Arbitrage Andy’s Alt Coin Master List

466: 15 Alt Coin Picks For 2025 & Beyond

Morning lords.

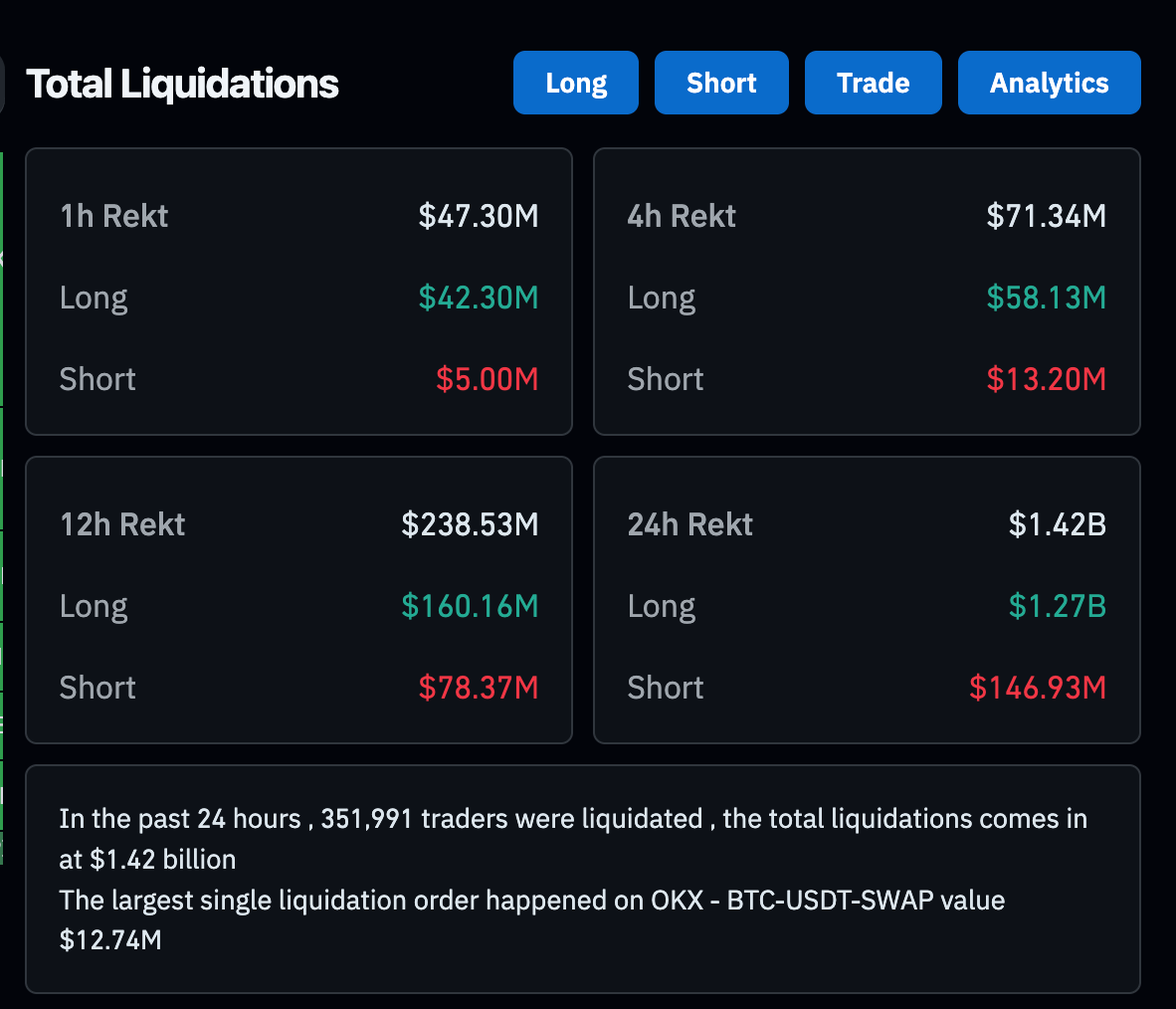

So, we got a big liquidation in crypto.

The panicans and softos are crying, maybe some of them even coughed up their coins to the shills at Blackrock and other major institutions who know this is a long game.

There are of course not a central cabal of lizard people manifesting shakeouts in crypto, but this recent price action does smell like one.

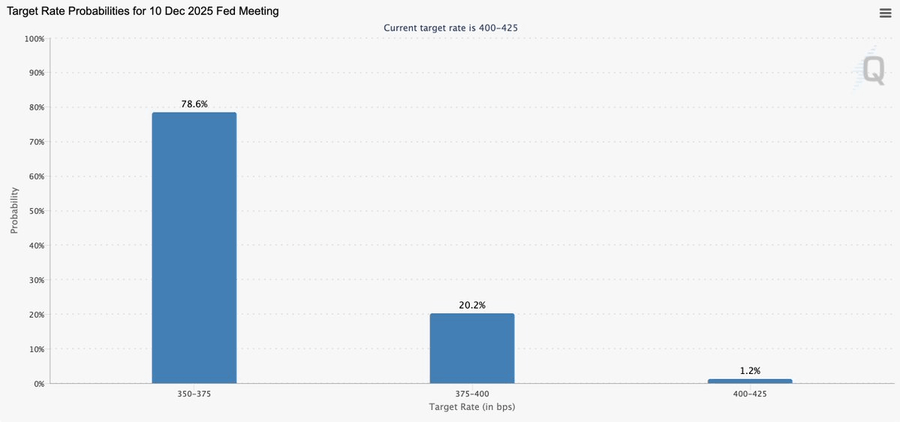

It took a baby dip for most to abandon all hope right as the Fed begins to pivot.

Google searches are plummeting.

Influencers on X are calling tops.

Pathetic.

Over the last year or so, we’ve called some excellent entries on Bitcoin and Ethereum that paid subs have profited from enormously.

Most of you realize by now that VERY simple strategies and emotional discipline on a long enough timeline, virtually guarantee you make money on BTC and ETH.

For Bitcoin, the trend is always up and to the right. It is the superior digital asset and store of value. Even if we do get the next bear leg down to the $70,000 - $80,000 range, you can rest assured in the coming decade it’s going to continue to chug higher.

Ethereum was later to the game but there was a point in time where everyone had given up on it. The desperation and dejection was palpable. Then it ripped and is now back to coiling.

Today we’re going to talk alt coins.

Why?

Well for starters, there’s still a window of opportunity there for most of us. Even if you missed the big moves for Bitcoin and Ethereum in the medium term, that doesn’t mean you need to miss out on what might be coming next. The timing of this post is perfect considering attention in crypto is likely pulling back a bit.

It won’t stay that way, but if you’re going to go shopping or get active, one of the best times to do it is when prices are not at all time highs and the hordes of normies are distracted by equities or their 3 shares of QQQ.

There is a high degree of uncertainty in markets right now, many are calling for tops. The pack is rarely correct.

But I like when this happens because it means people are de-risking and being scared out of their positions.

When the market does turn and when retail flocks back to crypto en masse, alts are going to rip. Even without the retail fuel that we traditionally see flowing into alt coins, over time there is a select group of alts that are going to see exponential institutional adoption and usage (some already are).

With that price will climb — aggressively in some cases, far beyond what an equity pick could give you.

We will cover what they do, why institutions are focused on them, the most recent bullish (or bearish) catalysts, and some of my expectations for the next few months. Now is the time to get squared away.

The window has re-opened for those who want to build a position and own a piece of the future financial landscape.

Where Do Markets Go From Here

In the aftermath of the first fed rate cut, we are in a tough to read spot this week. The S&P 500 keeps hitting new all time highs, gold is ripping like the apocalypse is coming, but crypto is lagging a bit right now, including Bitcoin.

The labor market is strained. With constant revisions and mixed sentiment from the Fed it’s difficult to get an accurate read on what’s actually going on. On top of that there’s still a lack of clarity on what the Fed is going to do at its next meeting. Will we get more rate cuts?

Will crypto fall in line with gold? Or will equities continue to decouple?

One thing is for sure. Regulatory tailwinds for crypto keep piling up despite the uncertainty in the short term:

US lawmakers this week asked the SEC to implement President Trump's executive order opening the $12.5 trillion 401k retirement market to crypto

The SEC just approved new listing rules that streamline the path for spot crypto ETFs. This move paves the way for a flood of new products beyond just Bitcoin and Ethereum

The US and UK have launched a joint task force to align crypto regulation across borders, smoothing the way for institutional capital to move globally

There are few of us who could’ve imagined the speed with which crypto adoption has picked up in 2025 on the institutional side.

It’s one of the reasons I think we are departing from the traditional 4 year cycle that has defined the last 20 years or so. The institutions will drive the growth of this industry in the coming decade. Short term broader economic sentiment aside, the industry is here for the long haul.

When risk on appetite returns and BTC/ETH start to move again, we may see alt coins pick up some serious steam. This is where a massive opportunity lies for those willing to put in the time to research and allocate at solid levels now. These are your bangers and homeruns that people are ignoring for shinier short term dopamine.

Let’s take a look at 15 of the alt coins in my sight for the coming months and years.

Don’t squander it. It might just take one of them to change your life.