Conditions are Primed for a Move Higher

496: Stimulus Checks, Government Re-Opening

Morning,

Normally like to avoid Monday mornings when everyone is getting back into the swing of things and headed into the office but we’ve got some interesting market news that could change the direction we were headed in last week.

Tomorrow is going to be a comprehensive financial health post for paid subs:

50 Year Mortgages, implications for younger people

Money printing and why it will continue

The concept that you need to hold assets or you will fall behind

Portfolio allocations by percentage

Ideal breakdown between equities x crypto x metals etc.

Security considerations (new Trezor 7 cold storage review)

The goal will be to form a blueprint for portfolio construction, security practices, and hedges for the coming years.

It would appear that we might be about to get out of the woods with recent sell offs and negative sentiment.

A number of key updates related to the US government shutdown, economy, and markets broke over the weekend.

You might still be able to mog all your relatives with your fat market gains at the Thanksgiving table this year…..

Markets Preview - Stimmie Checks and Government Reopening = Bullish?

Some potentially bullish news began trickling out this weekend. To kick things off the Trump Administration threw a Covid era curveball and announced that there may be a $2,000 check headed into American’s pockets.

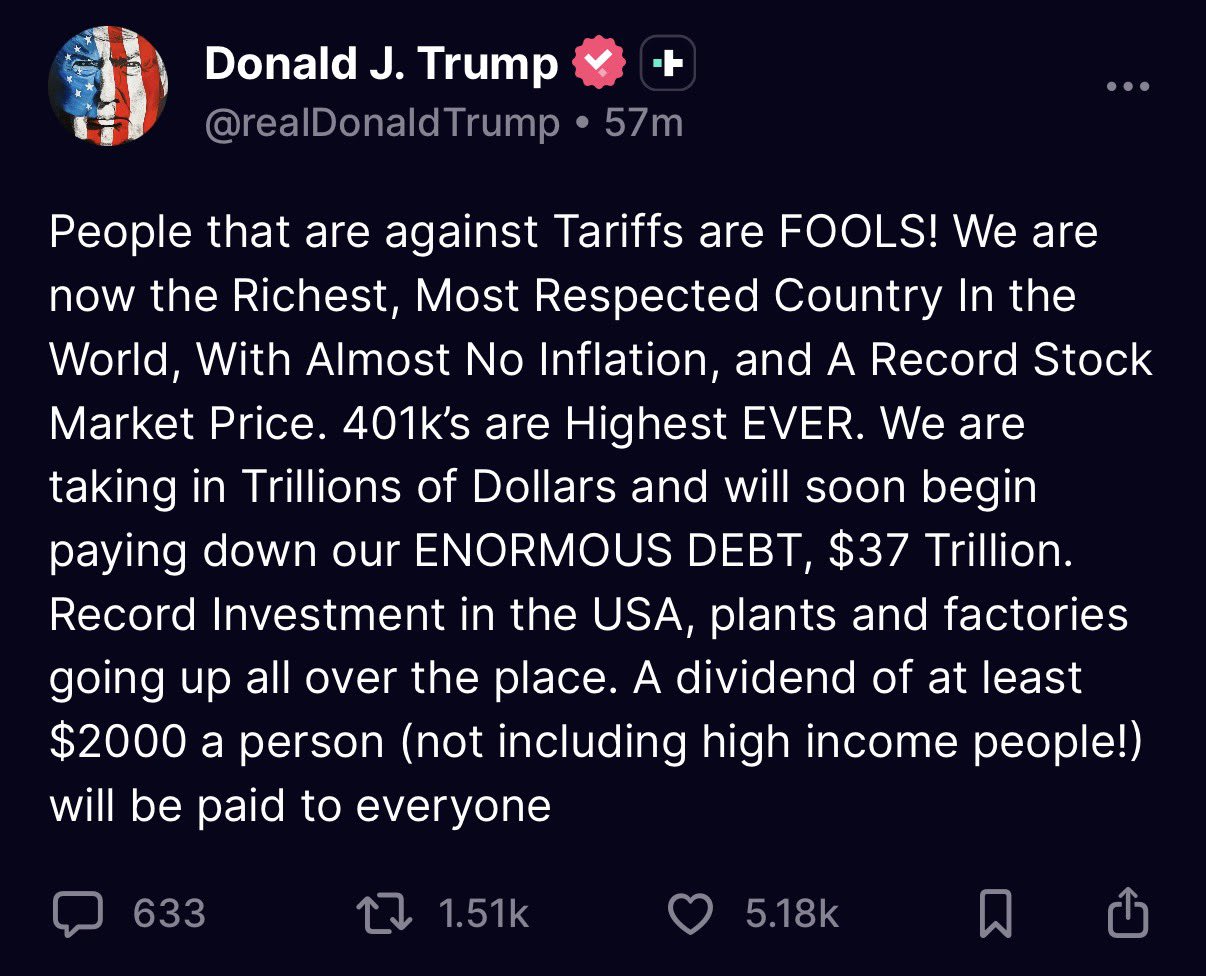

Trump grabbed headlines yesterday by proposing a $2,000 direct payment to most Americans, funded, he says, by tariff revenue.

On Truth Social, he called it a “Tariff Dividend,” claiming the money collected from foreign imports should be returned to citizens rather than absorbed by Washington. High-income earners would be excluded (sorry to most of you).

We can worry about technicalities later, for now, this is reminiscent of the Covid stimmies that sparked mass retail investment and gambling/trading in markets. This piece of info ALONE bumped crypto up. If it comes to fruition it could end up being quite bullish, reigniting social interest in crypto which has been pretty low the entire “cycle” so far.

Then we got bigger news.

After 40 days of gridlock, the Senate finally moved to reopen the federal government, voting 60-40 to advance a stopgap spending bill that funds operations through January 30. Eight Democrats crossed the aisle to join Republicans, breaking the deadlock that had frozen paychecks, permits, and federal contracts for over a month.

Polymarket now has odds that the shutdown will end November 12-15th at 86%.

History says investors usually breathe a sigh of relief once Washington stops playing chicken with the budget. Across every shutdown since the 1970s, the S&P 500 has been positive roughly 9 out of 10 times in the year after the government reopens, with average gains in the low-teens.

Anyways, expect some sort of rally today. We will have to wait and see how sustained it is but should be a good change of pace vs. last several days of trading.

Citi analyst Atif Malik has raised the price target on $NVDA to $220.00 (from $210.00) while maintaining a Buy rating (StreetInsider)

Citadel is expanding its European presence with a new stock-picking unit based in London, according to a report by The Wall Street Journal on Monday (Investing.com)

The EU is set to ban cash payments over €10,000 and enforce ID checks for crypto transactions through exchanges starting 2027 (SolidIntel)

Michael Saylor bought ANOTHER 487 Bitcoin worth $49.9 million

Gold futures extend gains to over +$100/oz on the day as the US government nears a deal to reopen (Kobeissi Letter)

With the stimmy news, government re-opening, and incoming QE from the fed (we might get some more data this week - CPI Thursday and PPI data Friday), things are looking sneaky bullish for the end of 2025 and 2026.

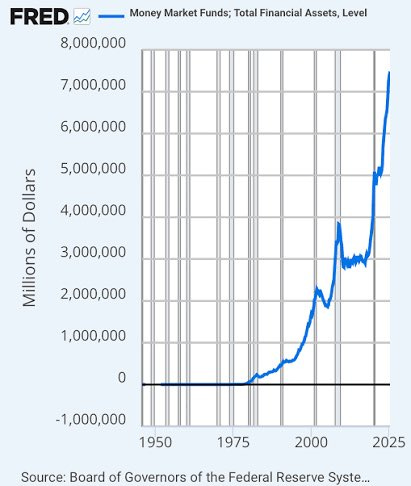

Also consider this: there is almost 7.5T in money market funds right now. Where do people think all of this money is going to go in a risk on environment?

I remain cautiously bullish right now. It seems the crowd is convinced that the AI bubble is going to burst and we are going much lower. Max pain would be a logic defying move higher.

Names I am looking to add this week include $META $SMCI $AMD and $KTOS.

Crypto Positioning

Sometimes when I am cooking fajitas or prepping a longer dinner I will dabble in crypto Youtube videos and just leave them on in the background. You know the kind with insane thumbnails. Most of the ones you will find on there are engagement slop but others have some gems.

I like to try and gather general sentiment on Youtube vs. X/Twitter as a general sense of where people’s heads are at.

I watched an interesting episode of Wolf of All Streets with Scott Melker and Ben Cowen in which Cowen placed a rough breakdown of where he thinks we are in this “cycle”. Ben has a solid track record in crypto and takes a quantitative data heavy approach to his analysis.

His thoughts are 70% chance we continue higher 30% chance we are entering some sort of bear market.

That’s about where I would say my feelings are.

To me it seems possible that we have only seen the beginning of bigger moves higher. Institutions are squared away, they are setting up infrastructure, and we are waiting on some major legislation that could open the flood gates. Bitcoin dominated the last several months, though ETH had a slight run, and even Solana had a nice moment when meme coins were going dummy earlier in the year.

The one thing we have not seen yet is everything move in conjunction. We are going to need to see Bitcoin remain above $98,000ish and Ethereum continue to hang out in the $3,500 range to avoid a bigger dump.

Anything below those ranges probably sparks the end for alts for a while (not forever but definitely for a few months at least).

As of this morning Bitcoin is trading around $106,000 and Ethereum is hanging out at $3,590. Chainlink has rebounded a bit, along with PEPE, Avalanche, Near Protocol, Aave, and The Graph.

Bank of England announced they are set to limit stablecoin holdings to £20,000

Rumble unveiled three major deals with Tether and Northern Data, expanding its AI infrastructure, ad business and cloud capacity (CoinDesk)

Monero is showing signs of institutional rotation, with traders shifting from Zcash to Monero as the next privacy-coin breakout candidate

On the derivatives front, the Commodity Futures Trading Commission (CFTC) is engaging with U.S. crypto exchanges to pilot leveraged spot crypto products, signalling deeper institutional and trading-layer maturity in the sector

Data shows that Zcash’s rise is being accompanied by a drop in exchange inflows, suggesting reduced retail selling pressure and increased accumulation by larger wallets

Coinbase is rumored to announce a new Launchpad platform tomorrow.

Last week we saw what people refer to as “dinosaur” alts rallying. Zcash, Filecoin, and others ripped pretty hard which led some to speculate we were witnessing an end of cycle pump by shitters.

The reality is a new narrative is emerging in crypto. As the U.S. and EU double down on KYC, on-chain analytics, and CBDC exploration, investors are rediscovering the appeal of true peer-to-peer money, assets that can’t be frozen, tracked, or blocked.

Zcash, Monero, and even older names like Dash are being re-examined not as relics of 2017, but as hedges against the creeping centralization of crypto itself. Inevitable in my opinion with the growing role of institutions in the markets, something many are not pleased to see.

It’s the pendulum swing. After years of chasing yield, AI tokens, and tokenized treasuries, the market is rotating back to first principles: sovereignty over convenience. Good for those of us who understand the first and prime use case of crypto.

Privacy coins are essentially the last stand for what Bitcoin once represented before Wall Street, ETFs, and chain surveillance took over.

Whether this becomes a lasting trend or just a reflexive bounce remains to be seen, but the timing fits the broader socio-political zeitgeist.

Governments are tightening control (UK stable coin legislation), data visibility is total, and trust in institutions is at historic lows. In that environment, privacy becomes alpha.

This could be the early spark of a cycle where capital begins to value truly untraceable liquidity as much as narrative hype. Don’t be shocked if the next wave of capital rotation flows not into yield farms or memecoins but into assets designed to disappear.

More crypto analysis tomorrow.

Global News - BBC Shake Up

The biggest story of the weekend was another major L for the UK. Sorry guys, I like UK drill music and Barbour-clad hunting trips in the English countryside but the entire country at this point has basically fallen into an Orwellian hellscape where the next major headline is more unbelievable than the next.

The British Broadcasting Corporation just imploded at the top. Within 24 hours, Director General Tim Davie and Head of News Deborah Turness both resigned, triggering a full-blown leadership crisis at the BBC.

The spark? A ‘Panorama’ documentary that edited Donald Trump’s January 6 speech to make it appear he directly urged supporters to march on the Capitol. The broadcast spliced together quotes delivered nearly an hour apart, and when that manipulation surfaced, accusations of “serious and systemic bias” exploded across Westminster and the press.

Is this really surprising?

The Trump edit was just the final straw. The network was already under fire for coverage of the Israel-Hamas war, gender politics, and the BBC Arabic division, all fueling claims that Britain’s taxpayer-funded broadcaster had lost the plot on neutrality.

Some former insiders are even calling the resignations an “internal coup,” hinting that political pressure and board infighting helped push the two out.

Unfortunately just another example in how far deranged leftists will go to “write” the truth. There is nothing beneath them when it comes to trying to manifest their version of reality and impress it upon others.

The ones who claim to stop “misinformation” very often write it themselves.

The media is inherently left leaning. This really shouldn’t surprise anyone, but it would be nice if we could move on from the trope of “big media company lies about Donald Trump”.

It’s getting truly exhausting having to entertain people who act like all of this isn’t the status quo.

Dubai has edged out New York as the top destination for the global elite according to a recent survey (Bloomberg)

More than one million people were evacuated and at least four killed as a super typhoon made landfall in the Philippines (SkyNews)

The EU tightened visa rules on Russians, scrapping most multi-entry Schengen visas and citing security concerns over sabotage and drone incidents near key infrastructure

Islamist militants have effectively surrounded Bamako, cutting fuel routes, choking supply lines, and plunging parts of the capital into blackouts

A massive prison riot in Machala, Ecuador left over thirty inmates dead, the deadliest in years

Bit slow on the global news front this morning so instead I will share this insane video from one of the accounts I follow on X.

Mike Shelby on X shared the video below of poachers encroaching on one of his friend’s ranches stating: These guys cut a fence at a buddy’s ranch. All were arrested shortly after by the game warden and sheriff’s office. But they should be dead.

In the video you can see his buddy monitoring the poachers on thermal and one of the horses bucking one of the riders.

Should be a big week for our bags, so make sure to tune in tomorrow.

Arbitrage Andy store will be restocked and ready for the holidays by end of day tomorrow. All orders will need to be in by end of November for guaranteed delivery by the Christmas. Also our holiday gift guide will drop either Thursday or Tuesday of next week.

See you guys on X and Discord.

Andy

Protect Your Crypto With TREZOR

Get Free Ethereum w/Gemini

Get Free PEPE w/Gemini

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before

BTB’s latest article suggested selling a portion of BTC and ETH if we drop and stay below 100k and 3400, respectively, for a sustained period (a day) and set the clock for rebuy for 12 months. Thoughts on this?

Man i am schizzing tf out about this

https://open.substack.com/pub/dejuremedia/p/your-phone-is-watching-you-right?r=4fpodh&utm_medium=ios

Am I losing it or is this not a big deal? Click baity title of course. Potentially worth a look