything and treat it like we're at the pico top right now, but I do think it's worth entertaining this outcome. There are a number of equity names that look particularly frothy to me at present that I will be trimming, including:

Palantir PLTR 0.00%↑ I love it of course and have held it since sub $40 but eventually there needs to be a pullback lol

Ebay EBAY 0.00%↑

Electronic Arts EA 0.00%↑ (likely because of Battlefield 6 rollout)

Netflix NFLX 0.00%↑ Netflix trades at a P/E of around 51, well above historical norms and far ahead of other streaming peers

Facebook META 0.00%↑

Again, doesn’t mean we don’t keep chugging higher, but for now I feel like it would be irresponsible to dance around and pretend like everything is fine. My counter argument to this (an environment in which we do just keep going up) was covered in a post from last week.

Only you can make the financial risk calls to weigh your exposure. If you need the cash. It's an obvious decision if not, and you're willing to wait for a longer time. Then just sit on your hands.

We will touch on the other two scenarios I have in mind with more depth tomorrow.

Global News

Wow, we're not gonna cover all of it in today's post due to space and size constraints the ongoing, cultural and suicidal clash in the United States continues to rear its head, whether it's the ongoing ICE raids across the country to enforce immigration laws or the recent deployment of federal assets in Washington DC to combat crime by the Trump administration, the political partisanship in this country is simply unavoidable.

I had this conversation with a friend this evening on whether or not the differences between these two camps in the west and the United States are reconcilable. I genuinely think they are not. But will save that post for another time.

At least, for the time, being with the exception of some strict rhetoric from Trump aimed at Putin, we've seen a bit of a pause on big updates or coverage in many of the regular conflict zones from the past 12 months, including the Middle East and Ukraine.

Muslim socialist Zohran Mamdani has an 82% chance of becoming the next mayor of NYC on Polymarket, reaching all-time highs.

President Trump will meet Vladimir Putin in Alaska on Friday to discuss a Ukraine ceasefire and markets are watching for any gas market moves tied to sanctions or relief

Trump is also pushing to extend the federal takeover of D.C.’s police beyond 30 days, citing crime

On Pakistan’s Independence Day, Secretary of State Rubio praised its counterterror and trade cooperation and floated the idea of expanded economic partnerships, especially in critical minerals and energy

The International Energy Agency has flagged a looming record glut in oil supply next year, sending prices to near two-month lows amid widespread concerns of oversaturation

The gangbang of Iran continues — fourteen countries, including the U.S. and NATO members, jointly condemned Iran’s coercive transnational operations, citing plots of assassination, cyberattacks, and threats across international borders.

Arbitrage Andy’s Crypto Guide Part I

Crypto continues to dominate market attention as equities hang out near all time highs. The rapid ascent of Ethereum caught many (hopefully nobody here) by surprise, ripping over $4,000 in the blink of an eye.

The revenge of Vitalik is at hand after everyone and their mother was saying Ethereum was dead.

Despite the strength from Ethereum the past weekend, this cycle is clearly not a linear one, as Bitcoin is showing us that she is not done putting in a show for the remainder of 2025 — hitting a new all time high last night over $124,000 and surpassing Google GOOGL 0.00%↑ to become the 5th largest asset in the world by market cap.

Whales aren’t done buying either.

On-chain monitoring firm Whale Alert identified some goated size lord individual or entity who threw down a MASSIVE BTC buy this week:

The demand for Bitcoin is reaching untenable levels.

Pretty insane considering the long journey it has taken to get here.

The institutional cascade of interest and activity has continued this week, increasing even more. Regulatory tailwinds are accelerating the adoption of blockchain technology and defi at a lightning fast pace. Crypto is also becoming a major political talking point as well.

Just this morning Eric Trump said that major U.S. banks, including Capital One, JPMorgan, Bank of America, and First Republic had closed hundreds of his accounts without warning, which was a big reason he turned to crypto.

Ethereum saw another wave of heavy institutional buying today, with spot ETH ETFs pulling in roughly $700 million in fresh inflows.

I wouldn’t say it’s too late to buy ETH for the long haul, but I would be careful getting into it with too much heft given how close it is to breaking all time highs. If you are DCAing into it, might make more sense to nibble and then wait for a red day to add the lion’s share of your position.

The nice thing about ETH though, is the correlation it has to alts and other defi assets.

Alt coins are starting to look pretty good at present. Chainlink, Aave, Ripple, Solana, and others are beginning to show some spark. Media coverage, while nowhere near insane levels, is starting to ramp up as is the influx of influencer and retail videos and media on platforms like X, Instagram, Youtube, and TikTok.

Standard Chartered Bank raises its 2025 year-end $ETH price target to $7,500.

Solana Treasury Firm Upexi forms advisory committee, naming Arthur Hayes as first member

Norway’s wealth fund increased its Bitcoin holdings. They now indirectly hold 7,161 $BTC via company stakes

Asset manager Choreo ($27B) revealed their 1st Bitcoin purchase this week

Do Kwon has pleaded guilty in the U.S. to conspiracy to defraud and wire fraud regarding the $40 billion TerraUSD and Luna collapse. He is facing up to 25 years in prison

Cathie Wood the architect of ARKK called Bitcoin, Ether and Solana as the "Big 3" cryptos for ARK Invest this week

The Google App Store is set to ban all crypto wallets without federal licenses in the U.S. and EU. Interesting news for sure

Fundstrat’s Tom Lee the new Ethereum Size God says Standard Chartered’s $7,500 $ETH forecast for the end of 2025 “might be low” (whaleInsider)

BlackRock ramped up its crypto exposure in a big way this week. Its Ethereum ETF added over 150,000 ETH in a single day, roughly $640 million worth, marking the fund’s largest ETH purchase to date and helping drive record daily inflows for Ethereum ETFs.

The firm is now sitting on over $100B of crypto…..

Bitcoin has hit multiple all time highs. Ethereum finally got the hint and is pumping, in the process of likely surpassing an all time high (like we said it would endlessly the past several months).

What’s next?

Alt season seems probable. Solana is starting to move at the time of me writing this (12:00am ET) along with AAVE and XRP.

People were frustrated in the past 48 hours that these weren’t moving but we’re watching the rotation play out in real time.

Remember — as of early August, roughly $7.15 trillion is sitting in U.S. money market funds. There are MANY people sidelined despite how high we are across the board.

As money rotates out of Bitcoin and Ethereum we are likely about to see retail, institutions, and trader move to take advantage of lower and mid caps coins. The goal of course is to multiply their capital.

If Bitcoin ranges and Ethereum is able to make a new ATH soon, you can expect everything to start going crazy. So much so it will be difficult to not make money buying something, but the tricky part is timing your exit on anything you don’t want to hold for several years.

Below is compilation of major price targets from institutions:

Standard Chartered has raised its Ethereum forecast to around $7,500 by late 2025 and $25,000 by 2028, pointing to stronger fundamentals and increasing adoption.

H.C. Wainwright projects Bitcoin over $200,000 by the end of 2025, driven by historical cycle patterns, spot ETF inflows, and institutional interest.

Anthony Scaramucci of SkyBridge expects Bitcoin to reach $200,000 in 2025, seeing the broader crypto market growing to $15–$20 trillion.

Cantor Fitzgerald analysts believe Bitcoin could hit $1 million in the long term if global adoption accelerates.

ARK Invest models Bitcoin’s 2030 scenarios at roughly $300k in a bear case, $710k in a base case, and $1.5 million in a bull case.

While I will expand tomorrow….

People are making a boat load of money right now, there is a degree of euphoria pouring into markets (certainly equities but now crypto) so it’s a good time to cover some basic risk concepts.

Some things to keep in mind if you’re new to crypto OR if you are a seasoned veteran in my opinion include:

Do NOT over-invest. It’s very easy to get sucked into the hype and chaos and want to chase pumps. This never ends well. Apeing your entire net worth into Bitcoin at $120,000+ is not a good idea (though in the long run you’d likely end up being okay)

Avoid having unit or notional bias. Just because you might be capital limited, doesn’t mean you should write off BTC/ETH and more “expensive” assets. Many of the “cheaper” coins will end up being vaporware. You will be in a race against the clock to dump before corrections. Focus on utility, narratives, and for meme coins, strong communities

Tailor and cull who you follow and the information you take in very carefully. In this cycle more than others, it is obvious who has absolutely no clue what they are talking about. Remember: the loudest voices at the top of the cycle are usually the ones who disappeared in the last bear market. Track records matter more than follower counts

Keep your core holdings separate from your trading stack so you don’t “accidentally” sell your long-term bets during a moment of panic

Don’t ignore security—hardware wallets, two-factor authentication, and avoiding shady links will save you from becoming exit liquidity for a hacker.

If you are disciplined, you have the opportunity to make an obscene amount of money in the coming days weeks and months, but it will require a higher degree of pragmatism then you're likely used to.

Don’t get emotional. Formulate a plan and stick to it.

*Important note*

If you’re interested, make sure to upgrade to Arb Letter premium to receive tomorrow morning’s Part 2 which will be a much more comprehensive post with a focus on the following.

Updated price targets for BTC/ETH and major alts

All my new positions and YOLO alt/meme plays

Sleeper alts and meme coin selections I’m watching

Thoughts on profit taking and when I will look to do so

My detailed scenarios on markets as whole and where go into the end of 2025

People keep DMing me asking for free unlocks to our paid content but the reality is our paid subs expect a higher degree of depth, quality, and alpha and are willing to contribute to the longevity of the publication as well as their own education. It wouldn’t be fair or ethical for me to unlock what some are happy to pay $5/month for.

If you’re happy with our free content I’ve put out no sweat! There are COUNTLESS free posts on crypto over the years. I will say Friday’s will be the most comprehensive so far in terms of specific plays, price expectations, themes I am watching closely, and what to expect next building on our success so far in 2025.

If you took the ETH trade covered 100x in Arb Letter premium over the past several months you paid for this at least 1,000x over.

Take care and see you guys in the morning!

Andy

Make sure to take advantage of our partnership with Gemini, you can get your choice of crypto free when you sign up and trade.

Get Free Ethereum w/Gemini

Get Free PEPE w/Gemini

Get Free Bitcoin w/Gemini

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before investing or trading.

What are we doing guys? Asking for free unlocks?!...smh. Pony up the $5/mth. The only regret you'll have is not having done it sooner. True story.

Wonder if we should trail some of the lesser known blackrock assets 👀 those prices are juicy - all it needs is some juice from the worlds largest asset manager