Before Monday Hits: What You Need to Know

469: Bitcoin Ripping, Mining Stocks, UK Terror Attack

Hope everyone is having a glorious Saturday.

Fall is in full effect now, the weather is gorgeous where I live, the stock market is soaring and Bitcoin is absolutely sending into the stratosphere obliterating bears and naysayers who had the audacity to suggest it was all over.

The bull market is most certainly NOT over.

Condolences if you bought into that disgusting bear propaganda.

Today we’re going to cover market movement, what comes next in crypto (fat pumps) as well as the biggest institutional catalysts and announcements on the horizon.

We will wrap up all information from this past week you should keep in mind as we move into October.

Tuesday morning, by popular demand, is going to be my ultra schizo guide to prepping/readiness in 2025 with an emphasis on companies and brands that offer some of the best tools and products to be able to adapt to the spicy environment we find ourselves in.

We will also touch on mindset. This is an extension of the civil unrest, terror threats, and unstable environment posts that I have put out the last couple of weeks. For those who don’t know I am an avid shooter, outdoorsman, and have recently started cutting my teeth on some EMS courses.

I’m by no means MacGyver but if you want to see how a 33 year old father “preps” and practically thinks about some of the considerations, threats, and real world problems in today’s world you will likely enjoy it. In today’s tech heavy society we have all neglected and moved away from very basic skillsets and capabilities that in my opinion many will wish they took the time to learn in the future.

Markets

U.S. equities pushed higher across the board this week, with the S&P 500 and Dow each climbing just over 1%, the Nasdaq up a similar amount, and small-caps in the Russell 2000 leading with nearly a 2% gain.

Both the S&P and Dow notched fresh record highs.

Nvidia rose again over the past week, gaining around 8% fueled by continued enthusiasm around AI infrastructure demand. The chart below shows just how absurd the AI boom has gotten for Nvidia.

Tesla TSLA 0.00%↑ posted robust third-quarter vehicle deliveries (near 497,000 units)

Electronic Arts EA 0.00%↑ agreed to a size lord record ~$55 billion leveraged buyout, adding M&A excitement to markets and boosting sentiment in gaming/tech adjacent stocks. Might just have to cop the new Battlefield to celebrate

Pfizer PFE 0.00%↑ inked a new deal with the federal government to list discounted drugs via a new platform

In macro land, weaker ADP payrolls (–32,000 jobs in September) reinforced the growing market expectations that the Fed will pivot sooner than feared. As of right now rate cut odds for October are sky high (CME FedWatch tool is showing probabilities of around 99-100% for a 25-basis-point reduction)

Right now best case scenario for us is that the Fed can pull off a soft landing in the coming months amid rate cuts. I do suspect some money to begin rotating out of the stock market into crypto plays if BTC/ETH continue to climb higher. The holidays are a period where we traditionally see people discuss crypto AND take the time to re-assess or create new accounts to purchase.

Quite a few of our picks have been continuing to rise over the last trading week. NB 0.00%↑ is continuing its ridiculous ascent climbing 22% on Friday. The capital raise for their Elk Creek Project closed (focuses on critical minerals including niobium, scandium, and titanium).

BBAI 0.00%↑ has slowed a bit, but remember the big short term catalyst for this name is a new contract with the Federal Government (unlikely amidst a shutdown). Regardless another round of rate cuts is likely to send it higher.

United States Antimony Corp UAMY 0.00%↑ , which I unfortunately missed has been on a mind blowing ripper this year (up 347% YTD). The company recently landed a five-year, $245 million contract to supply antimony metal ingots to the U.S. Defense Logistics Agency. Antimony is a metalloid chemical element, a silvery-white, brittle metal that is a critical component in various industrial applications.

Metals, industrials, and AI have been some of the strongest themes in markets this year, driven by both structural demand and zesty political tailwinds. The Trump administration’s aggressive push for domestic sourcing of critical minerals (regardless of how you feel about it politically), combined with defense rearmament and government contracts, has funneled capital into once-overlooked industrial names.

Might take a look at MP 0.00%↑ APLD 0.00%↑ and VRT 0.00%↑ this weekend.

Crypto

You guys probably remember a month or so back when we were praying for some ETH strength that would translate to alt season.

With Bitcoin’s recent strength I think we’ve just reverted the tape back and opened the door to play that exact scenario back over again.

Bear market rumors have been obliterated and crypto is on track to follow our loose plan for late 2025 early 2026. $550 million in crypto liquidations hit the market this week, with the majority coming from short positions.

Bitcoin surged past $120,000 this week (flipping AMZN 0.00%↑ market cap) reclaiming two-month highs and putting its prior all-time high back in sight. The move was driven by heavy new ETF inflows, softer U.S. economic data fueling hopes of a more dovish Fed, and cascading short liquidations as BTC broke key resistance. I wouldn’t rule out $140,000 in the near future now, you just cannot stop the king, who looks to be catching up with Gold.

Big banks price targets for BTC include:

• Citigroup: $133K (lame) • JPMorgan: $165K • Standard Chartered: $200K

This rally has reignited risk appetite across the market, with majors like ETH, SOL, and BNB catching bids, though Bitcoin dominance is clearly leading (which is what we want to see for an extended run AND the possibility that we get our coveted alt season).

The timeline has simply been pushed out a bit. I wouldn’t say that spring 2026 is far fetched for a blow off top or peak of some kind.

Spot Bitcoin ETFs saw over $600 million in inflows within 24 hours last week, while Ethereum ETFs also drew more than $300 million, extending the streak of institutional demand driving this recent rally

A U.S. court ruled this week that that Bored Ape NFTs and ApeCoin are not considered securities under federal law

Plasma, a high-performance layer-1 blockchain purpose-built for stablecoins, with over $5.5B in stablecoin supply just one week after launch, is joining Chainlink Scale to enable Plasma developers to build next-gen stablecoin applications (Chainlink X)

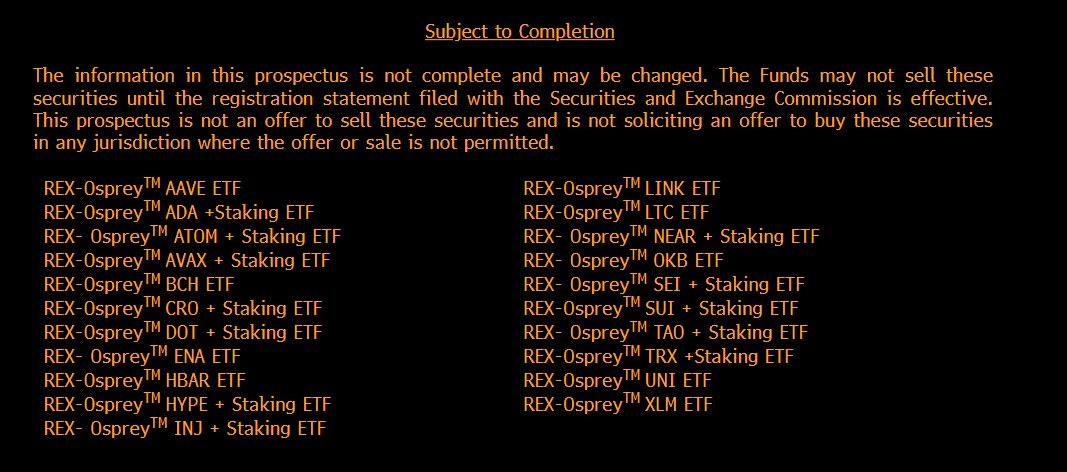

Rex-Osprey filed for 21 crypto ETFs including ADA, HYPE, LINK, HBAR and SUI (all projects we’ve covered here before)

Avalanche AVAX added $40,000,000,000 in DEX Volume over the last 3 months.

Institutional activity is SURGING right now as we move into Fall. This is symbolizing a flood gate being opened, and the most promising part is that they are moving past the vanilla BTC/ETH allocations into alt coins.

Hyper bullish for the industry.

NEAR Protocol is looking solid with some bullish catalysts this past week. It reclaimed the 20-week moving average, a key long-term technical line, signaling a potential shift back into an uptrend. NEAR Intents volume is rising, and ecosystem activity is increasingly focused on cross-chain and AI-agent integrations.

Cardano (ADA), something I probably don’t talk about enough, is showing renewed strength as institutional and on-chain dynamics lean positive. Whales and top wallets have been accumulating heavily, supporting the price base and signaling confidence in further upside.

Derivative markets seem to echo that sentiment: open interest on ADA futures is approaching all-time highs, with bullish bets gaining traction. Technically, ADA recently broke above key resistance and is consolidating just below new breakout zones. If you want to get really degenerate check out some of the meme coins on Cardano as well (SNEK has been strong).

Some solid news emerged as well for the XRP army, large holders have been accumulating heavily again, with whales adding more than 120 million XRP in the last three days based on wallet data.

More updates to come next week but my suspicion is:

THE MAJORITY ARE SIDELINED.

If you still do not have your ducks in a row GO READ THE GUIDES IN THE ARCHIVE.

2025 Crypto Bull Run Survival Guide

Any paid sub will tell you they’ve made the cost of a paid Arb Letter subscription 500-1,000x over just by following BASIC tips we cover. You can lead a degen to water but you can’t make him print bandos.

Global and US News

Across the U.S., political and social tensions are intensifying (shocker), with federal authorities taking a more visible and forceful posture in response to domestic unrest. Abroad, the Middle East remains volatile as shifting military strategies reflect both external pressure and internal instability. Trump’s activity in South America is also becoming a point of interest.

At the same time we are seeing a wave of new surveillance initiatives and security crackdowns spreading from Asia to Europe, highlighting what I think is a broader global drift toward tighter control, militarization, and centralized power.

There has been a confirmed heavy military presence outside the Broadview ICE facility in Illinois as the Trump administration cracks down on violent protests and crime across the US (including Memphis recently)

According to Axios the Israeli military has shifted to defensive operations in Gaza on Saturday morning after President Trump called on Israel to stop its strikes

Hong Kong is reportedly set to install surveillance cameras with AI facial recognition (InsiderPaper)

The U.S. military struck another vessel off the coast of Venezuela suspected of trafficking narcotics

In Portland, Oregon federal troops are being deployed to reinforce ICE facilities amid intensifying protests, provoking pushback from local authorities and mounting legal challenges

The UN Security Council approved a significantly expanded “Gang Suppression Force” for Haiti, granting it broader military authority and arrest powers to combat rapidly growing gang violence in Port-au-Prince

UK Terror Attack

One of the big stories this week comes from the UK.

A man, ironically named Jihad Al-Shamie (Syrian immigrant) drove a vehicle into pedestrians outside a synagogue in Manchester on Yom Kippur, then proceeded to stab worshippers before being shot dead by police.

But wait for it! He was out on bail for rape as well. Classic. What other country has trends like this where illegal migrant criminals are re-released constantly….

Stabbings and Europe go together like peanut butter and jelly these days.

Wonder what the big driver is?

Two people were killed and several injured. Tragically, one of those fatalities was later determined to have been struck by police gunfire amid the quick and chaotic response.

The assailant had been wearing what appeared to be an explosive vest (later found to be fake) and is believed to have been motivated by extremist ideology, though leftist media outlets were quick to say he had no known prior terror record. Some outlets even had the gall to suggest it was a far right attack lol.

Authorities and UK SAS have arrested multiple suspects as they investigate whether the attacker acted alone, prompting the UK government to vow heightened security for Jewish communities.

Tuesday’s guide will have some helpful color on ways to think about these continued threats in Western nations. If you read my posts from the week before last you know threat levels for terrorism in the US and Europe are quite high right now. Everyone should take these threats seriously and realize that the loose border policy, soft on crime policy, and surging illegal immigration have contributed to an environment that is highly unstable. Even worse we have no idea who may be in these countries or what they might be capable of.

Better to take some basic steps ahead of time to be prepared for the worst than to get caught with your pants down and be shit out of luck.

Quick one today, see you guys first thing Tuesday morning. Remember to take advantage of the discount for Trezor crypto cold storage below (Use Andy5 at checkout) and get your free crypto with Gemini before things get really silly in the coming months.

Have a great weekend.

Andy

Protect Your Crypto With TREZOR

Get Free Ethereum w/Gemini

Get Free PEPE w/Gemini

Get Free Bitcoin w/Gemini

Disclaimer - I am a former trader, enterprise sales rep, and current entrepreneur with a monkey brain. Nothing I say should be considered formal financial advice or life advice, these are my opinions - always do your own research and diligence before

Bull market does not seem to be over, but any thoughts on this being in bubble territory? PE on the S&P is 1990's levels, and should NVDA really be bigger than the entire pharma industry? Seems like a clear signal to sell Tech and buy value.

If we missed the recent rips in miners and materials, is it too late; should we wait for a pullback?