China, Psy Ops, and Gold All Time Highs

482: Friday Market & News Essentials

Happy Friday gents.

Normally I keep posts on Fridays short and sweet but we have a lot to unpack in today’s edition. I would suggest making some time to read this before you totally check out for the week or order that first beer.

Why?

Well because we’ve got the convergence of some pretty important themes this week, some potential warning signs, and some signal on trends we’ve been trading already (like rare minerals/gold/crypto/etc).

Today we need to attempt to get the best picture we can of the market landscape in front of us because it is getting a.) much more volatile and b.) unpredictable.

Some are convinced the giga top is in and that weeks of sell offs stare us in the face.

Others think we’re still deep into some sort of shakeout or psy op aimed at getting people out of markets before the green light is given to send us laughably higher.

At the moment I lean toward the latter camp, though I do not deny the red flags present across the economy and market.

Like I say often, do you think Trump and his admin are going to continue to play these wishy washy back and forth games that spook markets as we get closer to midterms?

I certainly don’t.

So have to ask yourself a pretty important question right now. Do you believe that the Fed’s upcoming pivot is enough to spark risk on appetite again? Do you think clarity on the ongoing trade war will help boost us higher?

Or do you think we are close to the end?

Because here’s the truth this is where the fog thickens.

We’re in the kind of zone where conviction gets truly tested (crypto is a great example), narratives flip overnight, and the loudest voices on X are usually the ones about to get margin-called.

You can feel it, sentiment is twitchy, liquidity is thin, and everyone’s pretending they have a game plan when in reality they’re guessing.

The regional bank wreck this week, gold ripping through new highs, crypto bleeding out one day and mooning the next, random tweets moving markets, these aren’t just random data points. They’re all signals of a market searching for some sort of an anchor (and I don’t know what that is yet). The old frameworks traditional investors and fundamental nerds rely on are shattered, the new ones aren’t really fully formed yet.

So before you write off the next few weeks as “just noise,” remember that chaos is a pattern too. And when politics, liquidity, and power all collide, like they are right now, that’s not the end of a cycle.

That’s usually the beginning of something much bigger.

Let’s break it down.

Markets & Crypto

If it wasn’t obvious we are in some strange Weimar-Republic type melt up/melt down area now where literally nobody knows what is going to happen next. Gold is on a parabolic climb, equities change direction violently by the hour, and crypto seems neutered for the moment.

Structural elements are bending as well with the shitty performance of regional banks and prolonged US government shutdown coming back into focus this week along with the upcoming Fed meeting.

Good day to not check the portfolio if you’re long.

U.S. M2 Money Supply jumped to a new all-time high of $22.2 Trillion

The WTO (World Trade organization) Chief warned this week that global GDP could drop by 7% if the US and China decouple (WatcherGuru)

US ETF inflows have crossed above +$1.0 trillion in 2025, the highest YTD total in history (Kobeissi Letter)

The IMF raised red flags this week, warning that stretched valuations and rising trade tensions have pushed global markets closer to a “disorderly correction”

Markets are now pricing in a near-certain Fed rate cut on October 29, with traders betting on additional easing before year-end as policymakers scramble to stabilize growth

A data blackout from the ongoing government shutdown has left markets flying blind, with traders forced to rely on high-frequency and private data in place of official reports/data

Denmark is raising its retirement age to 70 by 2040, which will be the highest in Europe (Unusual Whales)

Hopefully you took SOME profit if you managed to make some money on the rare mineral and energy names we covered earlier in the week and last week.

As I clearly pointed out — there is no big grand value play here and many of these were and are up hundreds of percentages this year. We own these a.) to capitalize on the trend and hype and b.) to POTENTIALLY own a company the Trump admin announces a stake in.

That’s it. Monkey brain plays.

I am still long NAK 0.00%↑ NB 0.00%↑ and UAMY 0.00%↑ all of which got clobbered yesterday. I made about 300% on UUUU 0.00%↑ calls and depending on how the market opens today I might dabble with adding to some of these, particularly NB 0.00%↑.

Most of the open calls I have come with February expiries.

For now some of the momentum seems tuckered out, with the Pentagon’s announcement to drop their tender to buy cobalt not helping sentiment.

I will be looking to bolster my defense holdings in the coming weeks as well as add to my SMCI 0.00%↑ and QUIK 0.00%↑ positions.

I still hold yolo calls for next year on SWBI 0.00%↑ because my instincts tell me that substantial social unrest is not far away.

Crypto

Bitcoin has softened in the last week, now down to the $105,000 range. It’s not surprising to see alts and ETH fall as well. It is odd though to see Bitcoin not playing into the “hard assets” “anti fiat” vibe that gold is clearly benefitting from.

We hoped for some more strength after that turbo liquidation spell, but find ourselves with a bit of stagnant price action.

My forecast is largely unchanged if you remember the earlier crypto posts in 2025. Barring any major global black swan or recession, I still believe we are in a bull market.

There is a myriad of geopolitical and market factors that are influencing risk assets right now including inflation, gold’s run, equities ripping, the Trump TACO dynamic, and more.

As I have said before: Bitcoin drops below $100K and I am backing up the truck.

No brainer. Is it possible we turbo dump to $70,000? Of course, it’s always possible and if that happened it would be fire sale time across the industry. However I still don’t buy this price action and think there’s a chance we pump higher into year end/early 2026 as the Fed completes the pivot and we gain clarity on trade wars/relations.

Just remember ETH and alts are going to bleed as long as Bitcoin is uneasy.

Expect that, and if you’re bullish, you should be treating it as an opportunity to add while attention shifts elsewhere because of the boring/red price action. The majority of you who have done extremely well in crypto understand there is no more important quality than being able to sit on your hands and be patient, even when price action is maddening.

All that being said, I can’t trade FOR you. Make decisions that align with your personal risk tolerance and parameters, financial situation, and goals. Don’t get caught up in hype or euphoria. If you’re bullish this likely a good spot to average some buys, if not perhaps you think we’re going lower soon.

Bitcoin and Ethereum broke key support levels, dragging total crypto market cap under about $3.8 trillion and triggering a wave of new liquidations from degenerates

A stablecoin “glitch” raised people’s eyebrows this week when PayPal’s blockchain partner accidentally minted $300 trillion in PYUSD, then burned the excess. Highlights how issuer control can morph into systemic risk

Eric Trump said this week that the Trump family has made more than $1 billion from crypto. did they make it or take it from us lmfao (Financial Times)

Charles Schwab has said interest in their crypto products is increasing, with 90% more visits to their crypto site (BitcoinMagazine)

The 21Shares Solana Spot ETF was approved

Tom Lee of Fundstrat is bullish.

My gut tells me we bounce higher soon, particularly since gold is looking toppy. I may just need to ape some more PEPE and ETH soon for the hell of it.

Stay frosty.

China, Psy Ops, and Gold

It’s psy op season again guys. Hopefully you can see that by now. That doesn’t mean there aren’t some legit red flags (gold prices/regional bank performance/inflation) but it’s super obvious that you can’t hinge on every single headline that comes out.

It’s at least in part, an effort to elicit an emotional reaction from market participants, and in my opinion, shake quite a few people out of positions.

For example look at the headlines and lunacy of the China updates that take the market down and up each time they drop:

President Trump announced that he will be meeting with China’s President Xi in 2 weeks. “I think we’ll be fine with China,” Trump said.

The White House Economic Advisor Hassett said “we’re not in a trade war with China”

China said we ARE in a trade war with the US

Snip snap snip snap.

Which one is it lmao?

What’s going on?

Every quote out of Beijing or D.C. feels like a trigger algorithmically designed to whip sentiment between “recession panic” and “soft landing euphoria.”

Maybe that’s the point.

Gold just hit a new ATH, trading around $4,388 — up almost 62% YTD.

Videos hit social media from a number of countries showing normies lining up outside of shops and mall stores to purchase physical gold. Now I am not an expert on metals or gold but to me? That definitely signals a potential local top of some sort.

Parabolic charts don’t climb forever. The sentiment’s overheated, RSI is screaming, and the same crowd panic-buying Krugerrands today will be selling them on the first 10% pullback. Long-term?

Gold still wins as fiat continues to rot and get printed recklessly.

Short-term? Don’t let FOMO nuke your discipline.

Regional Bank Red Flag

Awhile back we had some meltdowns from regional banks. It appears we are getting another run of that which may have contributed to price action this week.

Regional bank stocks got absolutely hammered yesterday. The KBW Regional Banking Index plunged about 7%, marking one of the worst single-day selloffs of the year.

The likely trigger? A string of ugly surprises that re-ignited fears about credit quality and fraud inside smaller lenders.

Zions Bancorp cratered over 12% after revealing a $50 million loss tied to two bad commercial loans and hiking its loss provisions by another $60 million. Western Alliance followed, sliding 10% on disclosures tied to alleged borrower fraud.

This renewed stress in regional banks is clearly rattling broader risk sentiment (with geopolitics adding fuel to the fire too). When credit quality fears resurface in the banking system, even at the regional level, it tightens financial conditions across the board.

Investors start to price in higher default risk, flight-to-safety flows end up pushing yields lower, and equity multiples compress as liquidity expectations start to fade. The move also reignites old fears from 2023’s mini-banking crisis, that unseen losses could still lurk in commercial loan books or CRE portfolios (and they likely do).

In short, this week’s selloff is less about two banks and more about confidence. When the foundation of credit weakens, risk assets across equities, crypto, and commodities tend to lose their bid strength.

The Fed’s coming rate cut now looks less like “stimulus,” and more like “ retroactive damage control”.

Will be interesting to see how today ends.

Global News

Outside of markets we got a wild slew of global news. Everything from updates in the NYC mayoral race, to escalation in Ukraine, and a new series of conversations between Trump and Xi as well as Putin.

All of it feeds the same undercurrent we’ve been tracking for months, the re-politicization of markets. Policy, power, and personality are merging again, and investors who ignore the political volatility risk missing the next macro shock.

World’s changing quickly friendo and you need to keep up or you’re going to get left far behind.

Former National Security Advisor John Bolton surrendered to federal authorities this week after being indicted on 18 counts related to the mishandling of classified materials

The U.S. Justice Department filed the first terrorism charges against left-wing radicals involved in the attack on a Texas migrant detention center on July 4

European financials tumbled this week, gold ripped to fresh record highs, and global risk appetite cratered

Oil collapsed to five-year lows

In Europe, Russian forces intensified drone and missile barrages on Ukrainian power infrastructure ahead of winter, knocking out multiple substations and prompting emergency blackouts in Kyiv and Dnipro

Counterterror operations ramped up in Southeast Asia after coordinated ISIS-K cells were disrupted in Indonesia and Malaysia

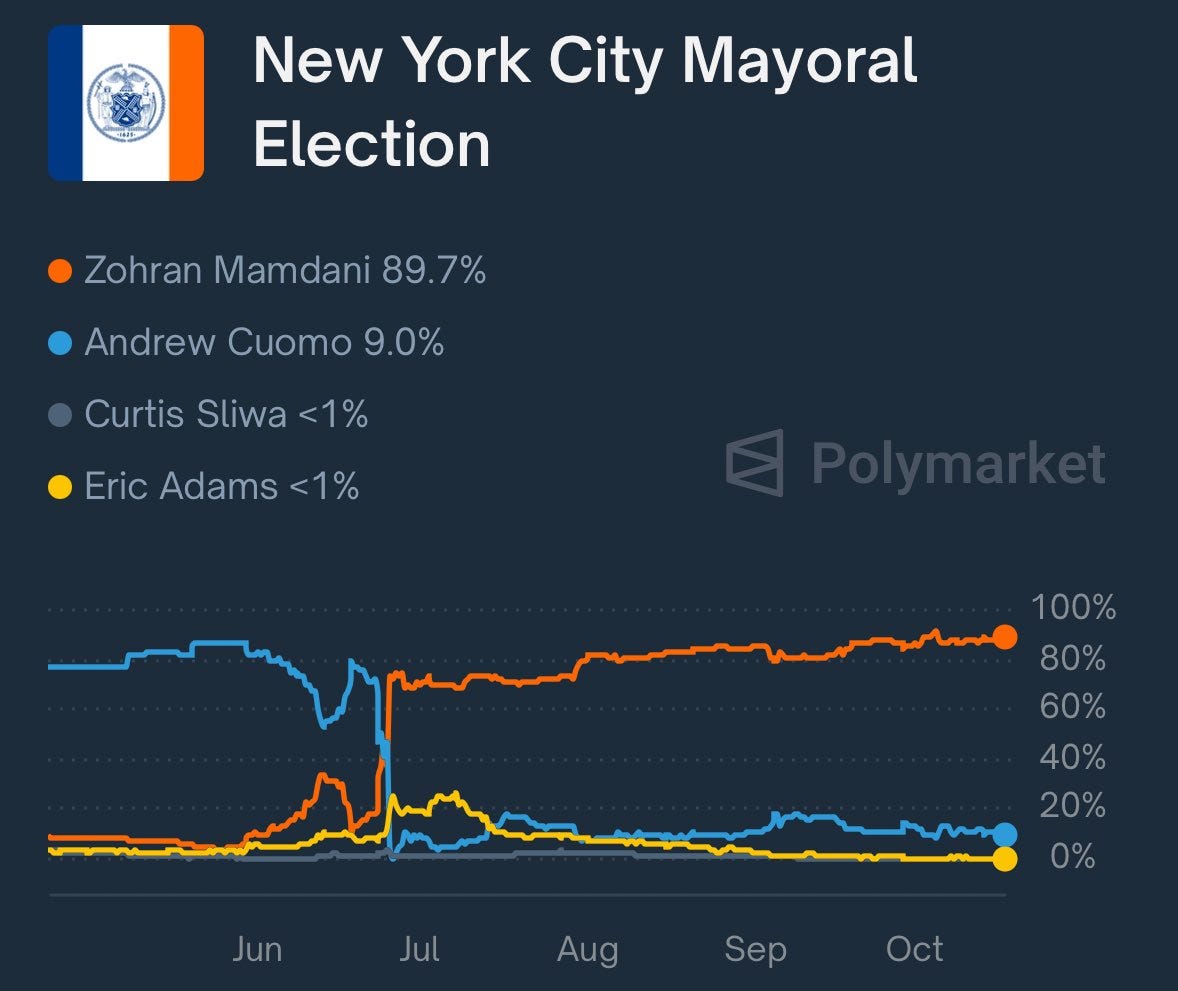

NYC Mayoral Race

Comrade Zohran Mamdani had some interesting answers this week in the NYC mayoral debate.

In the latest NYC mayoral face-off, Mamdani, a Muslim self-declared democratic socialist and Assembly member, took fire from Cuomo over his past statements, his alignment with the DSA, and his lack of executive experience. Cuomo pressed him on policies like decriminalizing misdemeanors and prostitution, proposals tied to the DSA platform, suggesting they would worsen public order.

Mamdani pushed back: he clarified that he does not support full legalization or blanket non-enforcement, and emphasized more nuanced reforms (e.g. “Cecilia’s Law”) that target penalizing traffickers rather than sex workers.

Upon being asked how he will make the buses in NYC free he responded:

“I’m going to raise taxes by $9 billion.”

Classic socialism lol.

Just fuck the people of NYC with another $9B in taxes. That totally won’t make people flee the city and leave you with a Gotham caliber shit hole.

The city may just need a dose of reality when this guy wins to learn a very valuable lesson. A full blown communist is going to be the mayor of New York City.

Unbelievable lol.

No Kings Protests

Stay safe out there this weekend.

This weekend’s nationwide “No Kings” protests mark the second major rollout of this movement, with organizers announcing rallies in over 2,500 cities across all 50 states. The coalition, led by groups like Indivisible, the 50501 Movement, the ACLU, and various unions, frames the protests as a stand against growing executive overreach and perceived erosion of “democratic” norms.

Some Republican governors (e.g. Texas) have preemptively mobilized law enforcement and National Guard forces in anticipation of unrest.

Leftist politicians continue to urge people to resist the Trump administration and lawful deportations of illegal migrants.

Gavin Newsom of California said the following on X:

I urge our nation to use this weekend’s No Kings marches as a declaration of independence against the tyranny and lawlessness currently running this country.

There is of course no tyranny or lawlessness. But that’s what gets the socialist street soldiers riled up and ready to resist federal law enforcement. It’s a continuation of the language that is driving violent resistance to ICE and other agencies enforcing the law across the US.

It’s also the same attitude and sentiment that celebrates political violence against the right.

We always knew there would be staunch resistance to a second Trump Administration, but what is striking (though not surprising) is the direct incitement by politicians across the US.

It’s so comical as I drive through my Northeastern suburb and see the fist shaped “resist” signs and overwhelming support for this far left movement on the green lawns of sprawling colonial mansions. People totally oblivious of what they are supporting and condoning while our nation faces grave threats related to crime, immigration, and political violence.

Everything is a cycle. Those people will eventually come to realize that this beast ends up eating itself and those who claim to be allies in due time.

That’s all I have for you guys today, we will be active in the Discord and on X this weekend and next week we’re going to take a look at the job market/economy again as well as some social issues related to the state of the US.

Take care, touch some grass, and I will talk to you next week. I will be diving into Jack Carr’s new book Cry Havoc can let those interested know how it is.

Andy

Protect Your Crypto With TREZOR

Get Free Ethereum w/Gemini

Get Free PEPE w/Gemini

Get Free Bitcoin w/Gemini

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before

Continuing to DCA Link here?

Hot take: Gold’s surge isn’t driven by inflation or dollar debasement. It stems from a global dollar shortage caused by high real interest rates. Tight credit and limited dollar liquidity are pushing investors toward no-counterparty assets like gold, but once liquidity improves, that move may reverse quickly.

Personally I have puts on gold and bought more btc this morning.

Yes m2 expansion is good for gold long term. But gold right now is in a bubble.

FWIW.